Global Caramel Color Market Size, Share, and COVID-19 Impact Analysis, By Type (Class I Caramel Color, Class II Caramel Color, Class III Caramel Color, Class IV Caramel Color, and Others), By Application (Bakery, Confectionery, Beverages, Dairy & Frozen Desserts, Ice Creams & Desserts, Soft Drinks, Alcoholic Beverages, Cosmetics and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Caramel Color Market Insights Forecasts to 2035

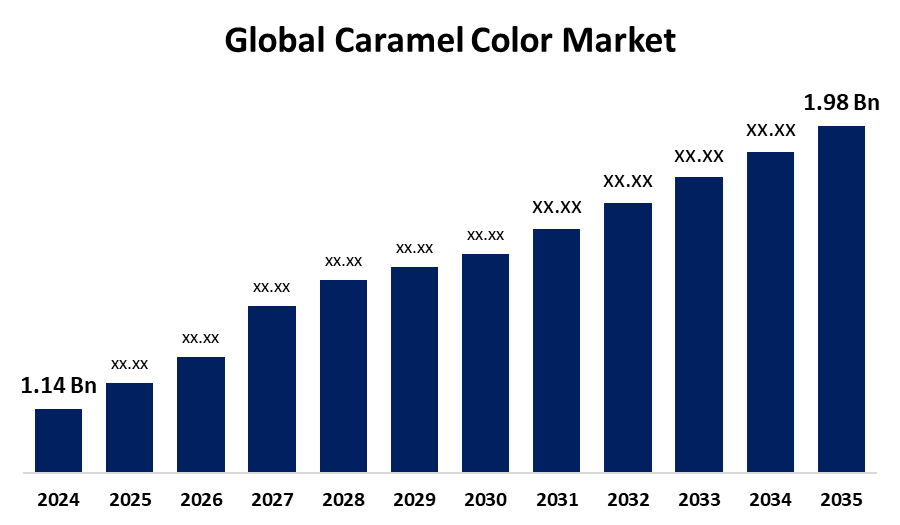

- The Global Caramel Color Market Size Was Estimated at USD 1.14 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.15% from 2025 to 2035

- The Worldwide Caramel Color Market Size is Expected to Reach USD 1.98 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the Forecast Period.

Get more details on this report -

The Global Caramel Color Market Size was Worth around USD 1.14 Billion in 2024 and is predicted to Grow to around USD 1.98 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 5.15% from 2025 and 2035. Increasing demand from processed foods and beverages, increasing urbanization, natural caramel color innovation, and increasing consumption in emerging markets propel the market for caramel color. These drivers increase usage in bakery, confectionery, soft drinks, and alcohol worldwide.

Market Overview

The caramel color industry covers the international production and commerce of caramel color, a common food additive used to impart brown color to food and beverage products. It is generally used to improve the appearance and texture of such products as soft drinks, baked goods, confectionery, sauces, and alcoholic drinks to make them more appealing to consumers. It enables the enhancement of product appearance and consumer appeal by manufacturers without altering taste considerably. Caramel color further facilitates product standardization and brand image by maintaining a consistent look with batches. Furthermore, increasing consumer interest in clean-label and natural ingredients has inspired manufacturers to develop organic and plain caramel colors with wider application opportunities. Innovations are further extended with the development of low-calorie and functional caramel colors that respond to health-conscious consumer needs. Process and extraction technological developments have made better color stability, lower 4-MEI levels, and more compatibility with various food and beverage uses possible. New low-calorie and sugar-free caramel flavor options are being developed for health-oriented markets by manufacturers. New developments intend to expand applications into beverages, bakery, sauces, and confectionery categories while making products safer, more functional, and sustainable.

Report Coverage

This research report categorizes the caramel color market size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the caramel color market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the caramel color market.

Global Caramel Color Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.14 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.15% |

| 2035 Value Projection: | USD 1.98 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | BASF SE, Caramel Color Company, DDW The Color House, Sensient Technologies Corporation, Kancor Ingredients Limited, Tate & Lyle PLC, Givaudan SA, ColorMaker Inc., Natural Color Company, Azelis, FMC Corporation, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Caramel color is used in large volumes in soft drinks, bakery, confectionery, sauces, and alcoholic beverages to enhance visual appeal and taste. Increasing usage of packaged and processed food globally enhances the demand for caramel color, triggering market growth. Furthermore, due to the requirement from consumers for natural and clean-label products, manufacturers are developing organic and plain caramel colors. The clean-label options are by regulatory requirements and consumer demand, enhancing the applications of caramel color and having a positive effect on market growth.

Restraining Factors

Some caramel colors, particularly class III and IV, contain 4-Methylimidazole (4-MEI), a suspected carcinogen. Consumer education and scientific research indicating health hazards generate fear and lower demand. Some countries regulatory agencies have imposed limits on the use of 4-MEI in caramel coloring, limiting its application and retarding market growth.

Market Segmentation

The caramel color market share is classified into type and application.

- The class III caramel color segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the caramel color market is divided into class I caramel color, class II caramel color, class III caramel color, class IV caramel color, and others. Among these, the class III caramel color segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to the class III caramel color is extensively used in soft drinks, beer, and other drinks for its intense, stable brown shade that serves to increase visual appeal and consumer acceptance. Its extensive use contributes to its market-leading share around the world.

- The bakery and confectionery segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the application, the caramel color market is divided into bakery and confectionery, beverages, dairy & frozen desserts, ice creams & desserts, soft drinks, alcoholic beverages, cosmetics, and others. Among these, the bakery and confectionery segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The growth is attributed to bakery and confectionery products like cakes, cookies, chocolates, and candies heavily relying on caramel color to obtain an attractive brownish color and added flavor. The worldwide demand for these products assures the large-scale application of caramel color, propelling the segment's substantial market share.

Regional Segment Analysis of the Caramel Color Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the caramel color market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the caramel color market over the predicted timeframe. North America, especially the U.S., boasts an advanced food and beverage industry. Caramel color is employed extensively in carbonated beverages, sauces, bakery items, and snacks. Mass production and region-based global food companies generate high demand, which makes it the foremost contributor to the worldwide market for caramel color. Large international food and beverage corporations and producers of caramel color like Cargill and Sensient are based in or have significant operations in North America. They have high-tech manufacturing facilities, R&D expenditure, and extensive distribution channels to provide a consistent and large quantity of caramel color to the regional and international markets.

Asia Pacific is expected to grow at a rapid CAGR in the caramel color market during the forecast period. Asia Pacific's food and beverages sector is growing quickly as a result of increasing disposable incomes and Western-style consumption habits. Caramel color is a standard in soft drinks, snacks, sauces, and ready-to-eat foods. Along with the growth in consumption of these products comes increased demand for caramel color, which is boosting the region's speedy market growth.

Europe is predicted to hold a significant share of the caramel color market throughout the estimated period. Europe boasts a solid food and beverage industry with high consumption of caramel color in foods such as bakery items, confectionery, soft drinks, and sauces. The complex culinary culture and developed market of the region facilitate consistent usage of caramel color, sustaining its commanding market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the caramel color market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Caramel Color Company

- DDW The Color House

- Sensient Technologies Corporation

- Kancor Ingredients Limited

- Tate & Lyle PLC

- Givaudan SA

- ColorMaker Inc.

- Natural Color Company

- Azelis

- FMC Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2022, Oterra, the leading natural color provider, expanded its caramel colors business with the introduction of an expanded range covering all four categories of caramel colors in liquid and powder form. The move is the latest in a series of expansions following the May 2021 acquisition of SECNA Natural Ingredients Group S.L., the major caramelized sugar color producer. The new range of products is aimed at fulfilling the increasing demand for natural coloring in different uses like beverages, dairy, bakery, and confectionery.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the caramel color market based on the below-mentioned segments:

Global Caramel Color Market, By Type

- Class I Caramel Color

- Class II Caramel Color

- Class III Caramel Color

- Class IV Caramel Color

- Others

Global Caramel Color Market, By Application

- Bakery and Confectionery

- Beverages

- Dairy & Frozen Desserts

- Ice Creams & Desserts

- Soft Drinks

- Alcoholic Beverages

- Cosmetics

- Others

Global Caramel Color Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the caramel color market over the forecast period?The global caramel color market is projected to expand at a CAGR of 5.15% during the forecast period.

-

2. What is the market size of the caramel color market?The global caramel color market size is expected to grow from USD 1.14 Billion in 2024 to USD 1.98 Billion by 2035, at a CAGR of 5.15% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the caramel color market?North America is anticipated to hold the largest share of the caramel color market over the predicted timeframe.

Need help to buy this report?