Global Caramel Chocolate Market Size, Share, and COVID-19 Impact Analysis, By Type (Dark Chocolate and White Chocolate), By Application (Sauce, Candy, and Flavoring & Coloring), By Distribution Channel (Supermarkets/Hypermarkets and Independent Retailers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Caramel Chocolate Market Insights Forecasts to 2035

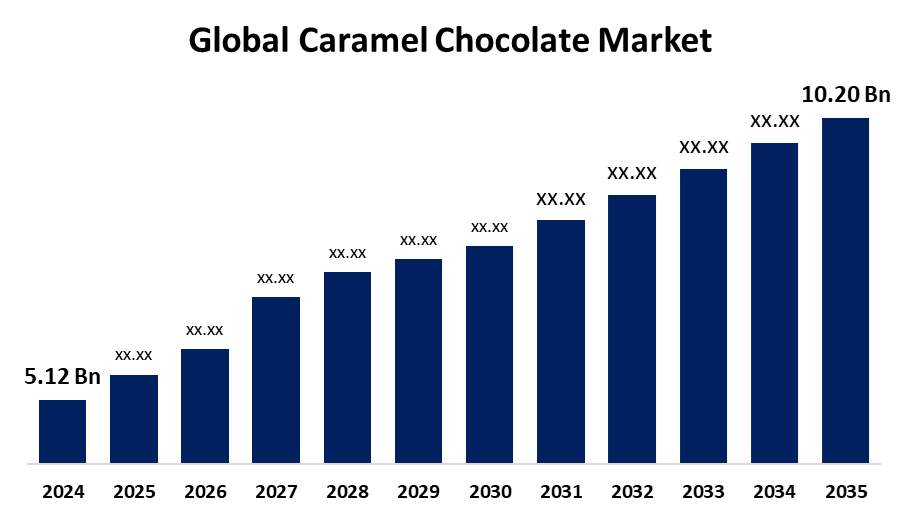

- The Global Caramel Chocolate Market Size Was Estimated at USD 5.12 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.47% from 2025 to 2035

- The Worldwide Caramel Chocolate Market Size is Expected to Reach USD 10.20 Billion by 2035

- North America is Expected to Grow the fastest during the Forecast Period.

Get more details on this report -

The Global Caramel Chocolate Market Size was Worth around USD 5.12 Billion in 2024 and is predicted to Grow to around USD 10.20 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 6.47% from 2025 and 2035. Increased consumer purchasing of rich chocolates, innovation in products with new tastes, growth of retail and e-commerce channels, and rising gifting and seasonal usage fuel the robust expansion of the market for caramel chocolate globally.

Market Overview

The Caramel Chocolate Industry is the business that produces, distributes, and retails chocolate products with caramel. These products include caramel-filled chocolates, bars, candies, and confectionery that have the smooth, creamy texture of caramel and the sweetness and bitterness of other forms of chocolate like milk, dark, and white chocolate. The main objective of this market is to fulfill the growing consumer demand for indulgent, great-tasting treats by introducing innovative products that cater to varied tastes and preferences. Caramel chocolate finds its strength in its distinctive taste and texture, which give consumers a rich and rewarding eating experience. This amalgamation caters to a broad segment of consumers seeking both regular indulgence and gift items during special occasions. Caramel candies are also versatile, being employed in snack bars, desserts, and confectionery mixes, enhancing market opportunity further. Innovation is key in sustaining the market pace. Companies continually create new caramel combinations, packaging sizes, and package designs that facilitate convenience, giftability, and product differentiation. Healthier versions with lower sugar content, and organic, and sustainable sourcing are also on the rise, fitting with increasing consumer health and environmental awareness. Overall, the caramel chocolate sector survives by blending age-old extravagance with contemporary trends, hence a vibrant and growing sector in the international confectionery market.

Report Coverage

This research report categorizes the caramel chocolate market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the caramel chocolate market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the caramel chocolate market.

Global Caramel Chocolate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.12 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.47% |

| 2035 Value Projection: | USD 10.20 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application, By Distribution, By Region |

| Companies covered:: | Barry Callebaut, Cargill, Ferrero, Ezaki Glico, Nestle, Mars, Mondelez, Blommer, Brookside, Hersheyas, Valrhona, Foleys Candies LP, Guittard Chocolate Company, Olam, CEMOI, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing demand for rich, delicious indulgences propels the sale of caramel chocolate. Richer textures and distinctive flavor blends, like caramel chocolates, are worth the premium price for consumers seeking indulgent experiences. The trend further boosts market growth, particularly in developed economies where higher disposable income is available. Additionally, ongoing product innovation, such as salted caramel, nut-filled caramel, and fusion flavors, attracts a variety of consumer segments. Well-designed packaging and portion packaging boost convenience and giftability. Both raise consumer appeal and stand out in a competitive marketplace.

Restraining Factors

Increasing health awareness and expanded understanding of sugar consumption constrain caramel chocolate sales. Consumers eschew sugary foods for fear of obesity, diabetes, and other lifestyle-related diseases. The trend puts pressure on manufacturers to revamp products or become vulnerable to losing health-aware consumers, limiting market growth, particularly in developed areas. Further, high-quality caramel chocolate uses quality ingredients and stringent processing, which incurs additional production expenses. These costs often translate into higher retail prices, which can deter price-sensitive consumers. Smaller manufacturers may struggle to compete with larger brands, limiting market expansion in price-competitive segments.

Market Segmentation

The caramel chocolate market share is classified into type, application, and distribution channel.

- The dark chocolate segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the caramel chocolate market is divided into dark chocolate and white chocolate. Among these, the dark chocolate segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to dark chocolate's mildly bitter, rich cocoa flavor complementing caramel sweetness to perfection. The opposition resonates with consumers looking for rich but less cloyingly sweet indulgences. Dark chocolate with caramel's rich, layered flavor profile caters to discerning tastes, fueling greater demand and reinforcing its market share leadership.

- The candy segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the caramel chocolate market is divided into sauce, candy, and flavoring & coloring. Among these, the candy segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is driven by caramel chocolate candies are well-loved for being sweet, creamy, and rich in taste. They cater to all age groups and are commonly bought for daily munching. Their high emotional and sensory appeal makes them an instant favorite, resulting in steady consumer demand and fueling their market leadership in the application segment.

- The supermarkets/hypermarkets segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the caramel chocolate market is divided into supermarkets/hypermarkets and independent retailers. Among these, the supermarkets/hypermarkets segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth is attributed to these store formats carrying a wide selection of caramel chocolate items, from mass to premium brands. The assortment prompts customers to experiment with various choices, increasing the volume of sales. Brands receive high visibility in the form of flashy store displays and allocated shelf space, whereby they reach target consumers effectively and solidify brand loyalty.

Regional Segment Analysis of the Caramel Chocolate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the caramel chocolate market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the caramel chocolate market over the predicted timeframe. As globalism expands, Asian consumers are being more and more exposed to Western food and Western-style lifestyles. Caramel chocolate, once more favored in Western nations, is now being adopted by Asian consumers who crave new tastes and luxurious experiences. Increasing acceptance of Western-type desserts and snack foods and targeted marketing from global players have increased the appeal of caramel chocolate in the region even more, further supporting Asia-Pacific's market leadership.

North America is expected to grow at a rapid CAGR in the caramel chocolate market during the forecast period. North American shoppers have increasingly turned to premium and artisanal chocolate products, especially ones with novel flavors such as caramel. Growth in the category has been fueled by the expansion of gourmet chocolate boutiques and specialty brands carrying salted caramel or caramel-filled chocolates. Shoppers are willing to spend more money on high-end, indulgent products, which is driving sales growth quickly and prompting brands to innovate with novel caramel chocolate products to match changing taste preferences and premiumization trends.

Europe is predicted to hold a significant share of the caramel chocolate market throughout the estimated period. Europe enjoys an extensive tradition of chocolate making, which is most well-developed in nations such as Switzerland, Belgium, France, and Germany. Cultural enjoyment is reflected in a strong demand for a variety of high-quality chocolate products, including those flavored with caramel. European consumers tend to be sophisticated and frequently prefer handcrafted or gourmet chocolates with complex flavors. Caramel provides a rich, buttery note against standard dark or milk chocolate, and the variety is popular. This cultural connection guarantees strong continued consumption and innovation within the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the caramel chocolate market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Barry Callebaut

- Cargill

- Ferrero

- Ezaki Glico

- Nestle

- Mars

- Mondelez

- Blommer

- Brookside

- Hersheyas

- Valrhona

- Foleys Candies LP

- Guittard Chocolate Company

- Olam

- CEMOI

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2024, Nestlé reintroduced caramel-flavored snacks for a limited period in the UK. It comes in standard 30g bars, three-bar multipacks, and sharing bags of buttons, and this taps into consumer nostalgia and the trend for increasing demand for caramel chocolate items.

- In July 2023, Galaxy, the Mars Wrigley-owned UK chocolate brand, widened its range of vegan products with the introduction of a new Vegan Salted Caramel Bar. The 100g bar is made with hazelnut paste and contains a smooth salted caramel filling, providing a dairy-free version of usual caramel chocolates.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the caramel chocolate market based on the below-mentioned segments:

Global Caramel Chocolate Market, By Type

- Dark Chocolate

- White Chocolate

Global Caramel Chocolate Market, By Application

- Sauce

- Candy

- Flavoring & Coloring

Global Caramel Chocolate Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Independent Retailers

Global Caramel Chocolate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the caramel chocolate market over the forecast period?The global caramel chocolate market is projected to expand at a CAGR of 6.47% during the forecast period.

-

2. What is the market size of the caramel chocolate market?The global caramel chocolate market size is expected to grow from USD 5.12 Billion in 2024 to USD 10.20 Billion by 2035, at a CAGR of 6.47% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the caramel chocolate market?Asia Pacific is anticipated to hold the largest share of the caramel chocolate market over the predicted timeframe.

Need help to buy this report?