Global Capsule Fertilizer Market Size, Share, and COVID-19 Impact Analysis, By Nutrient Composition (Nitrogen-based, Phosphorus-based, Potassium-based, and Multi-nutrient / NPK), By Crop Application (Cereal and Grain Crops, Fruits and Vegetables, Plantation and Cash Crops, and Turf, Ornamentals, and Home Gardening), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Capsule Fertilizer Market Size Insights Forecasts to 2035

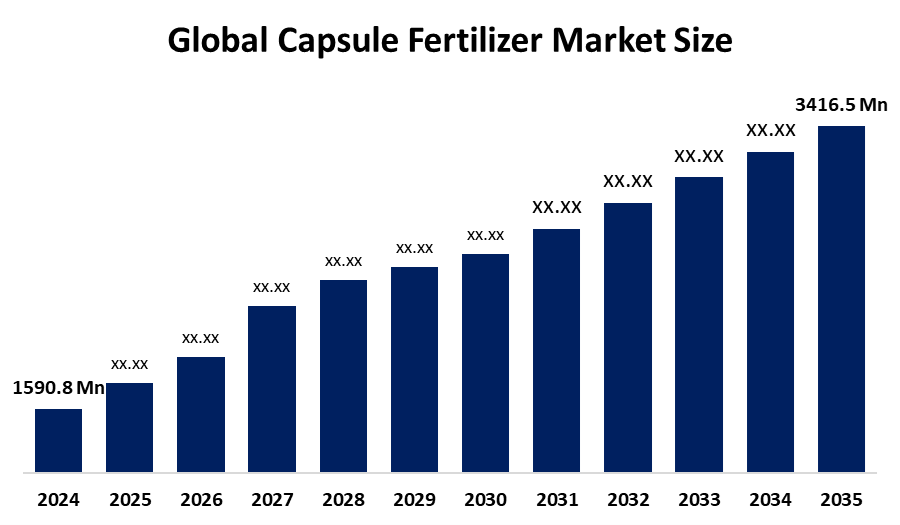

- The Global Capsule Fertilizer Market Size Was Estimated at USD 1590.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.2 % from 2025 to 2035

- The Worldwide Capsule Fertilizer Market Size is Expected to Reach USD 3416.5 Million by 2035

- Europe is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Capsule Fertilizer Market Size was valued at around USD 1590.8 million in 2024 and is predicted to grow to around USD 3416.5 million by 2035 with a compound annual growth rate (CAGR) of 7.2 % from 2025 to 2035. Enhanced nutrient efficiency, less environmental impact, adoption of precision agriculture, increased crop yields, sustainable farming methods, and rising demand for novel controlled-release fertilizers are all potential opportunities in the Capsule Fertilizer Market Size.

Market Overview

The global commerce and innovation in encapsulated or controlled-release fertilizers (CRFs), which include vital plant nutrients enclosed in protective coatings or semi-permeable membranes to allow for progressive, targeted release into the soil, are included in the Capsule Fertilizer Market Size. In line with the requirements of sustainable agriculture, this mechanism reduces nutrient leaching, improves absorption efficiency, and reduces environmental pollution. This market comprises a range of product categories, coating materials, nutrient formulations, and crop application techniques designed to meet a variety of horticultural, landscaping, and agricultural requirements. For Instance, in December 2025, ARPA-E allocated $38 million for nitrogen-reduction technologies in January 2025, while the U.S. Department of Agriculture launched a $700 million Regenerative Pilot Program in December 2025 to support soil-healthy practices, including CRFs. Ongoing R&D investments, coupled with government incentives for green fertilizers, are still the main drivers of the market's growth as they influence the farmers to utilize capsule fertilizers in contemporary agronomic practices.

Report Coverage

This research report categorizes the Capsule Fertilizer Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Capsule Fertilizer Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the Capsule Fertilizer Market Size.

Capsule Fertilizer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 1590.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.2% |

| 2035 Value Projection: | 3416.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Nutrient Composition, By Crop Application |

| Companies covered:: | Aglukon (COMPO Expert / Grupa Azoty), Haifa Group (Haifa Chemicals), Helena Chemical Company, ICL Group Ltd., JCAM Agri Co., Ltd., Kingenta Ecological Engineering Co., Ltd., Koch Industries (Koch Fertilizer), Nufarm Ltd., Nutrien Ltd., Pursell Agri-Tech, LLC, SQM S.A., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The primary driving force behind the world's population growth to 10 million is the need for more productive agricultural products, which will necessitate the creation of more accurate and efficient nutrient management strategies. Growing public knowledge of environmentally friendly farming methods and environmental preservation is another significant factor. Furthermore, the advancement of coating and encapsulation technologies has accelerated market expansion by improving the product's affordability, durability, and efficiency. Market expansion is also supported by government programs that encourage sustainable agriculture and effective fertilizer use, especially in developing nations.

Restraining Factors

High production costs, low farmer awareness, technological complexity, price sensitivity in developing nations, and delayed adoption rates because of inadequate infrastructure and a lack of standardized laws for sophisticated fertilizer products are the main factors restricting the Capsule Fertilizer Market Size.

Market Segmentation

The Capsule Fertilizer Market Size share is classified into nutrient composition and crop application.

- The nitrogen-based segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the nutrient composition, the Capsule Fertilizer Market Size is divided into nitrogen-based, phosphorus-based, potassium-based, and multi-nutrient / NPK. Among these, the nitrogen-based segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Nitrogen is a necessary component of chlorophyll, amino acids, and nucleic acids. Nitrogen-based products are used frequently in agricultural applications because nitrogen is a necessary nutrient for plant growth. Additionally, farmers are adopting nitrogen-based solutions to increase production due to the growing world population and increased food consumption.

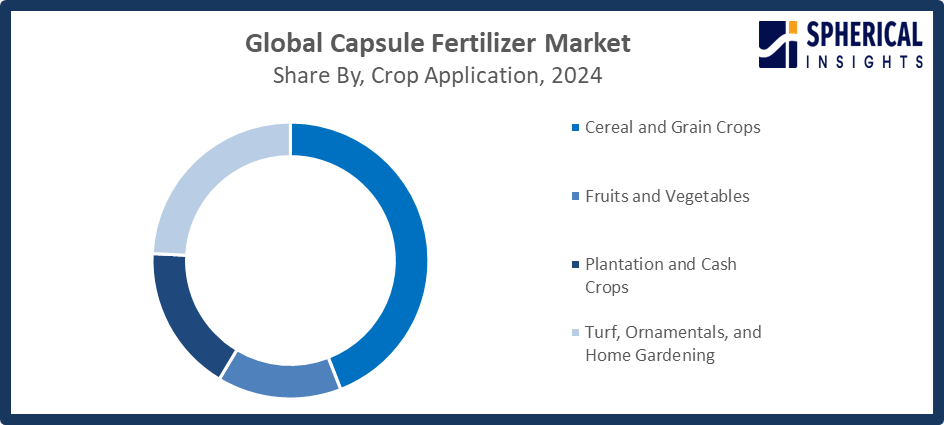

- The cereal and grain cropssegment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the crop application, the Capsule Fertilizer Market Size is divided into cereal and grain crops, fruits and vegetables, plantation and cash crops, turf, ornamentals, and home gardening. Among these, the cereal and grain cropssegment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Cereals and grain crops are active feeders, particularly in nitrogen, phosphorus, and potassium, to guarantee high biomass growth and crop filling. Large-scale farming of wheat, rice, maize, and other grains is driven by high demand, which supports stable consumption patterns in both developed and developing nations.

Get more details on this report -

Regional Segment Analysis of the Capsule Fertilizer Market Size

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the Capsule Fertilizer Market Size over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the capsule fertilizer market over the predicted timeframe. The Asia Pacific region's agricultural foundation and the rising food needs brought on by the region's expanding population serve as the region's primary motivators. Large-scale farming is common in nations like China, India, and Japan, which increases the need for creative and effective fertilizer techniques like capsule fertilizers that improve soil nutrient delivery while also lessening environmental impact. In order to improve nitrogen efficiency in Heilongjiang's corn belts, China's Ministry of Agriculture and Rural Affairs introduced a program in 2025 that reimburses 30% of the cost of controlled-release fertilizer. India's nutrient-based subsidy program increased by 55% to INR 379.52 million for the Rabi season, giving Uttar Pradesh and Punjab priority for formulations with improved efficiency.

Europe is expected to grow at a rapid CAGR in the Capsule Fertilizer Market Size during the forecast period. European farmers are looking for effective fertilizer management strategies that improve crop yield while adhering to environmental regulations. The EU's Common Agricultural Policy (CAP) reforms, which prioritize precision fertilization, nutrient efficiency, and emission reduction, are driving the areas' adoption. In order to cut nutrient losses in half by 2030, the EU's Farm to Fork Strategy, which was strengthened in March 2025, set aside €250 million for improved-efficiency fertilizers through the Common Agricultural Policy. In addition, subsidies for biodegradable CRF technologies were included in the November 2025 Bioeconomy Action Plan, which aims to increase use in Mediterranean regions by 20%.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Capsule Fertilizer Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

• Aglukon (COMPO Expert / Grupa Azoty)

• Haifa Group (Haifa Chemicals)

• Helena Chemical Company

• ICL Group Ltd.

• JCAM Agri Co., Ltd.

• Kingenta Ecological Engineering Co., Ltd.

• Koch Industries (Koch Fertilizer)

• Nufarm Ltd.

• Nutrien Ltd.

• Pursell Agri-Tech, LLC

• SQM S.A.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Capsule Fertilizer Market Size based on the below-mentioned segments:

Global Capsule Fertilizer Market Size, By Nutrient Composition

- Nitrogen-based

- Phosphorus-based

- Potassium-based

- Multi-nutrient / NPK

Global Capsule Fertilizer Market Size, By Crop Application

- Cereal and Grain Crops

- Fruits and Vegetables

- Plantation and Cash Crops

- Turf, Ornamentals, and Home Gardening

Global Capsule Fertilizer Market Size, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Capsule Fertilizer Market Size over the forecast period?The global Capsule Fertilizer Market Size is projected to expand at a CAGR of 7.2% during the forecast period.

-

2. What is the market size of the Capsule Fertilizer Market Size?The global Capsule Fertilizer Market Size is expected to grow from USD 1590.8 million in 2024 to USD 3416.5 million by 2035, at a CAGR of 7.2 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Capsule Fertilizer Market Size?Asia Pacific is anticipated to hold the largest share of the Capsule Fertilizer Market Size over the predicted timeframe.

-

4. Who are the top companies operating in the global Capsule Fertilizer Market Size?Aglukon, COMPO Expert GmbH, Haifa Group, Helena Chemical Company, ICL Group Ltd., JCAM Agri Co., Ltd., Kingenta Ecological Engineering Co., Ltd., Koch Industries, Nufarm Ltd., Nutrien Ltd., Pursell Agri‑Tech, LLC, SQM S.A., The Mosaic Company, and Others.

-

5. What factors are driving the growth of the Capsule Fertilizer Market Size?The market is driven by growing food demand, the use of precision agriculture, effective nutrient management, controlled-release technology, environmental sustainability, government initiatives, awareness of soil health, and advances in encapsulation technology.

-

6. What are the market trends in the Capsule Fertilizer Market Size?Controlled-release fertilizers, biodegradable capsules, precision farming integration, eco-friendly solutions, increased R&D investment, adoption of digital agriculture, and a focus on high-yield, economical, and sustainable fertilizing techniques are all becoming more common.

-

7. What are the main challenges restricting the wider adoption of the Capsule Fertilizer Market Size?Widespread use of capsule fertilizer is hampered by high manufacturing costs, poor farmer awareness, technological complexity, infrastructure constraints, price sensitivity, lack of standardization, slow adoption in developing regions, and restricted availability.

Need help to buy this report?