Global Capacitor Market Size, Share, and COVID-19 Impact Analysis, By Voltage (Low Voltage and High Voltage), By Capacitor Type (Ceramics, Aluminum, Tantalum, Papers & Plastics, and Supercapacitors), By End Use (Telecom, Computers, Consumer Electronics, Automotive, Industrial, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Semiconductors & ElectronicsGlobal Capacitor Market Insights Forecasts to 2035

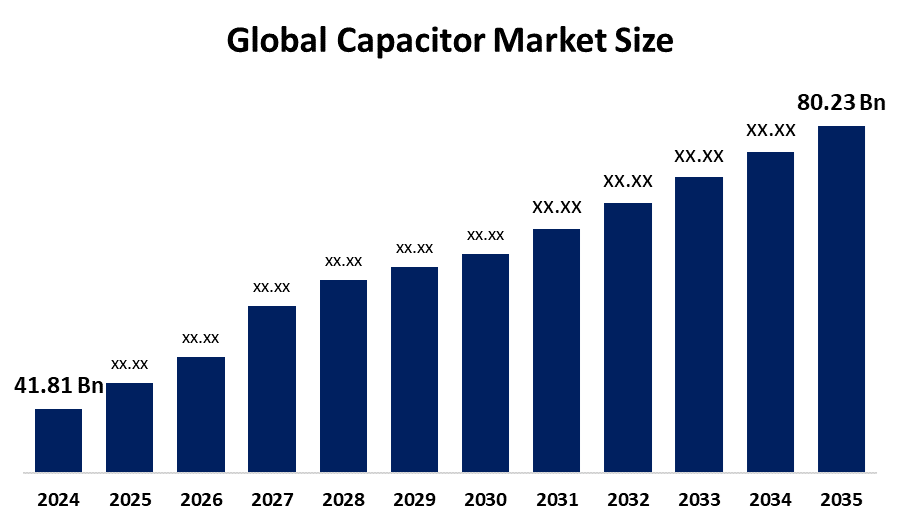

- The Global Capacitor Market Size Was Estimated at USD 41.81 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.1% from 2025 to 2035

- The Worldwide Capacitor Market Size is Expected to Reach USD 80.23 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Capacitor Market Size is Expected to Grow from USD 41.81 Billion in 2024 to USD 80.23 Billion by 2035, at a CAGR of 6.1% during The Forecast period 2025-2035. The capacitor market is increasing with rising demand for electronics, electric vehicles, and renewable energy systems, along with the development in miniaturization, efficiency, and high-performance materials, and the growth of IoT, 5G, and industrial automation industries

Market Overview

The global capacitor market refers to the business dealing with the manufacturing and utilization of capacitors, which are vital electronic components providing energy storage and delivery of electrical energy. Capacitors find extensive applications in consumer electronics, automotive, telecommunication, industrial equipment, and renewable energy devices for energy storage, power conditioning, signal coupling, and noise filtering purposes. The market is dominated by the growth in demand for electronic products, electric vehicle growth, and the rapid adoption of renewable energy technologies. The spread of IoT and 5G networks further fuels demand for high-performance capacitors with smaller size, higher efficiency, and reliability. Technological advances, including the invention of multilayer ceramic capacitors (MLCCs), supercapacitors, and film capacitors, are improving energy density, temperature range, and lifespan, addressing current electronic needs.

Opportunities are arising from increasing electric mobility, smart grids, and miniaturization in consumer devices. Government policies encouraging energy efficiency and eco-friendly technologies are also supporting capacitor uptake in future applications. Major market participants such as Murata Manufacturing Co., Ltd., TDK Corporation, Panasonic Holdings Corporation, KYOCERA Corporation, and Vishay Intertechnology, Inc. are significantly investing in R&D and capacity growth to consolidate their market positions. Strategic alliances, mergers, and product development are typical strategies to fulfill changing industry needs. The European Union REPowerEU strategy allocates around €300 billion by 2027 in order to boost renewable power and become energy independent. This program increases demand for power electronics components, most notably medium-voltage capacitors, that are needed to incorporate wind and solar power into advanced power grids and aid Europe's transition to sustainable energy.

Report Coverage

This research report categorizes the capacitor market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the capacitor market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the capacitor market.

Global Capacitor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 41.81 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.1% |

| 2035 Value Projection: | USD 80.23 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 222 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Voltage, By Capacitor Type, By End Use, By Region |

| Companies covered:: | Murata Manufacturing Co., Ltd., TDK Corporation, Kyocera Corporation, Vishay Intertechnology, Inc., KEMET Corporation, Abracon LLC, Nippon Chemi-Con, Eaton Corporation PLC, Yageo Corporation, VINATech Co., Ltd., Samsung Electro-Mechanics, Nichicon Corporation, Panasonic Holdings Corporation |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The growth of the global capacitor market is driven by the accelerated expansion of electronics, automotive, and renewable energy industries. High-performance capacitor demand is rising due to growing demand for smartphones, laptops, electric cars, and energy storage systems. Advances in technology, including miniaturization, increased capacitance, and enhanced efficiency, are driving adoption among industries. The growth of IoT devices, 5G equipment, and industrial automation is also driving the market growth. Environmental legislation encouraging energy-efficient components and the increasing demand for improved materials such as ceramic and electrolytic capacitors also benefit the market. Innovation and growing electronic use overall are driving factors.

Restraining Factors

The capacitor market is hampered by volatile raw material prices, such as aluminum and tantalum, that raise manufacturing expenses. Manufacturing and distribution can be impeded by supply chain interruptions and geopolitics. Intense competition, high-velocity technological advancements, and the increasing use of alternative energy storage technologies could further curtail growth, creating market instability and profitability hurdles.

Market Segmentation

The capacitor market share is classified into voltage, capacitor type, and end use.

- The low voltage segment dominated the market in 2024, approximately 42% and is projected to grow at a substantial CAGR during the forecast period.

Based on the voltage, the capacitor market is divided into low voltage and high voltage. Among these, the low voltage segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. This segment dominated due to the increasing need for small, energy-efficient capacitors in consumer electronics, automotive electronics, and IoT applications. Widening applications in smartphones, laptops, EV control systems, and communication equipment, combined with faster technological developments and miniaturization, are further driving this segment's adoption and market space internationally.

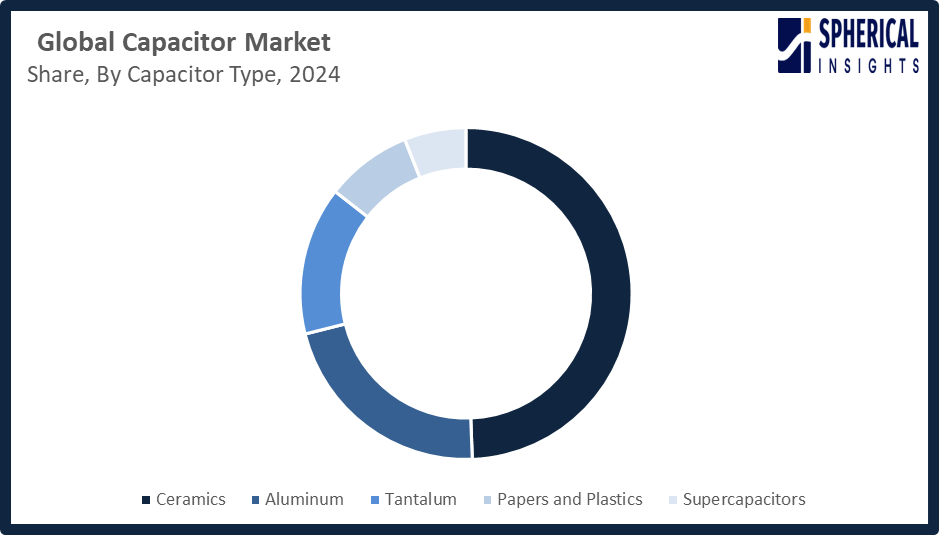

- The ceramics segment accounted for the largest share in 2024, approximately 49% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the capacitor type, the capacitor market is divided into ceramics, aluminum, tantalum, papers & plastics, and supercapacitors. Among these, the ceramics segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This segment is leading, attributed to their extensive applications in consumer electronics, telecommunications, automotive systems, and industrial devices. Ceramic capacitors possess benefits such as small size, high stability, low cost, and superior frequency characteristics, which make them suitable for multilayer applications in smartphones, laptops, and EVs. Moreover, the increasing requirements of multilayer ceramic capacitors (MLCCs) in 5G-enabled devices and electric vehicles further consolidated this segment's position.

Get more details on this report -

- The consumer electronics segment accounted for the highest market revenue in 2024, approximately 30% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the capacitor market is divided into telecom, computers, consumer electronics, automotive, industrial, and others. Among these, the consumer electronics segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The prevalence of this segment is owing to the extensive application of capacitors in smartphones, laptops, television sets, wearables, and various electronic products that need efficient power management and signal processing. The fast growth of smart devices, IoT uses, and 5G connectivity has accelerated the demand for small, high-capacitance devices such as multilayer ceramic capacitors (MLCCs).

Regional Segment Analysis of the Capacitor Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the capacitor market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the capacitor market over the predicted timeframe. Asia Pacific is expected to have 46% of the market share in the global capacitor market through the forecast period, as the region is a top electronics production base. Nations such as China, Japan, South Korea, and Taiwan are key contributors through heavy output of smartphones, laptops, electric automobiles, and industrial automation devices. Accelerating urbanization, increasing disposable incomes, and robust governmental support for energy from renewable sources and electronics production further drive demand. The fact that major capacitor manufacturers are based in these nations guarantees the adoption of advanced technology and consistent market growth in consumer, automotive, and industrial applications.

North America is expected to grow at a rapid CAGR in the capacitor market during the forecast period. North America is rapidly growing in the capacitor market in the forecast period, with an approximate 23% market share, led by the United States and Canada. Growth is driven by rising demand for electric vehicles, industrial automation, aviation, and sophisticated consumer electronics. Heavy investment in renewable energy equipment, smart grids, and high-performance electronic systems also promotes the adoption of capacitors. Moreover, technological innovations and having key semiconductor and capacitor suppliers present in the region improve production capacities, innovation, and market growth in automotive, industrial, and consumer markets.

Europe's capacitor market is also increasing steadily, led by nations such as Germany, France, and the United Kingdom. Expansion is spurred by renewable energy investments, electric vehicles, and industrial automation. Policies such as the REPowerEU plan induce energy efficiency and power-grid modernization, raising demand for medium- and high-voltage capacitors. The technological focus of the region on sustainable electronics, as well as strong manufacturing infrastructure, also boosts the adoption of capacitors in automotive, consumer electronics, and industrial segments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations companies involved within the capacitor market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Murata Manufacturing Co., Ltd.

- TDK Corporation

- Kyocera Corporation

- Vishay Intertechnology, Inc.

- KEMET Corporation

- Abracon LLC

- Nippon Chemi-Con

- Eaton Corporation PLC

- Yageo Corporation

- VINATech Co., Ltd.

- Samsung Electro-Mechanics

- Nichicon Corporation

- Panasonic Holdings Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

- silicon capacitor manufacturing capabilities.

Recent Development

In September 2025, Vishay Intertechnology introduced automotive-grade SMDY1 AC line ceramic disc safety capacitors, the first YI-rated capacitors in a surface mount package. Rated 500 VAC/1500 VDC with capacitance up to 4.7 NF, they provide EMI/RFI suppression and filtering in harsh, high-humidity automotive environments.Format Text EffectsAA

In September 2025, KYOCERA AVX launched the DSCC 25007 Mini BME Stacks, miniature high CV stacked X7R capacitors with base metal electrodes (BME). These capacitors undergo 100% Group A testing, reflecting KYOCERA AVX's focus on advanced, reliable electronic components for technological innovation.> Shadow> Reflection> Glove

In June 2025, YAGEO Group launched the ALV70 series, the industry's first aluminum electrolytic capacitors achieving a 750 V high-voltage rating, marking a milestone in high-voltage capacitor technology> Soft Edges

In June 2025, Murata Manufacturing began mass production of the GCM21BE71H106KE02 MLCC, the world's first 0805-inch (2.0 x 1.25 mm) capacitor offering 10 µF capacitance with 50 Vdc, designed for automotive applications. This innovation delivers high>3-0 Format

capacitance and voltage in a compact package while maintaining reliability, representing a major advancement in MLCC technology. In November 2024, Nippon Chemi-Con enhanced aluminum electrolytic capacitors for servers to support high-performance IT infrastructure. The company developed the industry's first capacitors compatible with Liquid Immersion Cooling (LIC), an efficient

server cooling method, and has begun providing samples, advancing reliability and efficiency in modern data centers. In October 2024, Murata Manufacturing launched a new silicon capacitor production line at its Caen, France, facility, expanding its integrated passive solutions. Announced in 2023, the project includes a 200 mm (8-inch) mass production line to strengthen Murata's silicon capacitor manufacturing capabilities.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the capacitor market based on the below-mentioned segments:

Global Capacitor Market, By Voltage

- Low Voltage

- High Voltage

Global Capacitor Market, By Capacitor Type

- Ceramics

- Aluminum

- Tantalum

- Papers and Plastics

- Supercapacitors

Global Capacitor Market, By End Use

- Telecom

- Computers

- Consumer Electronics

- Automotive

- Industrial

- Others

Global Capacitor Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the capacitor market over the forecast period?The global capacitor market is projected to expand at a CAGR of 6.1% during the forecast period.

-

2. What is the capacitor market?The capacitor market is the global industry for manufacturing and selling capacitors, which are essential electronic components that store electrical energy.

-

3. What is the market size of the capacitor market?The global capacitor market size is expected to grow from USD 41.81 billion in 2024 to USD 80.23 billion by 2035, at a CAGR of 6.1% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the capacitor market?Asia Pacific is anticipated to hold the largest share of the capacitor market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global capacitor market?Murata Manufacturing Co., Ltd., TDK Corporation, Kyocera Corporation, Vishay Intertechnology, Inc., KEMET Corporation, Abracon LLC, Nippon Chemi-Con, Eaton Corporation PLC, Yageo Corporation, VINATech Co., Ltd., Samsung Electro-Mechanics, Nichicon Corporation, Panasonic Holdings Corporation, and Others.

-

6. What factors are driving the growth of the capacitor market?The growth of the capacitor market is driven by increasing demand across high-growth industries like consumer electronics, electric vehicles, and renewable energy.

-

7. What are the market trends in the capacitor market?Key trends in the capacitor market include the high demand driven by the growth of electric vehicles (EVs) and renewable energy, which require more capacitors for power management and energy storage.

-

8. What are the main challenges restricting wider adoption of the capacitor market?The primary challenges limiting wider adoption of the capacitor market include raw material volatility, high production costs, and performance limitations, particularly when competing with more energy-dense batteries.

Need help to buy this report?