Global Canola Mayonnaise Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Organic Canola Mayonnaise and Conventional Canola Mayonnaise), By Application (Household, Food Service Industry and Food Processing Industry), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Canola Mayonnaise Market Insights Forecasts to 2035

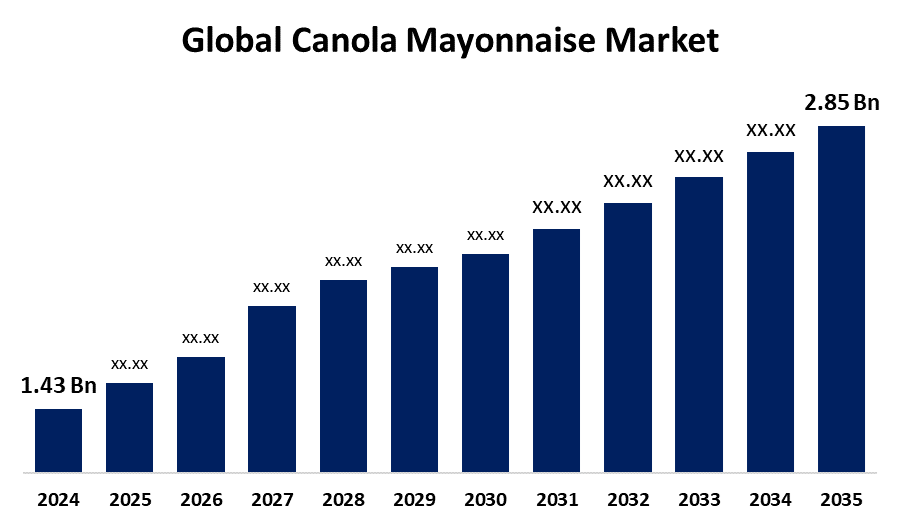

- The Global Canola Mayonnaise Market Size Was Estimated at USD 1.43 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.47% from 2025 to 2035

- The Worldwide Canola Mayonnaise Market Size is Expected to Reach USD 2.85 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Canola Mayonnaise Market Size Was Worth around USD 1.43 Billion in 2024 and is predicted to Grow to around USD 2.85 Billion by 2035 with a compound annual growth rate (CAGR) of 6.47% from 2025 and 2035. The canola mayonnaise market is driven by escalating health awareness, growth in plant-based and vegan diets, widening Western fast food, product development, and its broad retail and food service availability as a healthier, multi-purpose alternative to original mayonnaise.

Market Overview

The canola mayonnaise market is the industry focused on the production and use of mayonnaise produced mostly with canola oil. With its heart-healthy attributes, including reduced saturated fat and increased omega-3, it is a healthier version compared to conventional mayonnaise. Canola mayonnaise can be vegan and egg-free, rendering it more convenient for people with plant-based or dairy-free diets. The goal of the market is to offer a healthier, more versatile version of regular mayonnaise to meet changing consumer needs for nutritious and sustainable products. Additionally, restaurants and fast food establishments are finding canola mayonnaise to be a go-to ingredient in their recipes, allowing customers to enjoy a healthier, guilt-free treat. This trend is gaining further traction with the increasing popularity of international foods, several of which use mayonnaise as a staple condiment or ingredient, driving further demand for canola mayonnaise. Furthermore, advances in e-commerce and online food delivery have made it easier than ever for customers to shop from a broad variety of food products, including healthier options such as canola mayonnaise, further pushing market growth.

Report Coverage

This research report categorizes the canola mayonnaise market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the canola mayonnaise market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the canola mayonnaise market.

Global Canola Mayonnaise Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.43 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.47% |

| 2035 Value Projection: | USD 2.85 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 135 |

| Segments covered: | By Product Type, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Kraft Heinz Company, Unilever (Hellmann’s), McCormick & Company, Inc., Nestlé S.A., Cargill, Incorporated, Dr. Oetker, Kewpie Corporation, Kenko Mayonnaise Co., Ltd., Spectrum Organic Products, LLC, Hampton Creek (JUST Inc.), Sir Kensington’s and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Customers are looking for healthier foods, and canola mayonnaise, which is lower in saturated fat and richer in omega-3, fits into such health-oriented patterns. Such a trend towards healthier products has fueled the need for canola mayonnaise as a healthier option over regular mayonnaise. Furthermore, with Western fast foods spreading across the globe, the use of mayonnaise as a condiment is on the rise. Canola mayonnaise is becoming the choice of preference in most fast-food chains because of its healthier composition, leading to its increasing popularity in the food service sector.

Restraining Factors

Organic canola mayonnaise tends to be pricier because of the higher input costs that are involved in organic farming methods. Such a price premium will limit its demand among price-conscious consumers and decelerate overall market expansion, particularly when regular variants remain cheaper. Further, canola mayonnaise will have to contend with intense competition from other mayonnaise varieties made from olive oil, avocado oil, or plant-based products. The presence of such substitutes, which can address certain eating habits, is a challenge to the development of the canola mayonnaise market.

Market Segmentation

The canola mayonnaise market share is classified into product type and application.

- The conventional canola mayonnaise segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the canola mayonnaise market is divided into organic canola mayonnaise and conventional canola mayonnaise. Among these, the conventional canola mayonnaise segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to conventional canola mayonnaise is more readily available and generally cheaper than organic options. With its lower cost of production and greater distribution, conventional canola mayonnaise prevails in the market to become the first choice for both families and food service outlets.

- The food service industry segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the application, the canola mayonnaise market is divided into household, food service industry, and food processing industry. Among these, the food service industry segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The growth is attributed to canola mayonnaise finds extensive application in the food service industry, especially in restaurants, cafes, and fast-food outlets. Its versatility as a sandwich condiment, burger topping, salad dressing, and wrap filling makes it a key ingredient. The surging demand for healthier, plant-based alternatives in the foodservice industry fuels the market for canola mayonnaise, increasing its market share.

Regional Segment Analysis of the Canola Mayonnaise Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the canola mayonnaise market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the canola mayonnaise market over the predicted timeframe. Increased demand for alternative condiments such as canola mayonnaise has been driven by the growth of vegan and plant-based diets throughout the U.S. and Canada. Being egg-free and composed of plant-derived ingredients, this condiment trend fuels ongoing innovation. Major food companies like Kraft Heinz and Unilever (Hellmann's) introduce new canola mayo versions regularly, ranging from organic and flavored to plant-based options. These breakthroughs appeal to changing consumer preferences, boosting brand loyalty and market share, and maintaining North America as a market leader.

Asia Pacific is expected to grow at a rapid CAGR in the canola mayonnaise market during the forecast period. As Western food culture continues to gain prominence in Asia, especially in nations such as China, India, and Japan, mayonnaise is gradually integrated into regional diets. As a result of this trend, consumption of healthier mayonnaise-based products, such as canola-based ones, is on the rise. This consumption of fast food and meal-based snacks fuels the rapid market growth for canola mayonnaise in the region.

Europe is predicted to hold a significant share of the canola mayonnaise market throughout the estimated period. Europe is rich in the history of mayonnaise usage, especially among nations such as France, Germany, and the UK. Owing to the cooking creativity within the continent, numerous companies have developed conventional recipes that include the use of healthier options, such as canola oil. This creativity, coupled with the desire for premium, flavorful condiments, has made canola mayonnaise continue to hold a considerable market position in Europe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the canola mayonnaise market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kraft Heinz Company

- Unilever (Hellmann's)

- McCormick & Company, Inc.

- Nestlé S.A.

- Cargill, Incorporated

- Dr. Oetker

- Kewpie Corporation

- Kenko Mayonnaise Co., Ltd.

- Spectrum Organic Products, LLC

- Hampton Creek (JUST Inc.)

- Sir Kensington's

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the canola mayonnaise market based on the below-mentioned segments:

Global Canola Mayonnaise Market, By Product Type

- Organic Canola Mayonnaise

- Conventional Canola Mayonnaise

Global Canola Mayonnaise Market, By Application

- Household

- Food Service Industry

- Food Processing Industry

Global Canola Mayonnaise Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the canola mayonnaise market over the forecast period?The global canola mayonnaise market is projected to expand at a CAGR of 6.47% during the forecast period.

-

2. What is the market size of the canola mayonnaise market?The global canola mayonnaise market size is expected to grow from USD 1.43 Billion in 2024 to USD 2.85 Billion by 2035, at a CAGR of 6.47% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the canola mayonnaise market?North America is anticipated to hold the largest share of the canola mayonnaise market over the predicted timeframe.

Need help to buy this report?