Global Canned Mango Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Frozen Mango, Canned Mango Slices, Mango Puree and Canned Mango Chunks), By Application (Household Consumption, Foodservice Industry and Industrial Use), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Canned Mango Market Insights Forecasts to 2035

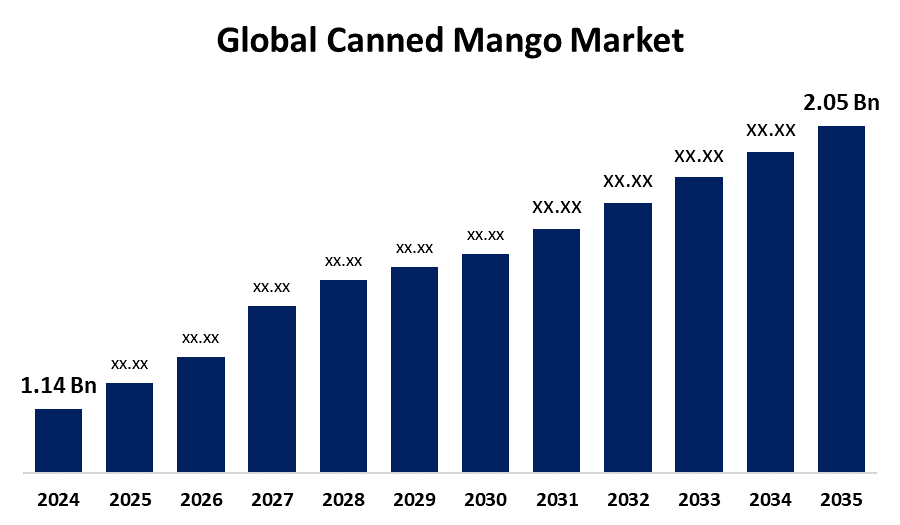

- The Global Canned Mango Market Size Was Estimated at USD 1.14 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.48% from 2025 to 2035

- The Worldwide Canned Mango Market Size is Expected to Reach USD 2.05 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Canned Mango Market Size was worth around USD 1.14 Billion in 2024 and is predicted to Grow to around USD 2.05 Billion By 2035 with a Compound Annual Growth Rate (CAGR) of 5.48% from 2025 and 2035. The canned mango market is driven by increasing demand for convenience food, increasing usage of mango-flavored foods, availability throughout the year, increasing international trade, and rising health consciousness. All these drivers enhance consumption within homes, foodservice, and industrial applications, leading to consistent growth in the market globally.

Market Overview

The canned mango industry is the worldwide sector concerned with producing, packing, distributing, and selling preserved mangoes in cans, which are processed to enhance shelf life and provide availability year-round outside the mango season. Year-round availability is made possible through canned mangoes, which guarantee availability irrespective of harvest times. They are easy to store, convenient, and have an extended shelf life, so they are perfect for busy homes and foodservice facilities. Canned mangoes contain vitamins A and C, antioxidants, and natural sweetness, so canned mangoes facilitate health-oriented diets. They are easily utilized in smoothies, desserts, sauces, drinks, and baked products. Their adaptability, allied with regular quality and flavor, renders canned mangoes a precious commodity in home and industrial kitchens alike. In addition, the medical community is aware of the nutritional value of canned mangoes and tends to include them in a healthy diet. This multifarious use is reflective of the critical role played by canned mangoes in facilitating a healthy life, along with serving the needs of contemporary consumers.

Report Coverage

This research report categorizes the canned mango market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the canned mango market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the canned mango market.

Canned Mango Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.14 Billion |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 5.48% |

| 2035 Value Projection: | USD 2.05 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 233 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application, and COVID-19 Impact Analysis |

| Companies covered:: | Dole, Annies Farm, Ayam Brand, Bonduelle, Goya Foods, Allens, The Mango Factory, Del Monte Foods, Jal Pan Foods, Rhodes Food Group, Siam Food, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Mango is a popular flavor in smoothies, juices, yogurts, and desserts. Increased consumption of fruit-based drinks and functional foods has driven demand for canned mango chunks and puree. Such consumption is particularly prevalent in health-oriented and younger consumer segments, driving manufacturers to develop mango-based products. Further, in contrast to fresh mangoes, which have a seasonal availability, canned mangoes are perennially available. This uniform availability is attractive to consumers and producers alike, sustaining consistent demand irrespective of harvest periods and geographical restrictions. It extends the application of mango into other products and markets across the world.

Restraining Factors

The canning of mangoes requires labor-intensive packaging, processing, and storage needs, and thus it is costly. Also, the cost of procuring quality mangoes and keeping the canning line may escalate costs, making canned mangoes more expensive than their fresh counterparts, which keeps the market growth restricted, particularly in price-sensitive markets. Additionally, the availability of fresh mangoes in most tropical and subtropical countries, and the growing demand for frozen mangoes, have put more competition in the market. The consumers can opt for fresh or frozen mangoes because they have a better taste and nutritional quality, which presents a challenge to the canned mango market.

Market Segmentation

The canned mango market share is classified into product type and application.

- The mango puree segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the canned mango market is divided into frozen mango, canned mango slices, mango puree, and canned mango chunks. Among these, the mango puree segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed to mango puree is extremely versatile, utilized in a high number of products, including juices, smoothies, desserts, sauces, and infant food. Its capability to fit into both sweet and savory foods in various industries, retail, foodservice, and beverages, makes it a popular ingredient, and this has led to its predominance in the market for canned mangoes.

- The household consumption segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the canned mango market is divided into household consumption, the foodservice industry, and industrial use. The household consumption segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is driven by canned mangoes provide convenience for busy shoppers who are looking for quick, ready-to-eat food or ingredients for meals. This ease-of-use appeals to households, where time-saving foods are greatly appreciated. Demand for such easy, healthy choices has led household consumption to dominate the market as the biggest segment.

Regional Segment Analysis of the Canned Mango Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the canned mango market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the canned mango market over the predicted timeframe. North American consumers have shown a strong liking for tropical and exotic fruits such as mangoes, driven by growing interest in foreign cuisines and health-oriented consumption. North America, and specifically the U.S., has a strong import mechanism allowing mango products to be available throughout the year. With limited national production of mangoes, nations such as Mexico, India, and the Philippines provide processed and canned mangoes seamlessly. This availability guarantees a consistent market supply and upholds the region's leadership in canned mango consumption.

Asia Pacific is expected to grow at a rapid CAGR in the canned mango market during the forecast period. Asia Pacific boasts the world's greatest mango producers in countries such as India, China, and Thailand. With this rich production, the region has access to a steady supply of mangoes, stimulating growth in canned mango products for both domestic and foreign markets. Mangoes have significant cultural value in most Asia Pacific nations, hence being a staple in local diets. With the growing availability of canned mango options, this deeply ingrained love for mangoes translates to an upward spiral demand for canned mango products in both the traditional and modern forms.

Europe is predicted to hold a significant share of the canned mango market throughout the estimated period. European customers are increasingly looking for exotic fruits such as mangoes for their unique taste and nutritional benefits. This trend, fueled by increasing demand for global cuisines and healthy food trends, has increased the popularity of canned mango products, establishing a considerable market share in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the canned mango market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dole

- Annie's Farm

- Ayam Brand

- Bonduelle

- Goya Foods

- Allens

- The Mango Factory

- Del Monte Foods

- Jal Pan Foods

- Rhodes Food Group

- Siam Food

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2024, GURU Organic Energy debuted its new Peach Mango Punch in Canada, after a successful U.S. launch in January 2024. The introduction is backed by a wide-ranging national marketing effort, consisting of in-store promotion, digital and social media activity, influencer sponsorships, university campus promotions, and specialty events in major metropolitan areas. The effort also includes a new look at the can with a dynamic, refreshed design.

- In September 2023, Coca-Cola's Maaza has introduced a premium variant, Maaza Mango Lassi, making its way into the premium drink’s portfolio. The introduction is backed by a new campaign "Rush Nahi, Sip Karo" with Bollywood star Ananya Panday. T&P conceptualized campaign urges people to slow down and enjoy the yummy flavor of Maaza Mango Lassi during their go-to leisure.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the canned mango market based on the below-mentioned segments:

Global Canned Mango Market, By Product Type

- Frozen Mango

- Canned Mango Slices

- Mango Puree

- Canned Mango Chunks

Global Canned Mango Market, By Application

- Household Consumption

- Foodservice Industry

- Industrial Use

Global Canned Mango Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the canned mango market over the forecast period?The global canned mango market is projected to expand at a CAGR of 5.48% during the forecast period.

-

2. What is the market size of the canned mango market?The global canned mango market size is expected to grow from USD 1.14 Billion in 2024 to USD 2.05 Billion by 2035, at a CAGR of 5.48% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the canned mango market?North America is anticipated to hold the largest share of the canned mango market over the predicted timeframe.

Need help to buy this report?