Global Cannabis Infused Edible Products Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Candy, Baked Goods, Beverages, Chocolate and Gummies), By Cannabis Type (THC-Infused, CBD-Infused and THC & CBD Blends), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience Store, Online Stores and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Cannabis Infused Edible Products Market Size Forecasts to 2035

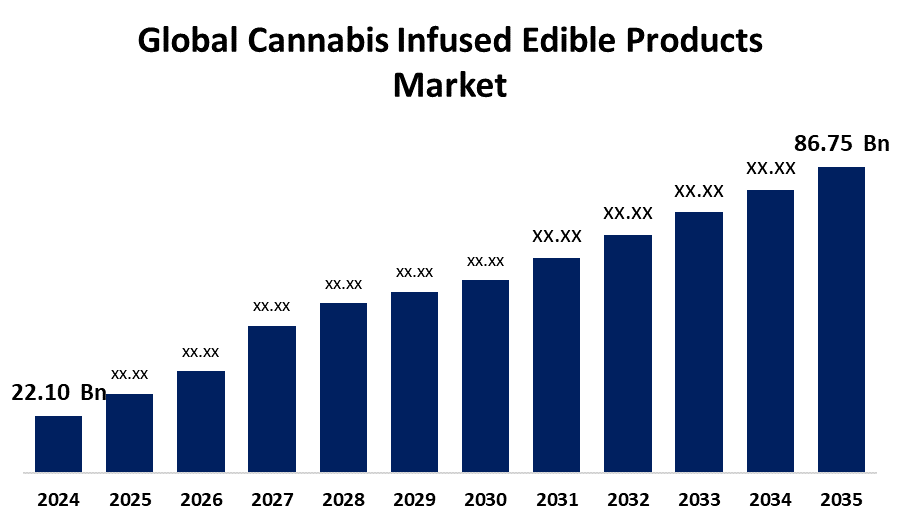

- The Global Cannabis Infused Edible Products Market Size Was Estimated at USD 22.10 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.24% from 2025 to 2035

- The Worldwide Cannabis Infused Edible Products Market Size is Expected to Reach USD 86.75 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The global cannabis infused edible products market size was worth around USD 22.10 billion in 2024 and is predicted to grow to around USD 86.75 billion by 2035 with a compound annual growth rate (CAGR) of 13.24% from 2025 and 2035. The cannabis infused edible products market is propelled by trends including rising legalization of cannabis, enhanced demand for health and wellness products, convenient and discreet consumption, product innovation, and heightened consumer education and awareness of the benefits of cannabis.

Market Overview

The cannabis infused edible products industry describes the business dedicated to food and beverage products infused with cannabis extracts, mainly THC (tetrahydrocannabinol) and CBD (cannabidiol). These edibles are ingested for recreational or therapeutic uses and exist in several formats, such as gummies, chocolates, drinks, baked items, and sweets. The industry encompasses products with psychoactive effects (THC-infused) and wellness- or medicinally directed products (CBD-infused). Furthermore, the increased consciousness about the therapeutic effects of cannabis-infused food is contributing substantially to the growth in the market. Such edibles are gaining popularity for their potential to alleviate cancer patients from problems such as inadequate appetite, loss of weight, pain, muscle spasms, and nausea. Further, the increased availability of cannabis-infused drinks, including cannabis cola, fruit punch, and coffee, by licensed marijuana dispensaries has also helped in improving their popularity. In addition to this, the increasing application of hemp and cannabidiol in animal feed products to cure ailments such as epilepsy, osteoporosis, anxiety, and pain in the joints is also having a positive impact on the global market.

Report Coverage

This research report categorizes the cannabis infused edible products market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cannabis infused edible products market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the cannabis infused edible products market.

Cannabis Infused Edible Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 22.10 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 13.24% |

| 2035 Value Projection: | USD 86.75 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Cannabis Type, By Distribution Channel, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Naturecan Ltd, Cannabinoid Creations, Hempfusion Wellness Inc., Botanic Labs, RS Group (Lifestar), Village Farms International Inc., Neurogen, Spring Cannabis Express, Canna River, BellRock Brands Inc. (Dixie Elixirs), CBDfx, Grön Confections (GrönCBD) LLC, and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

People are increasingly using cannabis infused edibles as a natural remedy for pain management, reduction of anxiety, and insomnia. The increased desire for wellness products, particularly natural ingredients, is a major force behind the demand for cannabis edibles with CBD and THC. Further, Cannabis-infused edibles like gummies, chocolates, and drinks are a convenient and discreet mode of consumption. Unlike smoking or vaping, edibles are easy to consume without drawing attention, making them a preferred choice for users seeking privacy or those in public settings, boosting their market growth.

Restraining Factors

Despite growing acceptance, there is still stigma around cannabis use in most areas. Misconceptions about cannabis edibles' safety, dosage, and potency can deter potential consumers. Poor education on how to use edibles properly and the consequent lack of understanding can also impede market development and lead to consumer hesitation.

Market Segmentation

The cannabis infused edible products market share is classified into type, cannabis type, and distribution channel.

- The gummies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the cannabis infused edible products market is divided into candy, baked goods, beverages, chocolate, and gummies. Among these, segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by gummies are convenient, portable, and discreet, which has made them extremely popular among cannabis first-timers and veterans alike. Their familiar shape, being just like common candy, makes them attractive, particularly for beginners, driving strong demand and causing them to lead the market.

- The THC-infused segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the cannabis type, the cannabis infused edible products market is divided into THC-infused, CBD-infused, and THC & CBD blends. Among these, the THC-infused segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The segmental growth is due to THC-infused edibles having been on the market longer in most legal markets, allowing consumers to be exposed to the products for a longer period. Having been the first cannabis edibles to catch on, THC-infused products such as gummies, chocolates, and drinks are a top choice among consumers, leading to them having a large market share in the edible market.

- The supermarkets/hypermarkets segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the cannabis infused edible products market is divided into supermarkets/hypermarkets, specialty stores, convenience stores, online stores, and others. Among these, the supermarkets/hypermarkets segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to supermarkets and hypermarkets generally provide a mix of items at one place, and cannabis-infused edibles can be kept along with other health-oriented and novelty products. It becomes more convenient for customers to try various types of edibles, ranging from gummies to chocolates, increasing the overall market share.

Regional Segment Analysis of the Cannabis Infused Edible Products Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the cannabis infused edible products market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the cannabis infused edible products market over the predicted timeframe. North America, particularly the U.S. and Canada, has pioneered cannabis legalization, with a regulated market that favors the development of edibles. Legislation makes it possible for businesses to operate in the open, invest in research, and guarantee product safety. The regulatory environment enhances customer confidence and business growth, positioning North America as the most developed and lucrative region for the industry.

Asia Pacific is expected to grow at a rapid CAGR in the cannabis infused edible products market during the forecast period. Several Asia-Pacific nations are slowly easing cannabis laws for medical and wellness use. Cannabis use has been decriminalized in Thailand, while South Korea and Australia permit the use of medical cannabis under strict controls. These changes open up new avenues for edibles, particularly CBD-focused ones. As more governments look to reform, the market is opening fast to both domestic and foreign players.

Europe is predicted to hold a significant share of the cannabis infused edible products market throughout the estimated period. Europe boasts a sophisticated food and beverage sector complemented by firm regulatory guidelines. This setting promotes the manufacture of high-quality, safe cannabis edibles. The developed infrastructure on the continent enables businesses to effectively establish, test, and distribute new forms of edibles such as chocolates, gummies, and beverages, enabling them to have a considerable share in the expanding global cannabis industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the cannabis infused edible products market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Naturecan Ltd

- Cannabinoid Creations

- Hempfusion Wellness Inc.

- Botanic Labs

- RS Group (Lifestar)

- Village Farms International Inc.

- Neurogen

- Spring Cannabis Express

- Canna River

- BellRock Brands Inc. (Dixie Elixirs)

- CBDfx

- Grön Confections (GrönCBD) LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, Trulieve Cannabis Corp. launched its 'Onward' line of THC-infused, non-alcoholic beverages. The beverages, offered in flavors such as sea salt margarita and peach bellini, are meant to deliver a healthy, refreshing experience to both recreational and medicinal consumers.

- In January 2025, Connecticut's Thomas Hooker Brewing introduced 'MUZE', a hemp-sourced THC seltzer with 3 mg of THC and 15 mg of CBD per serving. Raspberry lime and peach flavors are offered, and MUZE is promoted as a healthier, low-calorie version of alcoholic beverages.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the cannabis infused edible products market based on the below-mentioned segments:

Global Cannabis Infused Edible Products Market, By Product Type

- Candy

- Baked Goods

- Beverages

- Chocolate

- Gummies

Global Cannabis Infused Edible Products Market, By Cannabis Type

- THC-Infused

- CBD-Infused

- THC & CBD Blends

Global Cannabis Infused Edible Products Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Store

- Online Stores

- Others

Global Cannabis Infused Edible Products Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the cannabis infused edible products market over the forecast period?The global cannabis infused edible products market is projected to expand at a CAGR of 13.24% during the forecast period.

-

2. What is the market size of the cannabis infused edible products market?The global cannabis infused edible products market size is expected to grow from USD 22.10 Billion in 2024 to USD 86.75 Billion by 2035, at a CAGR of 13.24% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the cannabis infused edible products market?North America is anticipated to hold the largest share of the cannabis infused edible products market over the predicted timeframe.

Need help to buy this report?