Global Cannabidiol Market Size, Share, and COVID-19 Impact Analysis, By Source Type (Hemp and Marijuana), By End User (Medical, Personal Use, Pharmaceuticals, and Wellness), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Cannabidiol Market Insights Forecasts to 2035

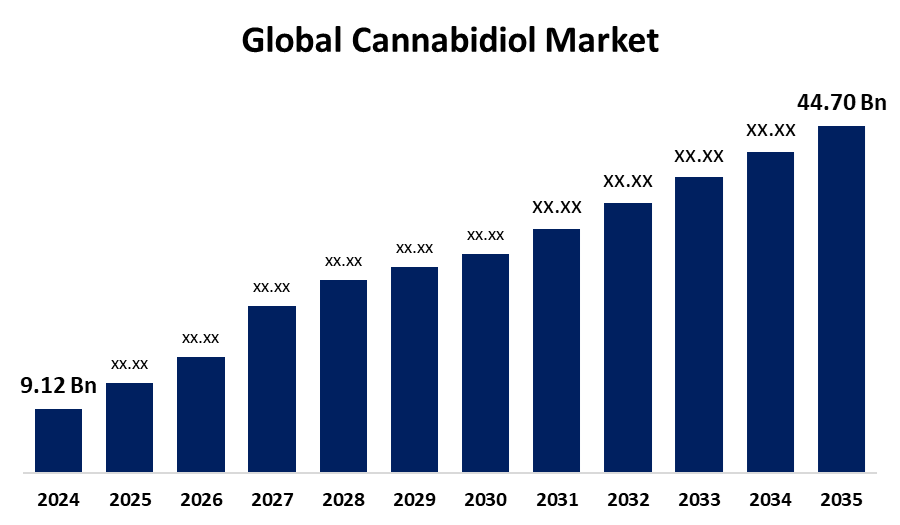

- The Global Cannabidiol Market Size Was Estimated at USD 9.12 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.55% from 2025 to 2035

- The Worldwide Cannabidiol Market Size is Expected to Reach USD 44.70 Billion by 2035

- Europe is Expected to Grow the fastest during the Forecast Period.

Get more details on this report -

The Global Cannabidiol Market Size was Worth around USD 9.12 Billion in 2024 and is predicted to Grow to around USD 44.70 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 15.55% from 2025 and 2035. The growing demand for CBD products to treat sadness and anxiety is anticipated to generate substantial potential for goods based on CBD oil, driving the cannabidiol market.

Market Overview

The global industry pertaining to the manufacturing, marketing, and distribution of products containing cannabidiol is known as the cannabidiol (CBD) market. Cannabidiol is used in personal care, wellness, and pharmaceutical applications. It is derived from hemp or marijuana. Hospital pharmacies, retail establishments, and internet platforms distribute the market's products, which include foods, tinctures, oils, capsules, and creams.

Consumer demand, medical research, and regulatory changes are which propel market growth. Its quick expansion and diversification are facilitated by growing use in the wellness and healthcare sectors. For instance, in October 2022, NuLeaf Naturals, a subsidiary of High Tide, Inc., launched multi-cannabinoid products in Ontario, Canada. Full Spectrum Hemp Multicannabinoid oil and plant-based softgels containing delta-9 tetrahydrocannabinol, cannabichromene, cannabidiol, cannabigerol, and cannabinol are among the items on the market.

The rise of e-commerce has helped businesses access a larger audience and boost sales through online channels, which has improved growth estimates for the cannabidiol market. The cannabidiol market is getting more competitive as more businesses enter the market and provide comparable products, which is helping the cannabidiol market. The market has grown significantly as a result of the increasing acceptance and legality of products derived from cannabis for therapeutic and medical purposes.

Report Coverage

This research report categorizes the cannabidiol market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cannabidiol market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the cannabidiol market.

Global Cannabidiol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.12 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 15.55% |

| 2035 Value Projection: | USD 44.70 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 241 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Source Type, By End User, By Region. |

| Companies covered:: | Elixinol, ENDOCA, PharmaHemp, Medical Marijuana, Inc., NuLeaf Naturals, LLC, Folium Europe B.V., Cannoid, LLC, The Cronos Group, Isodiol International, Inc., Canopy Growth Corporation, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The main driver of the market expansion is the demand for CBD for health and well-being. Additionally, increased manufacturing and sales are anticipated to result from the growing acceptability and use of these items brought about by official approvals. The increasing use of cannabidiol (CBD) for a range of purposes, especially in the wellness and health industries, is propelling significant industry trends in the cannabidiol market. One of the main factors propelling the cannabidiol (CBD) market is the growing recognition of CBD as a healthy product worldwide. Due to its medicinal properties, CBD is becoming more and more popular for use in health and wellness applications, which is the main factor propelling the cannabidiol market.

Restraining Factors

The cannabidiol market is restricted by a number of problems, such as supply chain interruptions, negative health consequences, and regulatory uncertainties. The cannabidiol market expansion is impeded by legal constraints and inconsistent rules, and consumer adoption is impacted by worries about possible negative effects.

Market Segmentation

The cannabidiol market share is classified into source type and end user.

- The hemp segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the source type, the cannabidiol market is divided into hemp and marijuana. Among these, the hemp segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Growing public knowledge of the health benefits and increased demand from the pharmaceutical business are the reasons behind the hemp segment. Oils, tinctures, concentrates, capsules, topical solutions like salves, lip balms, and lotions, as well as consumables like coffee, chocolate, gum, candies, and baked goods, are among the high-demand CBD items.

- The pharmaceuticals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the cannabidiol market is divided into medical, personal use, pharmaceuticals, and wellness. Among these, the pharmaceuticals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The pharmaceutical sector demand for these products is anticipated to be fueled by an increasing number of clinical trials evaluating the effects of CBD on various health issues.

Regional Segment Analysis of the Cannabidiol Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the cannabidiol market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the cannabidiol market over the predicted timeframe. Numerous variables, including the high number of health-conscious people, the increasing acceptability of CBD products, the existence of significant producers, and the 2020 ratification of the U.S. Farm Bill, are responsible for North America's resurgence. Additionally, the U.S. CBD market is expanding as more Americans become aware of the many advantages that cannabidiol offers. The area has the most CBD businesses and the most advantageous regulations for CBD product use, making it the most developed in terms of cannabis and its derivatives, including cannabidiol.

Europe is expected to grow at a rapid CAGR in the cannabidiol market during the forecast period. CBD oil has become more well-known in this area as a result of growing public awareness of its health advantages, accessibility, and reasonable costs. Store-bought products include a small amount of CBD and are combined with other ingredients. Additionally, personal care products like lotions, creams, and shampoos frequently contain cannabidiol market. There are several ways that CBD is sold, including CBD edibles, CBD pills, CBD hemp oil, and CBD vaping e-liquid.

Asia Pacific is predicted to hold a significant share of the cannabidiol market throughout the estimated period. Asia Pacific region, the establishment of facilities for hemp cultivation, especially in China. China produces almost half of the world's hemp, making it the top hemp grower in Asia. Growing acceptance and legality of hemp-based products, along with growing knowledge of their potential health advantages, are major factors driving the growth of the Asia Pacific cannabidiol (CBD) market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the cannabidiol market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Elixinol

- ENDOCA

- PharmaHemp

- Medical Marijuana, Inc.

- NuLeaf Naturals, LLC

- Folium Europe B.V.

- Cannoid, LLC

- The Cronos Group

- Isodiol International, Inc.

- Canopy Growth Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2024, The Nutrient CBD line, which includes five creative SKUs like two CBD Oil Tinctures, two CBD Creams, and one CBD Roll-On, was launched by cannabis manufacturer and distributor Rodedawg International Industries, Inc. to satisfy the diverse needs of customers looking for safe and efficient wellness solutions.

- In April 2023, in collaboration with Strainprint, Aurora Cannabis Inc. announced the opening of the Strainprint App tracking program. The purpose of the tracking program is to let Aurora patients monitor their journey with medical cannabis.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the cannabidiol market based on the below-mentioned segments:

Global Cannabidiol Market, By Source Type

- Hemp

- Marijuana

Global Cannabidiol Market, By End User

- Medical

- Personal Use

- Pharmaceuticals

- Wellness

Global Cannabidiol Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the cannabidiol market over the forecast period?The global cannabidiol market is projected to expand at a CAGR of 15.55% during the forecast period.

-

2. What is the market size of the cannabidiol market?The global Cannabidiol market size is expected to grow from USD 9.12 Billion in 2024 to USD 44.70 Billion by 2035, at a CAGR of 15.55% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the cannabidiol market?North America is anticipated to hold the largest share of the cannabidiol market over the predicted timeframe.

Need help to buy this report?