Global Cane Molasses Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Food Grade, Industrial Grade, Feed Grade), By Application (Food and Beverage, Animal Feed, Biofuel, Pharmaceuticals, and Others), By Distribution Channel (Online Stores, Supermarkets/Hypermarkets, Specialty Stores, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Cane Molasses Market Insights Forecasts to 2035

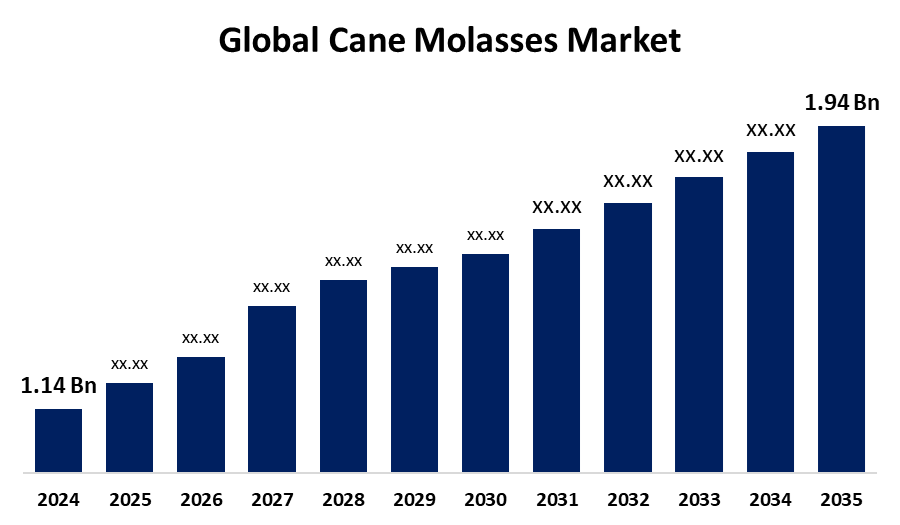

- The Global Cane Molasses Market Size Was Estimated at USD 1.14 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.95% from 2025 to 2035

- The Worldwide Cane Molasses Market Size is Expected to Reach USD 1.94 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

The global cane molasses market size was worth around USD 1.14 billion in 2024 and is predicted to grow to around USD 1.94 Billion by 2035 with a compound annual growth rate (CAGR) of 4.95% from 2025 and 2035. The global cane molasses market is fueled by growing demand for natural sweeteners, growth in the livestock feed sector, and growing applications in the biofuel industry. Its affordability, nutritional content, and compatibility with sustainability and zero-waste policies further promote steady global market expansion.

Market Overview

The cane molasses industry is the global sector that engages in the manufacturing, distribution, and use of molasses from processing sugarcane. Cane molasses is a dark-colored, thick, and nutrient-dense syrup that is obtained as a byproduct during sugar extraction. Increasing numbers of consumers are becoming conscious of their health and looking for alternatives to refined sugar. Cane molasses, a natural byproduct of sugarcane processing, retains essential nutrients such as iron, calcium, and magnesium. This renders it a favorite among those who would like to add sweetness to their foods and beverages without resorting to highly processed products. Additionally, increasing demand for functional foods is offering tremendous growth prospects for the cane molasses industry. As a natural source of essential minerals and vitamins, cane molasses is an unusual ingredient that serves consumers' need for flavorful food with genuine health value. Mixing it with foods such as nutrient-enriched bars, fortified breakfast cereals, and health-oriented beverages not only enhances their nutritive value but also infuses them with a unique flavor. With its wholesome and tasty nature, cane molasses presents itself as an attractive alternative to health-oriented consumers seeking well-being-promoting ingredients. Such a change in consumer patterns is likely to fuel greater cane molasses demand over the next few years.

Report Coverage

This research report categorizes the cane molasses market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cane molasses market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the cane molasses market.

Global Cane Molasses Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.14 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.95% |

| 2035 Value Projection: | USD 1.94 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product Type, By Application, By Distribution Channel, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Louis Dreyfus Company, Cargill, Incorporated, Wilmar International Ltd, Nordic Sugar A/S, Tereos Group, Mitr Phol Sugar Corporation, Guangxi Guitang Group Co., Ltd., Raizen Energia, Biosev S.A., Sudzucker AG, Bunge Limited, ED&F Man Holdings Limited, Associated British Foods plc and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Customers are now turning towards natural and less-refined sweeteners as safe alternatives to white sugar. Cane molasses, being a high-mineral content ingredient with iron and calcium, is gaining common usage in baked foods, sauces, and liquids, further boosting demand in the food and beverage sector. In addition, cane molasses is an economical, energy-dense feed additive that enhances feed palatability, digestibility, and nutrient level. As world consumption of meat and dairy products increases, demand for quality animal feed is escalating, furthering robust molasses consumption in cattle, poultry, and pig industries.

Restraining Factors

The production of cane molasses is directly related to sugarcane crops, which are influenced by weather, pests, and diseases. Droughts, floods, or disease may decrease sugarcane production, causing lower molasses availability and price fluctuation, derailing the market stability. Additionally, the production of cane molasses is seasonal and geographically concentrated in tropical regions. This restricts year-round availability in alternative markets to create possible supply shortages or enhanced import reliance, which can prevent growth, particularly in non-producing nations.

Market Segmentation

The cane molasses market share is classified into product type, application, and distribution channel.

- The feed grade segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the cane molasses market is divided into food grade, industrial grade, and feed grade. Among these, the feed grade segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to feed grade molasses containing high sugars, vitamins, and minerals, offering vital energy and nutrients for livestock. It enhances feed palatability and digestibility, thus improving animal growth, milk yield, and overall well-being, making it a preferred animal feed additive globally.

- The food and beverages segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the cane molasses market is divided into food and beverage, animal feed, biofuel, pharmaceuticals, and others. Among these, the food and beverages segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is driven by cane molasses a natural, less-processed sweetener that provides a rich, unique flavor to foods and beverages. Its bold caramel flavor enriches baked goods, sauces, and drinks, rendering it an ingredient of choice for manufacturers and consumers looking for authentic taste and healthier alternatives to sugar.

- The supermarkets/hypermarkets segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the distribution channel, the cane molasses market is divided into online stores, supermarkets/hypermarkets, specialty stores, and others. Among these, the supermarkets/hypermarkets segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The growth is attributed to supermarkets and hypermarkets possessing a huge network, covering extensive consumer bases in urban and suburban areas. Their large numbers of locations and high traffic ensure products of cane molasses are widely available, drawing in additional buyers than retail stores with small sizes. This wide outreach greatly increases their market share in the distribution of molasses.

Regional Segment Analysis of the Cane Molasses Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the cane molasses market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the cane molasses market over the predicted timeframe. Asia-Pacific, particularly India, China, and Thailand, grows most of the world's sugarcane. Substantial yields of sugarcane automatically result in huge quantities of molasses, which is a byproduct of sugar manufacturing. The abundance provides constant and affordable supplies of cane molasses, making the region a production and export leader. Asia-Pacific governments, particularly India and Thailand, have introduced aggressive ethanol blending schemes to cut fuel imports and emissions. This has increased the demand for ethanol based on molasses. Subsidies, blending requirements, and advantageous procurement policies make production more profitable promote expansion, and create a large market share for the region.

North America is expected to grow at a rapid CAGR in the cane molasses market during the forecast period. Cane molasses is universally employed as an energy-dense feed supplement for livestock. North America has witnessed a growing demand for cost-effective, healthy animal feeds in the dairy and beef sectors, spurring the consumption of molasses. Its large-scale commercial agriculture systems in the region prefer such cost-saving supplements, accelerating its rapid development in the molasses market. North American organizations are importing higher volumes of cane molasses from Asia and Latin America to satisfy growing demand. Supply contracts and strategic partnerships with manufacturers in countries such as the Caribbean and Central America guarantee regular supply. Such partnerships have facilitated fast expansion of supply chains and product integration, allowing for quick market growth.

Europe is predicted to hold a significant share of the cane molasses market throughout the estimated period. Europe boasts a well-established food and beverage industry where cane molasses is incorporated into bread, beer, and confectionery products. Its distinct taste and high nutritional value render it an ingredient of choice in classic European dishes, sauces, and desserts. That it has been used in cooking for centuries ensures consistent demand, supporting Europe's strong presence in the global molasses market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the cane molasses market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Louis Dreyfus Company

- Cargill, Incorporated

- Wilmar International Ltd

- Nordic Sugar A/S

- Tereos Group

- Mitr Phol Sugar Corporation

- Guangxi Guitang Group Co., Ltd.

- Raizen Energia

- Biosev S.A.

- Sudzucker AG

- Bunge Limited

- ED&F Man Holdings Limited

- Associated British Foods plc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2024, Expana introduced 24 fresh monthly Expana Benchmark Prices (EBP) for blackstrap, light, and dark cane molasses. These evaluations show the transactable value at 16:00:00 US Eastern Time and present a standardized price mechanism for the molasses market.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the cane molasses market based on the below-mentioned segments:

Global Cane Molasses Market, By Product Type

- Food Grade

- Industrial Grade

- Feed Grade

Global Cane Molasses Market, By Application

- Food Grade

- Industrial Grade

- Feed Grade

Global Cane Molasses Market, By Distribution Channel

- Online Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

Global Cane Molasses Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the cane molasses market over the forecast period?The global cane molasses market is projected to expand at a CAGR of 4.95% during the forecast period.

-

2. What is the market size of the cane molasses market?The global cane molasses market size is expected to grow from USD 1.14 Billion in 2024 to USD 1.94 Billion by 2035, at a CAGR of 4.95% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the cane molasses market?Asia Pacific is anticipated to hold the largest share of the cane molasses market over the predicted timeframe.

Need help to buy this report?