Global Candy & Chocolate Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Product & Service (Chocolate Candy, Non-Chocolate Candy, and Gum), By Major Market (Confectionery Wholesalers, Supermarkets & Grocery Stores, Food Manufacturers, Hospitality Trade, Discount Stores, and Direct to Public), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Candy & Chocolate Manufacturing Market Insights Forecasts to 2035

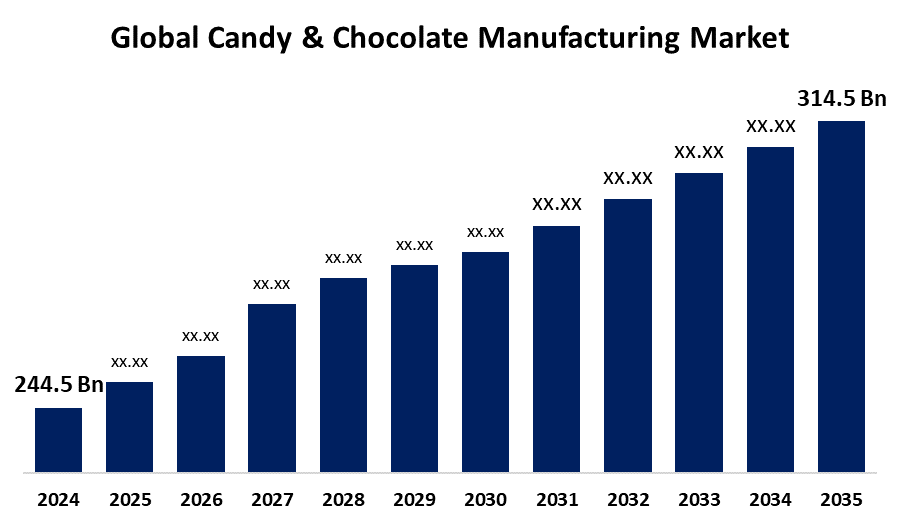

- The Global Candy & Chocolate Manufacturing Market Size Was Estimated at USD 244.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.32% from 2025 to 2035

- The Worldwide Candy & Chocolate Manufacturing Market Size is Expected to Reach USD 314.5 Billion by 2035

- Asia Pacific is Expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Candy & Chocolate Manufacturing Market Size was worth around USD 244.5 Billion in 2024 and is predicted to grow to around USD 314.5 Billion by 2035 with a compound annual growth rate (CAGR) of 2.32% from 2025 to 2035. The evolving consumer preferences towards premium and artisanal chocolates and the popularity of dark chocolate for perceived health benefits are driving the candy & chocolate manufacturing market globally.

Market Overview

The candy & chocolate manufacturing market refers to the market that encompasses the production and sale of various confectionery products, such as chocolate bars, boxed chocolates, and other candies. Candy & chocolate manufacturing is the multi-stage process, including sourcing of raw material to the final packaging. The process emphasizes the creation of different textures through the controlled heating and cooling of sugar and other ingredients, often involving crystallization or inversion processes. The candy and chocolate are increasing, triggered by the marketing and promotional activities. The growing chocolate consumption, owing to the awareness and consciousness about chocolate brands among the urban population, is driving the candy & chocolate manufacturing market demand. The emergence of innovative chocolate flavors, the introduction of healthy ingredients, and sugar alternative solutions are bolstering the market growth opportunities.

Report Coverage

This research report categorizes the candy & chocolate manufacturing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the candy & chocolate manufacturing market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the candy & chocolate manufacturing market.

Candy & Chocolate Manufacturing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 244.5 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.32% |

| 2035 Value Projection: | USD 314.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 126 |

| Companies covered:: | Barry Callebaut, Chocoladefabriken Lindt & Sprungli AG, Modelen International Inc., Nestle, The Hershey Company, Ferrero Group, Mars, Incorporated, The Australian Carob Co, Meiki Holdings Co Ltd, Arcor, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Consumers' increasing interest in premium and artisanal chocolates and the availability of dark chocolate and plant-based alternatives are driving the candy & chocolate manufacturing market. Further, the organic chocolate confectionery, impacted by the advertisement of organic food items and consumer preferences for such products, contributes to propelling market expansion. Additionally, an increasing disposable income among the middle-class population is driving the purchasing of candies and chocolates, thereby aiding in market demand.

Restraining Factors

Unfavourable weather patterns such as droughts and heavy rains, and plant diseases like swollen shoot virus that impact the cocoa production, are restraining the market. Further, the challenges or issues in quality control of chocolate manufacturing, like cocoa bean quality, contamination risks, process control, and improper packaging conditions, are hampering the market growth.

Market Segmentation

The candy & chocolate manufacturing market share is classified into product & service and major market.

- The chocolate candy segment dominated the candy & chocolate manufacturing market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product & service, the candy & chocolate manufacturing market is divided into chocolate candy, non-chocolate candy, and gum. Among these, the chocolate candy segment dominated the candy & chocolate manufacturing market in 2024 and is projected to grow at a substantial CAGR during the forecast period. It includes several steps starting from cocoa bean processing and culminating in the creation of various chocolate products. Consumers' increasing preference for chocolate candy due to its rich taste, variety, and cultural significance is contributing to driving the market.

- The supermarkets & grocery stores segment accounted for the largest market revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the major market, the candy & chocolate manufacturing market is divided into confectionery wholesalers, supermarkets & grocery stores, food manufacturers, hospitality trade, discount stores, and direct to public. Among these, the supermarkets & grocery stores segment accounted for the largest market revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Consumers increasing preference towards shopping for grocery products from supermarkets is anticipated to drive the market in the supermarkets & grocery stores segment.

Regional Segment Analysis of the Candy & Chocolate Manufacturing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the candy & chocolate manufacturing market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the candy & chocolate manufacturing market over the predicted timeframe. Consumer inclination in the confectionery market, driven by an increasing appetite for premium chocolate and innovative products, is driving the market of candy & chocolate manufacturing. The strong demand for artisanal chocolates during special occasions such as Christmas and Halloween is driving the market growth.

Asia Pacific is expected to grow at a rapid CAGR in the candy & chocolate manufacturing market during the forecast period. The emerging trend of healthy indulgence of low-fat and sugar-free chocolates is driving the candy & chocolate manufacturing market. Further, the trends towards premiumization, health-consciousness, and sustainability that are influencing the product development are bolstering the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the candy & chocolate manufacturing market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Barry Callebaut

- Chocoladefabriken Lindt & Sprungli AG

- Modelen International Inc.

- Nestle

- The Hershey Company

- Ferrero Group

- Mars, Incorporated

- The Australian Carob Co

- Meiki Holdings Co Ltd

- Arcor

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, the Ontario government welcomed an investment of $445 million by Ferrero Group, one of the world’s largest sweet-packaged food manufacturers, to expand the company’s production facility in Brantford.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the candy & chocolate manufacturing market based on the below-mentioned segments:

Global Candy & Chocolate Manufacturing Market, By Product & Service

- Chocolate Candy

- Non-Chocolate Candy

- Gum

Global Candy & Chocolate Manufacturing Market, By Major Market

- Confectionery Wholesalers

- Supermarkets & Grocery Stores

- Food Manufacturers

- Hospitality Trade

- Discount Stores

- Direct to Public

Global Candy & Chocolate Manufacturing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the candy & chocolate manufacturing market over the forecast period?The global candy & chocolate manufacturing market is projected to expand at a CAGR of 2.32% during the forecast period.

-

2. What is the market size of the candy & chocolate manufacturing market?The global candy & chocolate manufacturing market size is expected to grow from USD 244.5 Billion in 2024 to USD 314.5 Billion by 2035, at a CAGR of 2.32% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the candy & chocolate manufacturing market?North America is anticipated to hold the largest share of the candy & chocolate manufacturing market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the Global Candy & Chocolate Manufacturing Market?Key players include Barry Callebaut, Chocoladefabriken Lindt & Sprungli AG, Modelen International Inc., Nestle, The Hershey Company, Ferrero Group, Mars, Incorporated, The Australian Carob Co, Meiki Holdings Co. Ltd., and Arcor.

-

5. Can you provide company profiles for the leading Candy & Chocolate Manufacturing companies?Yes. For example, Barry Callebaut is a leading manufacturer of high-quality chocolate and cocoa products committed to making sustainable chocolate. Chocoladefabriken Lindt & Sprungli AG is a Swiss chocolate and confectionery company, known for its chocolate truffles and chocolate bars, among other sweets.

-

6. What are the main drivers of growth in the candy & chocolate manufacturing market?Preferences towards premium and artisanal chocolates and the popularity of dark chocolate for perceived health benefits are major market growth drivers.

-

7. What challenges are limiting the candy & chocolate manufacturing market?Unfavourable weather patterns and plant diseases, as well as quality control of chocolate manufacturing, remain key restraints.

Need help to buy this report?