Canada Plasma Fractionation Market Size, Share, and COVID-19 Impact Analysis, By Product (Albumin, Immunoglobulin, Coagulation Factors, Protease Inhibitors, and Others), By Application (Immunology & Neurology, Hematology, Critical Care, Pulmonology, and Others), By End User (Hospitals & Clinics, Clinical Research Laboratories, and Others), and Canada Plasma Fractionation Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareCanada Plasma Fractionation Market Insights Forecasts to 2035

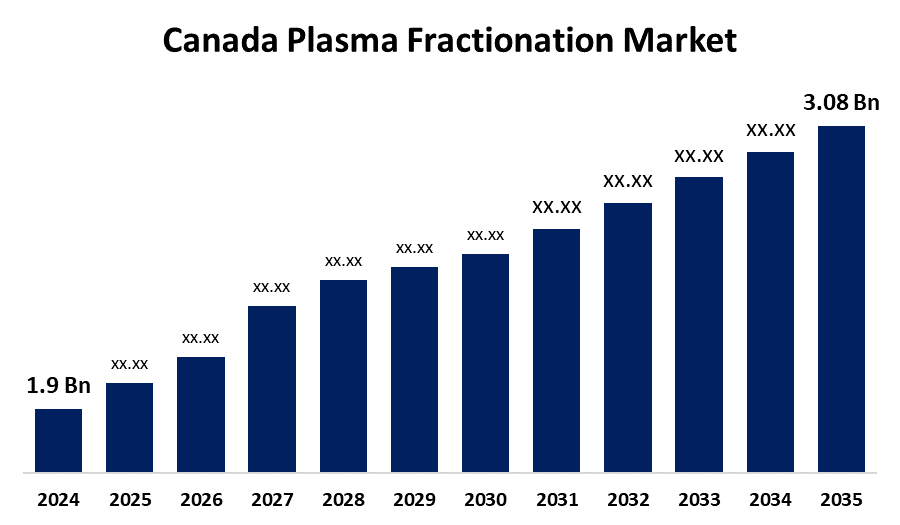

- The Canada Plasma Fractionation Market Size Was Estimated at USD 1.9 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.49% from 2025 to 2035

- The Canada Plasma Fractionation Market Size is Expected to Reach USD 3.08 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Canada Plasma Fractionation Market Size Is Anticipated To Reach USD 3.08 Billion By 2035, Growing At A CAGR Of 4.49% From 2025 To 2035. The market is driven by the rising demand for plasma-derived therapies, increasing prevalence of immunodeficiency and bleeding disorders, expanding use of immunoglobulins, and government initiatives to strengthen domestic plasma collection and processing infrastructure.

Market Overview

The Canada plasma fractionation market includes the industry that focuses on the collection of human plasma, along with its processing and subsequent distribution of these products. "Plasma fractionation is a significant step in the development of these human biologicals. During fractionation, human plasma is divided into individual components. These components have specific therapeutic properties; these include Immunoglobulins, Albumin, Coagulation factors, and Protease Inhibitors. These products are popular solutions for the treatment of various medical ailments, including Immune Deficiencies, Hemophilia, Chronic Inflammatory Disorders, Neurological Disorders, and Critical Care Conditions."

The Canada plasma fractionation industry is also experiencing significant trends that will impact the future of the business. Immunoglobulins account for the largest and fastest-growing segment in the Canada Plasma Fraction market on account of the necessity for immune deficiency and neurological disorder therapy. The trends in the Canada region demand better and improved fractionation technology for better production levels, which includes high-concentration immunoglobulins and better-quality virus filters. The consistently increasing demand for plasma-derived products in autoimmune and neurological disorders is another significant trend in the Canada region.

The Canadian government, in concert with healthcare authorities, is a significant contributor to the plasma fractionation industry by means of public funding of the Canadian healthcare system and initiatives to improve self-sufficiency in plasma. The Canadian Blood Services plays a pivotal role in the plasma industry through plasma supply agreements. Public-private partnerships foster innovation and capacity expansion.

Report Coverage

This research report categorizes the market for the Canada plasma fractionation market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada plasma fractionation market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada plasma fractionation market.

Canada Plasma Fractionation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.9 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.49% |

| 2035 Value Projection: | USD 3.08 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Product, By Application, By End User |

| Companies covered:: | CSL Behring, Grifols, Takeda Pharmaceutical, Octapharma, Kedrion Biopharma, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Canada plasma fractionation market is primarily driven by the increasing prevalence of immunodeficiency disorders, hemophilia, and neurological diseases, which require long-term plasma-derived therapies. Rising demand for immunoglobulins, expanding healthcare infrastructure, and growing awareness of plasma-based treatments further support market growth. Additionally, government efforts to improve plasma self-sufficiency and technological advancements in fractionation and purification processes enhance production efficiency and product safety.

Restraining Factors

Despite an environment of high growth potential, various restraints have an impact on the market. One of these is related to donors, costs related to constructing infrastructure for the collection and fractionation of plasma, as well as regulatory requirements. Being dependent on imported plasma products is another restraint faced by the market.

Market Segmentation

The Canada plasma fractionation market share is classified into product, application, and end user

- The immunoglobulin segment accounted for the largest revenue market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada plasma fractionation market is segmented by product into albumin, immunoglobulin, coagulation factors, protease inhibitors, and others. Among these, the immunoglobulin segment accounted for the largest revenue market in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominant product is used widely for primary/secondary immune deficiencies and, increasingly, for neurological conditions and off-label therapies. It is used to treat chronic autoimmune diseases, neurological conditions, and immunological deficits. The highest per-capita immunoglobulin usage rates in the world are made possible by robust clinical criteria and implementation. A growing age population and improved diagnostic immunoglobulin therapy.

- The immunology & neurology segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on application, the Canada plasma fractionation market is bifurcated into immunology & neurology, hematology, critical care, pulmonology, and others. Among these, the immunology & neurology segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Increased diagnosis rates of these diseases, along with easier access to sophisticated infrastructural facilities for diagnosis and treatment, have ensured the increased utilization of plasma fractionation products. In addition, the aging population of Canada makes this segment more prone to immune and neurological disorders.

- The hospitals & clinics segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on end user, the Canada plasma fractionation market is divided into hospitals & clinics, clinical research laboratories, and others. Among these, the hospitals & clinics segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The hospitals and clinics represent the main points of care where patients need IVIG therapy, coagulation factor, and albumin. The presence of specialized practitioners and the need to monitor patients, especially in plasma therapy, contribute to the high usage of therapy in the hospital and clinic settings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada plasma fractionation market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CSL Behring

- Grifols

- Takeda Pharmaceutical

- Octapharma

- Kedrion Biopharma

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In March 2025, Takeda Canada Inc.'s HyQvia received expanded authorization from Health Canada for treating chronic inflammatory demyelinating polyneuropathy (CIDP).

In January 2025, Takeda Canada announced Hema-Quebec would reimburse HyQvia for immunodeficiency treatments in adults and children.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Canada plasma fractionation market based on the below-mentioned segments:

Canada Plasma Fractionation Market, By Product

- Albumin

- Immunoglobulin

- Coagulation Factors

- Protease Inhibitors

- Other

Canada Plasma Fractionation Market, By Application

- Immunology & Neurology

- Hematology

- Critical Care

- Pulmonology

- Others

Canada Plasma Fractionation Market, By End User

- Hospitals & Clinics

- Clinical Research Laboratories

- Others

Frequently Asked Questions (FAQ)

-

1. What is the Canada plasma fractionation market?The Canada plasma fractionation market refers to the processing of human plasma into therapeutic proteins used to treat immune, hematological, and neurological disorders.

-

2. What is the Canada plasma fractionation market size?Canada plasma fractionation market size is expected to grow from USD 1.9 billion in 2024 to USD 3.08 billion by 2035, growing at a CAGR of 4.49% during the forecast period 2025-2035.

-

3. What are the key drivers of the Canada plasma fractionation market?The market is driven by rising demand for immunoglobulins, increasing disease prevalence, and government support for plasma self-sufficiency.

-

4. Who are the key companies operating in the Canada plasma fractionation market?Major players include CSL Behring, Grifols, Takeda Pharmaceutical, Octapharma, Kedrion Biopharma, etc.

-

5. What is the future outlook for the Canada plasma fractionation market?The market is expected to grow steadily through 2035, driven by medical demand, technological advancements, and healthcare investment.

Need help to buy this report?