Canada Phenol Market Size, Share, By Grade (Industrial Grade And Pharmaceutical Grade), By Application (Polycarbonates, Epoxy Resins, Nylon 6, Bakelite, And Surfactants & Detergents), And Canada Phenol Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsCanada Phenol Market Size Insights Forecasts to 2035

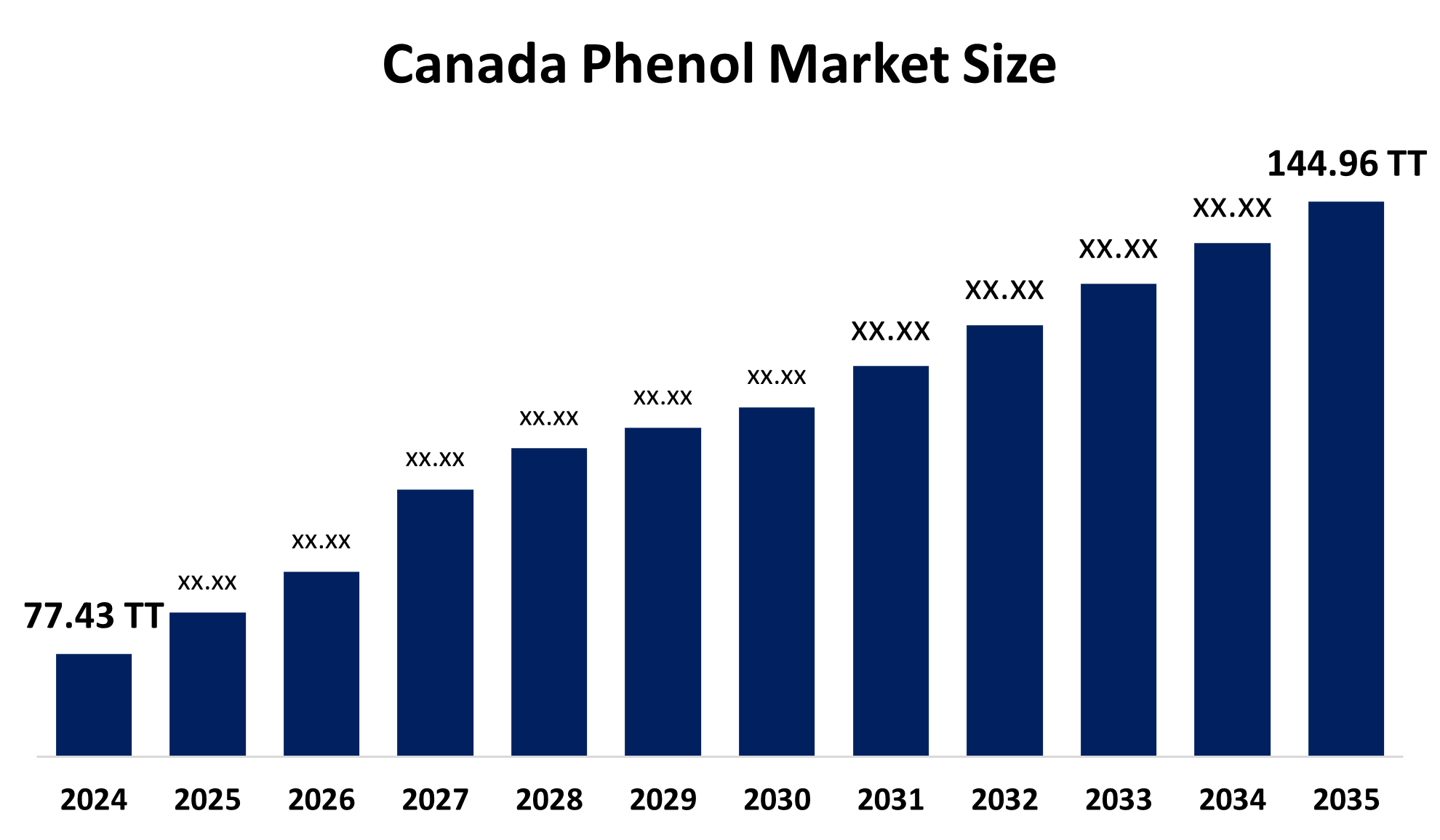

- Canada Phenol Market 2024: 77.43 Thousand Tonnes

- Canada Phenol Market Size 2035: 144.96 Thousand Tonnes

- Canada Phenol Market CAGR 2024: 5.87%

- Canada Phenol Market Segments: Grade and Application

Get more details on this report -

The Canada Phenol Market Size includes everything about phenol in Canada including its supply, trade, and use of phenol as imported materials and downstream use through the Canadian national chemical value chain. Phenol itself is an organic chemical compound belonging to the aromatic chemical family and acts as an essential raw material in the production of phenolic resins, adhesives, coatings, and other chemical products. Canada has historically produced phenol within Canada, but after halting production decades ago, Canada has relied on imports to meet the needs of its chemical industry.

The phenol in Canada are backed by government support, including the Canadian Environmental Protection Act (CEPA), under which phenol and related substituted phenols are assessed and managed to protect human health and the environment. Phenols are a significant traded chemical in Canada, with imports recorded at approximately C$126 million in 2024, indicating ongoing reliance on foreign supply to meet domestic demand for phenol and phenolic products.

As technology advances, Canada’s phenol providers are now using improved logistics for importing, as well as the handling of feedstock and processing of products, led to the creation of advanced technologies used by producers of resins and specialty chemicals. The introduction of innovative technologies based on new chemical processes such as green chemistry and bio-based alternative methods for producing phenol will eventually have an impact on overall production efficiency and ultimately on the ability of producers to create higher performance phenolic resins and BPA substitutes; however, most of these innovations are still in the early stages of development relative to more traditional petrochemical processes.

Market Dynamics of the Canada Phenol Market:

The Canada Phenol Market Size is driven by the downstream industrial demand, continued urban infrastructure development, growth in value-added chemical production create a baseline level of demand for phenolic intermediates, rise in international trade environment, exchange rates influence the cost and volume of phenol imports, advancements in environmentally friendly production technologies and recycling initiatives, and strong government support further propel the market growth.

The Canada Phenol Market Size is restrained by the regulatory constraints, environmental scrutiny under federal chemical management programs, high compliance costs for downstream manufacturers, Moreover, global competition for phenol supply, volatility in raw material availability and pricing, decreasing trend in phenol import volumes in recent years, and shifts in global supply chains challenges.

The future of Canada Phenol Market Size is bright and promising, with versatile opportunities emerging from the high-performance phenolic resins, bio-based phenolic derivatives, and new polymer types will be developed to meet growing demand from automotive, aerospace and electronics companies who want their suppliers to be more sustainable as well as produce sustainable products. The global market for phenolic derivatives is forecast to continue to grow as industrial uses diversify the global market creating new export and investment opportunities for Canadian chemical manufacturers that vertically integrate or innovate in downstream processing of phenolic derivatives. In addition, advances in environmentally friendly manufacturing technologies and recycling programs could provide new avenues for the use of phenolic derivatives in line with Canada’s environmental policy objectives.

Canada Phenol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 77.43 thousand tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.87% |

| 2035 Value Projection: | 144.96 thousand tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Grade, By Application |

| Companies covered:: | Hexion Inc., Georgia-Pacific Chemicals, Mancuso Chemicals Limited, SI Group, Inc., Dow Chemical Canada and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The Canada phenol market share is classified into grade and application.

By Grade:

The Canada Phenol Market Size is divided by grade into industrial grade and pharmaceutical grade. Among these, the industrial grade segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Dominant end use in construction and automotive sectors, primary feedstock of phenol derivatives, cost effectiveness with versatile applications, and established supply chain of high-purity industrial grade phenol all contribute to the industrial grade segment's largest share and higher spending on phenol when compared to other grade.

By Application:

The Canada Phenol Market Size is divided by application into polycarbonates, epoxy resins, nylon 6, Bakelite, and surfactants & detergents. Among these, the bakelite segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The bakelite segment dominates because it is used as a binder in the manufacturing of wood-based panels, provides excellent heat resistance, electrical insulation, and durability in molding applications, and heavily used in automotive industry, driven by industrial applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Canada Phenol Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Canada Phenol Market:

- Hexion Inc.

- Georgia-Pacific Chemicals

- Mancuso Chemicals Limited

- SI Group, Inc.

- Dow Chemical Canada

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Canada Phenol Market Size based on the below-mentioned segments:

Canada Phenol Market, By Grade

- Industrial Grade

- Pharmaceutical Grade

Canada Phenol Market, By Application

- Polycarbonates

- Epoxy Resins

- Nylon 6

- Bakelite

- Surfactants & Detergents

Frequently Asked Questions (FAQ)

-

Q: What is the Canada phenol market size?A: Canada phenol market is expected to grow from 77.43 thousand tonnes in 2024 to 144.96 thousand tonnes by 2035, growing at a CAGR of 5.87% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the downstream industrial demand, continued urban infrastructure development, growth in value-added chemical production create a baseline level of demand for phenolic intermediates, rise in international trade environment, exchange rates influence the cost and volume of phenol imports, advancements in environmentally friendly production technologies and recycling initiatives, and strong government support further propel the market growth.

-

Q: What factors restrain the Canada phenol market?A: Constraints include the regulatory constraints, environmental scrutiny under federal chemical management programs, high compliance costs for downstream manufacturers, Moreover, global competition for phenol supply, volatility in raw material availability and pricing, decreasing trend in phenol import volumes in recent years, and shifts in global supply chains challenges.

-

Q: How is the market segmented by grade?A: The market is segmented into industrial grade and pharmaceutical grade.

-

Q: Who are the key players in the Canada phenol market?A: Key companies include Hexion Inc., Georgia-Pacific Chemicals, Mancuso Chemicals Limited, SI Group, Inc., Dow Chemical Canada, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?