Canada Liquefied Petroleum Gas Market Size, Share, and COVID-19 Impact Analysis, By Application (Residential, Commercial, Chemical, Industrial, Autogas, Refinery, and Others), By Source (Refinery, Associated Gas, Non-Associated Gas, and Others), By Transportation (Ship, Railways, Intermodal ISO Tank Containers, Pipelines, Reticulated Gas System, Large Road Tankers, Bobtail Tankers, Bike Carts, and Others), and Canada Liquefied Petroleum Gas Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsCanada Liquefied Petroleum Gas Market Size Insights Forecasts to 2035

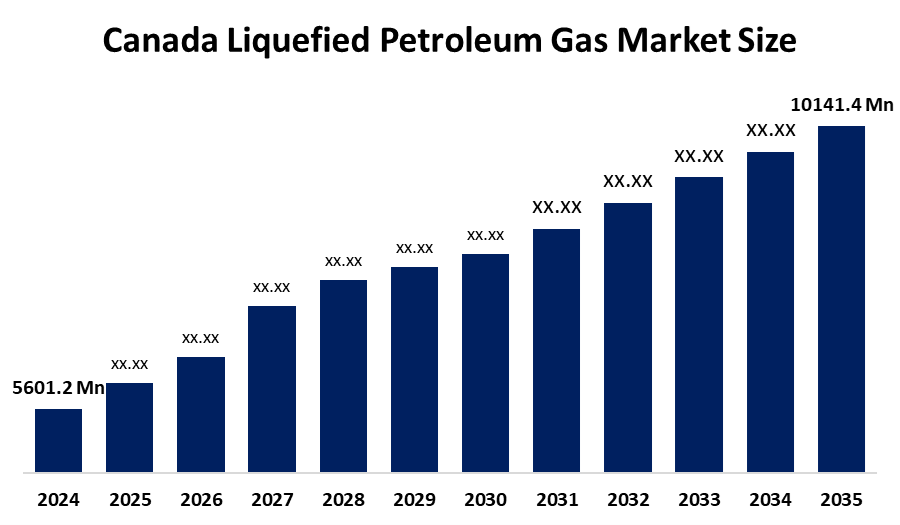

- The Canada Liquefied Petroleum Gas Market Size Was Estimated at USD 5,601.2 Million in 2024

- The Canada Liquefied Petroleum Gas Market Size is Expected to Grow at a CAGR of Around 5.55% from 2025 to 2035

- The Canada Liquefied Petroleum Gas Market Size is Expected to Reach USD 10,141.4 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Canada Liquefied Petroleum Gas Market Size is anticipated to reach USD 10,141.4 Million by 2035, Growing at a CAGR of 5.55% from 2025 to 2035. The Canada Liquefied Petroleum Gas Market is driven by abundant domestic production, strong residential and industrial demand, expanding export infrastructure, and the preference for LPG as a cleaner, cost-effective fuel alternative.

Market Overview

The Canada liquefied Petroleum Gas (LPG) Market Size refers to all activities related to the production, distribution, and eventual consumption of two major components of LPG, propane and butane, throughout Canada for their use as fuel and feedstock. Among other things, LPG finds major applications in residential heating & cooking, as a vehicle fuel, in the production processes of various industries, in agriculture, as well as in petrochemical sectors. The preference for LPG is mainly based on its clean, burning nature, high energy efficiency, and the ability to serve various purposes.

Canada’s adoption of the liquefied petroleum gas (LPG) market is closely linked to its population of about 40 million and vast geography, where many rural, remote, and off-grid communities lack access to natural gas pipelines. LPG plays a critical role in residential heating, cooking, agriculture (grain drying, crop heating), transportation, and industrial energy needs, offering a reliable, portable, and lower-emission alternative to coal, diesel, and heating oil. Harsh winter conditions and energy security requirements further highlight LPG’s importance in ensuring an affordable and uninterrupted energy supply across Canada.

Government support strengthens LPG adoption through clean-energy and transition policies. Under the Low Carbon Economy Fund (CAD 15 billion) and Clean Fuel Regulations, Canada promotes lower-carbon fuels, including propane, to reduce greenhouse gas emissions. Natural Resources Canada (NRCan) also supports cleaner energy technologies and infrastructure through programs such as the Energy Innovation Program (over CAD 1.5 billion allocated since 2016). These initiatives, combined with incentives for rural energy access and emissions reduction, position LPG as a strategic transition fuel, supporting Canada’s energy resilience, environmental goals, and market growth from a strong marketing and policy perspective.

Report Coverage

This research report categorizes the market for the Canada liquefied petroleum gas market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada liquefied petroleum gas market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada liquefied petroleum gas market.

Canada Liquefied Petroleum Gas Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5601.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.55% |

| 2035 Value Projection: | USD 10141.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, By Source |

| Companies covered:: | AltaGas Ltd., Keyera Corp., Pembina Pipeline Corporation, Gibson Energy Inc., Suncor Energy, Tourmaline Oil Corp., Polaris LPG, Enbridge Inc., Fermeuse Energy, Royal Vopak, Trigon Pacific Terminals Limited, TC Energy, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Canada liquefied petroleum gas (LPG) market is driven by strong demand from rural and remote communities that lack access to natural gas infrastructure, making LPG essential for residential heating and cooking. Growth in agriculture, industrial energy use, and transportation, along with LPG’s lower emissions compared to coal and diesel, and supportive government clean-energy and transition-fuel policies, further fuels market expansion.

Restraining Factors

The Canada liquefied petroleum gas (LPG) market is restrained by price volatility linked to crude oil and natural gas markets, which affects cost stability. Stringent environmental regulations, growing competition from electrification and renewable energy alternatives, and high storage, transportation, and infrastructure costs, especially in remote regions, also limit market growth.

Market Segmentation

The Canada Liquefied Petroleum Gas Market Size share is classified into application, source, and transportation.

- The chemical segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada liquefied petroleum gas market is segmented by application into residential, commercial, chemical, industrial, autogas, refinery, and others. Among these, the chemical segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The chemical segment is growing because liquefied petroleum gas is widely used as a feedstock for petrochemical production, including olefins, solvents, and chemical intermediates. Canada’s strong petrochemical manufacturing base, availability of cost-competitive propane and butane, and rising demand for plastics, specialty chemicals, and industrial materials are driving the sustained growth of this segment.

- The non-associated gas segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Canada liquefied petroleum gas market is segmented by source into refinery, associated gas, non-associated gas, and others. Among these, the non-associated gas segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The non-associated gas segment is growing because it provides a reliable and abundant supply of LPG, particularly propane, from Canada’s extensive natural gas production and processing infrastructure. The increasing development of shale and conventional gas fields, along with cost efficiency, supply stability, and lower dependence on crude oil production, is driving strong growth in this segment.

- The railways segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada liquefied petroleum gas market is segmented by transportation into ship, railways, intermodal ISO tank containers, pipelines, reticulated gas systems, large road tankers, bobtail tankers, bike carts, and others. Among these, the railways segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The railways segment is growing because rail transport offers a cost-effective, safe, and high-capacity solution for moving large volumes of LPG across Canada’s vast geography. Extensive rail infrastructure, reliable long-distance connectivity between production hubs and remote demand centers, and the ability to reduce road congestion and transportation costs are driving the strong growth of LPG shipments by rail.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada liquefied petroleum gas market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AltaGas Ltd.

- Keyera Corp.

- Pembina Pipeline Corporation

- Gibson Energy Inc.

- Suncor Energy

- Tourmaline Oil Corp.

- Polaris LPG

- Enbridge Inc.

- Fermeuse Energy

- Royal Vopak

- Trigon Pacific Terminals Limited

- TC Energy

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In June 2025, Trigon Pacific Terminals approved a C$750 million LPG export terminal project at the Port of Prince Rupert, British Columbia, with a capacity of 2.5 million tonnes per year, aimed at expanding Canadian LPG exports to global markets, particularly Asia.

Market Segment

This study forecasts revenue at the Mexico, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Canada liquefied petroleum gas market based on the below-mentioned segments:

Canada Liquefied Petroleum Gas Market Size, By Application

- Residential

- Commercial

- Chemical

- Industrial

- Autogas

- Refinery

- Others

Canada Liquefied Petroleum Gas Market Size, By Source

- Refinery

- Associated Gas

- Non-Associated Gas

- Others

Canada Liquefied Petroleum Gas Market Size, By Transportation

- Ship

- Railways

- Intermodal ISO Tank Containers

- Pipelines

- Reticulated Gas System

- Large Road Tankers

- Bobtail Tankers

- Bike Carts

- Others

Frequently Asked Questions (FAQ)

-

1. What is the Canada Liquefied Petroleum Gas Market Size in 2024?The Canada liquefied petroleum gas market size was estimated at USD 5,601.2 million in 2024.

-

2. What is the projected market size of the Canada Liquefied Petroleum Gas Market Size by 2035?The Canada liquefied petroleum gas market size is expected to reach USD 10,141.4 million by 2035.

-

3. What is the CAGR of the Canada Liquefied Petroleum Gas Market Size?The Canada liquefied petroleum gas market size is expected to grow at a CAGR of around 5.55% from 2024 to 2035.

-

4. What are the key growth drivers of the Canada Liquefied Petroleum Gas Market Size?The Canada Liquefied Petroleum Gas Market is driven by abundant domestic production, strong residential and industrial demand, expanding export infrastructure, and the preference for LPG as a cleaner, cost-effective fuel alternative.

-

5. Which source segment dominated the market in 2024?The non-associated gas segment dominated the market in 2024.

-

6. What segments are covered in the Canada Liquefied Petroleum Gas Market Size report?The Canada liquefied petroleum gas market is segmented on the basis of application and grade.

-

7. Who are the key players in the Canada Liquefied Petroleum Gas Market Size?Key companies include AltaGas Ltd., Keyera Corp., Pembina Pipeline Corporation, Gibson Energy Inc., Suncor Energy, Tourmaline Oil Corp., Polaris LPG, Enbridge Inc., Fermeuse Energy, Royal Vopak, Trigon Pacific Terminals Limited, TC Energy, and others.

-

8. Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?