Canada Healthcare Claim Management Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Claims Processing, Claims Denial Management, Claims Analytics and Reporting), By Deployment Mode (On-Premises, Cloud-Based and Web-Based), By End User (Healthcare Payers, Healthcare Providers, and Others), and Canada Healthcare Claim Management Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareCanada Healthcare Claim Management Market Insights Forecasts to 2035

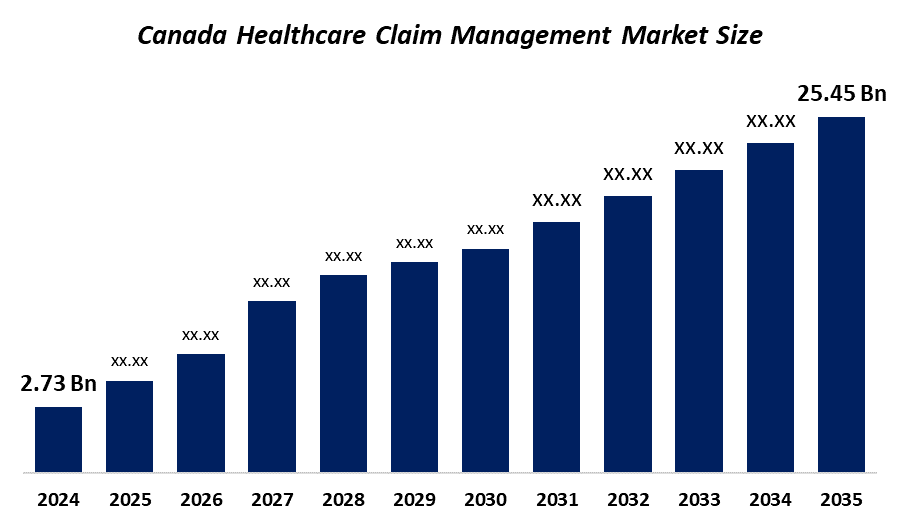

- The Canada Healthcare Claim Management Market Size Was Estimated at USD 2.73 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 22.5% from 2025 to 2035

- The Canada Healthcare Claim Management Market Size is Expected to Reach USD 25.45 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Canada Healthcare Claim Management Market Size Market is anticipated to reach USD 25.45 Billion by 2035, growing at a CAGR of 22.5% from 2025 to 2035. The market is growing as a result of new technology developments, the growing trend of automation in healthcare, an increase in research and development spending, rising health insurance premiums, a rise in the use of revenue cycle management software, a move to cloud-based and digital solutions, and the expanding use of artificial intelligence and analytics in the processing of claims.

Market Overview

Healthcare claims management is the process of handling medical insurance claims from the time they are submitted until they are finally reimbursed. It involves collecting payments, screening patient information, coding medical procedures, following regulatory rules, and managing acceptance or rejection. The goals of the claims processing are to reduce errors, prevent fraud, and ensure timely reimbursement to medical facilities while complying with insurance regulations and legal requirements. Medicare is the Canadian publicly funded healthcare program, providing physician and medically essential services. Primary healthcare serves as a first point of contact for Canadians seeking medical care.

In the healthcare claims processing market 72% people receive medical advice from a healthcare provider by telephone, 58 % have made an appointment electronically, and 70% of physicians believe that virtual care improves patient access and enables both quality and efficient care.

Artificial intelligence (AI) and machine learning (ML) algorithms streamline the entire claims process. They can analyze a vast amount of data and identify patterns of fraudulent activity, preventing healthcare organizations from financial losses and unnecessary payouts. AI reduces the burden on administrative staff, improves cash flow for healthcare providers, and decreases patients’ wait times.

Report Coverage

This research report categorizes the market size for the Canada healthcare claim management market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada healthcare claim management market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada healthcare claim management market.

Canada Healthcare Claim Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.73 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 22.5% |

| 2035 Value Projection: | USD 25.45 Billion |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Service Type,By Deployment Mode |

| Companies covered:: | Canada Life Desjardins Green Shield Canada Manulife Medavie Blue Cross Sun Life Financial The Canadian Association of Blue Cross Plans. Industrial Alliance eClinicalWorks McKesson Corporation and other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Healthcare Claim Management Markets Size in Canada are driven by rising healthcare expenditure, as healthcare costs continue to increase, healthcare providers and payers are seeking ways to streamline claims processing, reduce administrative costs, and optimize reimbursement overall healthcare expenditures effectively, growing emphasis on data analytics, technological advancements in healthcare such as automation, artificial intelligence, and machine learning, and transforming healthcare claims managements, AI-powered systems can help identity fraudulent claims, improve coding accuracy and enhance overall claims management efficiency.

Restraining Factors

The Healthcare Claim Management Market Size in Canada is restrained by the complex regulatory environment in healthcare, including compliance with privacy laws, billing regulations, and reimbursement policies, claims processing fragmentation of data systems and lack of interoperability between healthcare organizations and payers can hinder efficient claims management inconsistent data formats, limited data sharing, and siloed information can result in delays, errors, and challenges in claims processing and coordination among stakeholders Integration of claims management systems with electronic health records can enhance the accuracy and efficiency of claims processing.

Market Segmentation

The Canadian healthcare claim management market share is categorized by service type, deployment mode, and end user.

- The claims processing segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian Healthcare Claim Management Market Size is segmented by service type into claims processing, claims denial management, claims analytics and reporting. Among these, the claims processing segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is facilitated by the claims processing is the process of managing and resolving claims that patients and healthcare providers submit. A suitable claims management system is necessary due to it is a very time-consuming and complicated procedure that is more vulnerable to fraudulent activity. With the introduction of digitization, the process of managing claims has become more efficient and accurate. Claims denials are less likely when management services are appropriate.

- The web-based segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Canadian Healthcare Claim Management Market Size is segmented by deployment mode into on-premise, cloud-based, and web-based. Among these, the web-based segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is the procedure for managing and processing medical claims through web-based technologies or online platforms. Healthcare providers use specialized software systems or web portals to submit claims electronically. Web-based systems can see real-time eligibility information to determine whether a patient has insurance and whether the services are eligible for reimbursement.

- The healthcare payers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on end user, The Canadian Healthcare Claim Management Market Size is segmented into healthcare payers, healthcare providers, and others. Among these, the healthcare payers segment accounted for the largest share in 2024 during the forecast period. The segmental growth is driven by the payers are essential in handling payment procedures, guaranteeing adherence to legal requirements, and assessing and deciding claims. They make investments in cutting-edge claims management systems, hire qualified experts, and put fraud detection systems in place to maximize claims processing and control expenses.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations companies involved within the Canada healthcare claim management market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Canada Life

- Desjardins

- Green Shield Canada

- Manulife

- Medavie Blue Cross

- Sun Life Financial

- The Canadian Association of Blue Cross Plans.

- Industrial Alliance

- eClinicalWorks

- McKesson Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In October 2025, Cybin Inc., announced breakthrough Phase 3 clinical stage neuropsychiatry company committed to revolutionizing mental healthcare through proprietary drug discovery platforms and innovative delivery systems, is pleased to announce a registered direct offering of 22,277,750 common shares in the capital of the Company.

In October 2025, Desjardins Insurance launched CyberSuite Plus, an enhanced insurance solution to meet businesses' growing need for cybersecurity and fraud protection.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Canada Healthcare Claim Management Market based on the below-mentioned segments:

Canada Healthcare Claim Management Market, By Service Type

- Claims Processing

- Claims Denial Management

- Claims analytics and reporting

Canada Healthcare Claim Management Market, By Deployment Mode

- On-Premises

- Cloud-Based

- Web-Based

Canada Healthcare Claim Management Market, By End User

- Healthcare Payers

- Healthcare Providers

- Others

Frequently Asked Questions (FAQ)

-

What is the Canadian healthcare Claim Management market size?The Canada Healthcare Claim Management Market size is expected to grow from USD 2.73 billion in 2024 to USD 25.45 billion by 2035, growing at a CAGR of 22.5% during the forecast period 2025-2035.

-

What is healthcare Claim Management, and their primary use?Healthcare claims management is the process of handling medical insurance claims from the time they are submitted until they are finally reimbursed. It involves collecting payments, screening patient information, coding medical procedures, following regulatory rules, and managing acceptance or rejection.

-

What are the key growth drivers of the market?Market growth is driven by rising healthcare expenditure, as healthcare costs continue to increase, healthcare providers and payers are seeking ways to streamline claims processing, reduce administrative costs, and optimize reimbursement overall healthcare expenditures effectively, growing emphasis on data analytics, technological advancements in healthcare such as automation, artificial intelligence, and machine learning, and transforming healthcare claims managements, AI-powered systems can help identity fraudulent claims, improve coding accuracy and enhance overall claims management efficiency.

-

What factors restrain the Canadian healthcare Claim Management market?The Market is restrained by the complex regulatory environment in healthcare, including compliance with privacy laws, billing regulations, and reimbursement policies, claims processing fragmentation of data systems and lack of interoperability between healthcare organizations and payers can hinder efficient claims management inconsistent data formats, limited data sharing, and siloed information can result in delays, errors, and challenges in claims processing and coordination among stakeholders Integration of claims management systems with electronic health records (EHRs) can enhance the accuracy and efficiency of claims processing.

-

How is the market segmented by deployment mode?The market is segmented into on-premises, cloud-based, and web-based.

-

Who are the key players in the Canadian healthcare Claim Management market?Key companies include Canada Life, Desjardins, Green Shield Canada, Manulife, Medavie Blue Cross, Sun Life Financial, The Canadian Association of Blue Cross Plans., Industrial Alliance, eClinicalWorks, and McKesson Corporation

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?