Canada Frozen Food Market Size, Share, and COVID-19 Impact Analysis, By Product (Fruits, Vegetables, Meats, Frozen Desserts, Bakery Products, and Others), By Freezing Technology (Individual Quick Freezing, Blast Freezing, and Belt Freezing), By Distribution Channel (Food Service, Retail, Hypermarket & Supermarket, Convenience Stores, Online, and Others), and Canada Frozen Food Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesCanada Frozen Food Market Insights Forecasts to 2035

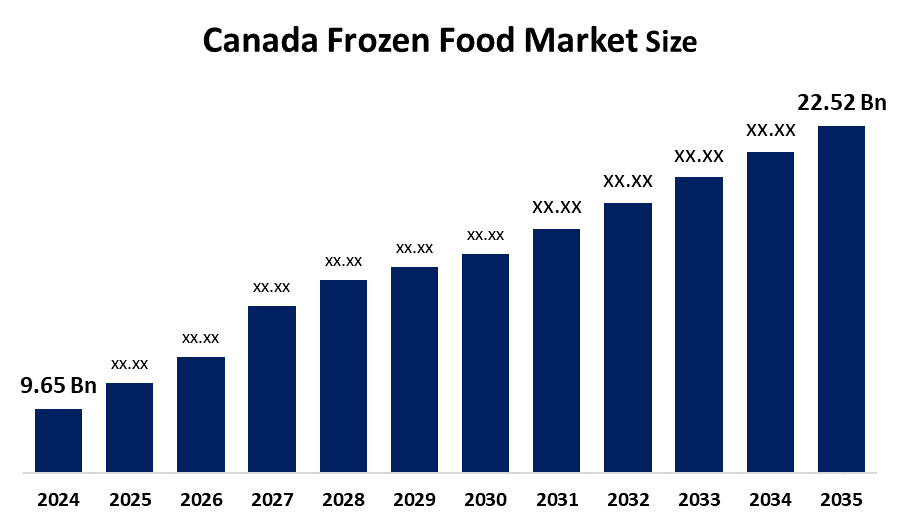

- The Canada Frozen Food Market Size Was Estimated at USD 9.65 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.01% from 2025 to 2035

- The Canada Frozen Food Market Size is Expected to Reach USD 22.52 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Canada Frozen Food Market Size is anticipated to reach USD 22.52 billion by 2035, growing at a CAGR of 8.01% from 2025 to 2035. The Canadian market is driven by developments in freezing technology, shifts in customer demand for frozen goods, and sustainability programs. It will also be crucial to keep an eye on regulatory changes and raw material prices in order to predict future changes in production costs.

Market Overview

Frozen foods refer to foods that have been instantaneously frozen and kept at temperatures lower than freezing until prepared for consumption. Canada is the world's third-largest provider. Many frozen food options save time and effort and are simple to prepare.

It is estimated that imports would reach $232 million by 2026, a 0% decrease from $234 million in 2021. Exports are predicted to increase by 1.2% from $157 million in 2021 to $168 million by 2026.

A 201% rise over the previous 12 months was recorded in the 202 shipments of frozen food that Canada exported between October 2023 and September 2024 (TTM); 10 Canadian exporters sold these commodities to 59 customers. Canada purchased 32 shipments of frozen food between November 2021 and October 2022 (TTM). These imports were supplied to nine Canadian consumers by six Indian exporters, indicating a 0% growth rate for the preceding 12 months. In October 2022 alone, the world imported 13 shipments of frozen food at this time.

Enhancing the safety of food produced and marketed throughout Canada or imported into the country, protecting the plant resource base, and promoting animal health are the three main goals of CFIA. The market has grown as a result of developments in transportation and freezing technologies, providing consumers with a wide range of frozen goods, from fruits and vegetables to prepared meals and desserts.

Report Coverage

This research report categorizes the market for the Canada frozen food market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada frozen food market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada frozen food market.

Canada Frozen Food Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.65 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.01% |

| 2035 Value Projection: | USD 22.52 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Freezing Technology, By Distribution Channel |

| Companies covered:: | Brecon Foods Inc Arctic Gardens Food Service Furlani Foods Due North Canadian Blast Freezers Sunrise Farm Freshline Foods MB Global Foods Cavendish Farms and Other, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Frozen Food Markets Size in Canada are driven by an increasing market for packaged food and drink that provides easy-to-prepare, ready-to-eat, and fast meal options. The marketing strategies and distribution networks are facilitated to reach a larger consumer base in the frozen food market. Millennials and Generation Z givers strong preference for frozen foods that are easy and convenient, a surge in eco-friendly and sustainable products.

Restraining Factors

The Frozen Food Market Size in Canada is restrained compared with fresh food; frozen food is less nutritious, despite efforts to improve product quality and nutritional value. change in the cost of raw materials and shifting consumer demand for healthier options. Alterations in the supply chain and raw materials also cause allergic responses and skin sensitivities.

Market Segmentation

The Canadian frozen food market share is categorized by product, freezing technology, and distribution channel.

- The frozen desserts segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canadian Frozen Food Market Size is segmented by product type into fruits, vegetables, meats, frozen desserts, bakery products, and others. Among these, the frozen desserts segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the rising demand due to low-calorie, low-sugar products, and it is organic in nature. Health-conscious consumers are altering the business to add healthier options with having same taste or quality. Luxurious options are attracting the customer's attention with their look and attractiveness, and lavish taste combinations.

- The individual quick-freezing segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Canadian Frozen Food Market Size is segmented by freezing technology into individual quick freezing, blast freezing, and belt freezing. Among these, the individual quick-freezing segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to its incredible ability to maintain food products' nutritious content, texture, and quality. These techniques freeze each ingredient separately, preventing clumping. customers demand for rapid, portioned meals, which stay fresh, is given by this method.

- The hypermarket & supermarket segment accounted for the largest share in 2024 during the forecast period.

Based on distribution channel, the Canadian frozen food market size is segmented into food service, retail, hypermarket & supermarket, convenience stores, online, and others. Among these, the hypermarket & supermarket segment accounted for the largest share in 2024 during the forecast period. The segmental growth is driven by providing a physical shopping environment where clients may inspect items before making a purchase. These stores are preferred by many customers because they offer quick access to goods, particularly in areas with poor home delivery operations. This segment's dominance was further enhanced by the presence of dedicated freezer areas, regular in-store discounts, and loyalty programs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada frozen food market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Brecon Foods Inc

- Arctic Gardens Food Service

- Furlani Foods

- Due North

- Canadian Blast Freezers

- Sunrise Farm

- Freshline Foods

- MB Global Foods

- Cavendish Farms

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In October 2025, Playa Bowls, the Belmar superfruit bowl shop franchise with nearly 350 outlets in the United States, announced a master agreement with Eat Up Canada Inc. to expand the brand across North America.

In June 2025, Cavendish Farms announced that the Quick Crisp line of frozen potato and appetizer products had been awarded the prestigious Canadian Grand New Product Award.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Canada Frozen Food Market based on the below-mentioned segments:

Canada Frozen Food Market, By Product Type

- Fruits

- Vegetables

- Meats

- Frozen Desserts

- Bakery Products

- Others

Canada Frozen Food Market, By Freezing Technology

- Individual Quick Freezing

- Blast Freezing

- Belt Freezing

Canada Frozen Food Market, By Distribution Channel

- Food Service

- Retail

- Hypermarket & Supermarket

- Convenience Stores

- Online

- Others

Frequently Asked Questions (FAQ)

-

What is the Canadian Frozen Food market size?The Canada Frozen Food Market size is expected to grow from USD 9.65 billion in 2024 to USD 22.52 billion by 2035, growing at a CAGR of 8.01% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by an increasing market for packaged food and drink that provides easy-to-prepare, ready-to-eat, and fast meal options. The marketing strategies and distribution networks are facilitated to reach a larger consumer base in the frozen food market. Millennials and Generation Z givers strong preference for frozen foods that are easy and convenient.

-

What factors restrain the Canadian Frozen Food market?The Market is restrained compared with fresh food; frozen food is less nutritious, despite efforts to improve product quality and nutritional value. change in the cost of raw materials and shifting consumer demand for healthier options.

-

How is the market segmented by product type?The market is segmented into fruits, vegetables, meats, frozen desserts, bakery products, and others.

-

Who are the key players in the Canadian Frozen Food market?Key companies include Brecon Foods Inc., Arctic Gardens Food Service, Furlani Foods, Due North, Canadian Blast Freezers, Sunrise Farm, Freshline Foods, MB Global Foods, Cavendish Farms

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?