Canada Footwear Market Size, Share, and COVID-19 Impact Analysis, By Product (Non-Athletic, Athletic), By Materials (Rubber, Leather, Plastic, Fabric, and Others), By Distribution Channel (Footwear Specialists, Online Sales, Supermarket and Hypermarkets, Departmental Stores, Clothing Stores, and Others), By End User (Men, Women, and Kids), and Canada Footwear Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsCanada Footwear Market Insights Forecasts to 2035

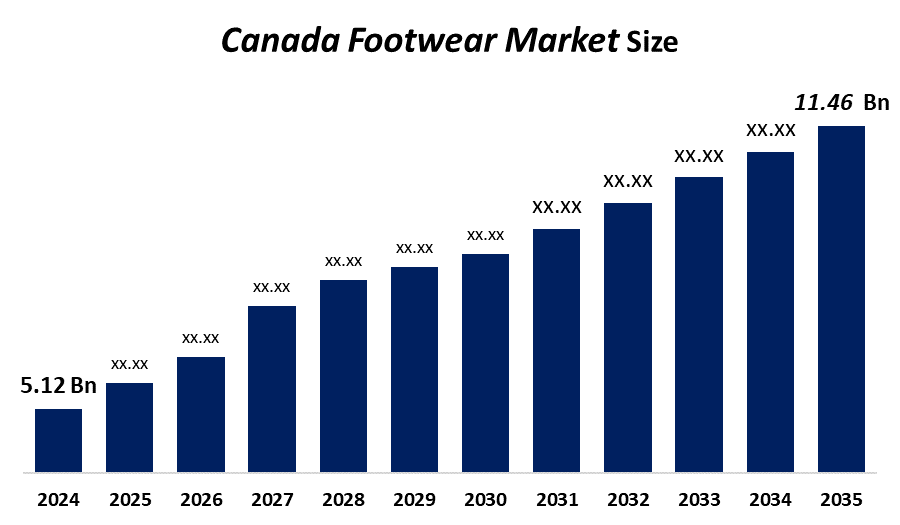

- The Canada Footwear Market Size Was Estimated at USD 5.12 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.6% from 2025 to 2035

- The Canada Footwear Market Size is Expected to Reach USD 11.46 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Canada Footwear Market Size is anticipated to reach USD 11.46 billion by 2035, growing at a CAGR of 7.6% from 2025 to 2035. The Canadian market is driven by changing fashion styles, increasing health consciousness, and a surge in the market for casual and athletic footwear. Consumer preferences and shopping behavior are being further shaped by the expansion of e-commerce as well as the availability of high-end and sustainable products.

Market Overview

The footwear Market Size, a thriving and diverse sector of the global economy, includes the manufacture, marketing, and distribution of a broad range of footwear items, such as shoes, boots, sandals, and flip-flops.

The rise of e-commerce sites has also changed the market landscape by providing customers with a vast array of luxury footwear options and previously unheard-of simplicity. The bulk of luxury footwear is imported because Canada produces very little of it domestically, making the market susceptible to changes in global trade dynamics and supply chain interruptions. In July 2025, Canadian brand lululemon is foraying into India in partnership with Tata CLiQ.

In 2022, the top partnership countries from which Canada import the product is China, Vietnam, Italy, Cambodia and Indonesia. In that the product import with China is 1632241.26 and import product share is 2.12%. With Indonesia import is 181041.11 and the import product share is 8.15%.

To exporters in client nations chosen by the Canadian government, TFO Canada provides several market studies tailored to individual products. To ascertain the HS code and relevant levies on imported footwear, the CBSA Guidelines are utilized to determine the composition of footwear uppers. Due to Black Friday sales and Christmas shopping, November and December are the greatest months to buy shoes in Canada.

One of the most known consumer trends in Canada is living an active and healthy lifestyle. The primary reasons driving the market's expansion are the growing need for athletic footwear, the increasing demand made possible by e-commerce, and the significant advertising expenditures made by footwear businesses.

Report Coverage

This research report categorizes the market for the Canada footwear market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada footwear market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada footwear market.

Canada Footwear Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.12 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product , By Materials |

| Companies covered:: | Aldo, Vessi, Pajar, La Canadienne, John Fluevog, Native Shoes, Baffin Inc, Kamik, Cougar, Santana Canada, Hartt Shoes, Manitobah Mukluks, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The footwear markets in Canada are driven by changes in lifestyles and increasing disposable money, a stronger focus on personalization and design, advancements in footwear manufacturing technology, an increase in e-commerce, and direct-to-consumer sales.

Restraining Factors

The footwear market in Canada is restrained by fluctuating prices for raw materials, including leather, rubber, and textiles; intense competition and market saturation; counterfeit footwear; disruptions in the supply chain; and changing consumer tastes.

Market Segmentation

The Canada footwear market share is classified into product type, materials, distribution channel, and end user.

- The non-athletic segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada footwear market is segmented by product type into non-athletic, athletic. Among these, the non-athletic segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by non-athletics made to be worn every day and be comfortable. They go well with a variety of ensembles and events, including social events, professional settings, and excursions. Additionally, they are created in a variety of patterns in accordance with current fashion trends. In this sense, casual footwear's ease and adaptability promote segmental growth.

- The rubber segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Canada footwear market is segmented by materials into rubber, leather, plastic, fabric, and others. Among these, the rubber segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of segment is particularly fueled by rubber soles are especially popular due to their ability to absorb shock and adjust to various terrain types, and they are the material of choice for work, sports, and casual footwear because of their affordability, flexibility, water resistance, and durability.

- The supermarket and hypermarket segment accounted for the largest share in 2024 during the forecast period.

Based on distribution channel, the Canada footwear market is segmented into footwear specialists, online sales, supermarket and hypermarkets, departmental stores, clothing stores, and others. Among these, the supermarket and hypermarket accounted for the largest share in 2024 during the forecast period. The segment is driven by due a variety of footwear brands are easily accessible in different shop formats. Customers are drawn to them because they also offer a large selection of affordable footwear along with special discounts.

- The men segment holds the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end user, the Canada footwear market is segmented into men, women, and kids. Among these, the men segment holds the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by growing fashion consciousness among male consumers and a rise in sports like cricket and football are the main drivers of male shoe sales. Major firms place a high priority on expanding their men's collections to spur growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada footwear market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aldo

- Vessi

- Pajar

- La Canadienne

- John Fluevog

- Native Shoes

- Baffin Inc

- Kamik

- Cougar

- Santana Canada

- Hartt Shoes

- Manitobah Mukluks

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In July 2025, Lululemon, the Canadian athletic brand, is entering the Indian market through a franchise partnership with Tata CLIQ.

In May 2025, Stoney CREEK, Canadian footwear brand Baffin launched protective footwear designed for miners, presents DETOUR, a Unisex safety boost designed specifically to offer maximum protection in mining applications and beyond.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Canada Footwear Market based on the below-mentioned segments:

Canada Footwear Market, By Product Type

- Non-Athletic

- Athletic

Canada Footwear Market, By Materials

- Rubber

- Leather

- Plastic

- Fabric

- Others

Canada Footwear Market, By Distribution Channel

- Footwear Specialists

- Online Sales

- Supermarket and Hypermarkets

- Departmental Stores

- Clothing Stores

- Others

Canada Footwear Market, By End User

- Men

- Women

- Kids

Frequently Asked Questions (FAQ)

-

What is the Canada Footwear market size?The Canada Footwear market was estimated at USD 5.12 billion in 2024 and is projected to reach USD 11.46 billion by 2035, growing at a CAGR of 7.6% during 2025–2035.

-

What are the key growth drivers of the market?Market growth is driven by the shifting lifestyles and rising disposable income, a greater emphasis on design and customization, technological developments in the production of footwear, a surge in e-commerce, and direct-to-consumer sales.

-

What factors restrain the Canada Footwear market?The Market is restrained by varying costs for raw materials including leather, rubber, and fabrics; fierce rivalry and market saturation; fake shoes; supply chain interruptions; and shifting consumer preferences.

-

How is the market segmented by product type?Key companies include Aldo, Vessi, Pajar, La Canadienne, John Fluevog, Native Shoes, Baffin Inc, Kamik, Cougar, Santana Canada, Hartt Shoes, and Manitobah Mukluks.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?