Canada Ethylene Vinyl Acetate Market Size, Share, By Product Grade (Very Low Density EVA, Low Density EVA, Medium Density EVA, And High Density EVA), By End Use (Footwear & Foams, Photovoltaic Panels, Packaging, Agriculture, And Others), And Canada Ethylene Vinyl Acetate Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsCanada Ethylene Vinyl Acetate Market Size Insights Forecasts to 2035

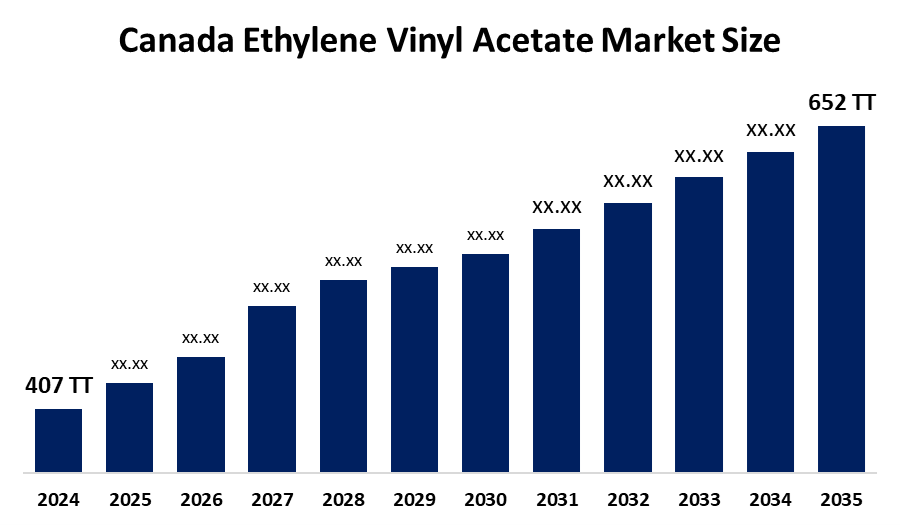

- Canada Ethylene Vinyl Acetate Market Size 2024: 407 Thousand Tonnes

- Canada Ethylene Vinyl Acetate Market Size 2035: 652 Thousand Tonnes

- Canada Ethylene Vinyl Acetate Market Size CAGR 2024: 4.38%

- Canada Ethylene Vinyl Acetate Market Size Segments: Product Grade and End Use

Get more details on this report -

Canada Ethylene Vinyl Acetate Market Size encompasses part of the larger polymer manufacturing industry including the production, consumption, and use of ethylene vinyl acetate copolymer products by end users in Canada. EVA is a flexible, strong thermoplastic blended material made from the combination of both ethylene and its precursor vinyl acetate. Because of these mechanical and elastic properties combined with UV resistance, EVA is used widely throughout various industries, such as in the manufacture of packaging films, solar photovoltaic encapsulants, adhesives, foam for footwear, insulation for wires and cables, and more.

The ethylene vinyl acetate in Canada are backed by government support, including the Canada Greener Homes Grant and Loan provide financial incentives and interest-free loans for solar PV installations along with other energy-efficient upgrades, thereby expanding solar capacity and supporting demand for EVA as a key encapsulant material in solar modules.

As technology advances, Canadian ethylene vinyl acetate providers are now using bio-based resins derived from renewable resources have resulted in higher-quality EVA products for more different purposes through advances in processing technology such as foam extrusion as well as co-extrusion. These advances will continue to improve mechanical properties of EVA products used for solar encapsulation and flexible packaging, while at the same time minimizing negative environmental impacts associated with these materials. In addition, research and development from both global and regional entities has been used to accelerate the adoption of these new formulations of EVA by aligning levels of functionality with increased regulation and consumer expectations concerning sustainable products.

Canada Ethylene Vinyl Acetate (EVA) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 407 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.38% |

| 2035 Value Projection: | 652 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Grade, By End Use |

| Companies covered:: | Celanese Corporation, Dow Inc., ExxonMobil Corporation, LyondellBasell Industries, Arkema S.A., Braskem S.A., Formosa Plastics Corporation, Hanwha Solutions, Bamberger Polymers Canada Corp., Formerra Distribution Canada Inc., TP Polymer Private Limited, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Canada Ethylene Vinyl Acetate Market Size:

The Canada Ethylene Vinyl Acetate Market Size is driven by the expanding packaging industry fueled by e-commerce growth, increase in solar energy installations, rising demand from segments such as footwear and construction materials, global trends of lightweight, durable, and multifunctional materials, renewable energy push, and regulatory support for green technologies create demand for EVA in photovoltaic modules.

The Canada Ethylene Vinyl Acetate Market Size is restrained by the volatility of raw material prices, manufacturing costs and profit margins challenges, increasing environmental scrutiny over plastic waste, complexity of recycling multilayer EVA materials, and complex regulatory compliance costs issues.

The future of Canadian ethylene vinyl acetate market is bright and promising, with versatile opportunities emerging from the EVA materials which are bio-based and biodegradable widely used in healthcare and medical device manufacture due to their biocompatibility. There is increased investment in new infrastructures requiring advanced insulation and flexible building materials. Increasing focus on sustainability and circular economies offers EVA producers opportunities to create new markets for higher value, more eco-friendly products, aligning market development data with both environmental imperatives and regulatory landscapes that are evolving.

Market Segmentation

The Canada Ethylene Vinyl Acetate Market Size share is classified into product grade and end use.

By Product Grade:

The Canada Ethylene Vinyl Acetate Market Size is divided by product grade into very low density EVA, low density EVA, medium density EVA, and high density EVA. Among these, the low density EVA segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. High demand for EVA films in packaging and solar encapsulation, require low-temperature sealing properties, superior flexibility, and lower melting points all contribute to the low density EVA segment’s largest share and higher spending on ethylene vinyl acetate segment when compared to other product grade.

By End Use:

The Canada Ethylene Vinyl Acetate Market Size is divided by end use into footwear & foams, photovoltaic panels, packaging, agriculture, and others. Among these, the packaging segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The packaging segment dominates because of high demand for flexible packaging films, adhesives, and food wraps, offer excellent durability, flexibility, and moisture resistance, and growth in e-commerce and food and beverage sectors in Canada.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Canada Ethylene Vinyl Acetate Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Canada Ethylene Vinyl Acetate Market Size:

- Celanese Corporation

- Dow Inc.

- ExxonMobil Corporation

- LyondellBasell Industries

- Arkema S.A.

- Braskem S.A.

- Formosa Plastics Corporation

- Hanwha Solutions

- Bamberger Polymers Canada Corp.

- Formerra Distribution Canada Inc.

- TP Polymer Private Limited

- Others

Recent Developments in Canada Ethylene Vinyl Acetate Market Size:

In May 2025, Borealis launched a new EVA solution for footwear midsoles. This grade was part of their Bornewables portfolio, made from waste and residue streams, offering a 45% lower carbon footprint, which was highly relevant for sustainability-focused converters.

In January 2024, Braskem strengthened its distribution partnership with FKuR to expand the availability of bio-based EVA in North America, including Canada.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Canada Ethylene Vinyl Acetate Market Size based on the below-mentioned segments:

Canada Ethylene Vinyl Acetate Market Size, By Product Grade

- Very Low Density EVA

- Low Density EVA

- Medium Density EVA

- High Density EVA

Canada Ethylene Vinyl Acetate Market Size, By End Use

- Footwear & Foams

- Photovoltaic Panels

- Packaging

- Agriculture

- Others

Frequently Asked Questions (FAQ)

-

What is the Canada Ethylene Vinyl Acetate Market Size?Canada Ethylene Vinyl Acetate Market Size is expected to grow from 407 thousand tonnes in 2024 to 652 thousand tonnes by 2035, growing at a CAGR of 4.38% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the expanding packaging industry fueled by e-commerce growth, increase in solar energy installations, rising demand from segments such as footwear and construction materials, global trends of lightweight, durable, and multifunctional materials, renewable energy push, and regulatory support for green technologies create demand for EVA in photovoltaic modules.

-

What factors restrain the Canada Ethylene Vinyl Acetate Market Size?Constraints include the volatility of raw material prices, manufacturing costs and profit margins challenges, increasing environmental scrutiny over plastic waste, complexity of recycling multilayer EVA materials, and complex regulatory compliance costs issues.

-

How is the market segmented by product grade?The market is segmented into very low density EVA, low density EVA, medium density EVA, and high density EVA.

-

Who are the key players in the Canada Ethylene Vinyl Acetate Market Size?A: Key companies include Celanese Corporation, Dow Inc., ExxonMobil Corporation, LyondellBasell Industries, Arkema S.A., Braskem S.A., Formosa Plastics Corporation, Hanwha Solutions, Bamberger Polymers Canada Corp., Formerra Distribution Canada Inc., TP Polymer Private Limited, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?