Canada Duty-Free and Travel Retail Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, and Others), By Distribution Channel (Airports, Airlines, Ferries, and Others), and Canada Duty-Free and Travel Retail Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsCanada Duty-Free and Travel Retail Market Insights Forecasts to 2035

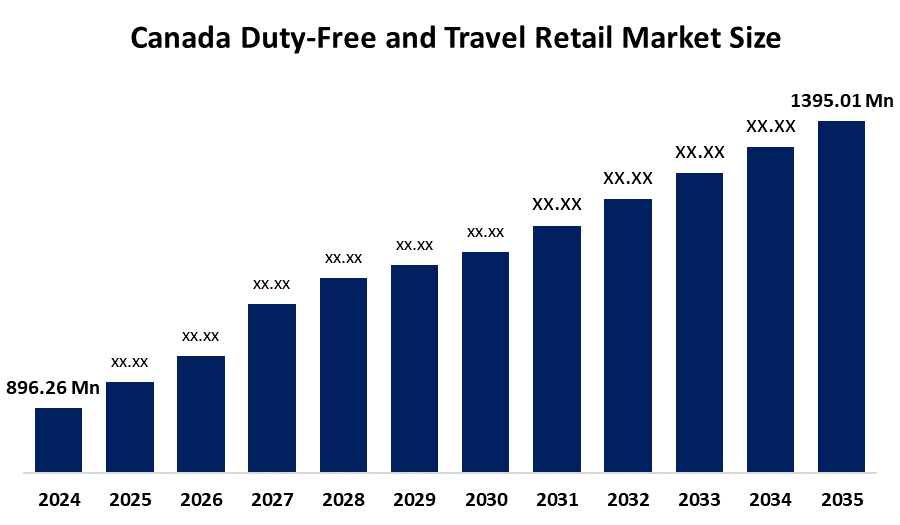

- The Canada Duty-Free and Travel Retail Market Size Was Estimated at USD 896.26 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.1% from 2025 to 2035

- The Canada Duty-Free and Travel Retail Market Size is Expected to Reach USD 1395.01 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Canada Duty-Free and Travel Retail Market size is anticipated to reach USD 1395.01 million by 2035, growing at a CAGR of 4.1% from 2025 to 2035. The Canadian market is driven by increased foreign traveler traffic, increased luxury goods spending, airport retail growth, robust Asian demand, collaborations with multinational brands, advantageous exchange rates, and impulsive purchases bolstered by alluring in-store marketing.

Market Overview

Shops that offer items to foreign customers without imposing regional import taxes or levies are referred to as duty-free retailers. The industry segment that includes the purchase of goods to foreign tourists via duty-free and duty-paid shops found in airports, seaports, airlines, cruise liners, and border shops is known as the travel retail sector.

New Zealand and Canada revealed plans to introduce offshore duty-free shopping, comparable to what has been done in China's Hainan, Japan's Okinawa, and South Korea's Jeju, marking historic advancements for their respective tourism and travel retail sectors. The two governments stated in a joint statement that they had closely collaborated on the projects during a thorough fact-finding mission of the three Asian regions in late 2023.

Decreases in travel to the US and prohibitions on selling American wines and spirits have severely hurt Canada's duty-free industry. Liquor boards have often followed provincial governments in cutting off supplies, including to duty-free shops.

Profitable business prospects in the click-and-collect, home delivery, and pre-order platforms for both domestic and international businesses, expanding their interaction with tourists and boosting conversion rates.

Report Coverage

This research report categorizes the market for Canada Duty-Free and Travel Retail Market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada Duty-Free and Travel Retail Market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada Duty-Free and Travel Retail Market.

Canada Duty-Free and Travel Retail Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 896.26 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.1% |

| 2035 Value Projection: | USD 1395.01 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 233 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Distribution Channel |

| Companies covered:: | Avolta, The Loop Duty Free, Global Travel Retail Magazine, Distribution Fontaine Inc., Duty Free Sarnia, Wheels Group, And Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The duty-free and travel retail markets in Canada are driven by an expansion of offshore duty-free zones, the rise of omnichannel pre-order models, arrival-hall duty-free formats, and premiumization in duty-free liquor, Airport privatization & non-aeronautical focus.

Restraining Factors

The duty-free and travel retail market in Canada is restrained by logistics, posing challenges to airport retailers.

Market Segmentation

The Canada duty-free and travel retail market share is categorized by product type and distribution channel.

- The beauty and personal care segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada duty-free and travel retail market is segmented by product type into beauty and personal care, wines and spirits, tobacco, eatables, fashion accessories and hard luxury, and others. Among these, the beauty and personal care segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment is being driven by consumers in the same region who have become more interested in natural and organic personal care products (NOPC) as their concerns about the negative consequences of chemically manufactured products have grown.

- The airport segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Canada duty-free and travel retail market is segmented by distribution channel into airports, airlines, ferries, and others. Among these, the airport segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is fueled by the typical traveler who has surely had to pass through a good number of airport duty-free shops. The buying preferences of travelers have changed due to shifting demographics. With the entry of low-cost airlines such as EasyJet and Spirit, air travel has become more reasonable; nevertheless, luxury items, even duty-free ones, are not.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada Duty-Free and Travel Retail Market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Avolta

- The Loop Duty Free

- Global Travel Retail Magazine

- Distribution Fontaine Inc.

- Duty Free Sarnia

- Wheels Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In June 2025, Dufry, part of Avolta AG, launched the Toronto Duty Free store at Pearson International Airport’s Terminal 3. It marks the start of a larger partnership with the Greater Toronto Airports Authority to enhance retail at Canada’s busiest airport.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Canada Duty-Free and Travel Retail Market based on the below-mentioned segments:

Canada Duty-Free and Travel Retail Market, By Product Type

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Others

Canada Duty-Free and Travel Retail Market, By Distribution Channel

- Airports

- Airlines

- Ferries

- Others

Frequently Asked Questions (FAQ)

-

What is the Canada Duty-Free and Travel Retail market size?The Canada Duty-Free and Travel Retail market was estimated at USD 896.26 Million in 2024 and is projected to reach USD 1395.01 Million by 2035, growing at a CAGR of 4.1% during 2025–2035.

-

What are the key growth drivers of the market?Market growth is driven by the expansion of offshore duty-free zones, the rise of omnichannel pre-order models, arrival-hall duty-free formats, and premiumization in duty-free liquor, Airport privatization & non-aeronautical focus

-

What factors restrain the Canada Duty-Free and Travel Retail market?The Market is restrained by the logistics, posing challenges to airport retailers.

-

How is the market segmented by product type?The market is segmented into beauty and personal care, wines and spirits, tobacco, eatables, fashion accessories and hard luxury, and others.

-

Who are the key players in the Canada Duty-Free and Travel Retail market?Key companies include Avolta, The Loop Duty Free, Global Travel Retail Magazine, Distribution Fontaine Inc., Duty Free Sarnia, and Wheels Group.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?