Canada Animal Feed Additives Market Size, Share, And COVID-19 Impact Analysis, By Product Type (Amino Acids, Vitamins, Enzymes, Antibiotics), By Livestock (Poultry, Ruminants, Swine, Aquaculture), By Form (Dry, Liquid), By Application (Animal Growth Promotion, Feed Efficiency, Health Improvement) And Canada Animal Feed Additives Market Insights, Industry Trend, Forecast To 2035

Industry: AgricultureCanada Animal Feed Additives Market Insights, Industry Trend, Forecast To 2035.

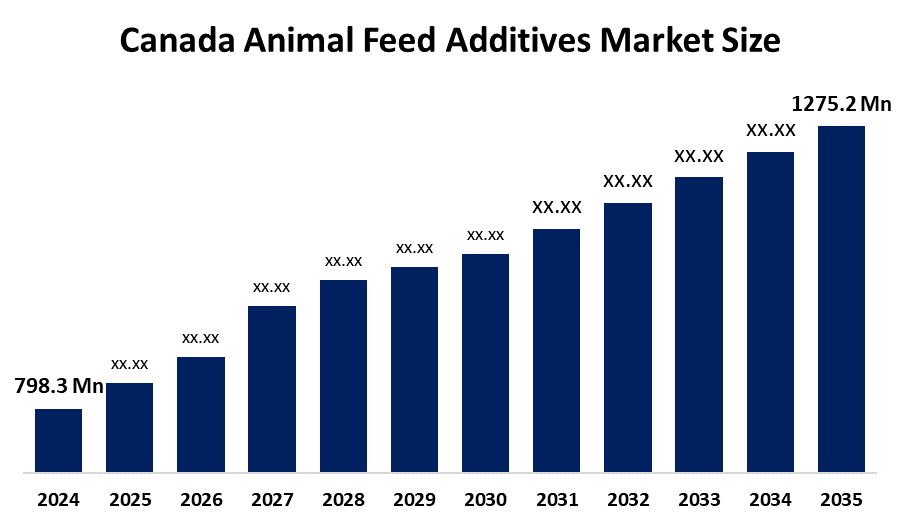

- Canada Animal Feed Additives Market Size Was Estimated at USD 798.3 Million in 2024.

- The Market Size is Expected to Grow at a CAGR of Around 4.35% from 2025 to 2035.

- Canada Animal Feed Additives Market Size is Expected to Reach USD 1275.2 Million by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Canada Animal Feed Additives Market size is anticipated to reach USD 1275.2 million by 2035, growing at a CAGR of 4.35% from 2025 to 2035. The Canada Animal Feed Additives Market is driven by factors such as ramping up of livestock production, escalating demand for high-quality animal protein, the opening of the animal health and nutrition, the progress in feed formulation technology, and the tightening of feed safety regulations in Canada.

Market Overview

Animal feed additives refer to specially developed nutrients that are combined with the regular feed of animals in order to enhance their digestion, metabolism, immunity, and general production results. Such a group of products are essentially made up of vitamins, amino acids, enzymes, probiotics, acidifiers, and other micro-ingredients that are minimally accounted for and are specifically engineered to ensure that poultry, pigs, ruminants, and aquaculture animals obtain nutritionally balanced diets. Additives are what make it possible to achieve better feed conversion, increased disease resistance, and stable growth performance. The consumption of livestock feed in Canada has increased to 28.9 million tonnes in 2024, which implies the wide usage of additives in commercial feed formulations produced by the 429 registered feed mills spread across the country and that they play a very essential role in maintaining animal health and supporting food supply chains.

The major breakthrough in feed additive technology is evident in precision nutrition and the utilization of scientifically validated enzyme and probiotic solutions that are able to improve nutrient absorption and lessen waste. The Government of Canada has revamped the CFIA Feeds Regulations, 2024 to upgrade safety standards, make the process of additive approvals more efficient, and conform with international practices to improve trade competitiveness. This new regulation facilitates transparency in ingredient registration and enables producers to have access to new types of additives. Standard systems such as the Canadian Feed Ingredients Table (CFIT) keep records of the verified additives that are approved for use, thereby promoting compliance and safety. Future opportunities may see the wider implementation of precision nutrition platforms, enzyme-based and probiotic blends, as well as the development of export routes facilitated by a strong regulatory framework.

Report Coverage

This research report categorizes the market for the Canada animal feed additives market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada animal feed additives market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada animal feed additives market.

Canada Animal Feed Additives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 798.3 Million |

| Forecast Period: | 2025-2035. |

| Forecast Period CAGR 2025-2035. : | CAGR Of 4.35% |

| 2035. Value Projection: | USD 1275.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 166 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Form ,By Livestock ,By Application |

| Companies covered:: | Jefo Nutrition Group, Canadian Bio-Systems Inc., Masterfeeds, Trouw Nutrition Canada Inc., Grand Valley Fortifiers, Sanimax, Floradale Feed Mill Limited, Cargill Inc., Archer Daniels Midland Co., Alltech, Inc., Evonik Industries AG, DSM-Firmenich, Elanco Animal Health Inc., BASF SE, IFF (Danisco Animal Nutrition), Adisseo, and Others Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The animal feed additives market in Canada is mainly influenced by the increased emphasis on animal health and welfare, which is also leading to the adoption of natural and organic additives. Precision nutrition technological innovations and better feed formulation contribute to nutrient absorption and overall farm efficiency. With the rise of the poultry and aquaculture industries, there is a corresponding increasing need for more specialized additives. The tough regulations imposed in Canada guarantee the manufacture of safe, top-quality, and eco-friendly feed products, which, as a result, promote innovation and the general opening up of the market.

Restraining Factors

Strict regulations increase the cost of doing business. Prices of raw materials that are subject to frequent changes limit the profits. The low level of awareness among farmers is a major obstacle in the adoption process. The consumer shift towards plant-based and clean-label products is resulting in a decrease in demand. The industry is facing challenges due to environmental concerns and the use of antibiotics in animal husbandry.

Market Segmentation

The Canada animal feed additives market share is categorized by product type, livestock, form, and application.

- The amino acids segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada animal feed additives market is segmented by product type into amino acids, vitamins, enzymes, and antibiotics. Among these, the amino acids segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Amino acids are the primary building materials for proteins and muscle tissue in animals. The largest demand and supply have been in the poultry and swine sectors due to the high growth and quality resulting from the optimized feeding of these animals, thus making this segment the market leader.

- The poultry segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada animal feed additives market is segmented by livestock into poultry, ruminants, swine, and aquaculture. Among these, the poultry segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The poultry segment is the major consumer of additives that are used for maintaining gut health, immunity, and feed conversion efficiency, which in turn support high production cycles and commercial-scale operations. This fact is responsible for this segment’s dominance.

- The dry form segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada animal feed additives market is segmented by form into dry and liquid. Among these, the dry form segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. It is easier to mix dry additives with feed, they also have a longer shelf life, and the storage costs are lower. The reason for commercial feed mills choosing them is their convenience and affordability.

- The animal growth promotion segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada animal feed additives market is segmented by application into animal growth promotion, feed efficiency, and health improvement. Among these, the animal growth promotion segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Additives for growth to the body goal of the animal optimizes metabolism, increase weight gain, and shorten production cycles. Producers, especially those in the poultry and swine industries, use these means to accelerate market readiness and increase output.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within The Canada animal feed additives market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Jefo Nutrition Group

- Canadian Bio-Systems Inc.

- Masterfeeds

- Trouw Nutrition Canada Inc.

- Grand Valley Fortifiers

- Sanimax

- Floradale Feed Mill Limited

- Cargill Inc.

- Archer Daniels Midland Co.

- Alltech, Inc.

- Evonik Industries AG

- DSM-Firmenich

- Elanco Animal Health Inc.

- BASF SE

- IFF (Danisco Animal Nutrition)

- Adisseo

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

• In January 2024, Canadian Food Inspection Agency (CFIA) has given the green light to 3 Nitrooxypropanol (3NOP) as a novel animal feed component to decrease methane emissions in cattle feed. Incorporating this methane decreasing agent into the diet of Canadian cows is compatible with environmental stewardship and provides a convenient way for Canadian beef farmers to reduce their carbon footprint and make their production more sustainable.

• In June 2025, The Canadian Food Inspection Agency (CFIA) has issued a Notice to Industry that provides guidance to the stakeholders how to move forward with the next phase of the Feeds Regulations, 2024, which include the requirements of a preventive control plan for feed businesses. This move of the regulation is a step towards safer additive use and preparation, thus making it easier for the businesses to comply and at the same time, enhancing the quality standards of feed additives throughout the country.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Canada Animal Feed Additives Market based on the below-mentioned segments.

Canada Animal Feed Additives Market, By Product Type

- Amino Acids

- Vitamins

- Enzymes

- Antibiotics

Canada Animal Feed Additives Market, By Livestock

- Poultry

- Ruminants

- Swine

- Aquaculture

Canada Animal Feed Additives Market, By Form

- Dry

- Liquid

Canada Animal Feed Additives Market, By Application

- Animal Growth Promotion

- Feed Efficiency

- Health Improvement

Frequently Asked Questions (FAQ)

-

Q: What is the projected market size & growth rate of the Canada animal feed additives market?A: Canada animal feed additives market was valued at USD 798.3 million in 2024 and is projected to reach USD 1275.2 million by 2035, growing at a CAGR of 4.35% from 2025 to 2035.

-

Q: What are the key driving factors for the growth of the Canada animal feed additives market?A: The market is driven by rising livestock production, increasing demand for high-quality animal protein, growing focus on animal health and nutrition, technological advancements in feed formulation, and strict feed safety regulations in Canada.

-

Q: What factors restrain the Canada animal feed additives market?A: Restraints include strict regulations raising costs, volatile raw material prices, low farmer awareness of additive benefits, consumer shift to plant-based diets, and environmental or antibiotic-related concerns.

-

Q: How is the market segmented by product type, livestock, form, and application?A: The market is segmented by product type (Amino Acids, Vitamins, Enzymes, Antibiotics), livestock (Poultry, Ruminants, Swine, Aquaculture), form (Dry, Liquid), and application (Animal Growth Promotion, Feed Efficiency, Health Improvement).

-

Q: Who are the key players in the Canada animal feed additives market?A: Key companies include Jefo Nutrition Group, Canadian Bio-Systems Inc., Masterfeeds, Trouw Nutrition Canada Inc., Grand Valley Fortifiers, Sanimax, Floradale Feed Mill Limited, Cargill Inc., Archer Daniels Midland Co., Alltech, Inc., Evonik Industries AG, DSM-Firmenich, Elanco Animal Health Inc., BASF SE, IFF (Danisco Animal Nutrition), Adisseo, and others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?