Canada Albumin Market Size, Share, and COVID-19 Impact Analysis, By Product (Alburex, Octalbin, Plasbumin, and Others), By Application (Therapeutics, Diagnostics, and Research), By End User (Hospitals & Clinics, Pharmaceutical & Biotechnology Industry, and Research Institutes), and Canada Albumin Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareCanada Albumin Market Size Insights Forecasts to 2035

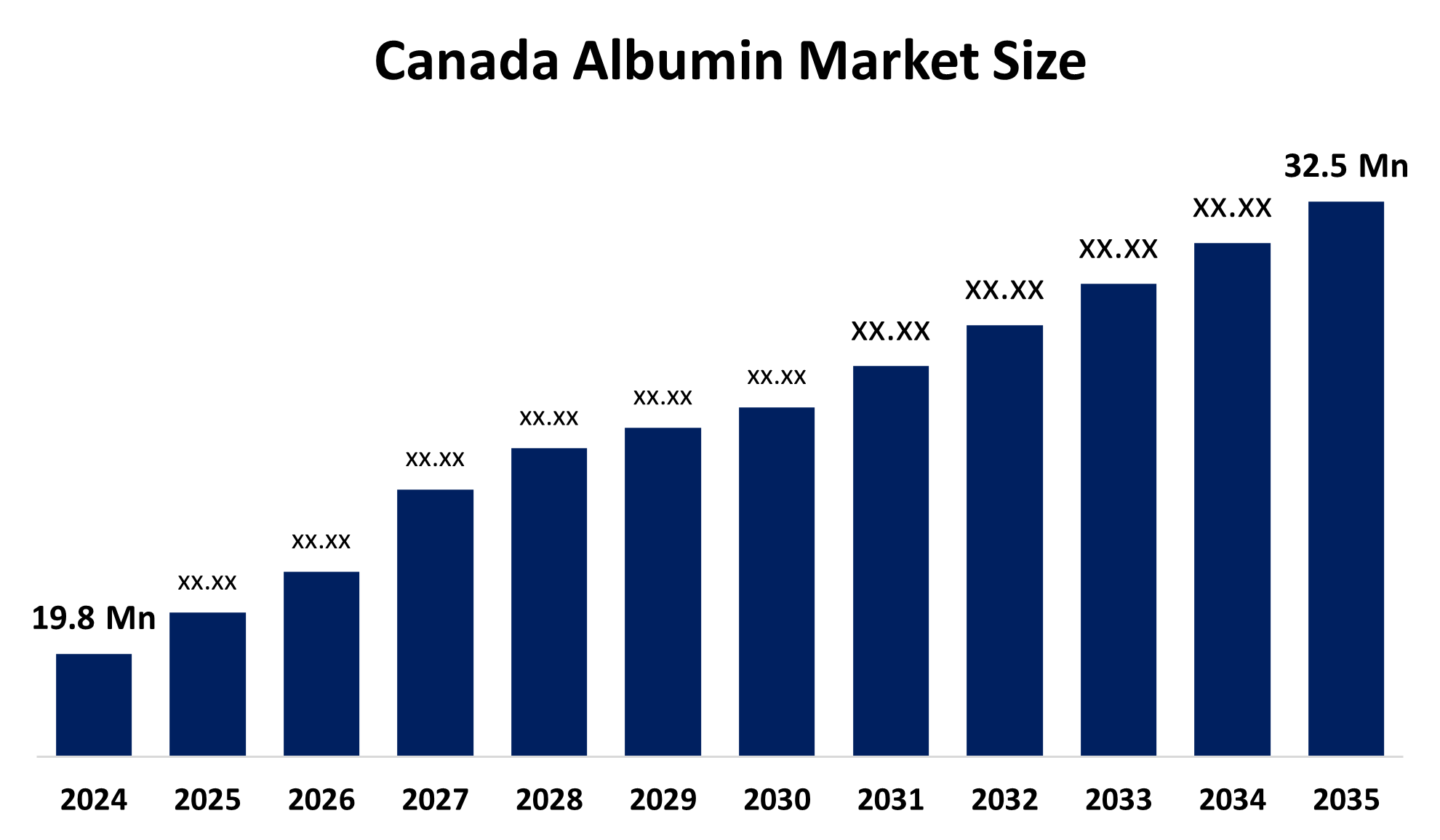

- The Canada Albumin Market Size Was Estimated at USD 19.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.6% from 2025 to 2035

- The Canada Albumin Market Size is Expected to Reach USD 32.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Canada Albumin Market Size is Anticipated to Reach USD 32.5 Million by 2035, Growing at a CAGR of 4.6% from 2025 to 2035. The Canada albumin market is driven by the rise in liver diseases, growing usage in trauma and cardiac surgeries, and demand in critical care.

Market Overview

The production, processing, and distribution of human serum albumin, a plasma protein with uses in clinical therapies, diagnostics, and biomedical research, which are all associated with the Canada Albumin Market Size. Hypovolemia, burns, liver cirrhosis, kidney problems, and shock are all treated with human serum albumin. The need for premium plasma proteins, government regulations, healthcare spending, and technological developments in plasma fractionation are the main drivers of the Canadian albumin market. Additionally, the rise of biopharmaceuticals and an increase in hospitalizations and critical care admissions are driving the growth of the albumin market in Canada.

Growing demand for plasma-derived therapies is one of the major trends influencing the Canada Albumin Market Size. Demand is rising as albumin is used more frequently in trauma care, critical care, and the treatment of chronic illnesses. Canada is focusing on strengthening domestic plasma collecting operations in order to reduce dependency on imports and ensure supply security. Technological Progress in Fractionation Clinical efficacy and product quality are being improved by safety and purification technologies.

The Canada government is a supporter of the albumin market through the regulations of Health Canada, which ensures that the plasma products are safe and of high quality. The Canadian Blood Services (CBS) is working towards improving the supply chain and enhancing plasma self-sufficiency. The government-funded public healthcare system is also contributing to the growth of the market.

Report Coverage

This research report categorizes the market for the Canada Albumin Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada albumin market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada albumin market.

Canada Albumin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 19.8 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.6% |

| 2035 Value Projection: | USD 32.5 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product, By End User |

| Companies covered:: | CSL Behring, Grifols S.A., Octapharma AG, Kedrion Biopharma, Takeda Pharmaceutical Company, Bio Products Laboratory (BPL) and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The rising prevalence of chronic diseases such as liver cirrhosis, chronic kidney disease, cancer, cardiovascular diseases, and sepsis is a key driver of albumin demand in Canada. Albumin is a critical component in the management of hypoalbuminemia, ascites, and fluid imbalance, especially among the elderly and critically ill patients. The aging population of Canada is another factor that the growth of the market. The rising number of surgeries and the use of albumin as a plasma expander in hospitals for the treatment of hypovolemia and shock are key demand drivers. A stable market for albumin products is ensured by significant investment in and accessibility to cutting-edge healthcare facilities, such as hospitals and clinics.

Restraining Factors

Albumin is more costly than other fluids like crystalloids, and provincial health systems required limit usage due to constraints. Because of limited supply, high cost, or strict guidelines, provincial healthcare authorities must control or reduce its usage. A significant portion of albumin used in Canada is imported from international suppliers. High safety, quality, and efficacy regulations for plasma-derived products can slow down market expansion.

Market Segmentation

The Canada albumin market share is classified into product, application, and end user.

- The alburex segment accounted for the largest revenue market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada Albumin Market Size is further divided on the basis of product into alburex, octalbin, plasbumin, and others. Among these, the alburex segment accounted for the largest revenue in 2024 and is expected to show significant CAGR during the forecast period. It is widely used in critical care, surgery, and emergency medicine, especially for plasma volume expansion and protein stabilization. Its high purity, quality, and reliability make it a widely preferred choice among medical professionals in Canada. Its widespread use in hospitals and intensive care units, as well as the increasing number of surgical and trauma cases, continues to make a significant contribution to revenue generation.

- The therapeutics segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada Albumin Market Size is classified by application into therapeutic, diagnostic, and research. Among these, the therapeutics segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because burns, liver failure, hypovolemia, shock, and renal disease are all commonly treated with albumin. This segment's domination is partly due to the rising number of hospital admissions and cases of chronic and life-threatening illnesses.

The research section is expected to grow at the fastest rate over the projection period. Increased drug development, clinical trials, and biopharmaceutical research are the causes of this. The need for albumin in the research sector has expanded due to its application in protein stability, cell culture, and medicine administration.

- The hospitals & clinics segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada Albumin Market Size is classified by end user into hospitals and clinics, the pharmaceutical and biotechnology industry, and research institutes. Among these, the hospitals and clinics sector had the most revenue in 2024 and is anticipated to expand at a substantial CAGR over the course of the forecast period. Because of the large number of new patients, the frequent emergency cases, and the widespread use of albumin in surgical procedures and intensive care units. Canada's strong healthcare system and universal healthcare coverage ensure hospital demand for albumin products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada Albumin Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CSL Behring

- Grifols S.A.

- Octapharma AG

- Kedrion Biopharma

- Takeda Pharmaceutical Company

- Bio Products Laboratory (BPL)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In Feb 2025, InVitria released Optibumin 25, a recombinant albumin substitute made without animal blood that is intended to increase safety in the production of cell and gene therapy.

- In July 2023, To demonstrate the effectiveness of long-term albumin treatment in cirrhosis patients, Grifols S.A. finished a Phase 3 trial for Albutein.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Canada Albumin Market Size based on the below-mentioned segments:

Canada Albumin Market, By Product

- Alburex

- Octalbin

- Plasbumin

- Other

Canada Albumin Market, By Application

- Therapeutics

- Diagnostics

- Research

Canada Albumin Market, By End Uses

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Industry

- Research Institutes

Frequently Asked Questions (FAQ)

-

1. What is the Canada albumin market?It refers to the market for plasma-derived albumin products used in medical treatments, diagnostics, and research in Canada.

-

2. What is the Canada albumin market size?The Canada albumin market was estimated to be USD 19.8 million in 2024 and is projected to grow to USD 32.5 million by 2035, expanding at a compound annual growth rate (CAGR) of approximately 4.6% during the forecast period from 2025 to 2035.

-

3. What are the key drivers of the Canada albumin market?Rising chronic diseases, increased surgeries, demand for critical care, and growth in biopharmaceutical research.

-

4. Which product segment dominates the Canada albumin market?Alburex holds the largest market share due to extensive hospital use.

-

5. What are the major trends in the Canada albumin market?Expansion of plasma collection, technological advancements in fractionation, and rising demand for plasma-derived therapies.

-

6. Who are the key companies operating in the Canada albumin market?Major players include CSL Behring, Grifols S.A, Octapharma AG, Kedrion Biopharma, Takeda Pharmaceutical Company, Bio Products Laboratory (BPL).

-

7. What are the restraints affecting the Canada albumin market?High production costs, donor shortages, and strict regulatory requirements.

-

8. What role does the Brazilian government play in the bunker fuel market?Through healthcare funding, plasma self-sufficiency initiatives, and strict quality regulations.

-

9. What is the future outlook for the Canada Albumin market?The market is expected to grow steadily at a CAGR of 4.6% through 2035.

Need help to buy this report?