Global Caloric Sweeteners Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Natural Sweeteners, Synthetic Sweeteners and Alcohol Sugars), By Application (Food & Beverages, Pharmaceuticals and Personal Care Products), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Caloric Sweeteners Market Insights Forecasts to 2035

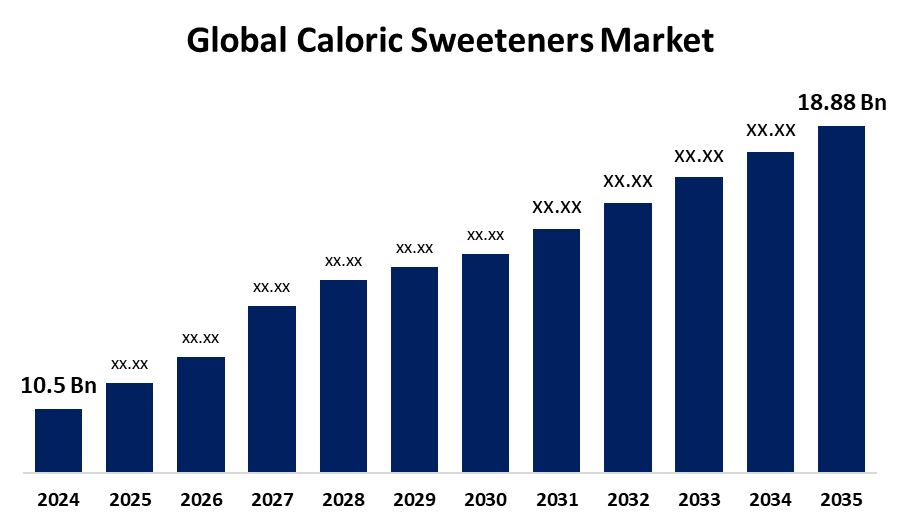

- The Global Caloric Sweeteners Market Size Was Estimated at USD 10.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.48% from 2025 to 2035

- The Worldwide Caloric Sweeteners Market Size is Expected to Reach USD 18.88 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Caloric Sweeteners Market Size was Worth Around USD 10.5 Billion in 2024 and is Predicted to Grow to Around USD 18.88 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 5.48% from 2025 to 2035. The demand for processed food, beverage consumption, popularity of dairy and confectionery products, affordability of sweeteners, product innovation, and urbanization, coupled with the support of regulations encouraging the use of foods and beverages with less sugar content, drives the market for caloric sweeteners.

Market Overview

The caloric sweeteners industry is the worldwide business engaged in manufacturing, marketing, and consumption of sweeteners that yield energy (calories) upon ingestion. They encompass natural sugars (e.g., sucrose, glucose, and fructose) and some sugar alcohols (e.g., sorbitol and xylitol). Caloric sweeteners are mostly applied in food and beverage applications to add sweetness, flavor, and shelf life. In contrast to non-caloric sweeteners, they are included in the total caloric value of the item and find extensive application in processed food, beverages, bakery items, and confectionery products. Caloric sweeteners are economical, enabling the manufacturers to keep prices low in large-scale production. Due to their extensive application in foods such as soft drinks, baked foods, and confectioneries, caloric sweeteners form an essential part of the food and beverage sector. In addition, companies are continuously developing to cater to the changing tastes of healthy-eating consumers. The popularity of natural and organic caloric sweeteners is one major trend since these sweeteners are perceived to be healthier. Furthermore, the popularity of plant-based diets and the desire for functional foods are propelling the demand for increasingly innovative sweetener solutions. With consumers increasingly seeking foods that are in line with their choice of lifestyle and dietary restrictions, the market for caloric sweeteners will continue to flourish.

Report Coverage

This research report categorizes the caloric sweeteners market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the caloric sweeteners market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the caloric sweeteners market.

Global Caloric Sweeteners Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 10.5 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.48% |

| 2035 Value Projection: | USD 18.88 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Application, By Region |

| Companies covered:: | Danisco A/S, Fraken Biochem Co., Giri Health Product, Glg Life Tech Corporation, Golden Time Enterprise (Shenzhen) Co., Ltd., Haitong Chemical Inteational Trading Co., Hermes Sweetener Ltd, King Way Corporation, Mcneil Nutritionals, Llc (Us), Merisant Worldwide Inc., Nutrasweet Company, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Drinks, such as soft drinks, energy drinks, and fruit juices, are high users of caloric sweeteners. As the use of these drinks continues to increase globally, firms are employing caloric sweeteners to improve taste, ensure homogeneity, and provide products in varying levels of sweetness, thus driving the market. Additionally, the food and beverage industry continues to innovate, with new products such as sugar-free or low-calorie versions. Caloric sweeteners play key roles in such innovations, allowing producers to achieve the required sweetness without employing artificial sweeteners. Such innovations propel the demand for caloric sweeteners to ensure market expansion.

Restraining Factors

The rising consumer demand for low-calorie, sugar-free, or naturally sweetened foods is diverting demand from regular caloric sweeteners. With the expanding usage of plant-based and healthier foods, demand for non-caloric or low-caloric sweeteners such as stevia and monk fruit has been increasing, limiting the market for caloric sweeteners. Additionally, the environmental footprint of sugar production, such as water consumption, land usage, and carbon output, has created an increase in consumer and regulatory attention. This has promoted the quest for sustainable, environmentally friendly solutions to conventional sources of sugar, placing pressure on the caloric sweeteners market.

Market Segmentation

The caloric sweeteners market share is classified into product type and application.

- The natural sweeteners segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the caloric sweeteners market is divided into natural sweeteners, synthetic sweeteners, and alcohol sugars. Among these, the natural sweeteners segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed to consumers increasingly preferring natural products over man-made ones as a result of increased health awareness. Natural sweeteners, including honey, maple syrup, and stevia, are seen as a healthier options. Such a consumer preference for clean-label, natural ingredients has generated greater demand for natural sweeteners in food and beverage applications, which has contributed to the market share dominance by these products.

- The food & beverages segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the application, the caloric sweeteners market is divided into food & beverages, pharmaceuticals, and personal care products. Among these, the food & beverages segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The segmental growth is due to the growing demand for convenience foods, including packaged snacks, ready-to-eat meals, and drinks, which propels the demand for caloric sweeteners. These sweeteners are used to add flavor, texture, and shelf life, thereby making them key ingredients in food processing, leading to the food & beverage industry's high market share.

Regional Segment Analysis of the Caloric Sweeteners Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the caloric sweeteners market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the caloric sweeteners market over the predicted timeframe. North America, particularly the United States, also boasts one of the highest per-capita consumption rates of packaged and processed foods that often contain caloric sweeteners such as high-fructose corn syrup (HFCS) and sucrose to enhance flavor and shelf life. The technologically developed food and beverage industry in the region, with the likes of Coca-Cola, PepsiCo, and Nestlé, is also dependent on these sweeteners, creating ongoing, large-scale demand and cementing North America's position as the leading player in the international caloric sweeteners market.

Asia Pacific is expected to grow at a rapid CAGR in the caloric sweeteners market during the forecast period. Most Asian cuisine has traditionally incorporated sweet ingredients, and sweet-flavored drinks and sweets are prevalent in consumption. This cultural inclination, on top of the popularity of Western-style convenience foods and beverages, is fueling greater use of caloric sweeteners. The combination of traditional and contemporary food influences adds to faster growth and demand in the market.

Europe is predicted to hold a significant share of the caloric sweeteners market throughout the estimated period. The cultural diversity of the population in Europe and the extensive array of food culture preferences for sweets account for various demands for sweeteners. Mediterranean countries prefer honey, while sugar is common in Northern Europe's dairy foods and sweets. The wide scope of tastes ensures high caloric sweetener consumption throughout the continent, fueling market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the caloric sweeteners market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Danisco A/S

- Fraken Biochem Co.

- Giri Health Product

- Glg Life Tech Corporation

- Golden Time Enterprise (Shenzhen) Co., Ltd.

- Haitong Chemical Inteational Trading Co.

- Hermes Sweetener Ltd

- King Way Corporation

- Mcneil Nutritionals

- Llc (Us)

- Merisant Worldwide Inc.

- Nutrasweet Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2023, Wisdom Natural Brands broadened its SweetLeaf portfolio to add two zero-calorie and three 50% lower-calorie sugars, adding new flavors like coconut and date. The addition addresses the increasing consumer need for natural sweeteners with fewer calories.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the caloric sweeteners market based on the below-mentioned segments:

Global Caloric Sweeteners Market, By Product Type

- Natural Sweeteners

- Synthetic Sweeteners

- Alcohol Sugars

Global Caloric Sweeteners Market, By Application

- Food & Beverages

- Pharmaceuticals

- Personal Care Products

Global Caloric Sweeteners Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the caloric sweeteners market over the forecast period?The global caloric sweeteners market is projected to expand at a CAGR of 5.48% during the forecast period.

-

2. What is the market size of the caloric sweeteners market?The global caloric sweeteners market size is expected to grow from USD 10.5 Billion in 2024 to USD 18.88 Billion by 2035, at a CAGR of 5.48% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the caloric sweeteners market?North America is anticipated to hold the largest share of the caloric sweeteners market over the predicted timeframe.

Need help to buy this report?