Global Calcium Powder Market Size, Share, and COVID-19 Impact Analysis, By End-Use Industry (Paper & Pulp, Food & Beverages, Pharmaceuticals, and Others), By Sales Channel (Direct and Indirect), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Calcium Powder Market Size Insights Forecasts to 2035

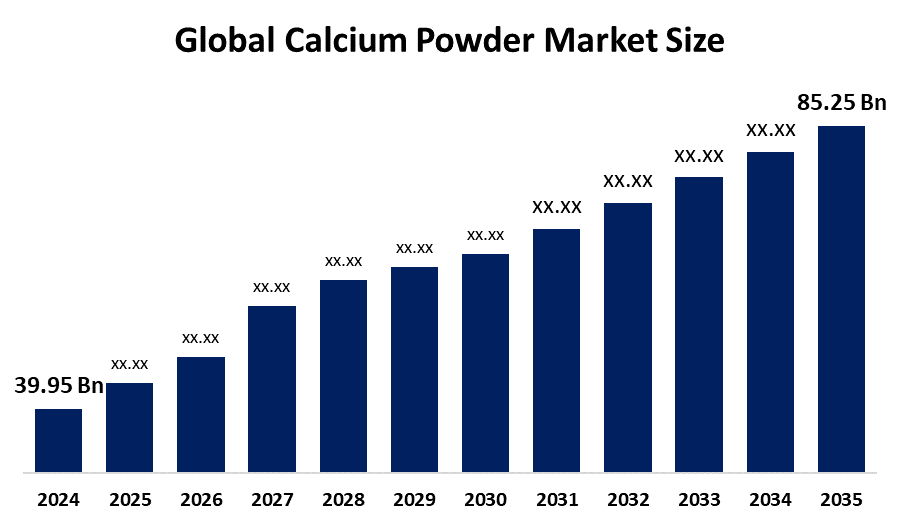

- The Global Calcium Powder Market Size Was Estimated at USD 39.95 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.13% from 2025 to 2035

- The Worldwide Calcium Powder Market Size is Expected to Reach USD 85.25 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Calcium Powder Market Size was worth around USD 39.95 Billion in 2024 and is predicted to Grow to around USD 85.25 Billion by 2035 with a compound annual growth rate (CAGR) of 7.13% from 2025 and 2035. The market for calcium powder has a number of opportunities to grow due to developments of calcium-based products across various sectors. Further, there is an increasing research on the application of calcium derived from marine organisms with regard to its sources, use of calcium supplements, calcium bioavailability, and novel applications of marine calcium.

Market Overview

The global industry of calcium powder encompasses the calcium carbonate (limestone/marble) and calcium compounds used for building materials, food fortification, and soil nutrition. Calcium powder, as a supplement, plays an important role in controlling immune cell communication. Additionally, it plays a role in the synthesis of some antimicrobial peptides that aid in infection defense. It is recommended that consistent daily use of calcium powder with a balanced diet enhances its effectiveness over time.

Calcium powder, derived from limestone, gypsum, and calcium carbonate, plays an essential role in enhancing nutritional content, improving soil productivity, and reinforcing material durability. In addition, consumer surging inclination towards convenient, health-focused nutrition options is driving the incorporation into fortified products like dairy and plant-based drinks, protein bars, and health snacks, which is accelerating the market.

Innovation and market expansion are anticipated as a result of major players' growing R&D expenditures and the expanding plant capacity. For instance, in November 2025, Izedon Carbonates, trading as IzeCarb, is expanding its calcium carbonates plant in Lampese, Edo, to 500,000 metric tons capacity to boost local production of the commodity.

Report Coverage

This research report categorizes the calcium powder market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the calcium powder market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the calcium powder market.

Global Calcium Powder Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 39.95 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.13% |

| 2035 Value Projection: | USD 85.25 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 165 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By End-Use Industry, By Sales Channel and COVID-19 Impact Analysis |

| Companies covered:: | Jiangxi Guangyuan Chemical Co., Ltd, Dujiangyan Calcium Products Co., Ltd., Kunal Calcium Limited, Marudhar Calcium Pvt. Ltd., Zhejiang Tianshi Nano-Tech Co., Ltd, Guangdong Qiangda New Materials Technology Co., Ltd, Guilin Sanxin New Material Co. LTD, Jiande Yunfeng Calcium Carbonate Co., Ltd, Lime Chemicals Limited, Sukesh Industries Private Limited, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The extensive application of calcium powder, including dietary supplements as well as across food, pharmaceuticals, cosmetics, and agriculture industries are driving the calcium powder market. Consumers’ increasing awareness about osteoporosis prevention and calcium deficiencies is driving the use of calcium powder in supplements, dairy products, and functional foods, which is ultimately propelling the market demand. Shelcal Pro Calcium & Vitamin D3, a Nutraceutical product deliver essential calcium to promote bone strength, joint health, and immune function.

Restraining Factors

The calcium powder market is restricted by factors like volatility in raw material prices, supply chain disruptions, and geopolitical factors. Further, environmental regulations associated with mineral extraction and processing are also responsible for inhibiting the market growth.

Market Segmentation

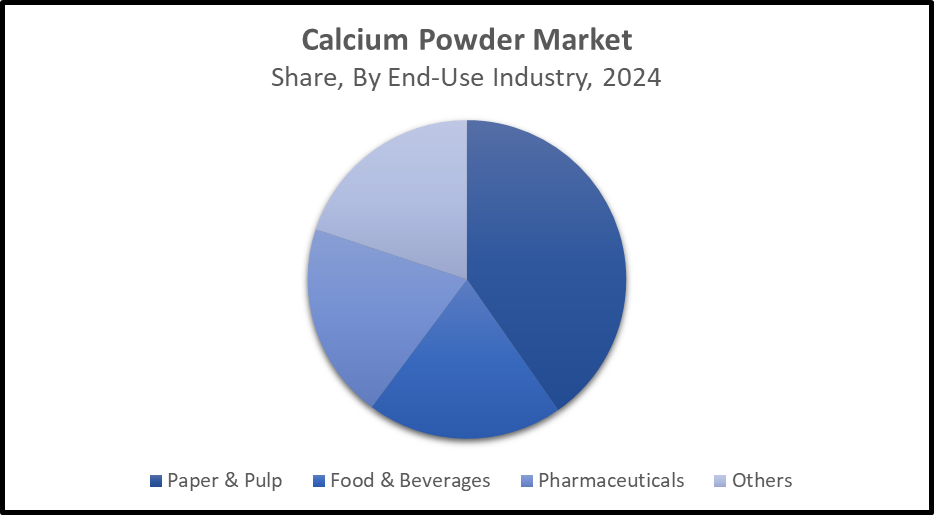

The calcium powder market share is classified into end-use industry and sales channel.

- The paper & pulp segment dominated the market with about 40.5% share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the end-use industry, the calcium powder market is divided into paper & pulp, food & beverages, pharmaceuticals, and others. Among these, the paper & pulp segment dominated the market with about 40.5% share in 2024 and is projected to grow at a substantial CAGR during the forecast period. Calcium carbonate powder is primarily used in the paper and pulp industry to enhance brightness, opacity, and smoothness while reducing production costs, replacing expensive wood fibres. Consistent demand for calcium carbonate in printing and packaging paper as a cost-effective filler supports the market growth.

Get more details on this report -

- The indirect segment accounted for the dominant market share of over 40.1% in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the sales channel, the calcium powder market is divided into direct and indirect. Among these, the indirect segment accounted for the dominant market share of over 40.1% in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. This includes procurement of raw materials or technically grade calcium products processed and distributed by wholesalers, importers, and traders for use in industries such as pharmaceuticals, construction, paint, and animal feed.

Regional Segment Analysis of the Calcium Powder Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the calcium powder market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of around 35.5% in the calcium powder market over the predicted timeframe. The market ecosystem in North America is strong, with its increased application in the construction, paper, and plastic industries. For instance, in April 2022, Imerys announced new capacity expansion and optimization investment in the Sylacauga (AL) plant, the Group’s largest site in North America, which is a part of a three-year site plan to support the growth demand for Ground Calcium Carbonate products. The United States is the leading country in the North America calcium powder market, holding about 77.4% regional share, driven by its larger industrial base and consumption across various end-use sectors.

Asia Pacific is expected to grow at a rapid CAGR of about 7.0% in the calcium powder market during the forecast period. The Asia Pacific area has a thriving market for calcium powder due to its population, increasing urbanization, and dietary changes, which drive the need for calcium supplements and fortified foods. China is dominating the market with the largest share of about 46.0% regional share, owing to the presence of the production industry and the implementation of an ETS (Emission Trading System) for combating climate change and reducing increasing greenhouse gas emissions while maintaining economic growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the calcium powder market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Jiangxi Guangyuan Chemical Co., Ltd

- Dujiangyan Calcium Products Co., Ltd.

- Kunal Calcium Limited

- Marudhar Calcium Pvt. Ltd.

- Zhejiang Tianshi Nano-Tech Co., Ltd

- Guangdong Qiangda New Materials Technology Co., Ltd

- Guilin Sanxin New Material Co. LTD

- Jiande Yunfeng Calcium Carbonate Co., Ltd

- Lime Chemicals Limited

- Sukesh Industries Private Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, the Finance Ministry’s Revenue Department imposed an anti-dumping duty on imports of Calcium Carbonate Filler Masterbatch from Vietnam. This has been done through Notification No. 37/2025-Customs (ADD).

- In October 2025, CarbonFree, a US-based manufacturer of circular, low-carbon materials, signed a Letter of Intent (LOI) with Univar Solutions USA LLC to explore a distribution partnership for Endurocal, a domestically produced, mine-free calcium carbonate. The partnership aims to expand access to sustainable, American-made mineral products for industrial and consumer markets.

- In September 2025, DGTR (Directorate General of Trade Remedies) launched an Anti-Dumping Probe on Calcium Carbonate Filler Masterbatch Imports from Vietnam, impacting Alok Industries.

Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the calcium powder market based on the below-mentioned segments:

Global Calcium Powder Market, By End-Use Industry

- Paper & Pulp

- Food & Beverages

- Pharmaceuticals

- Others

Global Calcium Powder Market, By Sales Channel

- Direct

- Indirect

Global Calcium Powder Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the calcium powder market?The global calcium powder market size is expected to grow from USD 39.95 Billion in 2024 to USD 85.25 Billion by 2035, at a CAGR of 7.13% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the calcium powder market?North America is anticipated to hold the largest share of the calcium powder market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Calcium powder Market from 2024 to 2035?The market is expected to grow at a CAGR of around 7.13% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Calcium powder Market?Key players include Jiangxi Guangyuan Chemical Co., Ltd, Dujiangyan Calcium Products Co., Ltd., Kunal Calcium Limited, Marudhar Calcium Pvt. Ltd., Zhejiang Tianshi Nano-Tech Co., Ltd, Guangdong Qiangda New Materials Technology Co., Ltd, Guilin Sanxin New Material Co. LTD, Jiande Yunfeng Calcium Carbonate Co., Ltd, Lime Chemicals Limited, and Sukesh Industries Private Limited.

-

5. Can you provide company profiles for the leading calcium powder manufacturers?Yes. For example, Jiangxi Guangyuan Chemical Co., Ltd. is a large high-tech enterprise integrating R&D, production, and sales of inorganic new non-metallic materials. With a registered capital of 360 million yuan, the group is headquartered in Yongfeng County, Jiangxi Province. Kunal Calcium Limited was established in 1997 as a Private Limited Company, core competency being the manufacturing of “Precipitated Calcium Carbonate” for versatile Applications across diverse .

-

6. What are the main drivers of growth in the calcium powder market?The extensive application of calcium powder, increasing awareness about osteoporosis prevention and calcium deficiencies, are major market growth drivers of the calcium powder market.

-

7. What challenges are limiting the calcium powder market?Volatility in raw material prices, supply chain disruptions, geopolitical factors, and environmental regulations remain key restraints in the calcium powder market.

Need help to buy this report?