Global Calcium Nitrate Market Size, Share, and COVID-19 Impact Analysis, By Process Type (Limestone with Nitric Acid, Ammonium Nitrate with Calcium Hydroxide, and Limestone with Nitric Acid), By Application (Fertilizer, Water-Treatment, Concrete and Mortars, Explosives, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Calcium Nitrate Market Size Insights Forecasts to 2035

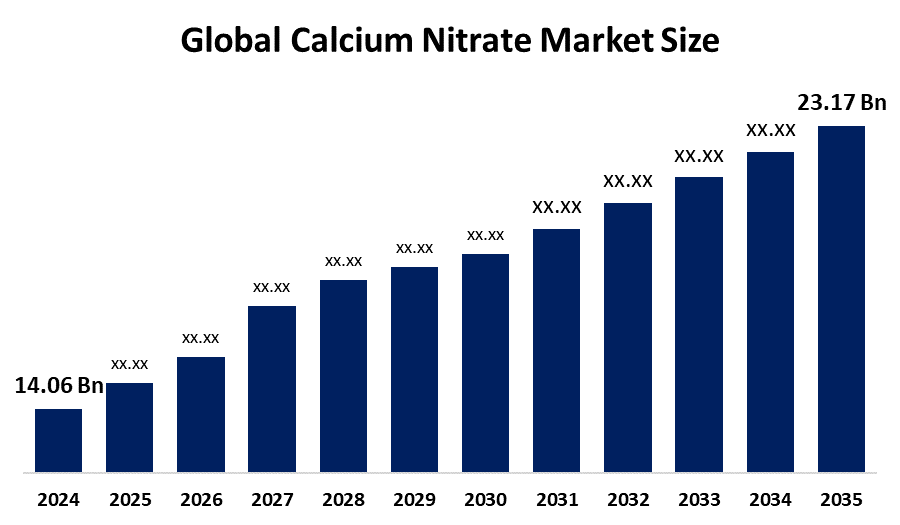

- The Global Calcium Nitrate Market Size Was Estimated at USD 14.06 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.65% from 2025 to 2035

- The Worldwide Calcium Nitrate Market Size is Expected to Reach USD 23.17 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Calcium Nitrate Market Size was worth around USD 14.06 Billion in 2024 and is predicted to Grow to around USD 23.17 Billion by 2035 with a compound annual growth rate (CAGR) of 4.65% from 2025 to 2035. The global calcium nitrate market is growing because precision agriculture requires high-efficiency fertilisers, wastewater treatment needs have increased, and greenhouse farming practices are expanding. The market expands because urbanization drives demand for high-yield crops, which deliver premium quality.

Market Overview

The global calcium nitrate market revolves around the production and distribution of calcium nitrate, which serves as a water-soluble nitrogen fertiliser and soil amendment. The product provides nitrogen and calcium in a form that plants can absorb, resulting in improved plant development, stronger cell structure, and better crop yields. Beyond agricultural applications, calcium nitrate serves as an odor control solution in wastewater treatment, a concrete admixture that enhances setting speed and durability, and an explosive manufacturing material. The market expansion occurs because global food requirements increase, greenhouse farming expands, and the adoption of fertigation systems grows, and farmers need efficient fertiliser solutions. Urban development, together with infrastructure projects, increases demand for construction materials.

The USDA started the $700 million Regenerative Agriculture Pilot Program in January 2026 to promote soil health while decreasing the use of synthetic fertilisers. The MAHA report features the initiative, which simplifies EQIP and CSP application processes and decreases administrative work while helping farmers adopt sustainable conservation-based production methods. The agricultural sector needs advanced opportunities, which sustainable farming methods provide through their balanced nutrient management approach. The main players in the market include Yara International, EuroChem Group, and Haifa Group, which establish their market control through product development and worldwide business growth.

Report Coverage

This research report categorizes the calcium nitrate market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the calcium nitrate market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the calcium nitrate market.

Global Calcium Nitrate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14.06 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.65% |

| 2035 Value Projection: | USD 23.17 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 174 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Process Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Yara International ASA, EuroChem Group, Uralchem JSC, Haifa Group, SQM S.A., Nutrien Ltd., OCI Global, Agrium Inc., CF Industries Holdings, Inc., Vardhaman Fertilizers, Rural Liquid Fertilizers (RLF), GFS Chemicals, Inc., Prathista Industries Limited, Shanxi Jiaocheng Tianlong Chemical Industry Co. Ltd., and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The global calcium nitrate market exists because agricultural science demands high-efficiency fertilizers to produce better crop yields and higher-quality crops and to resolve nutrient deficiency problems. The controlled-environment agriculture sector, which includes greenhouse farming and hydroponics systems that implement fertigation functions, is the main growth engine for agricultural markets. The rising urban population, together with wastewater treatment regulations that become more stringent, leads to increased usage of wastewater treatment systems for controlling odors and preventing damage to infrastructure. The construction industry uses calcium nitrate because it serves as a useful accelerator for concrete production. The market acceptance of products increases through sustainability practices that prioritize their creation with reduced emissions.

Restraining Factors

The global calcium nitrate market faces two major limitations because of its high hygroscopic properties, which cause caking and decrease product shelf life. The growth process experiences obstacles because of multiple factors, which include storage and transport safety regulations, ammonium nitrate raw material price fluctuations and environmental problems related to nitrogen leaching. The market expansion process encounters difficulties because of high production expenses.

Market Segmentation

The calcium nitrate market share is classified into process type and application.

- The limestone with nitric acid segment dominated the market in 2024, approximately 57% and is projected to grow at a substantial CAGR during the forecast period.

Based on the process type, the calcium nitrate market is divided into limestone with nitric acid, ammonium nitrate with calcium hydroxide, and limestone with nitric acid. Among these, the limestone with nitric acid segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment led market growth because it provides low-cost raw materials, and it uses an efficient production method that produces high calcium nitrate yields. The method ensures that industrial production maintains product standards while operating at full capacity. The segment experienced constant growth because agricultural demand, wastewater treatment needs and construction activities increased across the world.

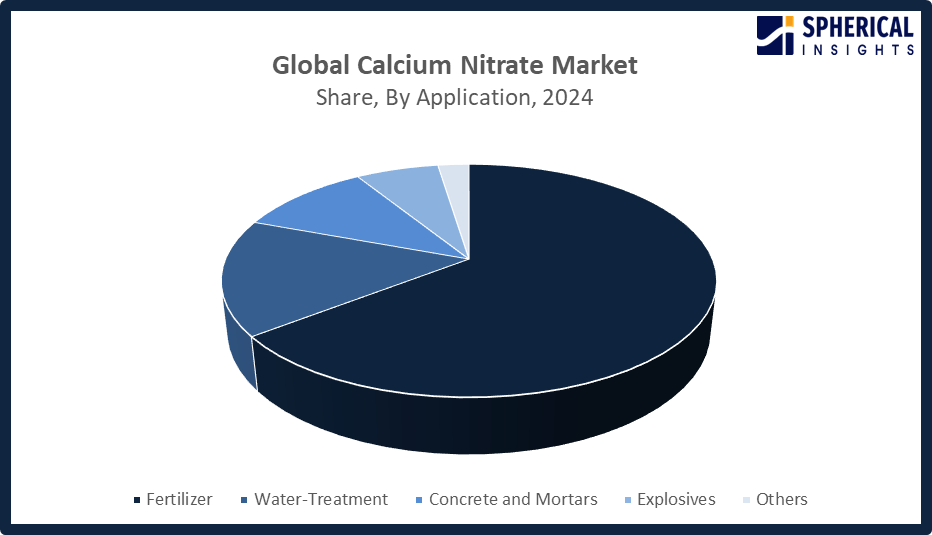

- The fertilizer segment accounted for the highest market revenue in 2024, approximately 65% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the calcium nitrate market is divided into fertilizer, water-treatment, concrete and mortars, explosives, and others. Among these, the fertilizer segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The fertilizer segment is growing due to rising global food demand, expanding agricultural activities, and increasing adoption of high-efficiency nutrient solutions. The increasing emphasis on soil health, together with precision farming practices and water-soluble fertilisers, has resulted in higher calcium nitrate consumption. The worldwide growth of this segment results from government subsidies and sustainable farming programs, and the requirement to enhance crop yield and quality.

Get more details on this report -

Regional Segment Analysis of the Calcium Nitrate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the calcium nitrate market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the calcium nitrate market over the predicted timeframe. The calcium nitrate market in the Asia Pacific will become the 42% share market segment because agricultural growth continues to expand, food needs grow, and farmers start using high-efficiency fertilizers. China and India drive consumption because government subsidies enable horticultural production to grow. Japan and South Korea develop their agricultural systems through advanced greenhouse technology and precision farming techniques. India announced its progress on the Soil Health Card Scheme, which the Ministry of Agriculture and Farmers' Welfare established in 2015, in July 2025, because the program achieved 8-10% fertilizer reduction while increasing national productivity by 5-6%.

North America is expected to grow at a rapid CAGR in the calcium nitrate market during the forecast period. The calcium nitrate market in North America will experience rapid growth with an approximate 23% share because farmers increasingly adopt precision agriculture and demand high-value crops, and wastewater treatment applications continue to grow. The United States leads regional growth with strong investment in sustainable farming practices, which include greenhouse cultivation and nutrient-efficient fertilizers. The Canadian government enhances expansion through its support of advanced irrigation methods and environmental regulations, which help improve soil health and water quality management.

Europe's calcium nitrate market expansion results from stringent environmental regulations and advanced greenhouse farming methods, as well as sustainable nutrient management practices. The Netherlands leads in intensive horticulture, while Germany and France increase demand through their high-value crop and precision farming methods. The European Commission extended Ireland's Nitrates Directive derogation until December 2025, which established new pollution control requirements while maintaining existing limit restrictions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the calcium nitrate market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Yara International ASA

- EuroChem Group

- Uralchem JSC

- Haifa Group

- SQM S.A.

- Nutrien Ltd.

- OCI Global

- Agrium Inc.

- CF Industries Holdings, Inc.

- Vardhaman Fertilizers

- Rural Liquid Fertilizers (RLF)

- GFS Chemicals, Inc.

- Prathista Industries Limited

- Shanxi Jiaocheng Tianlong Chemical Industry Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2026, the European Union formally adopted new rules on RENURE (Recovered Nitrogen from Manure), enabling processed livestock manure products to substitute mineral fertilizers. The measure lowers farmers’ costs, reduces dependence on imported fertilizers, and promotes sustainable nutrient recycling while minimizing water pollution risks through improved nitrogen recovery technologies.

- In March 2025, Haifa Group announced a €30 million investment to build a new Multicote controlled-release fertiliser plant in Lunel, South France. The facility will produce biodegradable-coated fertilisers, aligning with upcoming EU regulations banning products that leave microplastic residues and supporting sustainable agriculture initiatives.

- In January 2025, Bayer Crop Science launched Wojiarun, a new water-soluble calcium fertiliser, in Hangzhou, China. The product features advanced formulation and high purity, targeting China’s growing $1.43 billion crop health market, driven by modernized farming and rising demand for specialized nutrient solutions.

- In July 2024, Yara International and ATOME PLC signed Heads of Terms for renewable Calcium Ammonium Nitrate from ATOME’s Villeta project in Paraguay. The 264,000-ton annual facility, starting in 2027, will use renewable power to significantly reduce fertiliser production emissions.

- In October 2021, KCCW, a branch of Uralchem, completed commissioning of its calcium nitrate cake processing project. New Dieffenbach filter presses and modified reactor systems enable the separation and recycling of cake by-products back into calcium nitrate and complex mineral fertiliser production, reducing waste and improving operational efficiency.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the calcium nitrate market based on the below-mentioned segments:

Global Calcium Nitrate Market, By Process Type

- Limestone with Nitric Acid

- Ammonium Nitrate with Calcium Hydroxide

- Limestone with Nitric Acid

Global Calcium Nitrate Market, By Application

- Fertilizer

- Water-Treatment

- Concrete and Mortars

- Explosives

- Others

Global Calcium Nitrate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the calcium nitrate market over the forecast period?The global calcium nitrate market is projected to expand at a CAGR of 4.65% during the forecast period.

-

2. What is the market size of the calcium nitrate market?The global calcium nitrate market size is expected to grow from USD 14.06 billion in 2024 to USD 23.17 billion by 2035, at a CAGR of 4.65% during the forecast period 2025-2035.

-

3. What is the global calcium nitrate market?The global calcium nitrate market refers to worldwide production, distribution, and consumption of calcium nitrate across agriculture and industrial applications.

-

4. Which region holds the largest share of the calcium nitrate market?Asia Pacific is anticipated to hold the largest share of the calcium nitrate market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global calcium nitrate market?Yara International ASA, EuroChem Group, Uralchem JSC, Haifa Group, SQM S.A., Nutrien Ltd., OCI Global, Agrium Inc., CF Industries Holdings, Inc., Vardhaman Fertilizers, and Others.

-

6. What factors are driving the growth of the calcium nitrate market?Calcium nitrate market growth is driven by rising demand for high-efficiency fertilizers, increasing wastewater treatment needs for odor control, expanding greenhouse farming, and rapid adoption of smart, sustainable agricultural practices.

-

7. What are the market trends in the calcium nitrate market?Key trends include rising demand for water-soluble fertilizers in precision agriculture, increased wastewater treatment use, sustainable production, and rapid Asia-Pacific expansion.

-

8. What are the main challenges restricting wider adoption of the calcium nitrate market?The wider adoption of the calcium nitrate market, particularly in the agricultural sector, faces several key challenges related to cost, logistics, regulatory hurdles, and competition from alternatives.

Need help to buy this report?