Global Calcium Chloride Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Flakes 77%, Flakes 94%, Prills 94%, and Pellets 94%), By Application (Dust Control and De-icing, Gas and Oil, Construction, Food, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Calcium Chloride Market Insights Forecasts to 2035

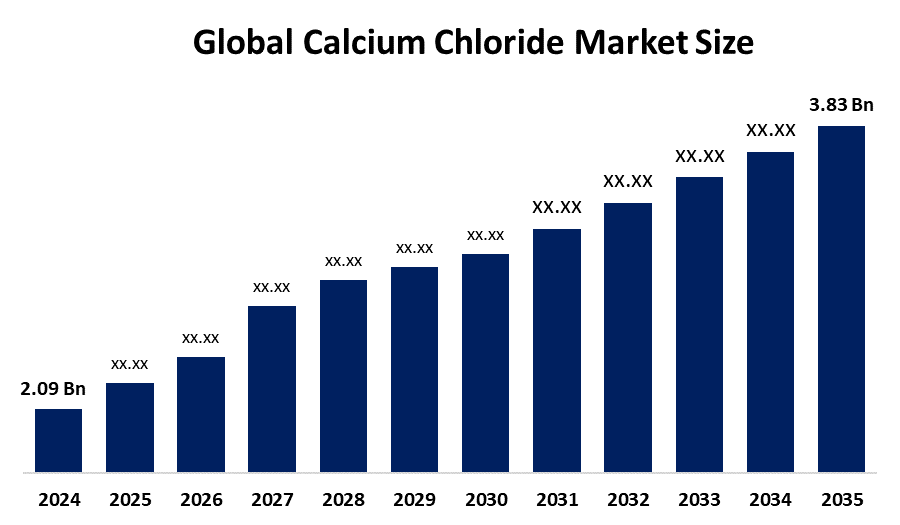

- The Global Calcium Chloride Market Size Was Estimated at USD 2.09 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.66% from 2025 to 2035

- The Worldwide Calcium Chloride Market Size is Expected to Reach USD 3.83 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global Calcium Chloride market size was worth around USD 2.09 billion in 2024 and is predicted to grow to around USD 3.83 billion by 2035 with a compound annual growth rate (CAGR) of 5.66 % from 2025 to 2035. The market for calcium chloride provides opportunities due to the growing need in the construction, de-icing, and oil and gas sectors, which is fueled by industrialization, urbanization, and the growing use of dust control and wastewater treatment products worldwide.

Global Calcium Chloride Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2.09 Billion

- 2035 Projected Market Size: USD 3.83 Billion

- CAGR (2025-2035): 5.66%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

The global production, distribution, and use of calcium chloride (CaCl2), a hygroscopic inorganic salt that is well-known for its use as a desiccant, dust control, and de-icing agent, concrete accelerator, and drilling fluid additive in sectors like construction, food processing, oil and gas, and agriculture, are all included in the market. Government initiatives have launched significant momentum in the Calcium Chloride market; the U.S. Department of Transportation launched contracts for 2025–26 dust control and dust control and de-icing in Iowa, while India’s Ministry launched efforts to reach a USD 304 million eco-friendly chemical sector by 2025. Growing applications in the food processing and construction sectors, as well as rising demand for dust management and dust control and dust control and de-icing solutions, are propelling the market. The growing need for calcium chloride in the concrete industry to strengthen concrete by improving its hydration process is one of the major factors currently favorably driving the market. It is also anticipated that a wider range of calcium chloride applications in the building industry will support the expansion of the calcium chloride market.

Key Market Insights

- North America is expected to account for the largest share in the calcium chloride market during the forecast period.

- In terms of product type, the flakes 77% segment is projected to lead the calcium chloride market throughout the forecast period

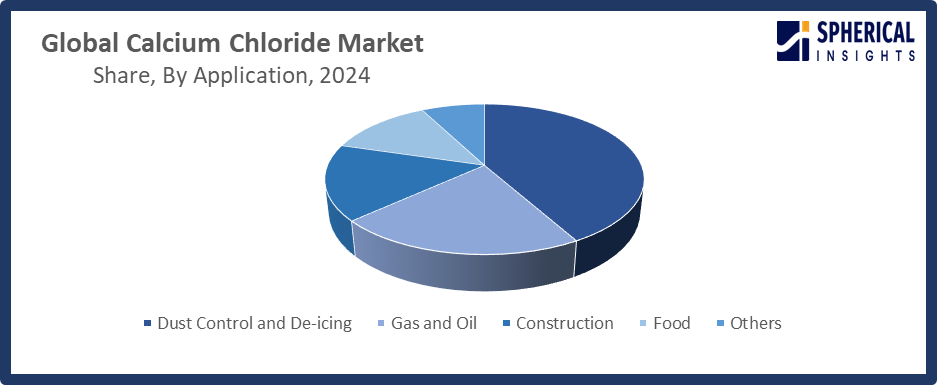

- In terms of application, the dust control and de-icing segment captured the largest portion of the market

Calcium Chloride Market Trends

- Growing Need for Winter De-Icing: In colder climates, governments and transportation agencies heavily rely on this technique to keep roads safe.

- Government Procurement and Support: Initiatives and contracts, particularly in the United States and India, encourage market expansion.

- Increasing Demand in Emerging Economies: The Asia-Pacific and Latin American markets are expanding due to industrialization and urbanization.

- Growth in Construction Applications: Promotes the quick growth of infrastructure by acting as a concrete accelerator in cold climates.

Report Coverage

This research report categorizes the calcium chloride market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the calcium chloride market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the calcium chloride market.

Global Calcium Chloride Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.09 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.66% |

| 2035 Value Projection: | USD 3.83 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Solvay, Zirax Limited, Tiger Calcium, Nedmag B.V., Auro Chemical, Ward Chemical Ltd, SAMEER CHEMICALS, Aditya Birla Chemicals, Dow, SaiChem Industries, TETRA Technologies, Inc., Vinipul Inorganics Pvt. Ltd., Sitara Chemical Industries Ltd., Occidental Chemical Corporation, Weifang Haibin Chemical Co., Ltd, And Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving factors

Road maintenance expenditures are rising, which is fueling the calcium chloride market's expansion. The increasing demand for clean, safe water for industrial and municipal uses is driving the calcium chloride market. Revenue from the calcium chloride industry is also being driven by the expansion of the paints and coatings sector. To absorb moisture, the industry uses calcium chloride as a drying agent. The requirement for calcium chloride is expected to increase as the building industry's need for paints and coatings grows. Numerous new prospects for the global market are anticipated as a result of the expanding potential uses of calcium chloride in the waste treatment and agricultural sectors.

Restraining Factor

The market for calcium chloride is restricted by several factors, including regulatory restrictions on chemical applications, health risks associated with improper handling, environmental concerns about excessive usage, and price volatility for raw materials. These factors work together to prevent steady market growth and adoption.

Market Segmentation

The global calcium chloride market is divided into product type and application.

Global Calcium Chloride Market, By Product Type:

- The flakes 77% segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on product type, the global calcium chloride market is segmented into flakes 77%, flakes 94%, prills 94%, and pellets 94%. Among these, the flakes 77% segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The broad usage of flakes in a variety of industries, such as dust control, oil and gas, de-icing, and construction, is responsible for the 77% piece. Increased demand for calcium chloride flakes, particularly for dust management and dust control and dust control and de-icing applications, is the main factor propelling the market.

The pellets 94% segment in the calcium chloride market is expected to grow at the fastest CAGR over the forecast period. Pellets 94 improved handling qualities, decreased dust production, and suitability for precise applications, including food processing, pharmaceuticals, and specialized industrial purposes are what are driving their increasing utilization.

Global Calcium Chloride Market, By Application:

- The dust control and de-icing segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on application, the global Calcium Chloride market is segmented into dust control and de-icing, gas and oil, construction, food, and others. Among these, the dust control and de-icing segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The widespread application of calcium chloride in winter road maintenance in areas with severe winters, especially in North America and Europe, is the key factor propelling the dust control and de-icing and dust control market. Cities and transportation officials favor due to it melts ice more effectively at lower temperatures than other salts. Its ability to suppress dust is also widely used in unpaved roads, building sites, and mining, greatly enhancing environmental safety and regulatory compliance.

Get more details on this report -

The gas and oil segment in the calcium chloride market is expected to grow at the fastest CAGR over the forecast period. The growing need for calcium chloride as a well stimulation agent, completion fluid, and drilling fluid additive in shale gas exploration and extraction operations is driving the oil and gas segment.

Regional Segment Analysis of the Global Calcium Chloride Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Calcium Chloride Market Trends

North America is expected to hold the largest share of the global calcium chloride market over the forecast period.

The North America region's need for calcium chloride is rising due to increased dust control and dust control and de-icing requirements and drilling operations brought on by recent climate change. As shale gas production and exploration in North America have expanded, so too has the demand for calcium chloride. Calcium chloride is utilized as a concrete accelerator in the construction industry. The rise in construction activity, particularly in the residential and commercial sectors, is driving up demand for calcium chloride. The need for calcium chloride is increasing to manufacture liquid grades, flakes, pellets, and prills in various concentrations for use as dust control and dust control and de-icing agents, accelerators for concrete, and other applications.

Get more details on this report -

U.S Calcium Chloride Market Trends

The main factor driving the U.S. is its widespread use in the severe winter months in northern regions for snow removal and de-icing. The chemical is also widely used in the oil and gas industry, especially in well completion fluids and drilling activities. Calcium chloride is used as a concrete accelerator in the building sector, which furthers market expansion. Demand is also supported by government procurement programs and infrastructure-building activities.

Canada Calcium Chloride Market Trends

The main reason for its widespread use in Canada is for snow control and road dust control and dust control and de-icing during harsh winter conditions. Because of its efficiency at low temperatures, the chemical is crucial for transportation and municipal agencies. Furthermore, calcium chloride is used in drilling and well stimulation procedures by Canada's oil and gas sector, which supports market expansion. It is used in the construction industry to hasten the cure of concrete in cold areas.

Asia Pacific Calcium Chloride Market Trends

Asia Pacific is expected to grow at the fastest CAGR in the calcium chloride market during the forecast period.

The demand from the end-use sector, regional economic conditions, and technological advancements are some of the factors influencing the calcium chloride market in Asia Pacific. Calcium chloride is widely used in a variety of industrial applications, such as dust control, de-icing, and desiccant use. The growing industrial sector in Asia Pacific, particularly in countries like China, India, and Japan, is driving the requirement. With agriculture gaining more and more attention, it is applied to agricultural land as a fertilizer and to enhance the soil's quality.

China Calcium Chloride Market Trends

China's increasing industrialization, urbanization, and infrastructure development are the main drivers of its growth. Calcium chloride is used extensively in the construction industry as a concrete accelerator, especially in colder climates. Furthermore, its use in well stimulation and drilling in the oil and gas sector further increases market demand. Market expansion is also supported by government initiatives that encourage environmentally friendly business practices and investments in the production of chemicals.

Japan Calcium Chloride Market Trends

The market for calcium chloride in Japan is driven by the wide range of industries that use it. Calcium chloride is specifically used in the construction industry to speed up the cure of concrete, particularly in colder areas. To support environmental management and infrastructure maintenance, the chemical is also used for dust control and dust control and de-icing and dust control. Market trends are influenced by Japan's strict environmental regulations, which promote the use of environmentally friendly chemical solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global calcium chloride market, along with a comparative evaluation primarily based on their Product Type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes Product Type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Calcium Chloride Market Include

- Solvay

- Zirax Limited

- Tiger Calcium

- Nedmag B.V.

- Auro Chemical

- Ward Chemical Ltd

- SAMEER CHEMICALS

- Aditya Birla Chemicals

- Dow, SaiChem Industries

- TETRA Technologies, Inc.

- Vinipul Inorganics Pvt. Ltd.

- Sitara Chemical Industries Ltd.

- Occidental Chemical Corporation

- Weifang Haibin Chemical Co., Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2024, Kemin Industries announced its entry into the U.S. dairy market with CholiGEM, an advanced rumen-protected choline supplement designed to combat fatty liver and ketosis in lactating dairy cows, enhancing herd health and productivity.

- In May 2024, Fast&Up, India’s leading active nutrition brand, launched Fast&Up Reload Ready-to-Drink, offering a convenient hydration solution for athletes and fitness enthusiasts seeking sustained energy and peak performance in their active lifestyles.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the calcium chloride market based on the following segments:

Global Calcium Chloride Market, By Product Type

- Flakes 77%

- Flakes 94%

- Prills 94%

- Pellets 94%

Global Calcium Chloride Market, By Application

- Dust Control and De-icing

- Gas and Oil

- Construction

- Food

- Others

Global Calcium Chloride Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the calcium chloride market over the forecast period?The global calcium chloride market is projected to expand at a CAGR of 5.66% during the forecast period.

-

What is the market size of the calcium chloride market?The global calcium chloride market size is expected to grow from USD 2.09 billion in 2024 to USD 3.83 billion by 2035, at a CAGR 5.66% of during the forecast period 2025-2035.

-

Which region holds the largest share of the calcium chloride market?North America anticipated to hold the largest share of the calcium chloride market over the predicted timeframe.

-

Who are the top companies operating in the global calcium chloride market?Solvay, Zirax Limited, Tiger Calcium, Nedmag B.V., Auro Chemical, Ward Chemical Ltd, SAMEER CHEMICALS, Aditya Birla Chemicals, Dow, SaiChem Industries, TETRA Technologies, Inc., Vinipul Inorganics Pvt. Ltd., Sitara Chemical Industries Ltd., Occidental Chemical Corporation, Weifang Haibin Chemical Co., Ltd, and others.

-

What factors are driving the growth of the calcium chloride market?The growth of the calcium chloride market is driven by increasing demand in de-icing, oil and gas, construction, and industrial applications, along with supportive government initiatives and infrastructure development.

-

What are market trends in the calcium chloride market?Market trends include rising use in dust control, eco-friendly chemical adoption, technological advancements in production, increased demand in emerging economies, and expanding applications across food, pharmaceutical, and water treatment sectors.

-

What are the main challenges restricting wider adoption of the calcium chloride market?Key challenges include environmental and health concerns, regulatory restrictions, fluctuating raw material prices, and limited awareness of advanced application benefits in certain regions, hindering broader adoption of calcium chloride products.

Need help to buy this report?