Global Calcium Carbonate Market Size, Share, and COVID-19 Impact Analysis, By Product (Ground Calcium Carbonate and Precipitated Calcium Carbonate), By Application (Automotive, Building & Construction, Pharmaceutical, Agriculture, Pulp & Paper, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Calcium Carbonate Market Insights Forecasts to 2035

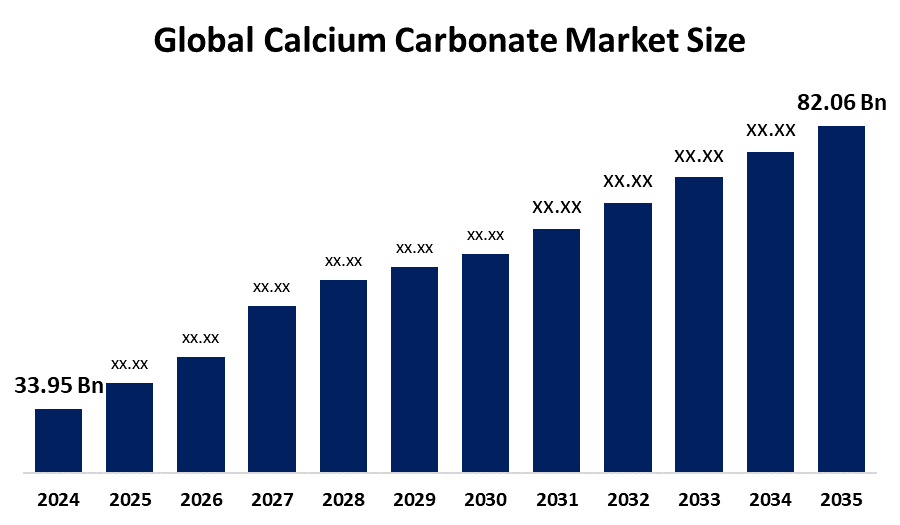

- The Global Calcium Carbonate Market Size Was Estimated at USD 33.95 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.35 % from 2025 to 2035

- The Worldwide Calcium Carbonate Market Size is Expected to Reach USD 82.06 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global calcium carbonate market size was worth around USD 33.95 billion in 2024 and is predicted to grow to around USD 82.06 billion by 2035 with a compound annual growth rate (CAGR) of 8.35 % from 2025 to 2035. Growing demand in construction, plastics, paper, medicines, and agriculture, together with rising industrialization, the use of sustainable materials, technological breakthroughs, and the expansion of international infrastructure, present opportunities in the calcium carbonate market.

Market Overview

Calcium carbonate or its PCC and GCC forms are obtained both processed, and delivered to the market as fillers and extenders in various industries like paper, plastic, paint and coating, construction, and even in pharmaceuticals and agriculture. The very high quality, brightness, and low cost of the material are the main reasons for its widespread use as a functional filler, additive, and pigment in many industries. Adoption is accelerated by government initiatives: Nigeria's December 2024 IzeCarb facility under federal support reduces imports; Ethiopia's May 2025 opening of MIDROC's coated GCC plant increases local pharma and plastics supply; and Saudi Arabia's 2025 high-purity GCC project by the Water Authority advances water treatment self-sufficiency. The market is growing gradually and steadily because many industries have started to depend upon the raw materials, which are versatile and cost-effective. The filler, neutralizing agent, and opacity enhancer characteristics made it indispensable in the construction, paper, plastics, and agriculture industries. The availability of natural resources such as limestone guarantees a constant supply, thus supporting the continuous industrial use and the long-term market growth.

Report Coverage

This research report categorizes the calcium carbonate market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the calcium carbonate market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the calcium carbonate market.

Driving Factors

The market for calcium carbonate is expanding as a result of technological developments in the process. The growing use of GCC as a filler in the plastic, rubber, paper, paint, and ink industries is one of the main reasons propelling the calcium carbonate market's expansion. The adoption of calcium carbonate seems to be driven by its versatility as a coating agent and filler, which improves product performance. The advantages of using calcium carbonate as a soil amendment and pH regulator are becoming more widely acknowledged in the agriculture industry. Environmental restrictions, technical improvements, industrial growth, raw material availability, and the need for lightweight and sustainable materials all have a positive effect on the calcium carbonate industry.

Restraining Factors

Environmental restrictions on mining operations, high energy consumption during processing, variations in raw material quality, transportation expenses, and competition from synthetic calcium carbonate products and other additives all restrict the calcium carbonate market.

Market Segmentation

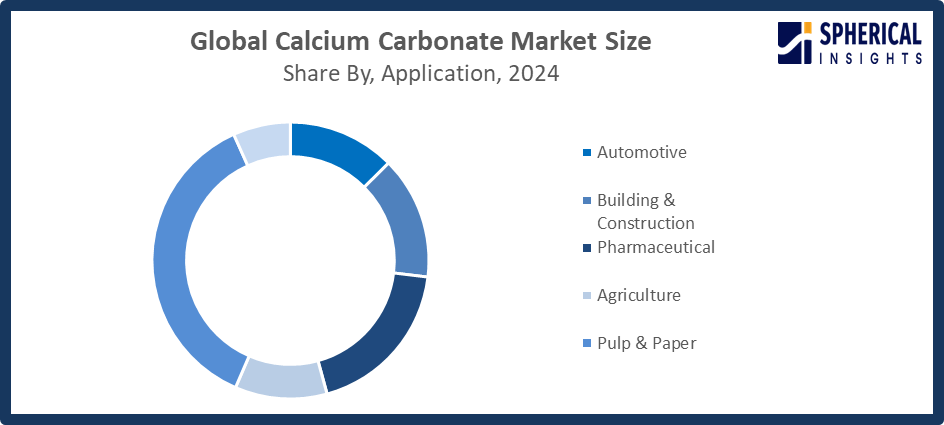

The calcium carbonate market share is classified into product and application.

- The ground calcium carbonate segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product, the calcium carbonate market is divided into ground calcium carbonate and precipitated calcium carbonate. Among these, the ground calcium carbonate segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The market for ground calcium carbonate is driven by its widespread application in manufacturing processes that call for bulk fillers, its cost-effectiveness, and its plentiful natural availability. GCC's excellent market position is supported by its stable quality, ease of processing, and suitability for paper coating, polymer reinforcement, and building materials.

- The pulp & paper segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the calcium carbonate market is divided into automotive, building & construction, pharmaceutical, agriculture, pulp & paper, and others. Among these, the pulp & paper segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The expanding e-commerce sector, which has raised demand for food, hygiene, and lightweight packaging products, is responsible for the pulp and paper market. High brightness and comparatively low cost, as well as the achievement of a porous surface of the paper sheet because of the rhombohedral particle form, are some of the criteria that support the use of Calcium Carbonate for applications in the paper industry.

Get more details on this report -

Regional Segment Analysis of the Calcium Carbonate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

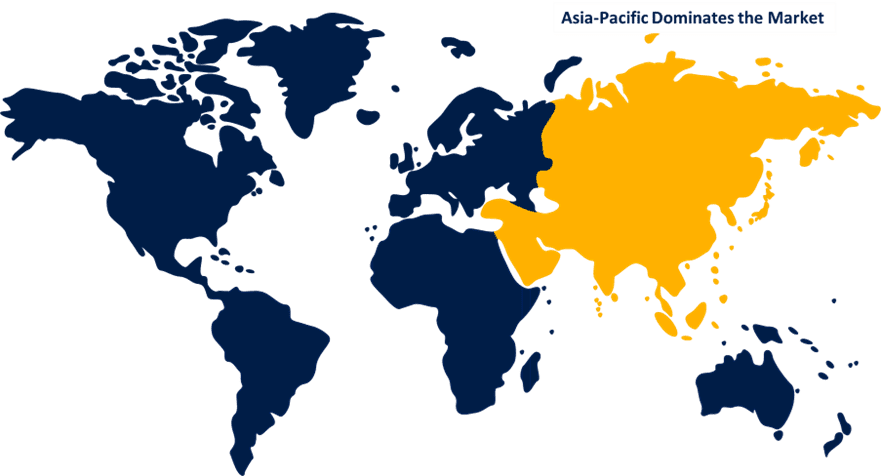

Asia Pacific is anticipated to hold the largest share of the calcium carbonate market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the calcium carbonate market over the predicted timeframe. Calcium Carbonate is in high demand across several industries in the Asia-Pacific region due to its varied and expanding industrial base. The need for GCC in this industry is driven by the expanding pharmaceutical markets, burgeoning populations, and increased health consciousness in nations like China, India, and Southeast Asia. Japan's October 2024 carbon-reduction program under the C4S Project encourages low-emission materials; China's 2025 industrial policy provides subsidies for green manufacturing, increasing GCC adoption in EVs and packaging; and India's March 2024 Smart Cities Mission allotted funds for infrastructure, requiring high-purity GCC in cement and coatings. Consumption is further stimulated by rising investments in housing developments, industrial growth, and infrastructural development.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the calcium carbonate market during the forecast period. The paint and coatings sector in North America is booming. GCC enhances the durability, opacity, and rheological qualities of paints and coatings by acting as a functional filler and pigment extender. The use of GCC in this industry is driven by the need for industrial coatings, architectural coatings, and other surface finishing applications in the US and Canada. The CHIPS and Science Act's extensions in 2025 encourage semiconductor factories to use premium fillers; Canada's 2024 Green Construction Code requires eco-materials in federal projects; and the U.S. Department of the Interior's August 2025 Draft List of Critical Minerals prioritizes domestic supply chains, indirectly supporting GCC via infrastructure incentives.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the calcium carbonate market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ascom Carbonate and Chemicals Manufacturing (ACCM)

- Carmeuse Group

- GLC Minerals

- Gulshan Polyols Ltd.

- Indocal

- Imerys

- J.M. Huber Corporation

- Kunal Calcium

- Minerals Technologies Inc.

- Multi Minerals

- NIGTAS A.S

- Whitegold Minerals

- other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2025, MIDROC Investment Group launched Ethiopia’s first coated calcium carbonate plant in Awash 7 Kilo, Afar Region, producing for plastics, pharmaceuticals, water pipes, shoe soles, sponges, and cables, enhancing industrial development.

- In February 2025, CarbonFree announced construction of a carbon-capture system at U.S. Steel’s Gary, Indiana, facility to produce carbon-neutral calcium carbonate via SkyCycle™, converting CO2 into high-purity CaCO3 for sustainable industrial applications.

- In December 2024, Izedon Carbonates (IzeCarb) launched a calcium carbonate plant in Lampese, Edo State, Nigeria, producing high-quality CaCO3 for PVC, paints, drilling fluids, and plaster, promoting import substitution and economic diversification.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the calcium carbonate market based on the below-mentioned segments:

Global Calcium Carbonate Market, By Product

- Ground Calcium Carbonate

- Precipitated Calcium Carbonate

Global Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

Global Calcium Carbonate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the calcium carbonate market over the forecast period?The global calcium carbonate market is projected to expand at a CAGR of 8.35% during the forecast period.

-

2. What is the market size of the calcium carbonate market?The global calcium carbonate market size is expected to grow from USD 33.95 billion in 2024 to USD 82.06 billion by 2035, at a CAGR of 8.35 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the calcium carbonate market?Asia Pacific is anticipated to hold the largest share of the calcium carbonate market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global calcium carbonate market?Ascom Carbonate and Chemicals Manufacturing (ACCM), Carmeuse Group, GLC Minerals, Gulshan Polyols Ltd., Indocal, Imerys, J.M. Huber Corporation, Kunal Calcium, Minerals Technologies Inc., Multi Minerals, NİĞTAŞ A.Ş., Whitegold Minerals, and Others.

-

5. What factors are driving the growth of the calcium carbonate market?The growth of the calcium carbonate market is driven by rising demand from construction, paper, plastics, infrastructure development, cost efficiency, abundant raw materials, and increasing industrialization across emerging and developed economies.

-

6. What are the market trends in the calcium carbonate market?The market trends include increasing use of sustainable fillers, advancements in grinding technology, rising demand for high-purity grades, lightweight material adoption, and expanding applications in plastics, coatings, and specialty industries.

-

7. What are the main challenges restricting the wider adoption of the calcium carbonate market?Major challenges restricting wider adoption include stringent environmental regulations, high energy consumption, transportation costs, raw material quality variability, and competition from synthetic calcium carbonate and alternative filler materials.

Need help to buy this report?