Global Calcium Acetate Market Size, Share, and COVID-19 Impact Analysis, By Function (Texturizer, Stabilizer, Thickener, Firming Agent, and Others), By Application (Pharmaceutical Ingredient, Resins, Coatings, Detergents, and Others), By End-User Industry (Pharmaceutical, Food & Beverage, Waste Water Treatment, Chemical, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Calcium Acetate Market Size Insights Forecasts to 2035

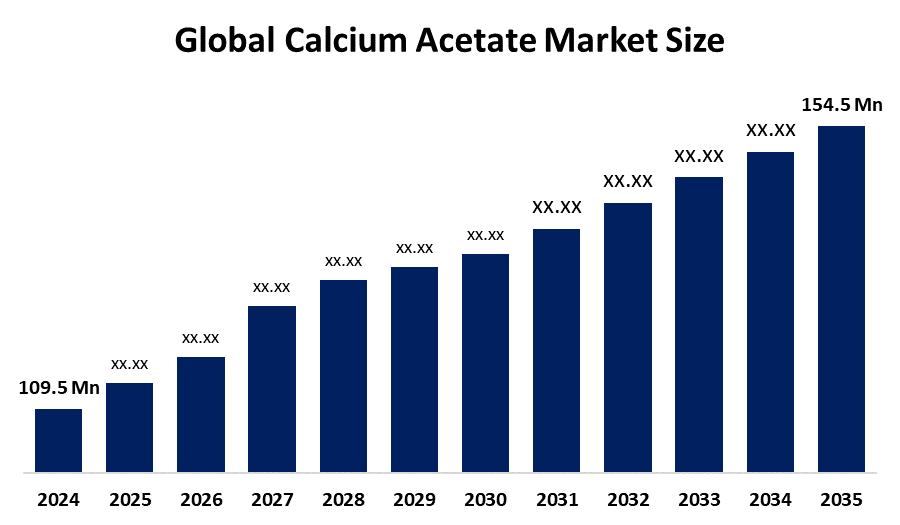

- The Global Calcium Acetate Market Size Was Estimated at USD 109.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.18% from 2025 to 2035

- The Worldwide Calcium Acetate Market Size is Expected to Reach USD 154.5 Million by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Calcium Acetate Market Size was worth around USD 109.5 Million in 2024 and is predicted to Grow to around USD 154.5 Million by 2035 with a compound annual growth rate (CAGR) of 3.18% from 2025 and 2035. The market for calcium acetate has a number of opportunities to grow due to its emerging applications in the field of biomedical engineering, sustainable agriculture, and energy storage.

Market Overview

The global industry of calcium acetate refers to the production, distribution, and sale of calcium acetate, which is a chemical compound primarily used in pharmaceuticals and the food industry. Calcium acetate is a calcium salt of acetic acid, used for treating hyperphosphatemia (too much phosphate in the blood) in patients with end-stage kidney disease who are on dialysis. The chemical compound works by binding with the phosphate in the food, so that it gets eliminated from the body without being absorbed. Multifaceted role of calcium acetate in various industries as a food additive, a stabilizer for resins & a buffer for beverages, soothing relief, lubricant manufacturing, the plastic industry, and others.

Innovation and market expansion are anticipated as a result of the expansion of major food & beverage, pharmaceuticals, and water treatment industries, with an upsurging trend towards cleaner industrial processes, driving the market demand for calcium acetate. The significant innovation in calcium acetate via an eco-friendly approach, by using renewable sources like wood vinegar, eggshell waste, is driving a huge surge in the global calcium acetate market.

Report Coverage

This research report categorizes the calcium acetate market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the calcium acetate market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the calcium acetate market.

Global Calcium Acetate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 109.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.18% |

| 2035 Value Projection: | USD 154.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 177 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Function, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Merck Millipore, Solvay, Alfa Aesar (Johnson Matthey Group), Avantor Performance Materials, J.M. Loveridge Ltd., Amresco LLC, Niacet, Macco Organiques, Akshay Group, Amsyn, Daito Chemical, Plater Group, Jiangsu Kolod Food, Wuxi Yangshan Biochemical, Tengzhou Zhongzheng Chemical, Alemark, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The calcium acetate market is primarily driven by its expanding application in pharmaceuticals, food & beverage, water treatment, and industrial manufacturing. Calcium acetate meets strict regulatory standards like USP and FCC specifications and is valuable due to its increased water solubility and buffering properties, which aid in maintaining pH stability. It also acts as a phosphate binder, used for patients with kidney disease. In addition, an increasing investment in investigating novel applications for calcium acetate by the research organizations, universities, and academic laboratories aids in promoting the market growth.

Restraining Factors

The calcium acetate market is restricted by factors, including the availability of alternative products. Further, the changing consumer inclination towards fresh and organic food is restricting the demand for calcium acetate, thereby hampering the market growth. Additionally, the fluctuation in raw material prices and supply chain disruptions are challenging the calcium acetate market.

Market Segmentation

The calcium acetate market share is classified into function, application, and end-user industry.

- The stabilizer segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the function, the calcium acetate market is divided into texturizer, stabilizer, thickener, firming agent, and others. Among these, the stabilizer segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Calcium acetate serves as a vital stabilizer in resins, used for adhesives to paints, thereby preventing degradation and ensuring long-term integrity of these crucial materials. Further, its increased use in various food & beverage products for maintaining the texture, consistency, and overall quality of food items is driving the market demand. For instance, calcium acetate is used as a food additive as a stabilizer, mainly in candy products under the number E263.

- The pharmaceutical ingredient segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR of 3.25% during the forecast period.

Based on the application, the calcium acetate market is divided into pharmaceutical ingredient, resins, coatings, detergents, and others. Among these, the pharmaceutical ingredient segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR of 3.25% during the forecast period. Due to calcium acetate’s approved safety and efficacy profile, it is extensively used in the pharmaceutical products, enhancing its stability and effectiveness. For instance, Niacet calcium acetate is an API (active pharmaceutical ingredient) used in phosphate binders, offered in both powder and agglomerate form, reducing its absorption in the human body.

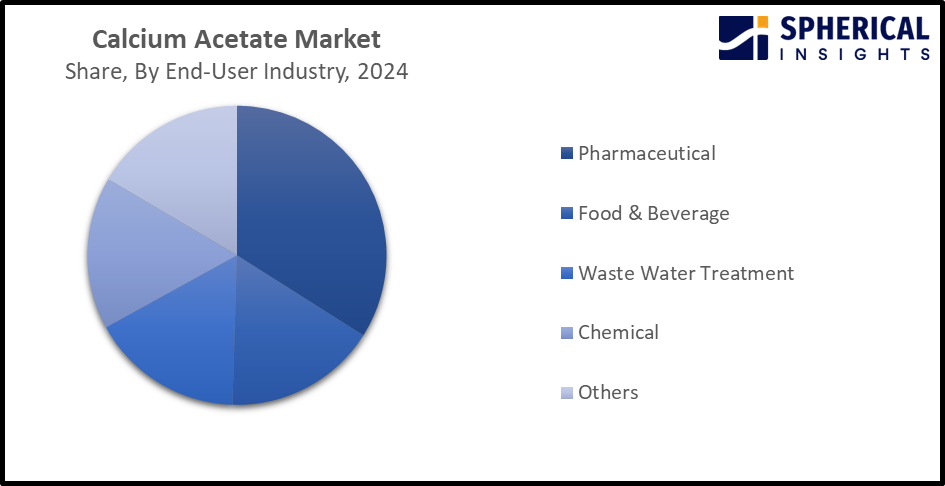

- The pharmaceutical segment held the largest share of the calcium acetate market, with about 30% share in 2024 and is expected to grow at a significant CAGR of 3.4% during the projected period.

Based on the end-user industry, the calcium acetate market is divided into pharmaceutical, food & beverage, waste water treatment, chemical, and others. Among these, the pharmaceutical segment held the largest share of the calcium acetate market, with about 30% share in 2024 and is expected to grow at a significant CAGR of 3.4% during the projected period. Pharmaceutical use of calcium acetate includes the clearance of excess phosphate from the bloodstream, maintaining a sufficient calcium level, especially in cases of hyperphosphatemia, which can be complicated in chronic kidney diseases and hemodialysis. The growing prevalence of chronic kidney diseases, driving the demand for calcium acetate as an effective treatment solution, is expected to propel the market in the pharmaceutical segment.

Get more details on this report -

Regional Segment Analysis of the Calcium Acetate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the calcium acetate market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of about 25% to 35% in the calcium acetate market over the predicted timeframe. The market ecosystem in North America is strong, with strategic alliances and strong industrial infrastructure. Further, the robust healthcare practices and prevalence of relevant medical conditions are contributing to driving the market demand. The United States is leading the calcium acetate market in the North America region, driven by the application of calcium acetate in pharmaceuticals, food additives, and wastewater treatment applications.

Asia Pacific is expected to grow at a rapid CAGR of 7.05% in the calcium acetate market during the forecast period. This is attributed to the stringent water quality standards and robust healthcare practices in the region, driving the use of calcium acetate. China is dominating the Asia Pacific calcium acetate market with a 39% share, owing to robust pharmaceutical consumption and increased overseas orders, and sustained bullish sentiment. For instance, in July 2025, calcium acetate prices in China surged due to tight supply, higher feedstock costs, and strong domestic & export demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the calcium acetate market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Merck Millipore

- Solvay

- Alfa Aesar (Johnson Matthey Group)

- Avantor Performance Materials

- J.M. Loveridge Ltd.

- Amresco LLC

- Niacet

- Macco Organiques

- Akshay Group

- Amsyn

- Daito Chemical

- Plater Group

- Jiangsu Kolod Food

- Wuxi Yangshan Biochemical

- Tengzhou Zhongzheng Chemical

- Alemark

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Brenntag Specialties selected a European distributor for Kerry’s pharmaceutical-grade acetates. Brenntag Specialties would provide pharmaceutical manufacturers and biopharmaceutical companies with a reliable supply of high-purity, GMP-compliant acetates.

- In September 2025, India restricted the import of ATS-8 pharma chemicals to stem low-priced goods. India has restricted imports of a key pharmaceutical chemical, ATS-8, with a price-cap set until September 2026 to regulate low-cost imports, primarily from China.

- In November 2024, FutureCeuticals, Inc. and Global Calcium Pvt., Ltd. announced a strategic global sales and manufacturing partnership to expand FutureCeuticals’ portfolio of clinically proven dietary supplement ingredients into high-growth markets in India, Southeast Asia, the Middle East, and Africa.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the calcium acetate market based on the below-mentioned segments:

Global Calcium Acetate Market, By Function

- Texturizer

- Stabilizer

- Thickener

- Firming Agent

- Others

Global Calcium Acetate Market, By Application

- Pharmaceutical Ingredient

- Resins

- Coatings

- Detergents

- Others

Global Calcium Acetate Market, By End-User Industry

- Pharmaceutical

- Food & Beverage

- Waste Water Treatment

- Chemical

- Others

Global Calcium Acetate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the calcium acetate market?The global calcium acetate market size is expected to grow from USD 109.5 Million in 2024 to USD 154.5 Million by 2035, at a CAGR of 3.18% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the calcium acetate market?North America is anticipated to hold the largest share of the calcium acetate market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Calcium Acetate Market from 2024 to 2035?The market is expected to grow at a CAGR of around 3.18% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Calcium Acetate Market?Key players include Merck Millipore, Solvay, Alfa Aesar (Johnson Matthey Group), Avantor Performance Materials, J.M. Loveridge Ltd., Amresco LLC, Niacet, Macco Organiques, Akshay Group, Amsyn, Daito Chemical, Plater Group, Jiangsu Kolod Food, Wuxi Yangshan Biochemical, Tengzhou Zhongzheng Chemical, and Alemark.

-

5. Can you provide company profiles for the leading calcium acetate manufacturers?Yes. For example, Alfa Aesar (Johnson Matthey Group) is a leading international manufacturer and supplier of research chemicals, metals and materials, with catalogue carries organic compounds, high purity inorganics, pure metals, alloys, elements, precious metal compounds and catalysts, rare earths, AA/ICP standards and more. Niacet, a Kerry company, is a leading producer of organic salts, including propionates and acetates, serving the Food, Pharmaceutical and Technical industries.

-

6. What are the main drivers of growth in the calcium acetate market?The expanding application of calcium acetate in pharmaceuticals, food & beverage, water treatment, and industrial manufacturing are major market growth drivers of the calcium acetate market.

-

7. What challenges are limiting the calcium acetate market?An increasing preference towards fresh and organic food and the availability of alternative substitutes remain key restraints in the calcium acetate market.

Need help to buy this report?