Global C9 Solvent Market Size, Share, and COVID-19 Impact Analysis, By Sales Channel (Direct and Indirect), By End User (Paints & Coatings, Adhesives & Sealants, Cleaning Agents, Printing Inks, Chemical Synthesis, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal C9 Solvent Market Size Insights Forecasts to 2035

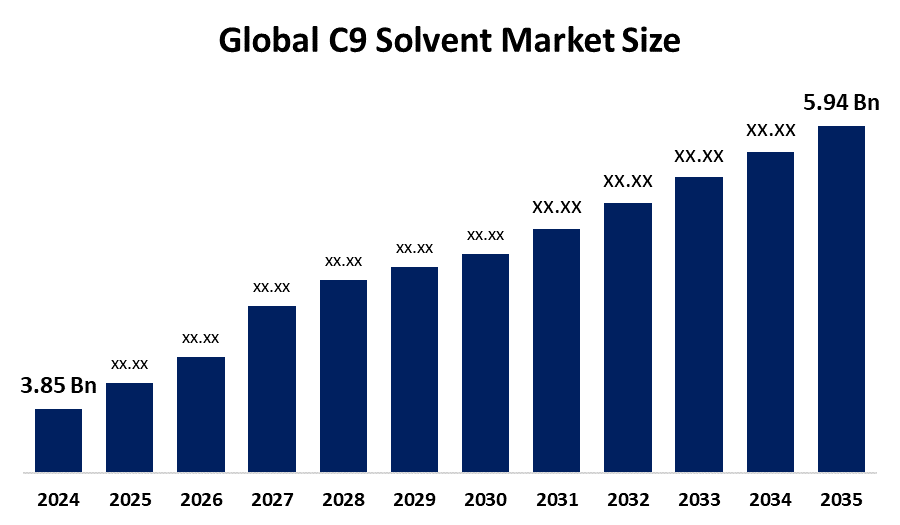

- The Global C9 Solvent Market Size Was Estimated at USD 3.85 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.02% from 2025 to 2035

- The Worldwide C9 Solvent Market Size is Expected to Reach USD 5.94 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global C9 Solvent Market Size was worth around USD 3.85 Billion in 2024 and is predicted to Grow to around USD 5.94 Billion by 2035 with a compound annual growth rate (CAGR) of 4.02% from 2025 to 2035. The market for C9 solvents offers opportunities due to the growing need in the paint, coating, adhesive, and rubber sectors, which is bolstered by urbanization, industrial expansion, and the expansion of infrastructure in emerging economies.

Global C9 Solvent Market Forecast and Revenue Outlook

- 2024 Market Size: USD 3.85 Billion

- 2035 Projected Market Size: USD 5.94 Billion

- CAGR (2025-2035): 4.02%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Market Overview

The global production and trade of aromatic hydrocarbon solvents with nine-carbon chains and benzene rings, which are mostly utilized in adhesives, inks, paints, sealants, and rubber for their anti-drying and solvent qualities, are referred to as the C9 solvent market. Higher carbon contents and a preponderance of aromatic molecules, including propylbenzenes, trimethylbenzenes, and other C9 compounds, are characteristics of these solvents. C9 solvents are vital in many industrial applications due to their strong solvency power, moderate volatility, and compatibility with a variety of resins. Neville Chemical Company expanded its low-VOC resin offering for adhesives and coatings in 2025 with the launch of NEVOXY® ECO-L2 and NEVOXY® ECO-LH, bio-hybrid epoxy modifiers intended for improved sustainability in epoxy compositions. The use of C9 solvent in the chemical, automotive, paint and coating, and other industries in the Asia Pacific region is the main factor driving the high demand for the solvent. The market for C9 solvent is driven by a number of important variables that work together to support its expansion and growth across different sectors and geographical areas. The paints and coatings sector, which uses C9 solvents widely because of their good solvency qualities, low volatility, and compatibility with alkyd resins, is one of the main drivers of the market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the C9 solvent market during the forecast period.

- In terms of sales channel, the direct segment is projected to lead the C9 solvent market throughout the forecast period

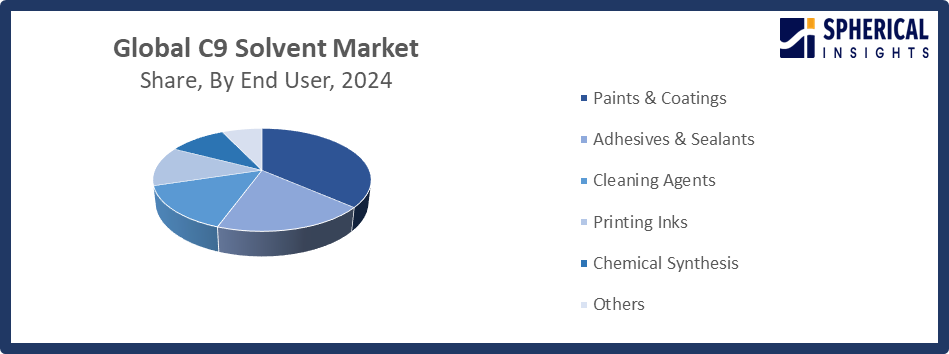

- In terms of end user, the paints & coatings segment captured the largest portion of the market

C9 Solvent Market Trends

- Excellent solvency and a moderate rate of evaporation are driving up demand in the paint and coatings industry.

- Increased solvent use is a result of the expansion of infrastructure and building projects, particularly in emerging economies.

- The growing application in the manufacturing and automotive industries for rubber processing, sealants, and adhesives.

- Change to low-odor, high-performance solvents to satisfy workplace and environmental safety regulations.

Report Coverage

This research report categorizes the C9 solvent market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the C9 solvent market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the C9 solvent market.

Global C9 Solvent Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.85 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.02% |

| 2035 Value Projection: | USD 5.94 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 171 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Sales Channel, By End User and COVID-19 Impact Analysis |

| Companies covered:: | DEZA a.s., Hanwha Global, Ganga Rasayanie P. Ltd., GALP ENERGIA, SGPS, S.A., Eastman Chemical Company, Kandla Energy and chemicals Ltd., Korea Petrochemical Ind. Co., LTD., ARHAM PETROCHEM PRIVATE LIMITED, Chevron Phillips Chemical Company LLC, Jiangsu Hualun Chemical Industry Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving factors

The need for paints, coatings, and related solvents is further increased by the growing rates of urbanization, infrastructure development, and construction activities, particularly in emerging nations. This need is further fueled by the growing packaging and automobile industries. C9 solvents are also used in rubber processing and compounding by the tire and rubber manufacturing sector, which boosts the market as a whole. C9 solvents are used as efficient diluents and carriers in the adhesives and sealants industry, which is another important driver of growth. In Asia-Pacific, Latin America, and the Middle East, countries are rapidly industrializing and developing economically, which is increasing the usage of industrial solvents, particularly C9 versions, to fulfill the demands of industry and production.

Restraining Factor

Increased environmental laws about volatile organic compound (VOC) emissions, shifting crude oil prices, which affect the cost of raw materials, and mounting health concerns about solvent exposure are all factors that put pressure on the C9 solvent market. Furthermore, the market's potential for growth is restricted by the growing trend toward water-based and environmentally friendly substitutes.

Market Segmentation

The global C9 solvent market is divided into sales channel and end user.

Global C9 Solvent Market, By Sales Channel:

- The direct segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on sales channel, the global C9 solvent market is segmented into direct and indirect. Among these, the direct segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growing focus on cost-effectiveness is one of the main causes of the direct sales segment's explosive rise. Industrial purchasers can avoid the middleman fees of distributors and third-party suppliers by buying C9 solvents straight from producers or main suppliers. Stronger customer relationships, improved product customization, and efficient supply chain management are all made possible by direct sales and are crucial in industrial applications that need for particular solvent formulas and constant quality.

The indirect segment in the C9 solvent market is expected to grow at the fastest CAGR over the forecast period. The increasing number of small and medium-sized businesses (SMEs) and regional manufacturers who choose to purchase solvents through distributors for convenience and cost effectiveness is what is driving the indirect channel's growth. Further market penetration is also made possible by indirect channels, particularly in isolated or less developed areas where there is little direct producer presence.

Global C9 Solvent Market, By End User:

- The paints & coatings segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on end user, the global C9 Solvent market is segmented into paints & coatings, adhesives & sealants, cleaning agents, printing inks, chemical synthesis, and others. Among these, the paints & coatings segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. C9 solvents are widely used in the production of high-performance paints and coatings due to their exceptional solvency power, slow evaporation rate, and compatibility with a wide range of resins. This usage propels the paints and coatings market. The global expansion of the automotive, industrial, and construction sectors contributes to the increasing demand for paints and coatings, making these industries significant consumers of C9 solvents.

Get more details on this report -

The adhesives & sealants segment in the C9 solvent market is expected to grow at the fastest CAGR over the forecast period. The growing use of adhesives and sealants in the construction, automotive, and packaging sectors all of which depend more and more on C9 solvents for improved formulation performance is responsible for the adhesives and sealants segment's rise.

Regional Segment Analysis of the Global C9 Solvent Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific C9 Solvent Market Trends

Get more details on this report -

Asia Pacific is expected to hold the largest share of the global C9 solvent market over the forecast period.

The Asia Pacific region is anticipated to hold the largest share of the C9 solvents market in the years to come. Asia Pacific is fueled by expanding infrastructure and building projects in nations like China, India, and Indonesia; growing demand for automotive coatings because the region is still a major hub for the production of automobiles; and growing urbanization, which raises the need for industrial coatings and decorative paints. The good solvency power, slow evaporation rate, and compatibility with a wide range of resins and materials make these solvents popular in product formulation for various sectors.

Japan C9 Solvent Market Trends

The modern automotive, electronics, and construction industries in Japan are the main drivers of the country's consistent growth in the C9 solvent industry. The usage of C9 solvents, which are prized for their potent solvents and moderate evaporation, is supported by the high demand for high-quality paints, coatings, adhesives, and rubber product. Manufacturers are prompted to innovate and create eco-friendly substitutes by Japan's strict environmental regulations, which promote the use of low-VOC and safer solvent formulations.

China C9 Solvent Market Trends

The strong industrialization, urbanization, and expanding automotive and construction industries in China are the main drivers of the C9 solvent market. China, Asia-Pacific's biggest consumer of paints, coatings, adhesives, and rubber goods, mostly depends on C9 solvents due to their exceptional performance and solubility. Demand is further increased by expanding infrastructure developments and growing disposable incomes.

North America C9 Solvent Market Trends

North America is expected to grow at the fastest CAGR in the C9 solvent market during the forecast period.

The main driver of North America's growth is rising demand from important end-use industries like paints and coatings, adhesives, sealants, and rubber processing, all of which heavily rely on C9 solvents because of their superior solvency power and slow evaporation properties. Strict environmental laws, especially those pertaining to volatile organic compound (VOC) emissions, have forced producers to develop safer, lower-VOC substitutes for C9 solvent. Furthermore, creating solvent formulations that are both high-performing and environmentally friendly is becoming more and more important in North America.

U.S C9 Solvent Market Trends

The paints & coatings, adhesives, and rubber sectors are driving the market for C9 solvents in the United States, which is expanding rapidly. The nation's growing manufacturing, automotive, and construction industries all have a major impact on solvent use. Low-VOC and environmentally friendly C9 solvent formulations have been developed and adopted as a result of stricter environmental restrictions, which has stimulated market innovation.

Canada C9 Solvent Market Trends

The demand from the paints and coatings, adhesives, and rubber manufacturing sectors is driving the steady growth of the Canada C9 solvent market. The need for solvents is driven by the expansion of the industrial, automotive, and construction industries, as well as a greater emphasis on producing high-quality, ecologically friendly goods. The adoption of low-VOC and sustainable C9 solvent formulations is encouraged by Canada's strict environmental standards, which also push producers to create more environmentally friendly substitutes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global C9 solvent market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The C9 Solvent Market Include

- DEZA a.s.

- Hanwha Global

- Ganga Rasayanie P. Ltd.

- GALP ENERGIA, SGPS, S.A.

- Eastman Chemical Company

- Kandla Energy and chemicals Ltd.

- Korea Petrochemical Ind. Co., LTD.

- ARHAM PETROCHEM PRIVATE LIMITED

- Chevron Phillips Chemical Company LLC

- Jiangsu Hualun Chemical Industry Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In March 2025, India’s label and package printing industry announced advancements in flexographic press technology, including wider press widths, increased automation, and LED-UV curing. The introduction of the Digifini converting line reinforces demand for specialized solvents like C9, essential for effective degreasing and superior print quality.

- In February 2025, South Korea’s Ministry of Economy and Finance announced temporary anti-dumping duties of 4.55% to 7.55% on petroleum resins from China and Taiwan, effective until June 20, 2025. Notably, C9 petroleum resins with a softening point above 130°C are exempt from these duties.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the C9 solvent market based on the following segments:

Global C9 Solvent Market, By Sales Channel

- Direct

- Indirect

Global C9 Solvent Market, By End User

- Paints & Coatings

- Adhesives & Sealants

- Cleaning Agents

- Printing Inks

- Chemical Synthesis

- Others

Global C9 Solvent Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the C9 Solvent market over the forecast period?The global C9 solvent market is projected to expand at a CAGR of 4.02% during the forecast period.

-

2. What is the market size of the C9 Solvent market?The global C9 solvent market size is expected to grow from USD 3.85 billion in 2024 to USD 5.94 billion by 2035, at a CAGR 4.02% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the C9 solvent market?Asia Pacific is anticipated to hold the largest share of the C9 solvent market over the predicted timeframe.

-

4. Who are the top companies operating in the global C9 solvent market?DEZA a.s., Hanwha Global, Ganga Rasayanie P. Ltd., GALP ENERGIA, SGPS, S.A., Eastman Chemical Company, Kandla Energy and Chemicals Ltd., Korea Petrochemical Ind. Co., LTD., ARHAM PETROCHEM PRIVATE LIMITED, Chevron Phillips Chemical Company LLC, Jiangsu Hualun Chemical Industry Co., Ltd., and Others.

-

5. What factors are driving the growth of the C9 solvent market?Increasing demand from paints, coatings, adhesives, and rubber industries, rapid industrialization, urbanization, infrastructure development, and technological advancements in solvent formulations are key drivers of the C9 solvent market growth.

-

6. What are market trends in the C9 solvent market?Shift towards eco-friendly, low-VOC solvents, rising use in water-based formulations, growing demand in adhesives and coatings, regional growth in Asia-Pacific, and technological innovations are prominent trends in the C9 solvent market.

-

7. What are the main challenges restricting wider adoption of the C9 solvent market?Stringent environmental regulations, health and safety concerns, volatility in raw material prices, and the increasing preference for sustainable and water-based alternatives restrict wider adoption of C9 solvents.

Need help to buy this report?