Global C4 Raffinate Market Size, Share, and COVID-19 Impact Analysis, By Product Type (C4 Raffinate I and C4 Raffinate II), By Application (Petrochemical Industry, Automotive Fuel, and Polymer Production), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal C4 Raffinate Market Insights Forecasts to 2035

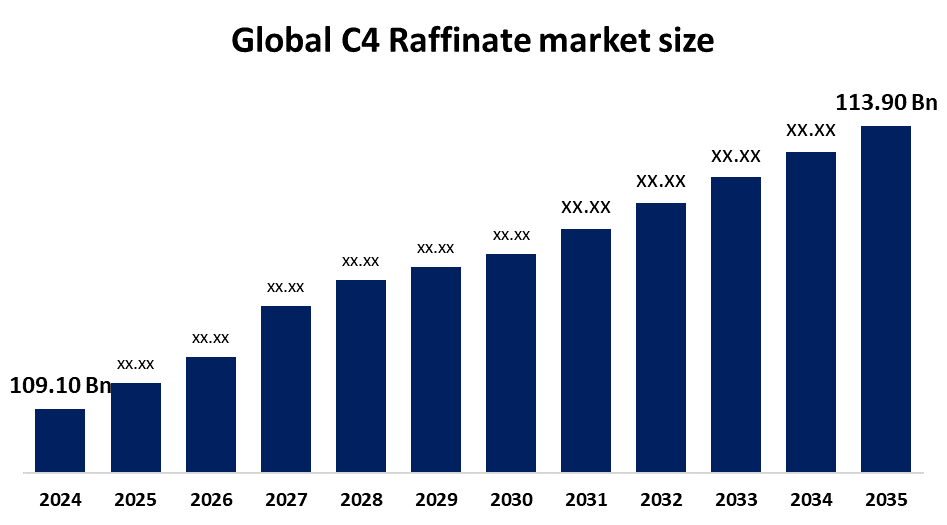

- The Global C4 Raffinate Market Size Was Estimated at USD 109.10 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.4% from 2025 to 2035

- The Worldwide C4 Raffinate Market Size is Expected to Reach USD 175.20 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, Global C4 Raffinate Market Size was worth around USD 109.10 Billion in 2024, growing to USD 113.90 Billion in 2025, and is predicted to grow to around USD 175.20 billion by 2035 with a compound annual growth rate (CAGR) of 4.4% from 2025 to 2035. Opportunities in the C4 raffinate market include growing applications in synthetic rubber and specialty chemicals, growing demand for butadiene derivatives, improvements in refining technologies, and growing industrialization in emerging economies that drive growth in chemical production and consumption.

Global C4 Raffinate Market Forecast and Revenue Size

- 2024 Market Size: USD 109.10 Billion

- 2025 Market Size: USD 113.90 Billion

- 2035 Projected Market Size: USD 175.20 Billion

- CAGR (2025-2035): 4.4%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Market Overview

The global trade and use of C4 Raffinate, an essential hydrocarbon stream in the petrochemical industry, is included in the C4 Raffinate market. C4 raffinate, also referred to as Raffinate-1 or Raffinate-2, is the residual C4 fraction that remains after 1,3-butadiene and isobutene are extracted from mixed C4 streams. It is derived from naphtha cracking. It is a vital feedstock for the production of methyl tert-butyl ether (MTBE), polybutenes, alkylate gasoline, and ethylene-propylene copolymers, which support industries including fuels, plastics, and synthetic rubber. Its main components are n-butane, isobutane, and butene isomers. According to the U.S. Department of Energy launched a USD 78 million initiative in 2023 to decarbonize chemical manufacturing, while South Korea launched a 2025 restructuring roadmap, both are driving innovation, sustainable C4 processing, and resilient petrochemical market growth amid global energy transitions. The growth of the petrochemical industry, which includes the manufacturing of synthetic textiles and plastics, is driving the need for C4 raffinate. Numerous petrochemical products are made using C4 raffinate as a feedstock. Demand from the chemical industry, the expansion of the automotive industry, and the expansion of the petrochemical industry are the factors propelling the growth of the C4 raffinate market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the C4 raffinate market during the forecast period.

- In terms of product type, the C4 raffinate I segment is projected to lead the C4 Raffinate market throughout the forecast period

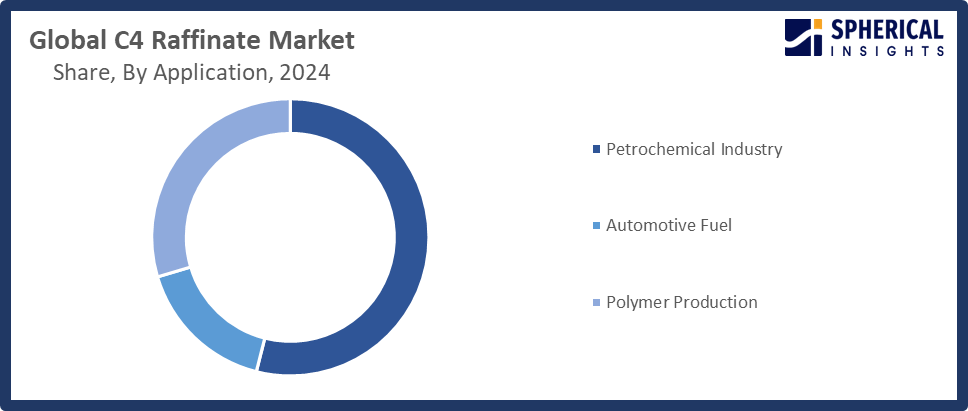

- In terms of application, the petrochemical industry segment captured the largest portion of the market

C4 Raffinate Market Trends

- The increasing demand for polymers made from C4 derivatives like butenes and synthetic rubber.

- The growing focus on energy-efficient processing and decarbonization in the production of petrochemicals.

- The technological developments in purification and separation procedures for improved quality and yield.

- C4 raffinate is being used more frequently in performance chemicals and gasoline additives.

- Major chemical producers in North America and Asia-Pacific are expanding their capacity and making strategic investments.

Report Coverage

This research report categorizes the C4 raffinate market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the C4 raffinate market. Recent market developments and competitive strategies, such as expansion, Product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the C4 raffinate market.

Global C4 Raffinate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 109.10 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.4% |

| 2035 Value Projection: | USD 175.20 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product Type, By Application, By Region |

| Companies covered:: | BASF, Braskem, TPC Group, Shell Plc, Royal Global Energy, Basparan Bandar Imam Co, Reliance Industries Limited, Faravaresh Bandar Imam Co., Buali Sina Petrochemical Co., Resonac Holdings Corporation, JG summit Olefins Corporation, Nouri Petrochemical Company, ONGC Mangalore Petrochemicals Ltd., Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving factors:

The market is expanding rapidly due to the growing demand for petrochemicals, which is driven by urbanization, industrialization, the growth of the automotive sector, improvements in manufacturing technology, and strict environmental rules that support eco-friendly products. Growing focus on sustainability and recycling could lead to new uses for C4 raffinate, which could open up new markets or require changes to current production processes. One major factor is the rising need for petrochemicals, especially in the manufacturing of different polymers and resins. India's C4 raffinate market is booming as a result of a number of factors, including increased industrial activity, technological advancements, and the region's shift to more environmentally friendly practices.

Restraining Factors:

The market for C4 raffinate is restricted by a number of factors, including fluctuating crude oil prices, strict environmental restrictions, high production and processing costs, a lack of technological standardization, and shifting downstream industry demand that affects the stability and profitability of the entire market.

Market Segmentation

The global C4 Raffinate market is divided into product type and application.

Global C4 Raffinate Market, By Product Type:

The C4 raffinate I segment led the C4 raffinate market, generating the largest revenue share. C4 Raffinate I is a combination of 1-butene, 2-butene, and isobutylene that is produced as a byproduct when butadiene is made from ethylene crackers. This subsegment is highly prized for its use as a feedstock in the petrochemical sector, where it is processed to create crucial derivatives like butyl rubber, isooctane, and plasticizers, advancing a number of end-use applications like consumer goods, construction, and automobiles.

The C4 raffinate II segment in the C4 raffinate market is expected to grow at the fastest CAGR over the forecast period. The synthetic rubber industry relies heavily on C4 Raffinate II, which comprises a heavier portion of the C4 stream, mainly made up of 1,3-butadiene, particularly for the manufacturing of nitrile rubber (NBR) and styrene-butadiene rubbers (SBR).

Global C4 Raffinate Market, By Application:

The petrochemical industry segment held the largest market share in the C4 raffinate market. The Petrochemical Industry, one of the main sub-segments, uses C4 raffinate as a crucial feedstock to produce a number of chemicals, such as butadiene, isobutylene, and 1-butene. The petrochemical sector is a major driver of demand in the C4 raffinate market since these chemicals are essential for creating high-value goods like synthetic rubber and plastics.

Get more details on this report -

The polymer production segment in the C4 raffinate market is expected to grow at the fastest CAGR over the forecast period. The function of C4 raffinate in producing different polymers and elastomers, particularly styrene-butadiene rubber (SBR) and other copolymers that are crucial in the production of tires, shoes, and other consumer goods, is highlighted in the Polymer Production sub-segment.

Regional Segment Analysis of the Global C4 Raffinate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific C4 Raffinate Market Trends

Get more details on this report -

The Asia Pacific region, which is rapidly becoming more industrialized and urbanized, has the greatest potential for growth because of the growing need for synthetic rubber and plastics, and major companies are investing in production capacity. Rapid industrialization in nations like China, India, South Korea, and Japan has raised demand for C4 derivatives, which are used to make gasoline additives, specialized chemicals, and synthetic rubber. According to S-Oil announced its USD 6.6 billion Shaheen project in South Korea, set for 2025 operations, while India announced PCPIR expansions with sustainable refining technologies, and China announced advancements in butadiene extraction to enhance C4 raffinate efficiency and output.

China C4 Raffinate Market Trends

Growing petrochemical production capacity, increased demand for gasoline additives and synthetic rubber, and ongoing improvements in refining technology are all contributing factors to the notable expansion of the China C4 Raffinate market. Product yield and value are being increased by strategic investments in butadiene extraction, raffinate processing, and downstream application integration. Furthermore, China's focus on resource optimization, innovation, and green chemistry is strengthening its standing as a major player in the global market for C4 Raffinate.

Japan C4 Raffinate Market Trends

Japan's well-established petrochemical sector and technological developments in refining and separation processes are driving the country's C4 Raffinate market's consistent expansion. The automotive and industrial sectors' growing need for gasoline additives, high-performance polymers, and synthetic rubber is propelling market growth. Japan's focus on sustainable and energy-efficient chemical manufacturing, along with government initiatives encouraging industry modernization, improves product quality and production efficiency.

North America C4 Raffinate Market Trends

Technological developments, rising industrial demand, and calculated investments in the petrochemical industry are all factors driving North America. Large-scale manufacturing of C4 derivatives like butenes and butadiene is supported by the region's extensive refining infrastructure and plentiful feedstock, especially in the United States and Canada. Furthermore, North America's focus on energy-efficient and sustainable chemical production is quickening market growth. In August 2025, the U.S. Department of Energy launched an expanded Industrial Decarbonization Roadmap, allocating USD 150 million for low-emission refining technologies, including carbon capture in C4 processing, supporting the nation’s 2050 net-zero objectives.

U.S C4 Raffinate Market Trends

The growing need for gasoline additives, synthetic rubber, and specialty chemicals in the automotive, construction, and industrial sectors is driving the U.S. C4 Raffinate market. Process optimization and sophisticated refining technologies have improved product output and quality, facilitating market growth. Sustainable and energy-efficient production methods are being promoted by government initiatives, such as supporting programmes for decarbonizing chemical manufacture.

Canada C4 Raffinate Market Trends

The market for Canada C4 Raffinate is continuously growing due to the rising demand for gasoline additives, polymers, and synthetic rubber in automotive and industrial applications. Production efficiency and product quality are boosted by the nation's well-established petrochemical industry as well as developments in separation and refining technology. Government initiatives that encourage investments in energy-efficient and sustainable chemical production processes are further driving market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global C4 raffinate market, along with a comparative evaluation primarily based on their Product of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes Product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in The C4 Raffinate Market Include

- BASF

- Braskem

- TPC Group

- Shell Plc

- Royal Global Energy

- Basparan Bandar Imam Co

- Reliance Industries Limited

- Faravaresh Bandar Imam Co.

- Buali Sina Petrochemical Co.

- Resonac Holdings Corporation

- JG summit Olefins Corporation

- Nouri Petrochemical Company

- ONGC Mangalore Petrochemicals Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, S-Oil Corporation announced the upcoming launch of its USD 7 billion Shaheen crude-to-chemicals project in Ulsan, South Korea, set for Q4 2025, boosting C4 raffinate-derived polyethylene and base oil yields by 15%.

- In August 2025, ExxonMobil launched its USD 1.2 billion Baytown Refinery Reconfiguration Project in North America, adding a raffinate hydroconversion unit to increase C4 raffinate processing by 20%, targeting diesel and Group III base stocks by mid-2026.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the C4 raffinate market based on the following segments:

Global C4 Raffinate Market, By Product Type

- C4 Raffinate I

- C4 Raffinate II

Global C4 Raffinate Market, By Application

- Petrochemical Industry

- Automotive Fuel

- Polymer Production

Global C4 Raffinate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the C4 Raffinate market over the forecast period?The global C4 Raffinate market is projected to expand at a CAGR of 4.4% during the forecast period.

-

2. What is the market size of the C4 Raffinate market?The global C4 Raffinate market size is expected to grow from USD 109.10 billion in 2024 to USD 175.20 billion by 2035, at a CAGR 4.4% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the C4 Raffinate market?Asia Pacific is anticipated to hold the largest share of the C4 Raffinate market over the predicted timeframe.

-

4. Who are the top companies operating in the global C4 Raffinate market?BASF, Braskem, TPC Group, Shell Plc, Royal Global Energy, Basparan Bandar Imam Co, Reliance Industries Limited, Faravaresh Bandar Imam Co., Buali Sina Petrochemical Co., Resonac Holdings Corporation, JG Summit Olefins Corporation, Nouri Petrochemical Company, ONGC Mangalore Petrochemicals Ltd., and others.

-

5. What factors are driving the growth of the C4 Raffinate market?Increased production of natural gas liquids (NGLs), improvements in refining technology, and growing demand for synthetic rubber in the construction and automotive industries are the main factors driving the C4 raffinate market.

-

6. What are market trends in the C4 Raffinate market?Current trends encompass technological innovations enhancing refining efficiency, a shift towards bio-based alternatives, and expansion in emerging markets, particularly in Asia-Pacific and the Middle East.

-

7. What are the main challenges restricting wider adoption of the C4 Raffinate market?Challenges include fluctuations in crude oil prices, stringent environmental regulations, competition from bio-based alternatives, and supply chain disruptions affecting production and distribution.

Need help to buy this report?