Global Butyl Methacrylate Market Size, Share, and COVID-19 Impact Analysis, By Type (N-Butyl Methacrylate and I-Butyl Methacrylate), By Application (Acrylic Sheets, Molding, and Others), By End-use (Paintings & Coatings, Adhesives & Sealants, Printing & Ink, and Acrylic Copolymer), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Butyl Methacrylate Market Size Insights Forecasts to 2035

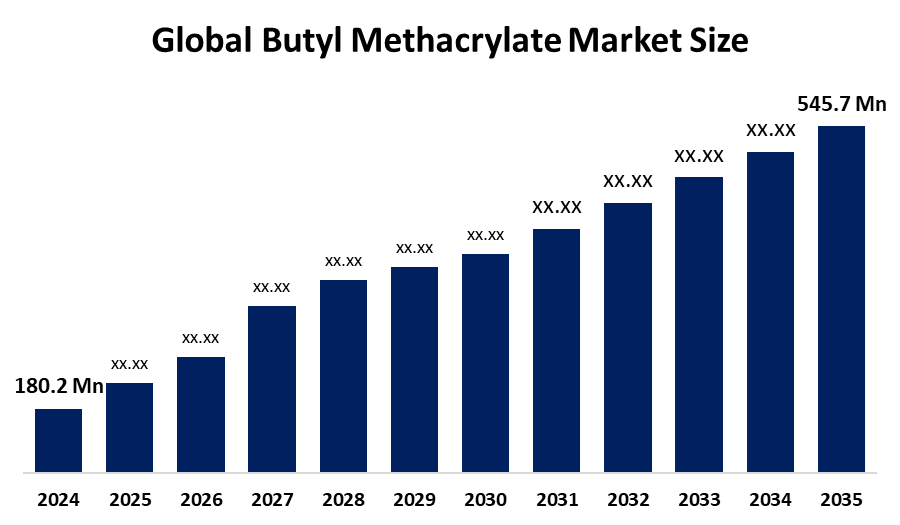

- The Global Butyl Methacrylate Market Size Was Valued at USD 180.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.6% from 2025 to 2035

- The Worldwide Butyl Methacrylate Market Size is Expected to Reach USD 545.7 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The global Butyl Methacrylate Market Size was worth around USD 180.2 Million in 2024 and is predicted to grow to around USD 545.7 Million by 2035 with a compound annual growth rate (CAGR) of 10.6% from 2025 to 2035. The global demand for the Butyl Methacrylate Market Size is on an upward trend, driven by increased demand for robust and weather-resistant coatings, as well as construction activities and other industries such as the automobile sector, alongside advancements in technology for producing high-performance acrylic polymers.

Market Overview

The Global Butyl Methacrylate Market Size refers to the worldwide market for the production, distribution, and sale of butyl methacrylate, a colourless, odourless, and liquid acrylic monomer. The main application of butyl methacrylate is as a monomer in polymers, copolymers, and resins production because of its high flexibility, weather resistance, adhesion, and strength. The world market of butyl methacrylate is mainly driven by the increasing demand for butyl methacrylate in the construction and automotive sectors because of the high demand in these sectors for high-quality coating materials and light materials. Increasing urbanization, infrastructure development, and increasing production of vehicles in the world are the factors providing impetus to the growth of the world market of butyl methacrylate.

Opportunities in the world market of butyl methacrylate are being opened in the increasing demand for waterborne and eco-friendly coatings, as well as in the increasing application of specialty polymers and medical materials. The growth of emerging economies, along with developments in polymer chemistry, also provides potential for growth for this market. However, this market experiences competition from key players such as BASF SE, Dow Inc., Mitsubishi Chemical Corporation, Evonik Industries AG, Arkema Group, and LG Chem, using developments such as capacity enhancement, R&D, and alliances. In March 2025, under U.S. TSCA regulations and the Canadian SOR/2025-270, PFAS and flame retardants came under regulatory concerns for safe substitutes, such as butyl methacrylate, for use in polymers. The FDA also issued regulations on cosmetics for formaldehyde and fragrance allergens, reflecting stricter regulatory requirements for chemicals and possibly ushering in safer cosmetics with methacrylate chemistry.

Report Coverage

This research report categorizes the Butyl Methacrylate Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Butyl Methacrylate Market Size. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Butyl Methacrylate Market Size.

Butyl Methacrylate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 180.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 10.6% |

| 2035 Value Projection: | 545.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application |

| Companies covered:: | BASF SE, LG Chem, Arkema Group, Mitsubishi Chemical Corporation, Evonik Industries AG, Dow Inc., KYOEISHA Chemical, Sumitomo Chemical Co., Ltd., Fushun Donglian Anxin Chemical, NIPPON SHOKUBAI CO., LTD., Shanghai HeChuang Chemical, TOAGOSEI CO., LTD., Huayi Hefeng Special Chemical, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Butyl methacrylate (BMA) demand is also driven by the rising usage in coatings, adhesives, sealants, and plastics sectors due to their superior resistance to weathering, flexibility, and durability. The infrastructural development activities in emerging regions, including the construction industry, are propelling demand for architectural coatings and seals. Increasing demands from the automotive industry and the electronics industry due to their superior polymer coatings drive the BMA market. Increasing demands for acrylic polymers in paints and inks, along with a growing trend towards lighter and tougher materials, further stimulate the development of the market. Moreover, innovation in butyl methacrylate polymer modification technology helps improve its usage across the globe.

Restraining Factors

The butyl methacrylate industry is challenged by volatile raw material price changes, specifically methacrylic and butanol, which have an effect on production costs. Tight regulations regarding VOCs and chemicals further restrict production and use. Secondly, the emergence and use of alternative acrylate substitutes and increasing demands for eco-friendly or bio-based substitutes may ultimately obstruct industry development.

Market Segmentation

The Butyl Methacrylate Market Size share is classified into type, application, and end-use.

- The N-butyl methacrylate segment dominated the market in 2024, approximately 67% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the Butyl Methacrylate Market Size is divided into N-butyl methacrylate and I-butyl methacrylate. Among these, the N-butyl methacrylate segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The N-butyl methacrylate (BMA) market led owing to its supreme weather resistance, flexibility, and adhesion capabilities, thus finding numerous applications in coating, adhesives, sealants, and plastic products. Another factor that increased its popularity and led to the market growth of N-butyl methacrylate is the rise of low-VOC and high-performance polymers.

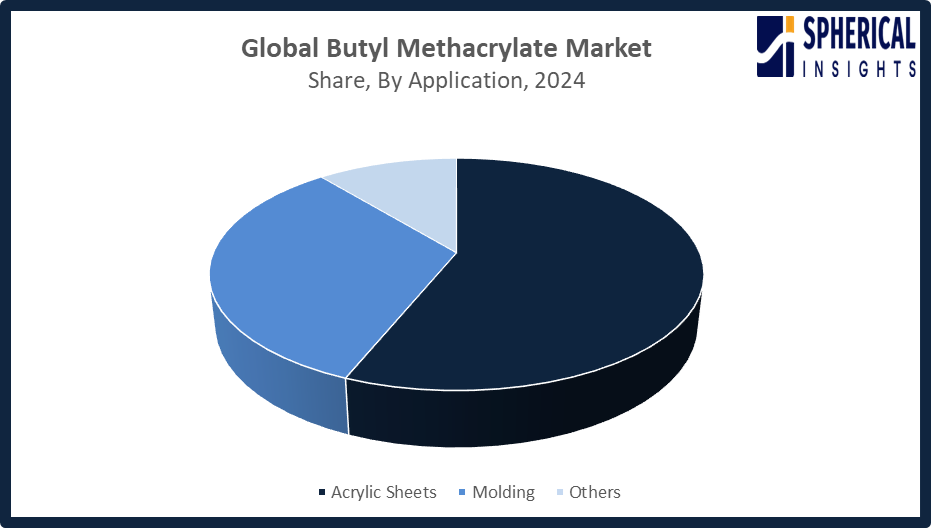

- The acrylic sheets segment accounted for the largest share in 2024, approximately 56% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the Butyl Methacrylate Market Size is divided into acrylic sheets, molding, and others. Among these, the acrylic sheets segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The acrylic sheet category held the dominant market share due to its strong transparency, hardness, and weather resistance. This material can now be found in many applications, such as signboard manufacturing, the construction industry, and the automotive sector, among others. The increasing need for a material that is light in weight, shock-resistant, and more beautiful is set to establish acrylic sheet as a prominent use for the product.

Get more details on this report -

- The paintings & coatings segment accounted for the highest market revenue in 2024, approximately 51% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the Butyl Methacrylate Market Size is divided into paintings & coatings, adhesives & sealants, printing & ink, and acrylic copolymer. Among these, the paintings & coatings segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The paints and coatings market growth in the Butyl Methacrylate Market Size is due to the popularity of durable, weatherable, and low-VOC coatings. Infrastructure development, urbanization, and the need for eco-friendly and high-performance acrylic coatings have increased their consumption, thus registering a significant contribution to the Butyl Methacrylate Market Size.

Regional Segment Analysis of the Butyl Methacrylate Market Size

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the Butyl Methacrylate Market Size over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the Butyl Methacrylate Market Size over the predicted timeframe. The Asia-Pacific region is also projected to encompass the 45% share of the global Butyl Methacrylate Market Size. This is due to the growing industrialization, construction activities, automotive sector, and usage in the electronics industry. China and India remain the major emerging markets with large demands for coatings, adhesives, sealants, and acrylic sheets. Increased consumption is further driven by the rising demand for low-VOC, eco-friendly building materials along with various ongoing and proposed new infrastructural projects. Strong manufacturing capabilities, along with government support, also enhance the production capacity of BMA. In July 2025, a pan-India VOC limit for architectural coatings was proposed to be effective from 2026, which includes the use of only low-VOC materials in new buildings. This will drive growth in the green building and BMA markets in India.

North America is expected to grow at a rapid CAGR in the Butyl Methacrylate Market Size during the forecast period. The North American market for BMA is expected to have a 24% market share, driven principally by the United States and Canada. This segment is being driven due to increasing demand from the automotive, construction, and industrial segments for high-performance coatings, adhesives, and specialty polymers. Strict norms related to environmental protection, including VOC limits, promote the use of eco-friendly BMA formulations. Additionally, advancements in polymer technologies and the development of new infrastructure supplement growth in the use of BMA within the region.

The European market for butyl methacrylate is witnessing positive growth on account of countries such as Germany, France, and the United Kingdom. Major driving forces of this market include the increase in demand for high-performance paints, adhesives, and plastics employed in the automotive, construction, and industrial sectors. In this regard, severe environmental policies have been laid down that compel the utilization of low-VOC materials, hence driving the consumption of butyl methacrylate, which would further support this market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Butyl Methacrylate Market Size, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- LG Chem

- Arkema Group

- Mitsubishi Chemical Corporation

- Evonik Industries AG

- Dow Inc.

- KYOEISHA Chemical

- Sumitomo Chemical Co., Ltd.

- Fushun Donglian Anxin Chemical

- NIPPON SHOKUBAI CO., LTD.

- Shanghai HeChuang Chemical

- TOAGOSEI CO., LTD.

- Huayi Hefeng Special Chemical

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, BASF announced the start-up of its butyl acrylate (BA) plant and mechanical completion of the steam cracker at its Zhanjiang Verbund site. Full operations by year-end aim to meet rising Asia-Pacific demand for high-quality petrochemical products, strengthening BASF’s regional presence.

- In July 2025, BASF completed the first batch of plants in its Zhanjiang Verbund acrylics complex, including glacial acrylic acid (GAA) and butyl acrylate (BA) plants. This milestone advances the site’s 2025 start-up, reinforcing BASF’s leadership in the global acrylics market.

- In May 2024, PT. Nippon Shokubai Indonesia obtained ISCC PLUS certification for acrylic acid, acrylates, and superabsorbent polymers. The certification enables production using biomass-derived raw materials across Belgium, Japan, and Indonesia, supporting sustainable supply chains, circular economy initiatives, and eco-friendly applications in paints, adhesives, and disposable diapers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Butyl Methacrylate Market Size based on the below-mentioned segments:

Global Butyl Methacrylate Market Size, By Type

- N-Butyl Methacrylate

- I- Butyl Methacrylate

Global Butyl Methacrylate Market Size, By Application

- Acrylic Sheets

- Molding

- Others

Global Butyl Methacrylate Market Size, By End-use

- Paintings & Coatings

- Adhesives & Sealants

- Printing & Ink

- Acrylic Copolymer

Global Butyl Methacrylate Market Size, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Butyl Methacrylate Market Size over the forecast period?The global Butyl Methacrylate Market Size is projected to expand at a CAGR of 10.6% during the forecast period.

-

2. What is the Butyl Methacrylate Market Size?The Butyl Methacrylate Market Size involves the production and sales of BMA, used in coatings, adhesives, plastics, and specialty polymers.

-

3. What is the market size of the Butyl Methacrylate Market Size?The global Butyl Methacrylate Market Size is expected to grow from USD 180.2 million in 2024 to USD 545.7 million by 2035, at a CAGR of 10.6% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the Butyl Methacrylate Market Size?Asia Pacific is anticipated to hold the largest share of the Butyl Methacrylate Market Size over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global Butyl Methacrylate Market Size?BASF SE, LG Chem, Arkema Group, Mitsubishi Chemical Corporation, Evonik Industries AG, Dow Inc., KYOEISHA Chemical, Sumitomo Chemical Co., Ltd., Fushun Donglian Anxin Chemical, NIPPON SHOKUBAI CO., LTD., and Others.

-

6. What factors are driving the growth of the Butyl Methacrylate Market Size?The Butyl Methacrylate Market Size is driven by rising demand for durable coatings, adhesives, and plastics, growth in construction and automotive sectors, adoption of low-VOC materials, and technological advancements in polymer applications.

-

7. What are the market trends in the Butyl Methacrylate Market Size?Trends include rising demand for eco‑friendly/low‑VOC formulations, specialty coatings, bio‑based monomers, regional production expansion, and advanced acrylic polymer applications across industries.

-

8. What are the main challenges restricting wider adoption of the Butyl Methacrylate Market Size?The wider adoption of the butyl methacrylate (BMA) market is primarily constrained by fluctuating raw material costs, stringent environmental regulations, and the high cost of production.

Need help to buy this report?