Global Butter Powder Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Salted Butter Powder and Unsalted Butter Powder), By Application (Bakery and Confectionery, Sauces and Dressings, Ready Meals, Snacks and Others), By End User (Food Service, Household and Industrial) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Butter Powder Market Size Forecasts to 2035

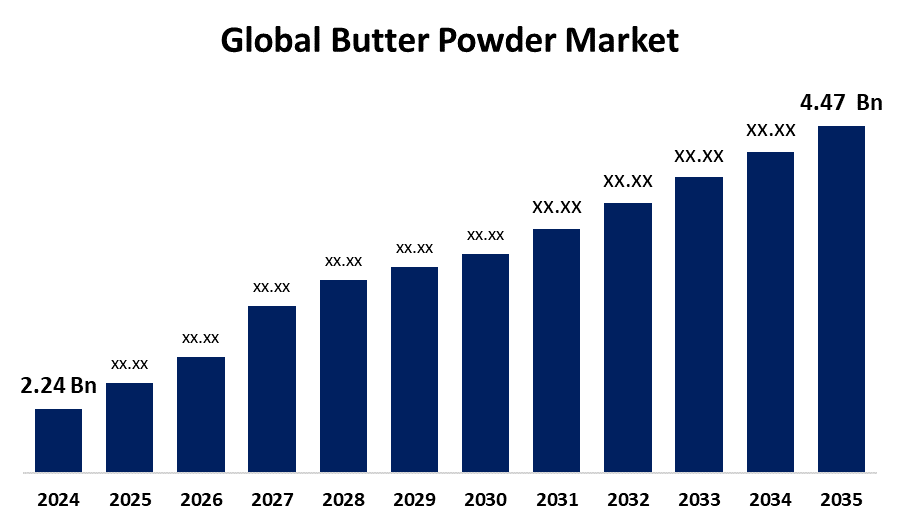

- The Global Butter Powder Market Size Was Estimated at USD 2.24 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.48% from 2025 to 2035

- The Worldwide Butter Powder Market Size is Expected to Reach USD 4.47 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Butter Powder Market size was worth around USD 2.24 Billion in 2024 and is predicted to grow to around USD 4.47 Billion by 2035 with a compound annual growth rate (CAGR) of 6.48 % from 2025 and 2035. The butter powder market is led by increasing demand for convenience food, long shelf life, convenience in storage, and increasing usage in the bakery, confectionery, and food service industries. Trends for healthy foods and innovations in dairy processing are also the key drivers of increasing global demand.

Market Overview

Butter powder industry is the global business of manufacturing, distributing, and consuming butter in powder form. Butter powder is produced by drying normal butter, usually by spray drying, to improve shelf life and convenience in storage. Butter powder finds extensive application in food processing businesses such as bakery, confectionery, ready meals, sauces, and snacks. Butter powder's long shelf life renders it particularly appealing to shoppers who like to stock up on long-shelf-life food. It's a versatile ingredient that is incorporated in several items either as a flavoring agent, source of fat, or butter replacer. Since it's convenient to store and is ready to eat, butter powder is just right for the increasing popularity of convenient foods. Most manufacturers place it among their products to provide palatable, convenient-to-make substitutes with the rich, comforting taste of butter without refrigeration. Additionally, increased home baking due to worldwide lockdowns has also fueled further growth in demand for ingredients such as butter powder that provide convenience as well as cooking versatility.

Report Coverage

This research report categorizes the butter powder market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Butter Powder market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Butter Powder market.

Butter Powder Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.24 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.48% |

| 2035 Value Projection: | USD 4.47 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Product Type, By Application, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Fonterra Co-operative Group Limited, Kraft Heinz Company, Land O’Lakes, Inc., Arla Foods amba, Dairy Farmers of America, Inc., Glanbia plc, Royal FrieslandCampina N.V., Agropur Dairy Cooperative, Nestlé S.A., Lactalis Group, Saputo Inc., and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

Butter powder has a major benefit over fresh butter because it has a longer shelf life and does not need refrigeration. This is a desirable ingredient for manufacturers and retailers, as it minimizes waste and storage expenses in industrial and domestic environments. Additionally, the fast-growing food service and catering industry fuels demand for butter powder, particularly in restaurants, hotels, and institutional foodservice. Its versatility and ease of use in volume cooking applications make it a standard in the foodservice market. With emerging health-oriented consumer trends, butter powder, especially unsalted options, fits the low-sodium and clean-label trend. This has resulted in expanding use in bakery, snack, and ready-meal applications, filling the demand for healthier alternatives.

Restraining Factors

The process of making butter powder includes sophisticated drying methods like spray-drying, which is energy-consuming and expensive. Such high production costs are usually transferred to consumers, thus butter powder becomes more costly than other substitutes. Additionally, there are several substitutes for butter powder, including margarine, vegetable oils, and other dairy powder products, which can be cheaper and more accessible. This substitute competition will constrain the growth of the market for butter powder.

Market Segmentation

The butter powder market share is classified into product type, application, and end user.

- The unsalted butter powder segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the butter powder market is divided into salted butter powder and unsalted butter powder. Among these, the unsalted butter powder segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by unsalted butter powder is the preferred choice for a host of applications, particularly in bakery and confectionery, where there is a need to control the salt content in the final product. It gives flexibility to chefs and manufacturers because it enables them to customize flavor profiles.

- The bakery and confectionery segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the application, the butter powder market is divided into bakery and confectionery, sauces and dressings, ready meals, snacks, and others. Among these, the bakery and confectionery segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The segmental growth is due to butter powder adds flavor, richness, and texture to baked foods such as cakes, cookies, and pastries. It mimics the effect of actual butter while providing consistency and shelf-stability, hence being crucial in commercial and artisan baking processes.

- The food service segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the butter powder market is divided into food service, household, and industrial. Among these, the food service segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to butter powder does not have to be refrigerated, thus lowering food service operators' costs of storage and transportation. It has a shelf life that limits waste and inventory turnover problems, which makes it a popular alternative to fresh dairy products in busy kitchens.

Regional Segment Analysis of the Butter Powder Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the butter powder market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the butter powder market over the predicted timeframe. The area has a technologically advanced food processing industry, which allows for effective production, quality control, and innovation using ingredients such as butter powder. This infrastructure facilitates large-scale production and the capacity to serve both domestic and global demand, enhancing North America's position as the leading market.

Asia Pacific is expected to grow at a rapid CAGR in the butter powder market during the forecast period. Several Asia-Pacific nations, such as China and Japan, have been increasing imports of dairy ingredients and making investments in domestic dairy processing facilities. This is an indication of the utilization of butter powder in mass food production, leading to a steep increase in market consumption and regional expansion.

Europe is predicted to hold a significant share of the butter powder market throughout the estimated period. Europe boasts a strong dairy culture with good infrastructure and experience in the processing of milk. France, Germany, and the Netherlands are prominent countries producing dairy products. The rich cultural heritage is favorable for the large-scale production and export of butter powder, with Europe being a major contributor to the international market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the butter powder market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fonterra Co-operative Group Limited

- Kraft Heinz Company

- Land O'Lakes, Inc.

- Arla Foods amba

- Dairy Farmers of America, Inc.

- Glanbia plc

- Royal FrieslandCampina N.V.

- Agropur Dairy Cooperative

- Nestlé S.A.

- Lactalis Group

- Saputo Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2024, Epi Ingredients, a French ingredients company, introduced an additive-free butter powder based on natural milk fat. The product addresses the increasing consumer trend towards clean-label ingredients and is appropriate for a range of applications, such as pastries, sauces, and ready meals.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the butter powder market based on the below-mentioned segments:

Global Butter Powder Market, By Product Type

- Salted Butter Powder

- Unsalted Butter Powder

Global Butter Powder Market, By Application

- Bakery and Confectionery

- Sauces and Dressings

- Ready Meals

- Snacks

- Others

Global Butter Powder Market, By End User

- Food Service

- Household

- Industrial

Global Butter Powder Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the butter powder market over the forecast period?The global butter powder market is projected to expand at a CAGR of 6.48% during the forecast period.

-

2. What is the market size of the butter powder market?The global butter powder market size is expected to grow from USD 2.24 Billion in 2024 to USD 4.47 Billion by 2035, at a CAGR of 6.48% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the butter powder market?North America is anticipated to hold the largest share of the butter powder market over the predicted timeframe.

Need help to buy this report?