Global Butadiene Market Size, Share, and COVID-19 Impact Analysis, By Application (Polybutadiene (PBR), Chloroprene, Styrene-butadiene (SBR), Nitrile Rubber (Acrylonitrile Butadiene NBR), Acrylonitrile Butadiene Styrene (ABS), Adiponitrile And Others), By End User (Plastic and Polymer, Tire and Rubber, Chemical, And Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal Butadiene Market Insights Forecasts to 2033

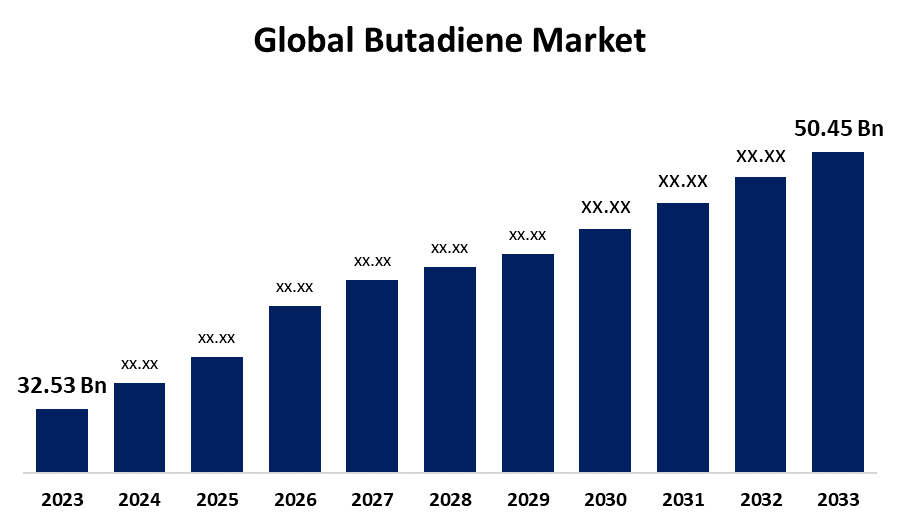

- The Global Butadiene Market Size was estimated at USD 32.53 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 4.49% from 2023 to 2033

- The Worldwide Butadiene Market Size is Expected to Reach USD 50.45 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Butadiene Market size was worth around USD 32.53 Billion in 2023 and is predicted to grow to around USD 50.45 Billion by 2033 with a compound annual growth rate (CAGR) of 4.49% between 2023 and 2033. The butadiene industry is spurred by the rising demand from the automotive sector for synthetic rubber, petrochemical industry growth, increased tire production, and increasing use of chemicals, plastics, and adhesives. Economic expansion in emerging markets also stimulates demand.

Market Overview

The butadiene market is the world market dealing with the production, distribution, and consumption of butadiene, which is a colorless gaseous hydrocarbon produced mainly from crude oil and natural gas processing. Butadiene is also termed as 1,3-butadiene. It is colorless and strongly reactive. Moreover, it has noncorrosive and mild aromatic order at room temperature and pressure. It may be manufactured as a by-product produced from the units of propylene and ethylene, mainly as a monomer used in the manufacture of plastics and synthetic rubbers. It may also be applied as a chemical intermediate if consumed in limited quantities. Furthermore, the consumption of butadiene-based products is on the rise with the rising level of automotive production. Also, increased infrastructure construction activity leads to development in the construction sector in which synthetic rubber goods have numerous end-use applications. Therefore, a robust rubber industry supported by growth in tire and automotive, as well as construction, is likely to propel the growth of the global butadiene market shortly.

Report Coverage

This research report categorizes the butadiene market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the butadiene market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the butadiene market.

Global Butadiene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 32.53 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.49% |

| 2033 Value Projection: | USD 50.45 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Application, By End User, By Region and COVID-19 Impact Analysis |

| Companies covered:: | ExxonMobil Chemical Company, Royal Dutch Shell Plc., BASF SE, Sinopec, TPC Group Inc., Braskem S.A., LyondellBasell Industries N.V., ENI S.p.A., Ineos Group AG, China Petroleum & Chemical Corporation, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Styrene-butadiene rubber (SBR) and polybutadiene rubber (PBR), both butadiene-derived, are critical for high-quality tires and other rubber applications. With the tire market expanding worldwide due to increasing vehicle manufacturing and demand for long-lasting tires, butadiene is in constant demand. In addition, the continued development of butadiene manufacturing technologies is enhancing yield and lowering costs, making the process more economical. Also, the production of bio-based butadiene is creating interest in alternative sustainable options, which may further increase the market.

Restraining Factor

Butadiene is produced from petroleum and natural gas by cracking processes, so its manufacture is subject to the vagaries of crude oil and natural gas prices. Unstable raw material costs can cause volatile butadiene prices, impacting profitability for producers and raising the cost of production. The environmental footprint of butadiene manufacture, such as its contribution to emissions and pollution, has raised regulatory issues. Governments are increasingly applying more stringent regulations to petrochemical processes and emissions, which may result in greater compliance costs and affect production levels, particularly in countries with stringent environmental policies.

Market Segmentation

The butadiene market share is classified into application and end user.

- The styrene-butadiene (SBR) segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the application, the butadiene market is divided into polybutadiene (PBR), chloroprene, styrene-butadiene (SBR), nitrile rubber (acrylonitrile butadiene NBR), acrylonitrile butadiene styrene (ABS), adiponitrile and others. Among these, the styrene-butadiene (SBR) segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed to SBR being greatly prized for its abrasion resistance, wear characteristics, and performance properties, which are necessary to make high-quality tires. Because tires consume a major percentage of rubber worldwide, the ever-growing automotive industry fuels demand for SBR.

- The tire and rubber segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the end user, the butadiene market is divided into plastic and polymer, tire and rubber, chemical, and others. Among these, the tire and rubber segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth is due to approximately 60-70% of butadiene that is manufactured worldwide is utilized in tire making. SBR and PBR play a crucial role in producing tires because they possess excellent performance traits, such as abrasion resistance, durability, and heat resistance.

Regional Segment Analysis of the Butadiene Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the butadiene market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the butadiene market over the predicted timeframe. Asia-Pacific is the global manufacturing hub, particularly in China, India, and Japan, where butadiene is utilized heavily in the manufacture of synthetic rubbers, plastics, and chemicals. The growth of the region's industry and urbanization are major drivers of the demand. Asia-Pacific has some of the largest petrochemical complexes, which are significant users of butadiene. The region is a world leader in the manufacture of plastics, chemicals, and synthetic rubbers, another factor that increases butadiene demand.

North America is expected to grow at a rapid CAGR in the butadiene market during the forecast period. North America, the United States in specific, is among the biggest markets for tyres because of its strong automotive sector. Butadiene consumption is driven by the demand for styrene-butadiene rubber (SBR) used in tyres. The region's increasing automotive production keeps powering the aggressive growth of the market for butadiene.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the butadiene market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ExxonMobil Chemical Company

- Royal Dutch Shell Plc.

- BASF SE

- Sinopec

- TPC Group Inc.

- Braskem S.A.

- LyondellBasell Industries N.V.

- ENI S.p.A.

- Ineos Group AG

- China Petroleum & Chemical Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2024, Michelin, together with IFPEN and Axens, inaugurated France's first industrial-scale pilot unit for the production of bio-based butadiene at its Bordeaux site. This move represents an important milestone in sustainable butadiene manufacturing.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the butadiene market based on the below-mentioned segments:

Global Butadiene Market, By Application

- Polybutadiene (PBR)

- Chloroprene

- Styrene-butadiene (SBR)

- Nitrile Rubber (Acrylonitrile Butadiene NBR)

- Acrylonitrile Butadiene Styrene (ABS)

- Adiponitrile

- Others

Global Butadiene Market, By End User

- Plastic and Polymer

- Tire and Rubber

- Chemical

- Others

Global Butadiene Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the butadiene market over the forecast period?The global butadiene market is projected to expand at a CAGR of 4.49% during the forecast period.

-

2. What is the market size of the butadiene market?The global butadiene market size is expected to grow from USD 32.53 Billion in 2023 to USD 50.45 Billion by 2033, at a CAGR of 4.49% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the butadiene market?Asia Pacific is anticipated to hold the largest share of the butadiene market over the predicted timeframe.

Need help to buy this report?