Global Business Process Automation (BPA) Market Size, Share, and COVID-19 Impact Analysis, By Deployment Mode (On-premise BPA Software and Cloud-based BPA Software), By Industry (IT & Telecom, Retail, Government, Healthcare, BFSI, Manufacturing, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Information & TechnologyGlobal Business Process Automation (BPA) Market Insights Forecasts To 2035

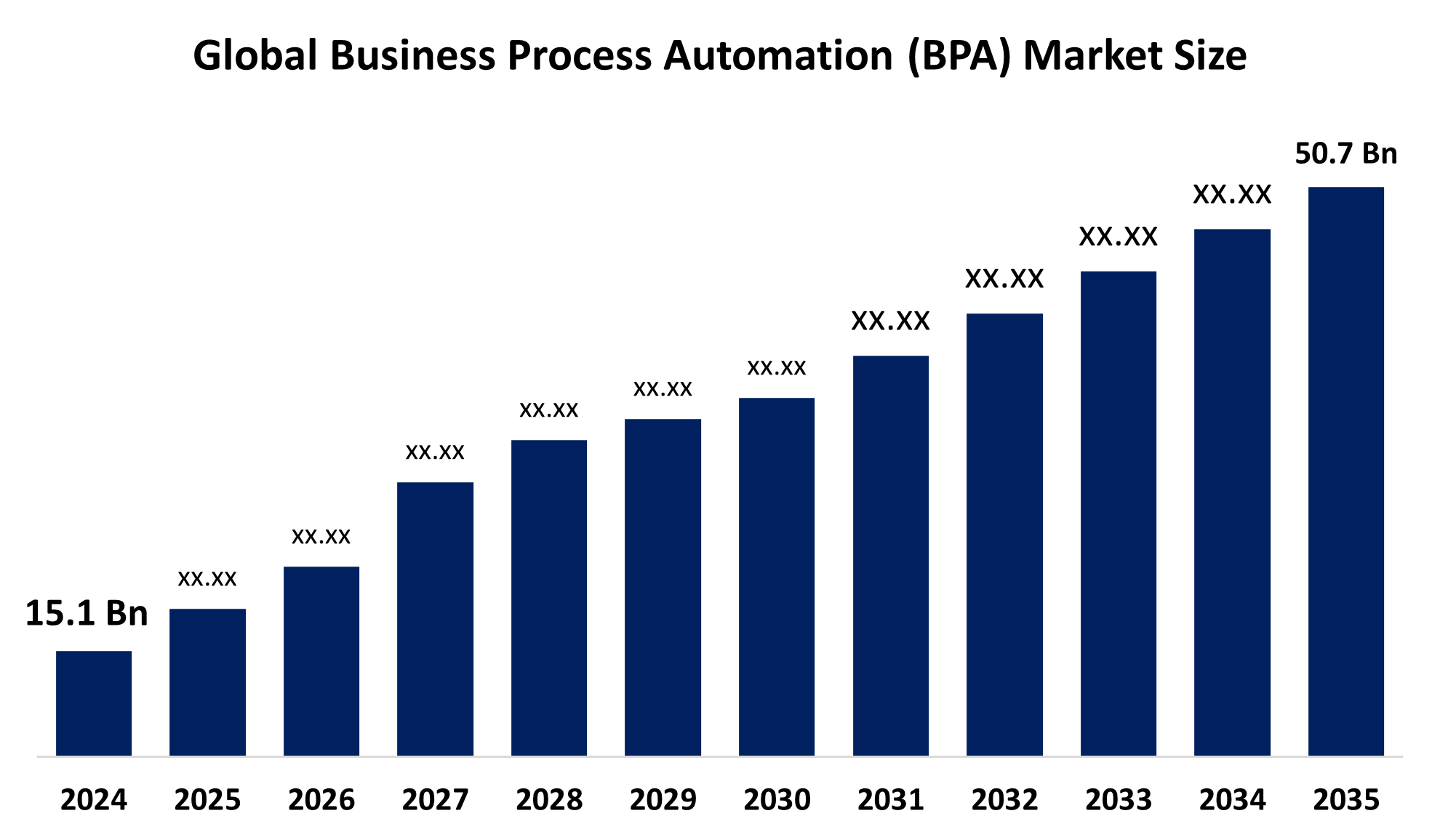

- The Global Business Process Automation (BPA) Market Size Was Estimated at USD 15.1 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.64% from 2025 to 2035

- The Worldwide Business Process Automation (BPA) Market Size is Expected to Reach USD 50.7 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Business Process Automation (BPA) Market Size was worth around USD 15.1 Billion in 2024, Growing to USD 16.89 Billion in 2025, and is Predicted To Grow to around USD 50.7 Billion by 2035 with a compound annual growth rate (CAGR) of 11.64% from 2025 to 2035. The business process automation (BPA) market is increasing due to the quest for operational efficiency, cost savings, and productivity enhancement through repetitive task automation. The convergence of modern technologies such as artificial intelligence (AI) and machine learning (ML) makes intelligent automation possible, while growing customer expectations for improved experiences also spur adoption.

Global Business Process Automation (BPA) Market Forecast and Revenue Outlook

- 2024 Market Size: USD 15.1 Billion

- 2025 Market Size: USD 16.89 Billion

- 2035 Projected Market Size: USD 50.7 Billion

- CAGR (2025-2035): 11.64%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

The business process automation (BPA) market refers to using technology to automate repeated tasks or processes in a business where human effort can be substituted. It assists companies in streamlining operations, improving efficiency, cutting costs, and eliminating human error. BPA is extensively used in various industries, including banking, healthcare, manufacturing, IT, and retail, to automate processes such as workflows, data entry, invoicing, customer service, and compliance processes. The market is being propelled by increasing demand for digital transformation, operational efficiency, and decision-making driven by data. Further, growth in remote working and the use of AI, machine learning, and cloud computing has increased BPA deployment at a rapid pace.

Future opportunities exist in the combination of BPA with robotic process automation (RPA) and advanced analytics, particularly in small and medium-sized businesses. Market leaders are IBM, Oracle, Microsoft, Appian, Pegasystems, and UiPath, among others. They are making R&D investments to upgrade automation capabilities. In addition, governments across the globe are promoting automation efforts through programs of funding and digital economy policies aimed at encouraging innovation and minimizing inefficiencies in the public sector. For instance, Germany, the U.S., and Singapore have initiated programs to motivate industries and public services to adopt automation.

Key Market Insights

- North America is expected to account for the largest share in the business process automation (BPA) market during the forecast period.

- In terms of deployment type, the cloud-based BPA software segment is projected to lead the business process automation (BPA) market throughout the forecast period

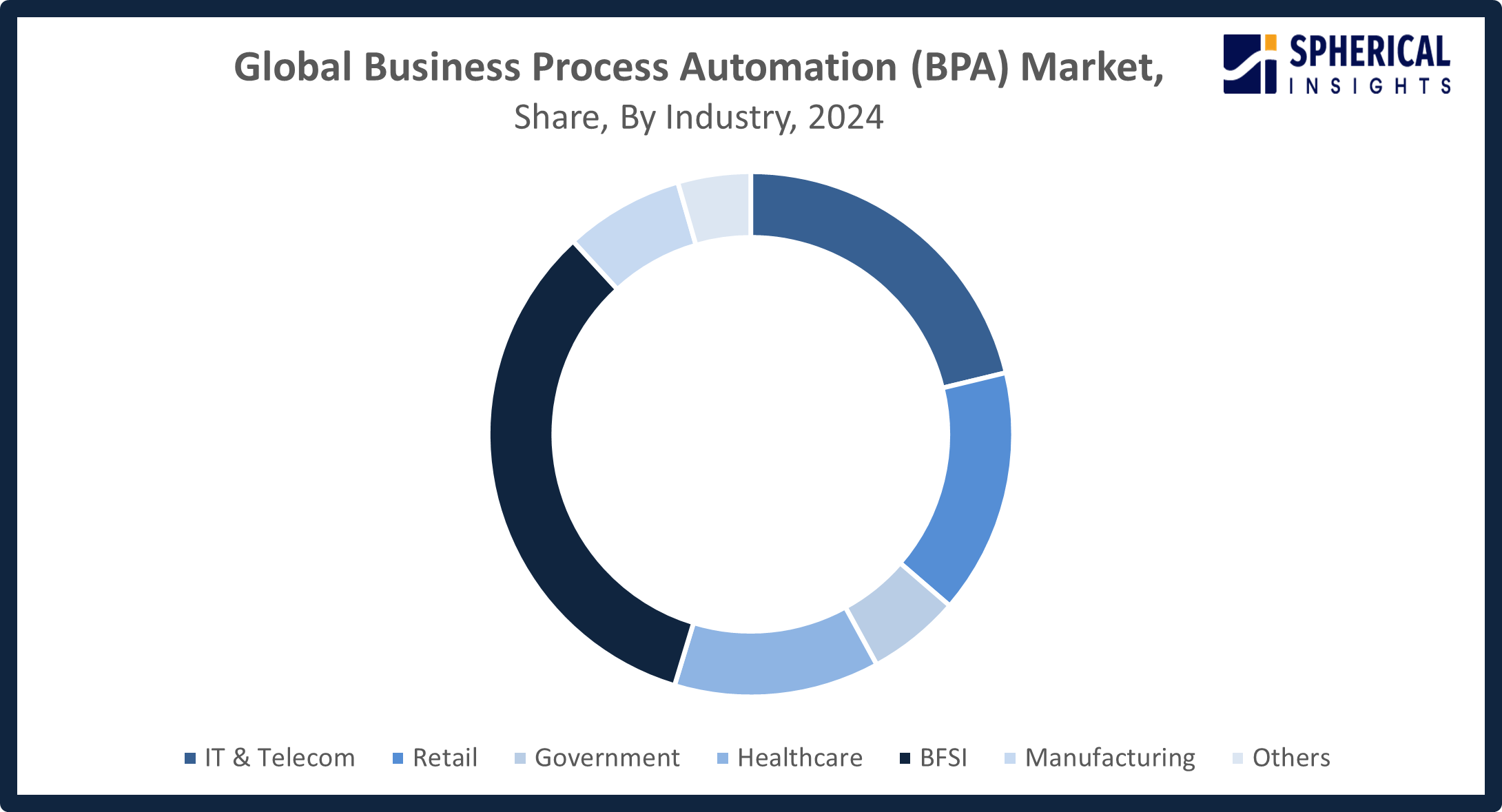

- In terms of industry, the BFSI segment captured the largest portion of the market

Business Process Automation (BPA) Market Trends

- Integration of AI, machine learning, and RPA is transforming traditional automation into intelligent automation.

- The BPA market is rapidly expanding due to increased demand for operational efficiency and cost reduction.

- Small and medium-sized enterprises are increasingly adopting BPA to streamline workflows and stay competitive.

- Government digital transformation initiatives are significantly accelerating BPA adoption in the public sector.

- Cloud-based BPA solutions are gaining traction for their scalability and flexibility.

Report Coverage

This research report categorizes the business process automation (BPA) market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the business process automation (BPA) market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the business process automation (BPA) market.

Global Business Process Automation (BPA) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 15.1 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.64% |

| 2035 Value Projection: | USD 16.89 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Deployment Mode, By Industry, By Region |

| Companies covered:: | Microsoft Corporation, Salesforce Inc., Oracle Corporation, IBM Corporation, ServiceNow Inc., SAP SE, Appian Corporation, UiPath Inc., Celonis SE, Zoho Corporation Pvt, Pegasystems Inc., Software AG, OpenText Corporation, Nintex Ltd, Automation Anywhere Inc., Others, and |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving factors

Key drivers for the BPA market are increasing demand for process efficiency, AI/ML integration, cost savings, and the desire to optimize processes through changing technologies. BPA is being implemented by organizations to increase process efficiency by automating business activities, accelerating processes, and eliminating errors. AI and machine learning integration further automate processes and support intelligent decision-making and management of complex processes. BPA also fosters cost savings through reduced labor costs and reduced rework. Furthermore, the necessity to simplify processes with emerging technologies such as cloud computing, IoT, and analytics spurs companies to digitalize processes for more agile and collaborative operations.

Restraining Factor

Restraining factors for the BPA market are high expenditures, complexity of integration, data security issues, inadequate skills, and organizational resistance. Excessive implementation expenditures may constrain the adoption of BPA, particularly for small organizations. Complexity in integration with current systems presents technical issues. Data security issues result from processing sensitive data. Inadequate skills impede deployment, whereas organizational resistance retards change and adoption.

Market Segmentation

The global business process automation (BPA)market is divided into deployment type and industry.

Global Business Process Automation (BPA) Market, By Deployment Type:

Why did the cloud-based BPA software segment dominate the market in 2024?

The cloud-based BPA software segment is leading due to its scalable, affordable, and ease of deployment. Remote access, smooth integration with other cloud solutions, and quicker updates are enabled by it. These features rendered it very desirable to businesses looking for flexible, efficient, and updated automation solutions.

The on-premise BPA software segment in the business process automation (BPA) market is expected to grow at the fastest CAGR over the forecast period. Growing demand for on-premises BPA offerings is attributed to concerns over data security, compliance requirements with regulations, increased control over infrastructure, and the necessity for customization in highly regulated or sensitive businesses.

Global Business Process Automation (BPA) Market, By Industry:

Why did the BFSI segment account for the largest share of the BPA market in 2024?

The BFSI segment dominated the market for BPA due to high demand for process efficiency, compliance, and preventing fraud. Automation facilitated process automation such as loan processing, onboarding, and managing risk. The need for enhancing customer experience and lowering operational expenses further increased BPA demand in the industry.

Get more details on this report -

The IT & telecom segment in the business process automation (BPA) market is expected to grow at the fastest CAGR over the forecast period. BPA is essential for the IT & telecom sector since it streamlines complex processes, enhances service provision, minimizes human error, and improves scalability to address increasing customer and infrastructure needs.

Regional Segment Analysis of the Global Business Process Automation (BPA) Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Business Process Automation (BPA) Market Trends

What factors contribute to North America’s leading position in the business process automation (BPA) market?

North America is at the forefront of the BPA market due to its developed digital infrastructure, high penetration of technology, and the presence of top-tier global BPA vendors. Key industry demand from sectors such as BFSI, healthcare, and IT drives growth, complemented by high innovation and R&D investments. Supportive government policies, focus on regulatory compliance, and a well-developed cloud ecosystem also facilitate the rapid deployment of BPA, making the region a strong contender in the international market.

Why are BPA adoption rates increasing rapidly in the U.S. market?

BPA implementation in America is increasing due to the requirement for enhanced efficiency, cost savings, increased technology integration, and competitiveness in sectors such as BFSI, healthcare, and IT industries.

Asia Pacific Business Process Automation (BPA) Market Trends

Why is consumer demand for business process automation (BPA) increasing rapidly in the Asia Pacific region?

Consumer demand for business process automation (BPA) in the Asia Pacific is growing rapidly due to the region's increasing digital transformation projects, the development of IT and telecom industries, and the increase in cloud technology adoption fuels the growth. Companies are looking to enhance operational efficiency, decrease costs, and increase customer experiences in the face of tough competition. Moreover, government policies encouraging smart cities and Industry 4.0 fuel BPA adoption. The growing number of small and medium businesses adopting automation to expand operations further fuels the region's high-speed demand for BPA solutions.

What factors are driving increased BPA adoption among Indian businesses?

High adoption of BPA in India is fueled by swift digitalization, expanding IT and telecom industries, the requirements of cost efficiency, and government policies that encourage automation. BPA is also adopted by small and medium enterprises to improve productivity and remain competitive in a rapidly changing business environment.

Why is the BPA market expanding rapidly in China?

China's BPA market is growing extremely fast through the government's encouragement of digitalization, development of manufacturing and IT industries, expanding demand for operational efficiency, and enhanced adoption of innovative automation technologies.

Why are Japanese companies focusing on BPA to improve operational efficiency?

Japanese businesses concentrate on BPA to overcome labor shortages, simplify complicated workflow processes, lower operating expenses, and improve productivity, thus ensuring competitiveness in the face of an aging workforce and changing market requirements.

What key factors are accelerating BPA adoption across European industries?

BPA implementation among European industries is speeding up with the necessity to enhance operational efficiency, adhere to regulations such as GDPR, and the imperative to adopt digital transformation. Improvements in cloud computing, AI, and machine learning, as well as government backing for Industry 4.0 initiatives, are compelling organizations to implement automation and boost productivity within the region.

What factors are driving BPA adoption among German industries?

Industry 4.0 efforts, regulatory requirements, operational efficiency demands, AI and IoT integration, and government patronage for digitalization and automation are driving the adoption of BPA among German industries.

Why is the BPA market growing steadily in France?

The BPA market in France is growing steadily due to increasing digital transformation efforts, rising demand for process efficiency, supportive government policies, and growing adoption of cloud-based and AI-driven automation solutions across industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global business process automation (BPA) market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Business Process Automation (BPA) Market Include

- Microsoft Corporation

- Salesforce Inc.

- Oracle Corporation

- IBM Corporation

- ServiceNow Inc.

- SAP SE

- Appian Corporation

- UiPath Inc.

- Celonis SE

- Zoho Corporation Pvt

- Pegasystems Inc.

- Software AG

- OpenText Corporation

- Nintex Ltd

- Automation Anywhere Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In August 2025, Appian announced enhancements including AI-powered semantic search, FedRAMP-compliant AI access, automatic data fabric scaling, and Process HQ reports, delivering faster insights, greater scalability, and improved security for AI process automation.

- In June 2025, Automation Anywhere launched pre-built Agentic Solutions and a new workspace, allowing business users to create and interact with agents via natural language. Initial solutions support accounts payable, customer support, banking, and healthcare industries.

- In May 2025, Zoho Corporation launched Zoho Payments, a unified online payment solution supporting cards and ACH. Integrated within Zoho, it enables businesses to manage payments seamlessly within their existing financial workflows for improved efficiency and control.

- In May 2025, Celonis showcased how its Process Intelligence platform maximizes ROI from AI deployments, enabling AI agents to work with humans. Updates to AgentC, Orchestration Engine acquisition, and platform advancements simplify AI orchestration and enterprise-wide deployment.

- In May 2025, at Knowledge 2025, ServiceNow launched its AI-powered Core Business Suite, designed to transform core functions such as HR, finance, and procurement. Built on the ServiceNow AI Platform, it enhances efficiency and includes a new Finance Case Management solution to automate back-office workflows and reduce manual tasks.

- In April 2025, UiPath launched its next-generation UiPath Platform, unifying AI agents, robots, and people on one intelligent system. Featuring secure orchestration, it enables scalable, flexible, and compliant creation, deployment, and management of reliable automation workflows.

- In November 2024, Nintex launched Nintex Apps, an intuitive tool for rapidly building personalized applications. It integrates with Nintex workflows and document generation, helping businesses streamline workflows, consolidate data, and reduce reliance on additional technologies.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the business process automation (BPA) market based on the following segments:

Global Business Process Automation (BPA) Market, By Deployment Type

- On-premise BPA Software

- Cloud-based BPA Software

Global Business Process Automation (BPA) Market, By Industry

- IT & Telecom

- Retail

- Government

- Healthcare

- BFSI

- Manufacturing

- Others

Global Business Process Automation (BPA) Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the business process automation (BPA) market over the forecast period?The global business process automation (BPA) market is projected to expand at a CAGR of 11.64% during the forecast period.

-

2. What is the market size of the business process automation (BPA) market?The global business process automation (BPA) market size is expected to grow from USD 15.1 billion in 2024 to USD 50.7 billion by 2035, at a CAGR 11.64% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the business process automation (BPA) market?North America is anticipated to hold the largest share of the business process automation (BPA) market over the predicted timeframe.

-

4. What factors are driving the growth of the business process automation (BPA) market?Key drivers of BPA market growth include digital transformation, AI and ML integration, low-code and no-code platforms, and a growing demand for cost reduction, increased efficiency, improved customer experiences, and enhanced scalability.

-

5. What are market trends in the business process automation (BPA) market?Key market trends in business process automation (BPA) include integration of AI/ML, hyper automation, low-code/no-code platforms, and a focus on sustainable practices.

-

6. What are the main challenges restricting wider adoption of the business process automation (BPA) market?Legacy systems, high costs, data issues, unclear ROI, resistance to change, security concerns, and complex integration limit BPA adoption.

-

7.Who are the top 10 companies operating in the global business process automation (BPA) market?The major players operating in the business process automation (BPA) market are Microsoft Corporation, Salesforce Inc., Oracle Corporation, IBM Corporation, ServiceNow Inc., SAP SE, Appian Corporation, UiPath Inc., Celonis SE, Zoho Corporation Pvt, and Others.

Need help to buy this report?