Global Business Jets Market Size By Aircraft Type (Light, Mid-Sized), By Point Of Sale (OEM, Aftermarket), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Business Jets Market Insights Forecasts to 2033

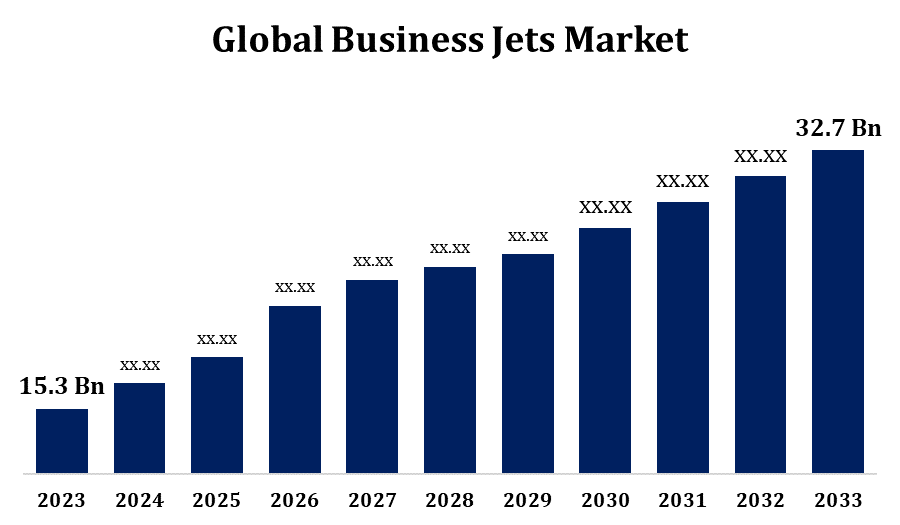

- The Global Business Jets Market Size was valued at USD 15.3 Billion in 2023

- The Market Size is growing at a CAGR of 7.89% from 2023 to 2033

- The Worldwide Business Jets Market Size is expected to reach USD 32.7 Billion by 2033

- Asia Pacific Market is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Business Jets Market Size is expected to reach USD 32.7 Billion by 2033, at a CAGR of 7.89% during the forecast period 2023 to 2033.

The business jets market consists of the production, sale, and operation of private jet aircraft intended for corporate or individual use. These planes provide luxury and customisable interiors, as well as the convenience of point-to-point flying. Positive economic conditions are frequently associated with an increase in demand for business jets as firms and wealthy individuals engage in private air travel. Business jets save time by allowing customers to get at their destinations faster than commercial airline schedules allow. Growing desire for personalised and sophisticated interiors that represent the interests and branding of individual owners or corporate clientele. Economic downturns can have an impact on the business jets market, as corporations and individuals reconsider their discretionary spending on luxury goods.

Business Jets Market Value Chain Analysis

The value chain starts with R&D work to design and develop new business jet models. This stage incorporates aerodynamics, avionics, materials science, and other technical fields. Once a business jet model has been conceptualised, the design step begins. Manufacturing entails acquiring resources, assembling components, and performing quality control to verify compliance with safety and performance standards. Business jet manufacturers collaborate with a network of suppliers on numerous components such as engines, avionics, interiors, and other systems. The sales and marketing phase entails presenting business jet models to prospective purchasers, which include individual owners, corporations, and charter firms. Business jet manufacturers may engage with dealerships or directly with clients to facilitate aircraft sales and delivery. Pilot training is required to operate business jets safely. Manufacturers may offer training programmes or work with training organisations to guarantee that pilots are qualified to operate their aircraft.

Business Jets Market Opportunity Analysis

Business jet makers can adopt and incorporate cutting-edge technology including improved avionics, fuel-efficient engines, and materials that improve performance, safety, and sustainability. The rise of urban air mobility creates potential for business jet manufacturers to explore new markets and technologies, such as electric or hybrid propulsion systems, to meet short-haul urban transportation demands. Expanding into emerging areas, particularly Asia-Pacific and the Middle East, where economic growth and an increasing number of wealthy individuals are boosting demand for private aviation services. There are opportunities for integrating modern connectivity technologies and in-flight services to improve the passenger experience, making business jets more appealing for both work and pleasure travel.

Global Business Jets Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 15.3 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.89% |

| 2033 Value Projection: | USD 32.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Point Of Sale, By Region, By Geographic Scope |

| Companies covered:: | Bombardier Inc., Cessna Aircraft Company, Gulfstream Aerospace Corporation, Dassault Aviation S.A., Adam Aircraft, Boeing Commercial Airplanes, Eclipse Aviation, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Business Jets Market Dynamics

Rising popularity of long-range aircraft in the aviation industry

Long-range business jets can connect distant places without the need for layovers or refueling stops. This is especially enticing to business travellers and wealthy persons with global commercial interests. Long-range aircraft greatly shorten travel time on transcontinental or intercontinental flights. Business leaders and individuals cherish the time saved by avoiding many layovers, which allows them to better manage their schedules. Long-range business jets frequently have spacious and well-equipped cabins, making them ideal for working or relaxing on long journeys. This increases productivity and comfort for passengers. The rise of multinational corporations and globalisation has boosted demand for long-range business jets among organisations with operations on numerous continents. Executives require swift and direct travel options for international business meetings.

Restraints & Challenges

Operating and maintaining a corporate jet can be costly. High fuel prices, maintenance charges, staff salaries, and insurance all contribute to total operational costs. Economic downturns can exacerbate cost worries, resulting in deferred purchases or fleet contraction. The market for business jets, particularly in specific areas, may become saturated. Intense competition among manufacturers, as well as the availability of used aircraft, might offer hurdles to new sales. Global economic crises, geopolitical tensions, and public health events (for example, pandemics) have the potential to disrupt the business jets market. Travel restrictions and economic worries during such events may have an influence on new purchases and charter services. The aviation sector is experiencing a shortage of experienced pilots. Attracting and maintaining experienced pilots is critical to the business jet industry.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Business Jets Market from 2023 to 2033. The North American business jet fleet includes a wide range of aircraft, such as light jets, mid-size jets, large jets, and ultra-long-range jets. The region has a mix of corporate aircraft, fractional ownership, and charter services. Given the huge distances that North American business customers frequently travel, there is a high demand for long-range and ultra-long-range business jets. These aircraft are designed to meet the needs of executives travelling across continents for business. Fractional ownership and charter services are common models in North America, giving businesses and individuals more flexible access to private air travel without committing to owning an entire aircraft. Many significant firms in North America maintain their own business jet fleets to expedite executive travel, increase efficiency, and give flexible transportation options.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific area, particularly China, India, and Southeast Asian states, has experienced significant economic growth. This has resulted in increased wealth generation and a growing number of high-net-worth individuals seeking private aircraft. The growing number of HNWIs in Asia-Pacific has been a significant driver of the business jets market. These people frequently desire the comfort, privacy, and time-saving benefits provided by private jet travel. Urbanisation and the growth of corporate hubs in major cities all contribute to increased demand for business jets. Business executives in developing urban areas prefer the flexibility and time savings provided by private aviation.

Segmentation Analysis

Insights by Aircraft Type

The liquid segment accounted for the largest market share over the forecast period 2023 to 2033. Light jets are often less expensive to acquire, operate, and maintain than bigger aircraft. This makes them appealing to corporations and individuals seeking more affordable private aviation choices. Light planes have the benefit of flying from smaller airports with shorter runways. This flexibility in airport access is beneficial to those who need to visit places with minimal infrastructure. Light planes are ideal for regional and short-haul travel. They offer a handy form of transportation for CEOs, entrepreneurs, and anyone doing business in a specific geographic area. The light category has experienced an upsurge in demand for charter services and fractional ownership options. Individuals and businesses use these services to acquire access to private plane travel.

Insights by Point of Sale

The OEM segment accounted for the largest market share over the forecast period 2023 to 2033. The growth of the OEM segment is largely related to global economic situations. During periods of economic expansion, firms and high-net-worth people are more inclined to invest in new business jets, increasing demand for OEMs. Aircraft have a limited operating life, thus firms frequently replace their fleets due to technology obsolescence, maintenance expenses, and regulatory compliance. These replacement cycles increase demand for new aircraft from OEMs. OEMs frequently diversify their product ranges to target various market segments. Offering a variety of aircraft sizes, capabilities, and price points enables OEMs to serve a larger client base.

Recent Market Developments

- In August 2022, Bombardier has ordered the first Challenger 3500 Business Jet based in Europe for use in charter operations by Air Corporate SRL.

Competitive Landscape

Major players in the market

- Bombardier Inc.

- Cessna Aircraft Company

- Gulfstream Aerospace Corporation

- Dassault Aviation S.A.

- Adam Aircraft

- Boeing Commercial Airplanes

- Eclipse Aviation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Business Jets Market, Aircraft Type Analysis

- Light

- Mid-Sized

Business Jets Market, Point of Sale Analysis

- OEM

- Aftermarket

Business Jets Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Business Jets Market?The Global Business Jets Market Size is expected to grow from USD 15.3 Billion in 2023 to USD 32.7 Billion by 2033, at a CAGR of 7.89% during the forecast period 2023-2033.

-

2. Who are the key market players of the Business Jets Market?Some of the key market players of the market are Bombardier Inc., Cessna Aircraft Company, Gulfstream Aerospace Corporation, Dassault Aviation S.A., Adam Aircraft, Boeing Commercial Airplanes, Eclipse Aviation.

-

3. Which segment holds the largest market share?The OEM segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Business Jets Market?North America is dominating the Business Jets Market with the highest market share.

Need help to buy this report?