Global Bus Rapid Transit (BRT) Market Size, Share, and COVID-19 Impact Analysis, By Bus Type (Standard, Articulated, and Others), By Propulsion (ICE and Electric), and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Automotive & TransportationGlobal Bus Rapid Transit (BRT) Market Insights Forecasts to 2035

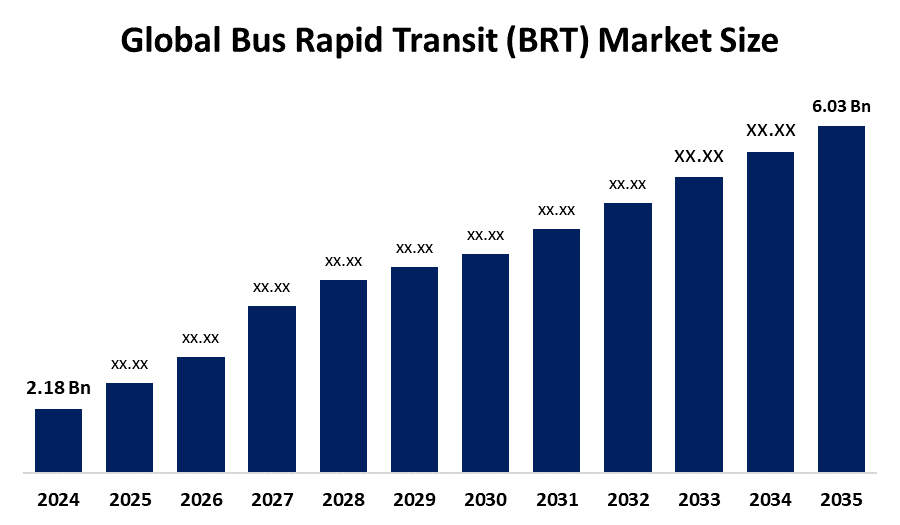

- The Global Bus Rapid Transit (BRT) Market Size Was Estimated at USD 2.18 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.69 % from 2025 to 2035

- The Worldwide Bus Rapid Transit (BRT) Market Size is Expected to Reach USD 6.03 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global bus rapid transit (BRT) market size was worth around USD 2.18 billion in 2024 and is predicted to grow to around USD 6.03 billion by 2035 with a compound annual growth rate (CAGR) of 9.69% from 2025 to 2035. Future opportunities in the bus rapid transit (BRT) market include urbanization-driven demand, government smart mobility initiatives, sustainable transportation adoption, integration with electric buses, and expansion in developing regions.

Market Overview

The bus rapid transit (BRT) market refers to high-capacity, dedicated bus-based public transport systems designed to provide faster, efficient, and reliable urban mobility. Market growth is driven by increasing urbanization, traffic congestion, and environmental concerns, prompting cities to adopt sustainable transport solutions. According to the United Nations, over 55% of the global population lives in urban areas, creating high demand for mass transit solutions. Government initiatives promoting low-emission and smart city projects, such as India’s Smart Cities Mission and Brazil’s urban mobility programs, are accelerating BRT adoption. Recent developments include the integration of electric and hybrid buses, advanced ticketing systems, real-time passenger information, and priority signaling, enhancing efficiency, convenience, and environmental sustainability.

Report Coverage

This research report categorizes the bus rapid transit (BRT) market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the bus rapid transit (BRT) market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the bus rapid transit (BRT) market.

Bus Rapid Transit (BRT) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.18 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 9.69% |

| 2035 Value Projection: | USD 6.03 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Bus Type, by Region |

| Companies covered:: | AB Volvo, Tata Motors, MAN, Ashok Leyland, Yutong, Marcopolo S.A., King Long, BYD Company Ltd., Mercedes Benz, Alexander Dennis Limited, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The BRT market is driven by rapid urbanization, traffic congestion, and the need for sustainable transport. Over 55% of the global population resides in urban areas, increasing demand for efficient mass transit. Governments are investing in low-emission public transport, with initiatives like India’s Smart Cities Mission and Brazil’s urban mobility programs. Rising environmental awareness and emission reduction targets, alongside adoption of electric and hybrid buses, advanced ticketing, and real-time information systems, are further propelling BRT system implementation worldwide.

Restraining Factors

High infrastructure costs, limited right-of-way availability, lengthy implementation timelines, maintenance challenges, and public resistance to change hinder BRT adoption, particularly in densely populated or economically constrained urban regions.

Market Segmentation

The bus rapid transit (BRT) market share is classified into bus type and propulsion.

- The articulated segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the bus type, the bus rapid transit (BRT) market is divided into standard, articulated, and others. Among these, the articulated segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The Articulated bus segment leads the BRT market due to its higher passenger capacity, accommodating 120–180 passengers per bus, compared to 80–100 in standard buses. This efficiency reduces congestion and operating costs on busy urban routes. Rapid urbanization, with over 55% of the global population in cities, and increasing BRT adoption in high-demand corridors further drive growth.

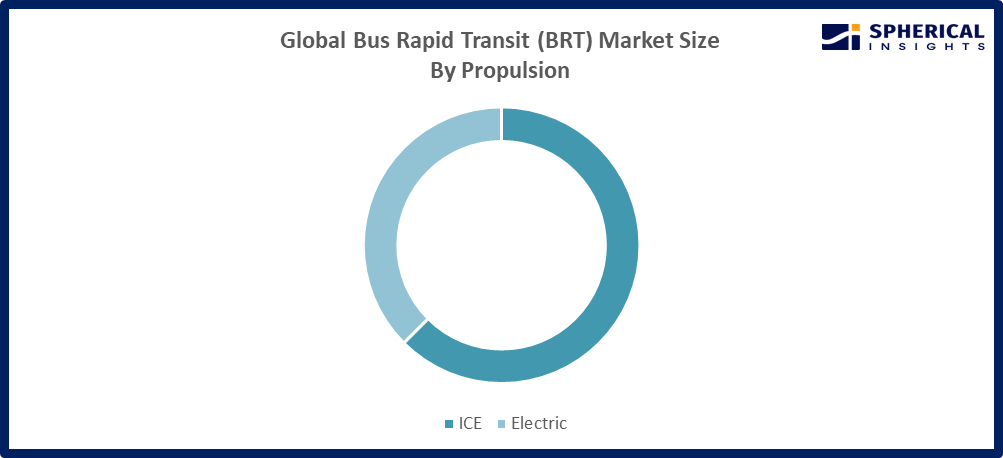

- The ICE segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the propulsion, the bus rapid transit (BRT) market is divided into ICE and electric. Among these, the ICE segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The Internal Combustion Engine (ICE) segment accounted for the highest market revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. ICE buses dominate current BRT fleets due to lower upfront costs, established refueling infrastructure, and ease of maintenance compared to electric buses, especially in developing regions where electrification is still limited.

Get more details on this report -

Regional Segment Analysis of the Bus Rapid Transit (BRT) Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the bus rapid transit (BRT) market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the bus rapid transit (BRT) market over the predicted timeframe. Asia Pacific is expected to dominate the BRT market because it accounted for over 40% of global BRT systems in 2024, driven by rapid urbanization, rising population density, and government initiatives like China’s urban transit expansion and India’s Smart Cities Mission. High demand for efficient mass transit and investments in electric and articulated buses further boost market growth.

North America is expected to grow at a rapid CAGR in the bus rapid transit (BRT) market during the forecast period. North America is expected to grow at a rapid CAGR in the BRT market due to increasing urban congestion, government investments in sustainable and low-emission transit systems, and modernization of public transportation infrastructure. Adoption of electric and articulated buses, smart ticketing, and dedicated BRT corridors in cities like Los Angeles, Bogotá-inspired programs, and Canadian urban centers are accelerating market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the bus rapid transit (BRT) market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AB Volvo

- Tata Motors

- MAN

- Ashok Leyland

- Yutong

- Marcopolo S.A.

- King Long

- BYD Company Ltd.

- Mercedes Benz

- Alexander Dennis Limited

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

• In September 2025, Bi-State Development and the City of St. Louis began exploring bus rapid transit (BRT) for the Green Line Transit Corridor. This initiative aims to deliver a faster, more reliable, and cost-effective transit solution following high light-rail costs and limited prospects for federal funding. The adaptation study will commence with planning and engineering work approved by the commissioners.

Global Bus Rapid Transit (BRT) Market, By Bus Type

- Standard

- Articulated

- Others

Global Bus Rapid Transit (BRT) Market, By Propulsion

- ICE

- Electric

Global Bus Rapid Transit (BRT) Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the bus rapid transit (BRT) market over the forecast period?The global bus rapid transit (BRT) market is projected to expand at a CAGR of 9.69% during the forecast period.

-

2. What is the market size of the bus rapid transit (BRT) market?The global bus rapid transit (BRT) market size is expected to grow from USD 2.18 billion in 2024 to USD 6.03 billion by 2035, at a CAGR of 9.69 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the bus rapid transit (BRT) market?Asia Pacific is anticipated to hold the largest share of the bus rapid transit (BRT) market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global bus rapid transit (BRT) market?AB Volvo, Tata Motors, MAN, Ashok Leyland, Yutong, Marcopolo S.A., King Long, BYD Company Ltd., Mercedes Benz, and Alexander Dennis.

-

5. What factors are driving the growth of the bus rapid transit (BRT) market?Rapid urbanization, traffic congestion, government initiatives, sustainable transport adoption, rising public transit demand, and integration of electric and high-capacity buses drive BRT market growth.

-

6. What are the market trends in the bus rapid transit (BRT) market?Electric and hybrid buses, advanced ticketing systems, dedicated lanes, real time passenger information, and smart city integration are key bus rapid transit market trends.

-

7. What are the main challenges restricting the wider adoption of the bus rapid transit (BRT) market?High infrastructure costs, limited road space, long implementation timelines, maintenance challenges, and public resistance hinder wider adoption of bus rapid transit systems.

Need help to buy this report?