Global Bulletproof Security Glass Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Material (Polycarbonate, Glass-Clad Polycarbonate, and Acrylic), By Application (Automotive, Defense, Banking, and Construction), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsBulletproof Security Glass Market Summary, Size & Emerging Trends

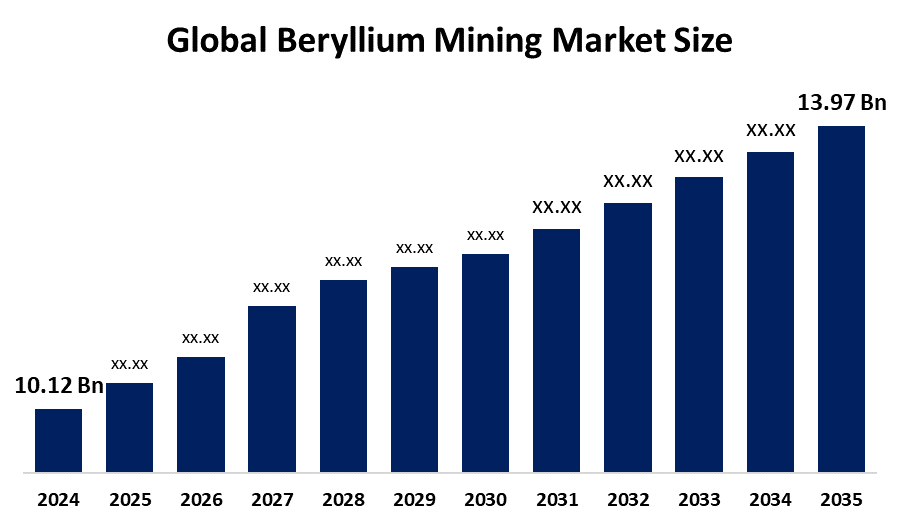

According to Decision Advisor, The Global Bulletproof Security Glass Market Size is expected to grow from USD 4.60 Billion in 2024 to USD 7.32 Billion by 2035, at a CAGR of 4.31% during the forecast period 2025-2035. Increasing security concerns worldwide, along with the rising need for protective glass solutions in automotive, defense, banking, and construction sectors, are primary growth drivers for the market.

Get more details on this report -

Key Market Insights

- Asia Pacific is expected to hold the largest share in the bulletproof security glass market during the forecast period due to rapid urbanization, infrastructure growth, and increasing investments in defense and automotive sectors.

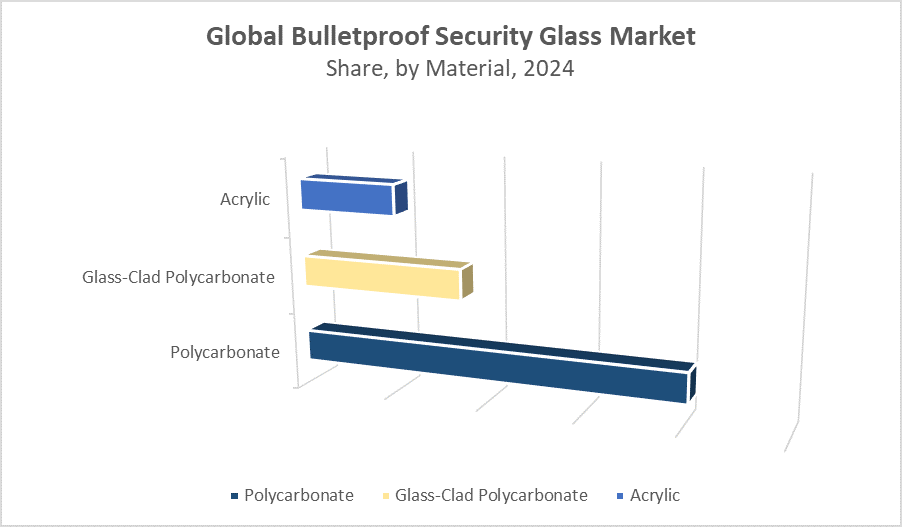

- Among materials, Polycarbonate dominates the market in terms of revenue due to its superior impact resistance and lightweight properties.

- The automotive segment accounted for the largest revenue share, driven by growing adoption of bulletproof glass in passenger and commercial vehicles for enhanced safety.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 4.60 Billion

- 2035 Projected Market Size: USD 7.32 Billion

- CAGR (2025-2035): 4.31%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Bulletproof Security Glass Market

Bulletproof security glass is a specially engineered laminated glass designed to protect against ballistic threats and physical impacts. It consists of multiple layers of glass combined with polycarbonate or acrylic sheets that absorb and disperse the energy from bullets or projectiles. This type of glass is crucial for high-security applications, including military vehicles, armored banks, government buildings, and other secure facilities. Growing safety concerns across both public and private sectors are driving global demand for bulletproof security glass. Advances in materials engineering have enhanced its durability, impact resistance, and optical clarity, making it more effective and appealing for various industries. These improvements, along with increasing security requirements, are fueling the market’s expansion worldwide, positioning bulletproof glass as a vital component in protective infrastructure and transportation.

Bulletproof Security Glass Market Trends

- Increasing integration of advanced polymers like glass-clad polycarbonate for enhanced ballistic resistance and reduced weight.

- Rising adoption of bulletproof glass in luxury and commercial vehicles for occupant safety.

- Growing use of bulletproof glass in public infrastructure, including banks and government buildings, due to heightened security concerns.

- Development of multilayer and hybrid glass solutions combining acrylic and polycarbonate to balance transparency with strength.

Global Bulletproof Security Glass Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.60 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.31% |

| 2035 Value Projection: | USD 7.32 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Material, By Application and By Region |

| Companies covered:: | AGC Inc., Saint-Gobain S.A., Guardian Glass, Eastman Chemical Company, SABIC, Mitsubishi Chemical Corporation, 3M Company, Kuraray Co., Ltd., Sekisui Chemical Co., Ltd., Evonik Industries AG, Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Bulletproof Security Glass Market Dynamics

Driving Factors: The automotive industry’s emphasis on occupant safety

The demand for bulletproof security glass is fueled by rising global security concerns, including increasing crime rates, terrorism, and geopolitical instability. The automotive industry’s emphasis on occupant safety, especially in high-risk regions, further boosts market growth. Governments impose strict safety regulations in defense, banking, and other high-security sectors, mandating the use of advanced protective glass. Meanwhile, technological advancements have led to lightweight and more impact-resistant materials, broadening the scope of applications and accelerating market adoption worldwide.

Restrain Factors: High production and installation costs of bulletproof security glass limit its widespread use

High production and installation costs of bulletproof security glass limit its widespread use, particularly in price-sensitive markets. The heavier weight of some glass types poses challenges for automotive and construction design, affecting efficiency and feasibility. Supply chain issues related to essential raw materials such as polycarbonate and acrylic can hamper manufacturing. Additionally, limited market awareness and slow adoption in developing regions restrict overall growth, presenting a barrier to the market’s global expansion.

Opportunity: Rapid urbanization and infrastructure growth in emerging economies

Rapid urbanization and infrastructure growth in emerging economies offer promising opportunities for bulletproof glass use in public transport, banks, and commercial buildings. The development of smart glass technologies, including features like anti-glare and UV protection coatings, enhances product functionality and unlocks new markets. The rise of electric and autonomous vehicles also drives demand for lightweight, high-performance bulletproof glass. Collaborations between manufacturers and material scientists can spur innovation and reduce costs, further expanding market potential.

Challenges: Achieving the right balance between bullet resistance

Achieving the right balance between bullet resistance, optical clarity, and lightweight design remains a significant technical hurdle. Differences in regional safety standards and certification procedures complicate market entry and limit global uniformity. The market faces competition from alternative materials such as ceramic armor and composite panels, which may reduce bulletproof glass’s market share. Additionally, raw material price volatility, driven by geopolitical tensions and environmental regulations, threatens stable supply and production consistency.

Global Bulletproof Security Glass Market Ecosystem Analysis

The ecosystem consists of raw material suppliers (polycarbonate, glass manufacturers), bulletproof glass producers, testing and certification bodies, and end-users in automotive, defense, banking, and construction industries. Leading manufacturers focus on R&D to improve product performance while complying with international safety standards. Strategic partnerships between material suppliers and glass fabricators facilitate innovation. Regulatory agencies play a crucial role in defining quality benchmarks and promoting safety protocols. Growing collaborations among defense organizations, automotive OEMs, and technology firms drive tailored product development.

Global Bulletproof Security Glass Market, By Material

The polycarbonate segment dominated the bulletproof security glass market in terms of revenue during the forecast period, holding the largest share. This dominance is due to polycarbonate’s outstanding impact resistance, lightweight nature, and ease of fabrication. It is extensively used in automotive and defense sectors, where both protection and weight reduction are critical. Polycarbonate’s ability to endure high-velocity impacts while maintaining optical clarity makes it the preferred choice for bulletproof security glass across multiple applications.

Get more details on this report -

Glass-clad polycarbonate is rapidly gaining traction, capturing a growing revenue share in the market. This hybrid material combines the optical clarity of glass with the impact resistance of polycarbonate, offering superior ballistic protection at a reduced weight. Its unique balance of security and aesthetics makes it especially popular in specialised defence and banking applications, where high-performance protective solutions are required without compromising visibility or design appeal.

Global Bulletproof Security Glass Market, By Application

The automotive segment held the largest revenue share in the global bulletproof security glass market. This growth is driven by increasing concerns over passenger safety and the rising use of armored vehicles in high-risk regions. Bulletproof glass is widely used in passenger cars, commercial vehicles, and specialty vehicles serving VIPs and government officials. The demand for enhanced protection without compromising visibility or vehicle performance makes this segment a dominant contributor to market revenue.

The defence segment demands the highest levels of ballistic protection, making bulletproof security glass essential for military vehicles, personnel carriers, and secure facilities. This segment accounts for a significant share of the market, supported by continuous technological advancements aimed at improving resistance to armour-piercing projectiles. The need for durable, lightweight, and high-performance protective glass solutions in defence applications drives steady market growth and innovation in this critical sector.

Asia Pacific is projected to hold the largest share of the bulletproof security glass market during the forecast period.

Get more details on this report -

This growth is fueled by rapid urbanization, ongoing infrastructure development, and increasing defense budgets in major economies such as China, India, and Japan. Additionally, the expansion of the regional automotive industry, combined with heightened investments in banking security, public safety, and commercial infrastructure, is accelerating demand for high-performance security glass across both civilian and defense applications.

North America is expected to be the fastest-growing region in the bulletproof security glass market

led primarily by the United States. Strong regulatory standards, high defense spending, and advanced manufacturing capabilities support this growth. The region benefits from robust government initiatives aimed at enhancing security in critical infrastructure, public transport, and law enforcement. Moreover, increased demand from the automotive and banking sectors, along with the integration of cutting-edge materials, continues to drive market expansion in North America.

WORLDWIDE TOP KEY PLAYERS IN THE BULLETPROOF SECURITY GLASS MARKET INCLUDE

- AGC Inc.

- Saint-Gobain S.A.

- Guardian Glass

- Eastman Chemical Company

- SABIC

- Mitsubishi Chemical Corporation

- 3M Company

- Kuraray Co., Ltd.

- Sekisui Chemical Co., Ltd.

- Evonik Industries AG

- Others

Product Launches in Bulletproof Security Glass Market

- In January 2024, Saint-Gobain unveiled a new lightweight glass-clad polycarbonate panel specifically engineered for military vehicles. This innovation offers enhanced ballistic protection while significantly reducing vehicle weight, addressing the defense sector’s demand for both security and mobility.

- In September 2023, AGC Inc. introduced an advanced acrylic-based bulletproof glass product tailored for banking and commercial construction applications. This new solution offers improved optical clarity without compromising on ballistic performance, meeting the rising demand for transparent yet secure glazing in high-risk civilian environments.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the bulletproof security glass market based on the below-mentioned segments:

Global Bulletproof Security Glass Market, By Material

- Polycarbonate

- Glass-Clad Polycarbonate

- Acrylic

Global Bulletproof Security Glass Market, By Application

- Automotive

- Defense

- Banking

- Construction

Global Bulletproof Security Glass Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

Q: What is the market size of the Global Bulletproof Security Glass Market in 2024?A: The Global Bulletproof Security Glass Market size was estimated at USD 4.60 billion in 2024.

-

Q: What is the projected market size of the Global Bulletproof Security Glass Market by 2035?A: The market is expected to reach USD 7.32 billion by 2035.

-

Q: What is the forecasted CAGR of the Global Bulletproof Security Glass Market from 2025 toA: The market is projected to grow at a CAGR of 4.31% during the forecast period.

-

Q: Which region held the largest market share in the Bulletproof Security Glass Market in 2024?A: Asia Pacific held the largest share in 2024, driven by infrastructure growth and rising defense and automotive investments.

-

Q: Which region is expected to be the fastest growing in the Bulletproof Security Glass Market?A: North America is projected to be the fastest-growing region, led by strong security regulations and defense spending in the U.S.

-

Q: Which material dominates the Global Bulletproof Security Glass Market?A: Polycarbonate dominates the market due to its high impact resistance, lightweight nature, and widespread use in automotive and defense sectors.

-

Q: What are the key applications of bulletproof security glass?A: Major applications include automotive, defense, banking, and construction, with the automotive sector holding the largest revenue share.

-

Q: What are the main drivers of growth in the Bulletproof Security Glass Market?A: Rising global security concerns, advancements in material science, and increasing demand in automotive and defense industries are key growth drivers.

Need help to buy this report?