Global Bulgur Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Grain Size (Fine, Medium, and Coarse), By Channel (Retail and Foodservice/Industrial), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesBulgur Market Summary, Size & Emerging Trends

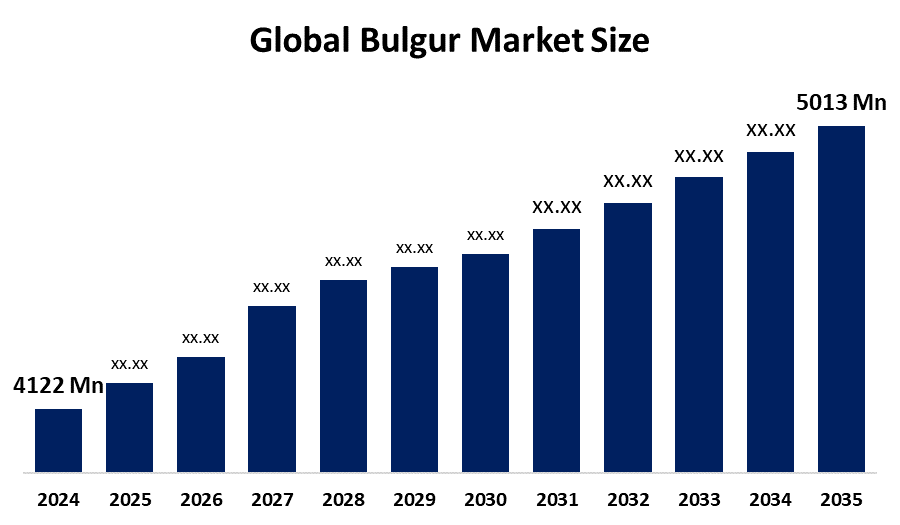

According to Spherical Insights, The Global Bulgur Market Size is Expected to Grow from USD 4122 Million in 2024 to USD 5013 Million by 2035, at a CAGR of 1.79% during the forecast period 2025-2035. Rising health consciousness, increased demand for whole grains, and a shift toward plant-based diets are key factors driving the growth of the bulgur market globally.

Get more details on this report -

Key Market Insights

- Asia Pacific is expected to account for the largest share in the bulgur market during the forecast period.

- In terms of grain size, the medium grain size segment dominated in terms of revenue during the forecast period.

- In terms of channel, the retail segment accounted for the largest revenue share in the global bulgur market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 4122 Million

- 2035 Projected Market Size: USD 5013 Million

- CAGR (2025-2035): 1.79%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Bulgur Market

The bulgur market revolves around the rising demand for bulgur, a minimally processed, fiber-rich whole grain made from cracked wheat. Known for its quick cooking and nutritional value, bulgur is widely used in traditional dishes like pilafs, salads, and soups. Its popularity is increasing due to growing health awareness, plant-based diets, and the global shift toward whole grains. The market benefits from the expanding vegetarian and vegan consumer base and the rising demand for functional and convenient foods. Manufacturers are introducing organic variants, sustainable packaging, and expanding their presence in retail and foodservice sectors. As consumers seek natural, high-fiber, and easy-to-prepare options, bulgur continues to gain traction across both developed and emerging markets. This positions it as a key grain in modern diets and a promising product in the evolving food industry landscape.

Bulgur Market Trends

- Rising popularity of whole grains and plant-based foods across global diets.

- Product innovation including organic, ready-to-cook, and flavored bulgur variants.

- Expanding distribution via online platforms and health-focused retail outlets.

- Adoption of bulgur in foodservice and industrial applications like ready meals and snacks.

Global Bulgur Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4122 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 1.79% |

| 2035 Value Projection: | USD 5013 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Grain Size, By Channel and By Region |

| Companies covered:: | Tat Gida, Duru Bulgur, Yayla Agro, Oba makarna, Akkaya, Dogus, sera, Reis Gida, and |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Bulgur Market Dynamics

Driving Factors: Bulgur’s versatility supports its growing use in household kitchens and industrial food manufacturing

The bulgur market is driven by increasing health awareness and a global shift toward high-fiber, whole grain consumption. As more consumers adopt vegetarian and vegan lifestyles, bulgur’s plant-based nature enhances its appeal. Its convenience as a quick-cooking grain also suits busy lifestyles. Furthermore, bulgur’s versatility supports its growing use in household kitchens and industrial food manufacturing, boosting demand in ready meals, health foods, and ethnic cuisines across diverse regional markets.

Restrain Factors: Limited consumer awareness in several regions

Despite growing demand, the bulgur market faces restraints such as limited consumer awareness in several regions. It also competes with more well-known grains like quinoa and couscous. Price fluctuations in wheat, the core raw material can affect production costs. In emerging markets, high logistics and distribution expenses, along with limited cold-chain infrastructure, further challenge market expansion. These factors collectively create barriers that may hinder consistent demand and adoption in some parts of the world.

Opportunity: Consumers are increasingly seeking healthier and sustainable alternatives

Opportunities in the bulgur market stem from rising demand for organic, natural, and gluten-free food options. Consumers are increasingly seeking healthier and sustainable alternatives, making bulgur a promising candidate. Packaging and product innovations such as instant, flavored, or pre-cooked bulgur enhance market appeal. Foodservice adoption is also growing, especially in health-oriented menus. Additionally, expanding into emerging markets where dietary habits are evolving presents new avenues for growth and brand presence, especially for premium and value-added bulgur products.

Challenges: Global supply chain disruptions

The bulgur market faces challenges from wheat price volatility, affecting manufacturing stability and profit margins. Global supply chain disruptions, particularly in grain sourcing and logistics, can delay product availability. In many regions, shelf awareness and consumer education on bulgur’s health benefits remain low, limiting its appeal. Logistical and regulatory hurdles in new markets also pose difficulties. Combined, these challenges create complexity for companies seeking to scale operations and build long-term consumer trust and market penetration.

Global Bulgur Market Ecosystem Analysis

The global bulgur market ecosystem is made up of interconnected players including raw wheat suppliers, grain processors, packaging manufacturers, distributors, and end-user channels like retail and foodservice. Each stage contributes to value creation, from sourcing quality wheat to delivering consumer-ready products. Leading companies are adopting advanced milling technologies for efficiency and consistency, while also embracing sustainable, eco-friendly packaging solutions. Strategic collaborations and regional expansions are helping firms enhance their global footprint. The ecosystem thrives on balancing traditional food practices with modern innovations to meet evolving consumer preferences.

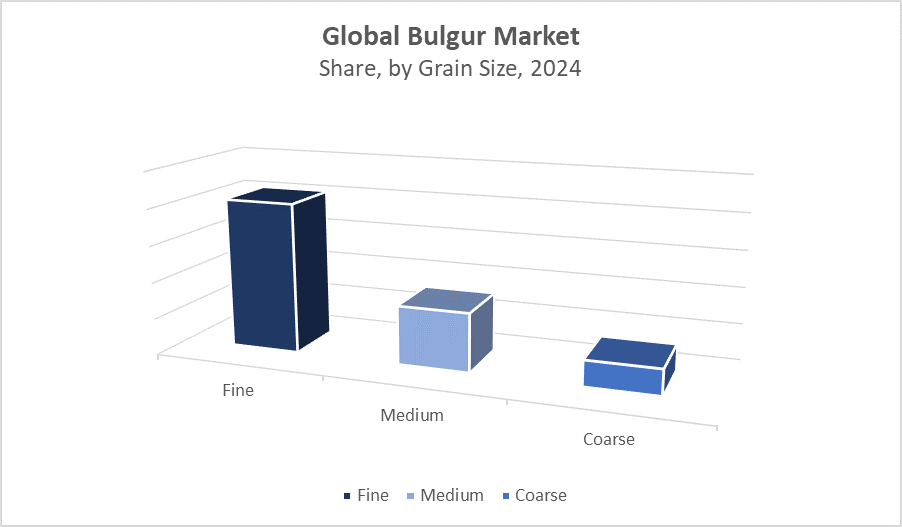

Global Bulgur Market, By Grain Size

The fine grain size segment is gaining popularity, accounting for approximately 35% of the global bulgur market share. Its quick cooking time makes it ideal for convenient meals and processed foods. Fine bulgur is widely used in bakery products, soups, and instant meal mixes, appealing to consumers seeking fast and easy-to-prepare options. Growing demand from busy households and the foodservice industry is driving the adoption of fine bulgur, especially in urban markets focused on convenience without compromising nutrition.

Get more details on this report -

The medium grain size segment dominates the global bulgur market, holding around 50% of the market share. This size is highly versatile and preferred for its texture and cooking performance. It is commonly used in traditional dishes such as salads, pilafs, and side dishes across many cuisines. The widespread use and consumer familiarity with medium bulgur contribute to its leading position. Its balanced cooking time and texture make it a staple in both household kitchens and commercial food preparation.

Global Bulgur Market, By Channel

The retail segment is the largest distribution channel for bulgur, capturing approximately 65% of the global market share. Growth in supermarket chains, rising consumer preference for packaged and convenient foods, and the expansion of online grocery platforms are key drivers. Retail offers easy accessibility for households and health-conscious consumers seeking nutritious whole grains. Increasing product variety and organic options in retail outlets further boost bulgur’s popularity, making this channel the primary avenue for market growth worldwide.

The foodservice and industrial segment holds about 35% of the global bulgur market share and is steadily gaining traction. Bulgur’s growing use in restaurants, catering services, and institutional kitchens is driven by demand for healthy, plant-based ingredients. Additionally, its incorporation into processed foods like ready meals, snacks, and convenience products expands industrial consumption. Innovations in product forms suitable for large-scale preparation contribute to this channel’s rising importance in the bulgur market ecosystem.

Asia Pacific is projected to dominate the global bulgur market with around a 40% share

Get more details on this report -

driven by rapid urbanization, rising health consciousness, and expanding middle-class populations. Countries like India, China, Japan, and Southeast Asian nations are witnessing a shift toward healthier diets, with bulgur gaining traction as a nutritious, fiber-rich whole grain. Increased disposable incomes, growing awareness of wellness foods, and changing dietary preferences further boost demand. The expanding retail sector and foodservice industry adoption support the region’s leading role in bulgur market growth globally.

Europe holds roughly 25% of the global bulgur market

characterised by a strong foundation of traditional bulgur consumption, especially in Mediterranean countries such as Turkey, Greece, and Italy. These regions have long integrated bulgur into their culinary heritage. Simultaneously, modern dietary trends embracing whole grains, plant-based nutrition, and functional foods are expanding bulgur’s appeal beyond traditional markets. Increased consumer education and demand for organic and gluten-free products contribute to steady growth, supported by well-established retail and foodservice infrastructures.

North America accounts for about 20% of the global bulgur market and is one of the fastest-growing regions.

Increasing health awareness among consumers is driving demand for natural, clean-label, and high-fiber foods like bulgur. The rise of vegetarian and vegan lifestyles further supports this trend. Retail expansion, especially through supermarkets and e-commerce platforms, enhances accessibility. Additionally, foodservice providers are incorporating bulgur into menus focused on health and wellness. The region’s focus on functional foods and convenience meals positions it as a strong growth market for bulgur.

WORLDWIDE TOP KEY PLAYERS IN THE BULGUR MARKET INCLUDE

- Tat Gida

- Duru Bulgur

- Yayla Agro

- Oba makarna

- Akkaya

- Dogus

- sera

- Reis Gida

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the Bulgur market based on the below-mentioned segments:

Global Bulgur Market, By Grain Size

- Fine

- Medium

- Coarse

Global Bulgur Market, By Channel

- Retail

- Foodservice/Industrial

Global Bulgur Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

Q: What are the key factors driving growth in the bulgur market?A: Rising health consciousness, increased demand for whole grains, and a global shift toward plant-based diets are the main growth drivers.

-

Q: What are the major challenges limiting the growth of the bulgur market?A: Limited consumer awareness in some regions, competition from other grains like quinoa and couscous, wheat price volatility, and global supply chain disruptions are key challenges.

-

Q: What are the emerging trends in the Global Bulgur Market?A: Trends include the rising popularity of whole grains and plant-based foods, product innovations like organic and ready-to-cook bulgur, and expanding distribution via online platforms.

-

Q: What opportunities exist in the bulgur market?Q: What opportunities exist in the bulgur market? A: Opportunities include increasing demand for organic, natural, and gluten-free options, product innovation (instant, flavored bulgur), and expansion into emerging markets with evolving dietary habits.

-

Q: Who are the top companies operating in the Global Bulgur Market?A: Leading companies include Tat Gıda, Duru Bulgur, Yayla Agro, Oba Makarna, Akkaya, Dogus, Ulukaya, Sera, Reis Gıda, and Ceres Organics.

-

Q: How is bulgur used across different applications and channels?A: Bulgur is widely used in household kitchens and foodservice/industrial applications including ready meals, snacks, and ethnic cuisines, with retail being the dominant distribution channel.

Need help to buy this report?