Global Buckwheat Market Size, Share, and COVID-19 Impact Analysis, By Source (Conventional and Organic), By Form (Flakes, Groats, Flour, and Others), By Application (Animal Feed, Food and Beverages, Personal Care and Cosmetics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Food & BeveragesGlobal Buckwheat Market Insights Forecasts to 2033

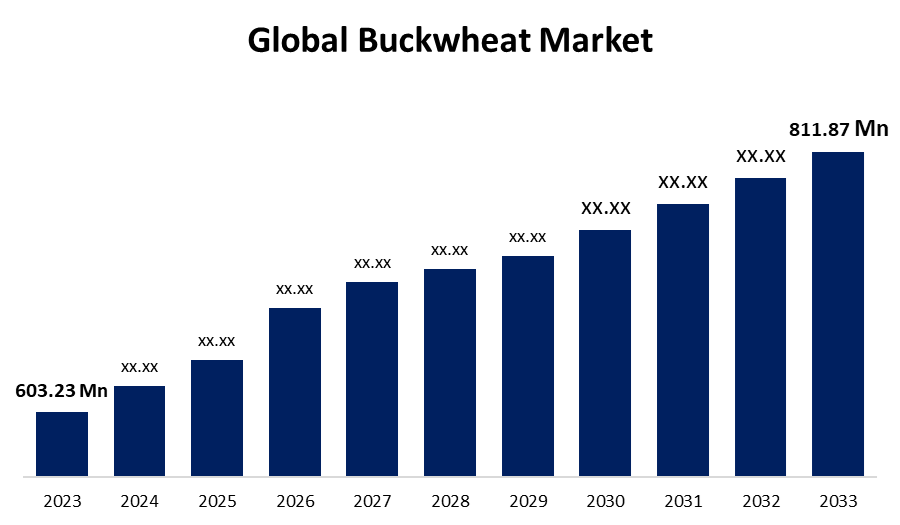

- The Global Buckwheat Market Size was Estimated at USD 603.23 Million in 2023

- The Market Size is Expected to Grow at a CAGR of around 3.01% from 2023 to 2033

- The Worldwide Buckwheat Market Size is Expected to reach USD 811.87 million by 2033

- Asia Pacific is predicted to Grow at the fastest CAGR throughout the projection period

Get more details on this report -

The Global Buckwheat Market Size is predicted to Exceed USD 811.87 million by 2033, Growing at a CAGR of 3.01% from 2023 to 2033.

Market Overview

The buckwheat market encompasses the global trade and industry of buckwheat, a gluten-free pseudocereal with nutritional benefits. Originating in Russia, China, and Ukraine, it is used in food, beverages, animal feed, and cosmetics due to its versatility. Common buckwheat, also known as sweet buckwheat, and tartary buckwheat, sometimes known as bitter buckwheat, are the two main species of buckwheat, a group of pseudocereals of the Fagopyrum genus. In Eastern Europe, hulled kernels are processed as kasha and eaten like rice, making it a staple pseudograin crop. In the US and Canada, buckwheat cakes are made with buckwheat flour. In addition to being abundant in protein and carbs, buckwheat contains trace quantities of vitamins B1 and B2. In the US and Canada, it is used to manufacture griddle cakes known as buckwheat cakes. A nutritious food, buckwheat has several health benefits, such as lowering blood pressure, cholesterol, diabetes, gallstones, heart disease, breast cancer, and asthma. Additionally, it contains nutraceuticals that improve food intolerances and airborne allergies by preventing blood clots and histamine generation. This is due to rising health consciousness and consumer preference for natural and organic products, the market is being pushed by the increased demand for buckwheat from a variety of industries. As it is gluten-free, buckwheat is a popular choice for health-conscious consumers, including corporate professionals, fitness instructors, and bodybuilders. The market for buckwheat is being driven by the expanding global trend toward natural and organic products.

Report Coverage

This research report categorizes the global buckwheat market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the global buckwheat market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the global buckwheat market.

Global Buckwheat Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 603.23 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.01% |

| 2033 Value Projection: | USD 811.87 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Source, By Form, By Application and By Region |

| Companies covered:: | Homestead Organics, Bulk Barn Foods, Ningxia Newfield Foods, Galinta, Archer Daniels Midland Company, Wilmar International, Lee Kum Kee, Krishna India, UA Global, Minn-Dak Growers, Birkett Mills, Bob’s Red Mill Natural Foods, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors:

The gluten-free grain buckwheat is becoming increasingly popular owing to its many health advantages, which include lowering the risk of diabetes, heart disease, and stroke. The market for buckwheat is anticipated to rise as people learn more about these health advantages. Because of its versatility, buckwheat can be used in a wide range of recipes, such as noodles, pancakes, and morning cereals. Additionally, it is discovering new uses in the food and beverage sector, including plant-based milks and yogurts, pastas, and breads that are gluten-free. Products like gluten-free breads and pastas are made with buckwheat flour.-

Restraining Factors

The adulteration in the buckwheat, decreasing magnitude of the production of the buckwheat, lack of awareness regarding the beneficial effects of the buckwheat in the various industries, high cost of the raw materials, and alterations in the climatic conditions may impede the market growth.

Market Segmentation

The global buckwheat market share is classified into source, form, and application.

- The conventional segment dominated the global buckwheat market in 2023 and is anticipated to grow at a CAGR of 2.92% throughout the forecast period.

Based on the source, the global buckwheat market is categorized into conventional and organic. Among these, the conventional segment dominated the global buckwheat market in 2023 and is anticipated to grow at a CAGR of 2.92% throughout the forecast period. The segment growth is driven by a simple production process, rich in nutrition, comprising a greater number of antioxidants, quality of standard, and cost-effective, gluten-free, and essential role in the management of the hyperglycemic condition and cardiovascular diseases.

- The groats segment accounted for the largest market share of 37.21% in 2023 and is expected to grow at a significant CAGR throughout the projected timeframe.

Based on the form, the global buckwheat market is categorized into flakes, groats, flour, and others. Among these, the groats segment accounted for the largest market share of 37.21% in 2023 and is expected to grow at a significant CAGR throughout the projected timeframe. The segment growth is facilitated by the following factors such as containing more nutrition, extensive usage in the food industry, and excellent source of the minerals, vitamins, and fiber.

- The food and beverages segment accounted for the largest market share in 2023 and is predicted to grow at a CAGR of 2.87% throughout the projected timeframe.

Based on the application, the global buckwheat market is categorized as animal feed, food and beverages, personal care and cosmetics, and others. Among these, the food and beverages segment accounted for the largest market share in 2023 and is predicted to grow at a CAGR of 2.87% throughout the projected timeframe. The sector growth is attributed to the extensive usage in food products owing to the richness in the essential amino acids, vitamins, consumption of the buckwheat in the dairy products such as bread, biscuits and other confectionaries, employed in the dietary supplements, and growing preference for the natural ingredients.

Regional Segment Analysis of the Global Buckwheat Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global buckwheat market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global buckwheat market over the predicted timeframe. The market for buckwheat in North America is driven by health benefits, plant-based food demand, gluten-free product, animal feed, and accessibility. Rich in protein, fiber, and essential minerals, buckwheat is naturally gluten-free, lowering the risk of heart disease, diabetes, and obesity. As vegetarian and vegan lifestyles gain popularity, there is a greater demand for plant-based foods like buckwheat, which can be used as a substitute for wheat in gluten-free products, especially for poultry and swine. Additionally, the demand for organic products is rising due to sustainable farming practices, and buckwheat is used in a variety of industries, owing to its antioxidant qualities and health benefits.

Asia Pacific is anticipated to grow at the fastest CAGR throughout the projected timeframe. Buckwheat is a staple in traditional cuisines in countries like Japan, China, and Korea, contributing to its steady demand. Buckwheat is widely used in food products like noodles, bread, snacks, beverages, and cosmetics due to its nutritional and antioxidant properties. The growing prevalence of gluten intolerance and celiac disease has led to the greater adoption of buckwheat as a gluten-free alternative. Moreover, organic farming practices are driving the production and consumption of organic buckwheat. Buckwheat is cultivated as a cover crop to improve soil fertility and prevent erosion. These factors are driving the Asia-Pacific buckwheat market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global buckwheat market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Homestead Organics

- Bulk Barn Foods

- Ningxia Newfield Foods

- Galinta

- Archer Daniels Midland Company

- Wilmar International

- Lee Kum Kee

- Krishna India

- UA Global

- Minn-Dak Growers

- Birkett Mills

- Bob’s Red Mill Natural Foods

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2025, Ukrainian engineering company Olis opened a buckwheat processing plant in Estonia, featuring its Optimatyk H-24 grain processing system. The plant can process up to 24 tons per day and includes metal structures, aspiration, gravity, pneumatic transport systems, electrical components, and automation. The equipment was adapted to fit the client's facility's architectural features and implemented multi-format packaging solutions from large bags to small retail packs.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global buckwheat market based on the below-mentioned segments:

Global Buckwheat Market, By Source

- Conventional

- Organic

Global Buckwheat Market, By Form

- Flakes

- Groats

- Flour

- Others

Global Buckwheat Market, By Application

- Animal Feed

- Food and Beverages

- Personal Care and Cosmetics

- Others

Global Buckwheat Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global buckwheat market?The global buckwheat market is projected to expand at a CAGR of 3.01% during the forecast period.

-

2. Who are the top key players in the global buckwheat market?The key players in the global buckwheat market are Homestead Organics, Bulk Barn Foods, Ningxia Newfield Foods, Galinta, Archer Daniels Midland Company, Wilmar International, Lee Kum Kee, Krishna India, UA Global, Minn-Dak Growers, Birkett Mills, Bob’s Red Mill Natural Foods, and others.

-

3. Which region holds the largest share of the market?North America is anticipated to hold the largest share of the global buckwheat market over the predicted timeframe.

Need help to buy this report?