Brazil Welding Equipment Market Size, Share, And COVID-19 Impact Analysis, By Equipment (Electrodes & Filler Metal Equipment, Oxy-Fuel Gas Equipment, And Other Equipment), By Type (Automatic, Semi-Automatic, And Manual), By Technology (Arc Welding, Resistance Welding, Laser Beam Welding, Oxy-Fuel Welding, And Other Technology), By End Use (Aerospace, Automotive, Building & Construction, Energy, Oil & Gas, Marine, And Other End Use), And Brazil Welding Equipment Market Insights, Industry Trend, Forecast To 2035

Industry: Machinery & EquipmentBrazil Welding Equipment Market Insights Forecasts to 2035

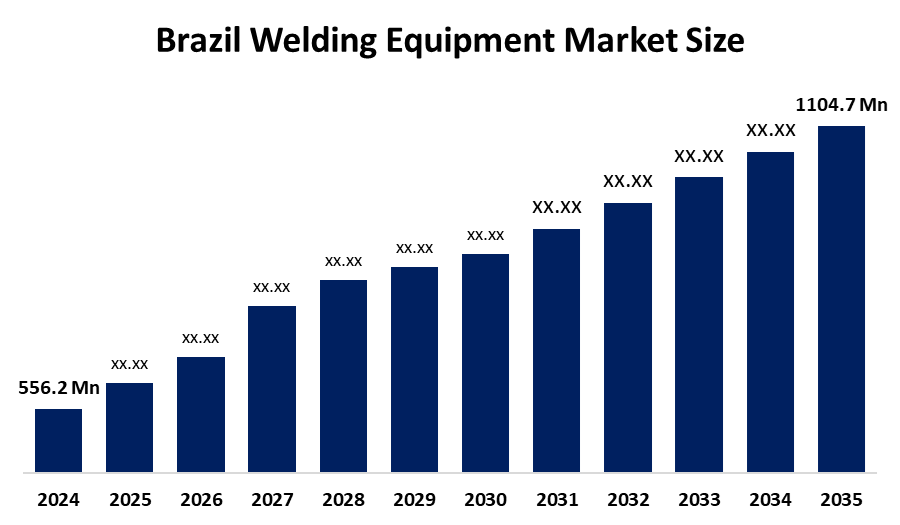

- Brazil Welding Equipment Market Size Was Estimated at USD 556.2 Million in 2024.

- The Market Size is Expected to Grow at a CAGR of Around 6.44% from 2025 to 2035.

- Brazil Welding Equipment Market Size is Expected to Reach USD 1104.7 Million by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Brazil Welding Equipment Market size is anticipated to reach USD 1104.7 Million by 2035, Growing at a CAGR of 6.44% from 2025 to 2035. The Brazil Welding Equipment Market Size is driven by industrial growth, infrastructure development, technological innovation and automation, sustainability pressures, and government industrial policies.

Market Overview

Welding Equipment refers to machines and tools used in the process of joining metals by melting them through the application of heat, pressure, or both to create a strong, unified bond. In most cases, additional filler materials will be added during the welding process to produce a strong joint when the product being manufactured is complete. The Brazil welding equipment market includes all of the welding equipment manufactured, sold, and supplied to all industries in Brazil, including automotive, construction, aerospace, oil & gas, and infrastructure. The equipment offered in this market includes traditional arc welding, resistance welding, advanced technologies, including laser and automated welding, and all associated consumables and accessories.

The Brazil Welding Equipment Market Size is driven by expanding industrial and manufacturing sectors, especially automobile and heavy fabrication industries that require high-quality joining processes. The growth of the construction and infrastructure market has created a demand for welding machines. Moreover, the advancement of technology such as automation, robotics and smart welding systems provide high levels of efficiency and accuracy in the manufacturing sector, also Brazil government program, Nova Industria Brasil program provides financial resources to modernize Brazilian industry from both public and private sources via credit lines for machines and equipment that have advanced technology integrated into them. As part of the Nova Industria Brasil program, in August 2025 the government announced the creation of a R$12 billion credit line for financing Industry 4.0 (advanced digitalized) equipment through BNDES and FINEP, with the objective of modernizing the Brazilian industrial base and improving its global competitiveness, thereby creating a favourable condition for the growth of the welding equipment market in Brazil.

Report Coverage

This research report categorizes the market for the Brazil Welding Equipment Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil Welding Equipment Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil Welding Equipment Market.

Brazil Welding Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 556.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.44% |

| 2035 Value Projection: | USD 1104.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 161 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Equipment, By Type, By Technology, By End Use |

| Companies covered:: | ESAB, Fronius do Brasil, Lincoln Electric, Panasonic Welding Systems, IIIinois Tool Works (ITW), Megalaser Industria Metalurgica Ltda., Laserflex Industrial Ltda., CenterLine, White Martins, Condor, Valmig Gas Solution, Gullco International, Motofil, PFERD TOOLS do Brasil, Amada Weld Tech,and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Brazil Welding Equipment Market Size is driven by industrial growth, rise in adoption of inverter-based welding machine, skilled labour shortage driving automation, growth of metal fabrication, shift towards lightweight materials, sustainability pressures, technological innovation, infrastructure development, and support from government industrial policies.

Restraining Factors

High initial investment costs, economic volatility, industrial uncertainty, maintenance and operating challenges, limited technology penetration in SMEs, infrastructure and logistic concerns issues restrain the welding equipment market in Brazil.

Market Segmentation

The Brazil welding equipment market share is classified into equipment, type, technology, and end use.

- The electrodes & fillers metal equipment segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil welding equipment market is segmented equipment into electrodes & filler metal equipment, oxy-fuel gas equipment, and other equipment. Among these, the electrodes & filler metal equipment segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by high usage in core industries, used with a variety of welding machines and processes, cost effective and affordable, easily contrast with other equipment recurring consumption, and wide applicability in the market.

- The automatic segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil welding equipment market is segmented by type into automatic, semi-automatic, and manual. Among these, the automatic segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to higher productivity, lower defect rates, integration with automation trends including robotics, sensors, and real time process control, and strong adoption by industrial manufacturers reducing reliance on manual labour increasing flexibility.

- The arc welding segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil welding equipment market is segmented by technology into arc welding, resistance welding, laser beam welding, oxy-fuel welding, and other technology. Among these, the arc welding segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by its ability to join varied metal types and thickness, low purchase and operating costs making it ideal for small workshops and field fabrication, and established presence in market with trained welders supporting continued high usage.

- The automotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil welding equipment market is segmented by end use into aerospace, automotive, building & construction, energy, oil & gas, marine, and other end use. Among these, the automotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to extensive use of welding in vehicle manufacturing assembling making welding equipment indispensable for this sector, high production volume and automation to maintain high precision and quality control in mass production, and technological adoption to meet quality standards.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within The Brazil welding equipment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ESAB

- Fronius do Brasil

- Lincoln Electric

- Panasonic Welding Systems

- IIIinois Tool Works (ITW)

- Megalaser Industria Metalurgica Ltda.

- Laserflex Industrial Ltda.

- CenterLine

- White Martins

- Condor

- Valmig Gas Solution

- Gullco International

- Motofil

- PFERD TOOLS do Brasil

- Amada Weld Tech

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

• In September 2025, ESAB, a global manufacturer in Brazil, introduced several new products at the FABTECH event, including the Dueler EHKL 1500 handheld laser welder and new heavy-industrial Cutmaster X manual plasma cutters (models 90 and 110). The company also launched a new Warrior Edge Aluminum System featuring the PP 350W push-pull MIG gun.

• In April 2024, ESAB launched the Warrior Edge 500 DX, a versatile multi-process power source that includes new WeldModes designed to optimize performance in various welding applications.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2025 to 2035. Spherical Insights has segmented the Brazil Welding Equipment Market based on the below-mentioned segments:

Brazil Welding Equipment Market, By Equipment

- Electrodes & Filler Metal Equipment

- Oxy-Fuel Gas Equipment

- Other Equipment

Brazil Welding Equipment Market, By Type

- Automatic

- Semi-Automatic

- Manual

Brazil Welding Equipment Market, By Technology

- Arc Welding

- Resistance Welding

- Laser Beam Welding

- Oxy-Fuel Welding

- Other Technology

Brazil Welding Equipment Market, By End Use

- Aerospace

- Automotive

- Building & Construction

- Energy

- Oil & Gas

- Marine

- Other End Use

Frequently Asked Questions (FAQ)

-

Q. What is the projected market size & growth rate of the Brazil Welding Equipment Market?A. Brazil Welding Equipment Market was valued at USD 556.2 Million in 2024 and is projected to reach USD 1104.7 Million by 2035, growing at a CAGR of 6.44% from 2025 to 2035.

-

Q. What are the key driving factors for the growth of the Brazil Welding Equipment Market?A The Brazil welding equipment market is driven by industrial growth, rise in adoption of inverter-based welding machine, skilled labour shortage driving automation, growth of metal fabrication, shift towards lightweight materials, sustainability pressures, technological innovation, infrastructure development, and support from government industrial policies.

-

Q. What are the top players operating in the Brazil Welding Equipment Market?A. ESAB, Fronius do Brasil, Lincoln Electric, Panasonic Welding Systems, IIIinois Tool Works (ITW), Megalaser Industria Metalurgica Ltda., Laserflex Industrial Ltda., CenterLine, White Martins, Condor, Valmig Gas Solution, Gullco International, Motofil, PFERD TOOLS do Brasil, Amada Weld Tech, and Others.

-

Q. What segments are covered in the Brazil Welding Equipment Market report?A. Brazil Welding Equipment Market is segmented based on Equipment, Type, Technology, and End Use

Need help to buy this report?