Brazil Vehicle Rental Market Size, Share, By Application Type (Leisure/Tourism, Business, and Daily Commuting), By Booking Type (Online and Offline), By Vehicle Type (Passenger Cars and Commercial Vehicles), By End User (Tour Operators and Fleet Operators), Brazil Vehicle Rental Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationBrazil Vehicle Rental Market Insights Forecasts to 2035

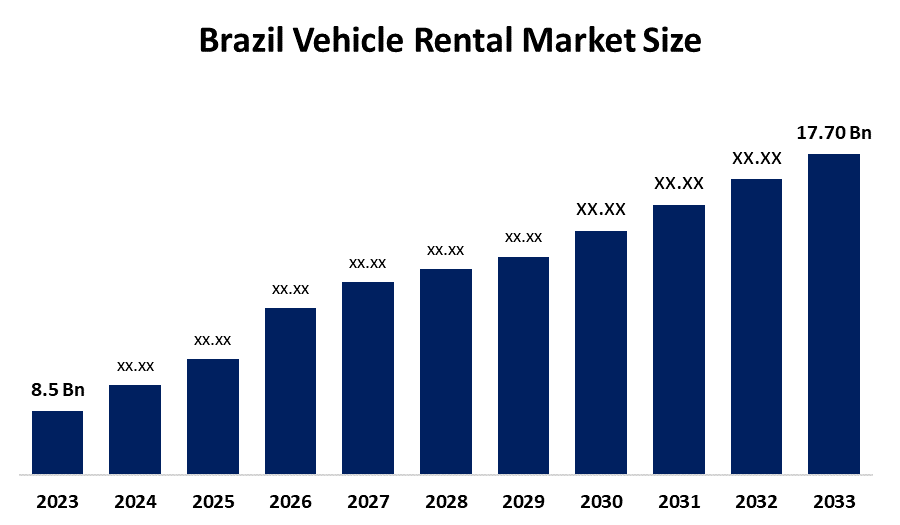

- Brazil Vehicle Rental Market Size 2024: USD 8.5 Bn

- Brazil Vehicle Rental Market Size 2035: USD 17.70 Bn

- Brazil Vehicle Rental Market CAGR 2024: 6.9%

- Brazil Vehicle Rental Market Segments: Application Type, Booking Type, Vehicle Type, End User.

Get more details on this report -

Vehicle rental is a transportation service that enables individuals or businesses to hire vehicles for short-term or long-term use by paying a rental fee. It includes cars, motorcycles, vans, buses, and trucks, offering flexibility, convenience, and cost savings by eliminating ownership, maintenance, insurance, and depreciation responsibilities for users. Furthermore, the Brazil vehicle rental market is growing due to rising tourism, increasing urbanization, expanding corporate travel, and growing preference for flexible mobility over vehicle ownership. Digital booking platforms, fleet modernization, and cost advantages compared to ownership further support steady market expansion.

The adoption of digital booking platforms is reshaping Brazil’s vehicle rental market, offering seamless user experiences through mobile apps and websites. For instance, as per industry reports, Unidas, a Brazil-based vehicle rental company with digital services, estimated a 10% revenue increase in 2024, supported by the steady growth of the rental market. Furthermore, Corporate demand for long-term vehicle leasing and fleet outsourcing is increasing as businesses seek cost-effective mobility solutions. For instance, according to industry reports, Brazil's car rental market fleet is expected to expand by 5.1%, reaching 1,650,000 vehicles in 2024, up from 1,570,820 in 2023, reflecting steady industry growth and rising demand.

Technological advancements are transforming the sector, with digital booking platforms streamlining reservations and enhancing customer experience. Online and mobile-based rental services offer seamless transactions, driving consumer preference for digital convenience. The growing trend of fleet outsourcing among businesses, particularly in logistics and transportation, is also driving demand. Economic factors, such as fluctuating vehicle ownership costs and shifting consumer preferences toward flexible mobility options, further encourage rental adoption. Regulatory support and financial incentives for fleet management companies contribute to the sector’s long-term sustainability and competitiveness. For instance, in December 2024, Brazil’s BNDES approved R$94.8 million (USD 15.6 million) in funding for MobiBrasil to purchase 87 electric buses for São Paulo, supporting the city’s transition to sustainable public transportation.

Market Dynamics of the Brazil Vehicle Rental Market:

The Brazil vehicle rental market is driven by increasing domestic and international tourism, which boosts short-term vehicle demand. Rising urbanization and corporate travel requirements encourage rentals. Consumers prefer renting over ownership due to cost savings, convenience, and flexible mobility. Digital platforms and mobile apps further simplify bookings, while fleet modernization and improved infrastructure support market growth. Economic development and higher disposable incomes also contribute, making vehicle rentals more accessible and popular among both individuals and businesses.

The Brazil vehicle rental market faces restraints such as high vehicle maintenance and fuel costs, fluctuating fuel prices, and economic uncertainties that affect consumer spending. Strict regulations, insurance requirements, and taxes increase operational costs for rental companies. Additionally, vehicle theft, damage risks, and limited availability of modern fleets in smaller cities can hinder market growth and profitability.

The Brazil vehicle rental market presents significant opportunities driven by increasing demand for short-term and long-term rentals among tourists, corporate clients, and urban commuters. The growing trend of digitalization, including mobile apps and online booking platforms, enhances customer convenience and expands market reach. Electric and hybrid vehicle rentals offer sustainable mobility solutions, attracting environmentally conscious consumers. Expanding fleet services, corporate partnerships, and vehicle subscription models also create new revenue streams, while infrastructure development and rising disposable incomes further support market growth and diversification.

Brazil Vehicle Rental Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8.5 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.9% |

| 2035 Value Projection: | USD 17.70 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 176 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Application Type,By Booking Type |

| Companies covered:: | Localiza Rent a Car S.A,Movida Participações S.A,Avis Budget Group,Enterprise Holdings,Sixt SE,Europcar Mobility Group,FOCO Rent a Car,Turbi,Vamos Locação,And others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Brazil Vehicle Rental Market share is classified into application type, booking type, vehicle type, and end user.

By Application:

The Brazil Vehicle Rental market is divided by application type into leisure/tourism, business, and daily commuting. Among these, the leisure/tourism segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The leisure/tourism segment dominates because Brazil is a major tourist destination, attracting both domestic and international travelers. Tourists prefer renting vehicles for flexibility, convenience, and the ability to explore multiple locations at their own pace. Seasonal demand peaks during holidays, festivals, and vacation periods, further boosting rentals. Additionally, popular tourist destinations often lack extensive public transport, making vehicle rentals more practical. The segment benefits from strong marketing, digital booking platforms, and tailored rental packages for travelers.

By Booking Type:

The Brazil Vehicle Rental market is divided by booking type into online and offline. Among these, the online segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The dominance of the online booking segment in Brazil’s vehicle rental market is driven by growing internet and smartphone penetration, which makes digital access convenient for consumers. Online platforms allow customers to compare prices, check vehicle availability, read reviews, and receive instant confirmations. Flexible payment options, discounts, and promotional offers further encourage online reservations. Additionally, the increasing adoption of mobile apps and digital solutions by rental companies enhances user experience, reduces dependency on offline channels, and expands market reach across urban and remote areas.

By Vehicle Type:

The Brazil Vehicle Rental market is divided by vehicle type into passenger cars and commercial vehicles. Among these, the passenger cars segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The dominance of passenger cars in Brazil’s vehicle rental market is driven by high demand from tourists, business travelers, and daily commuters seeking convenient and flexible personal transportation. Passenger cars provide comfort, fuel efficiency, and ease of use, making them ideal for city travel and leisure trips. In contrast, commercial vehicles are mainly rented for logistics or corporate purposes, which constitute a smaller portion of the market. The availability of diverse car models and affordable rental options further strengthens this segment’s leading position.

By End User:

The Brazil Vehicle Rental market is divided by end user into tour operators and fleet operators. Among these, the tour operators segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The dominance of tour operators is due to the country’s strong tourism sector, attracting both domestic and international travelers. Tour operators often arrange vehicles in bulk for sightseeing, excursions, and holiday packages, ensuring convenience and reliable transportation for tourists. This consistent demand during peak travel seasons drives higher rental volumes. In contrast, fleet operators cater primarily to corporate clients, which represent a smaller market segment. The organized services and marketing efforts of tour operators further strengthen their leading position.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil vehicle rental market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Vehicle Rental Market:

- Localiza Rent a Car S.A.

- Movida Participações S.A.

- Avis Budget Group

- Enterprise Holdings

- Sixt SE

- Europcar Mobility Group

- FOCO Rent a Car

- Turbo

- Vamos Locação

- Others

Recent Developments in Brazil Vehicle Rental Market:

In February 2024, Daimler Truck announced plans to launch its first truck-rental program in Brazil after investing R$ 200 million to seed a 100-unit fleet that will double by year-end.

In August 2024, Addiante announced a R$1 billion investment in partnership with Ambipar. The deal involves purchasing trucks, leaseback agreements, and fleet renewal for the group.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil vehicle rental market based on the below-mentioned segments:

Brazil Vehicle Rental Market, By Application Type

- Leisure/Tourism

- Business

- Daily Commuting

Brazil Vehicle Rental Market, By Booking Type

- Online

- Offline

Brazil Vehicle Rental Market, By Vehicle Type

- Passenger Cars

- Commercial Vehicles

Brazil Vehicle Rental Market, By End User

- Tour Operators

- Fleet Operators

Frequently Asked Questions (FAQ)

-

1. What is the Brazil vehicle rental market?It is a market where individuals and businesses hire vehicles, including cars and commercial vehicles, for short-term or long-term use.

-

2. Which segment dominates by application type?The leisure/tourism segment dominates due to high tourist demand and flexibility needs.

-

3. Which booking type is most popular?Online bookings lead the market because of convenience, instant confirmation, and easy comparison of prices.

-

4. Which vehicle type is most rented?Passenger cars dominate as they are preferred by tourists, commuters, and business travelers

-

5. Who are the major players in this market?Key companies include Localiza, Movida, Avis, Enterprise, Sixt, Europcar, FOCO, Turbi, Vamos, and Unidas.

-

6. What drives market growth?Rising tourism, urbanization, digital booking platforms, and preference for flexible mobility are major growth drivers.

-

7. What are the challenges in this market?High maintenance costs, fuel price fluctuations, theft risks, and regulatory requirements restrain growth.

-

8. What opportunities exist?Electric/hybrid vehicles, fleet expansion, corporate partnerships, and mobile app-based rentals offer significant growth opportunities.

-

1. What is the Brazil vehicle rental market?It is a market where individuals and businesses hire vehicles, including cars and commercial vehicles, for short-term or long-term use.

-

2. Which segment dominates by application type?The leisure/tourism segment dominates due to high tourist demand and flexibility needs.

-

3. Which booking type is most popular?Online bookings lead the market because of convenience, instant confirmation, and easy comparison of prices.

-

4. Which vehicle type is most rented?Passenger cars dominate as they are preferred by tourists, commuters, and business travelers

-

5. Who are the major players in this market?Key companies include Localiza, Movida, Avis, Enterprise, Sixt, Europcar, FOCO, Turbi, Vamos, and Unidas.

-

6. What drives market growth?Rising tourism, urbanization, digital booking platforms, and preference for flexible mobility are major growth drivers.

-

7. What are the challenges in this market?High maintenance costs, fuel price fluctuations, theft risks, and regulatory requirements restrain growth.

-

8. What opportunities exist?Electric/hybrid vehicles, fleet expansion, corporate partnerships, and mobile app-based rentals offer significant growth opportunities.

Need help to buy this report?