Brazil Toys and Games Market Size, Share, and COVID-19 Impact Analysis, By Product (Puzzles, Preschool Toys, Outdoor and Sports, Dolls, Video Games, Others), By Applications (Up to 8 years, 9 - 15 years, 15 years and above), By Distribution Channel (Offline, Online), and Brazil Toys and Games Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsBrazil Toys and Games Market Insights Forecasts to 2035

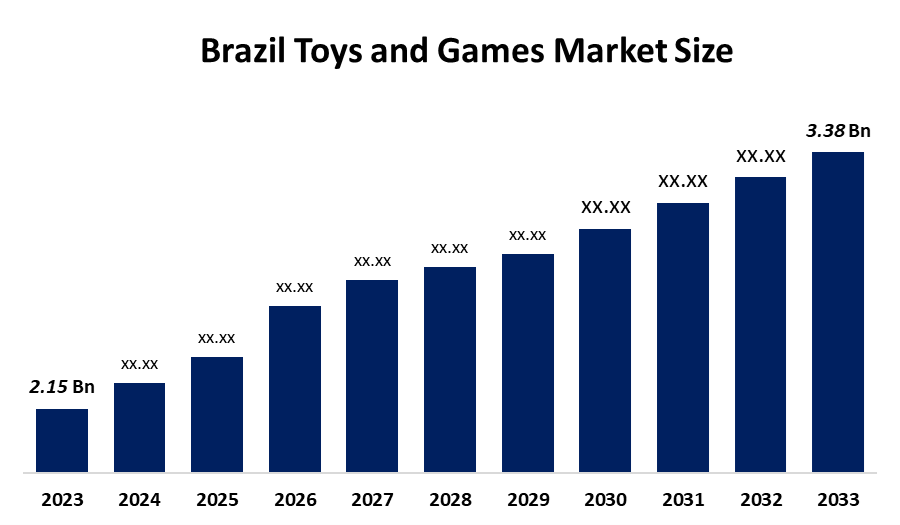

- The Brazil Toys and Games Market Size Was Estimated at USD 2.15 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.2% from 2025 to 2035

- The Brazil Toys and Games Market Size is Expected to Reach USD 3.38 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Brazil Toys and Games Market size is anticipated to reach USD 3.38 Billion by 2035, growing at a CAGR of 4.2% from 2025 to 2035. Brazil toys and games market is driven by rising disposable incomes, a large child population, growing demand for educational and digital toys, strong licensing of popular characters, expanding e-commerce channels, and increasing parental focus on creativity, learning, and entertainment.

Market Overview

Toys and games are products designed for play, entertainment, and the educational development of children. They include a wide range of offerings such as physical toys, board games, puzzles, and digital games, catering to different age groups and supporting creativity, social interaction, cognitive development, and recreational enjoyment. In Brazil, the toys and games market is strongly influenced by the country’s young population and the cultural significance of play. Rising disposable income is driving demand for a diverse range of toys and games, while licensing agreements with popular media franchises and the growing impact of digital technology on gaming are further supporting market growth. Additionally, increasing consumer preference for educational and eco-friendly toys is shaping the overall market landscape.

The Brazilian government plays an important role in the toys and games market by emphasizing safety standards, intellectual property protection, and the promotion of creativity and innovation. Government policies support local manufacturers, encourage innovative toy designs, and ensure compliance with strict safety regulations. In collaboration with industry stakeholders, regulatory authorities continue to introduce updated safety guidelines to promote responsible and sustainable market growth.

Following Brazil’s post-pandemic economic recovery, consumer spending has increased, leading to higher demand for non-essential products such as toys and games. The sector recorded approximately a 15% increase in sales during the first half of 2023, as households resumed discretionary spending. In 2024, the Brazil toys and games market further expanded, driven by the rising popularity of video games and the growing “kidult” trend. Additionally, the resurgence of traditional toys and games—partly supported by restrictions on mobile phone use in schools—contributed to strong sales growth in board games and puzzles. Consumers continued to favor established and trusted brands, which maintained significant influence over purchasing decisions. Despite this, the market remains fragmented, with a substantial share of value sales concentrated among leading companies.

Report Coverage

This research report categorizes the market for the Brazil toys and games market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil toys and games market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil toys and games market.

Brazil Toys and Games Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.15 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 4.2% |

| 2035 Value Projection: | USD 3.38 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product |

| Companies covered:: | Manufatura de Brinquedos Estrela S.A., Tectoy S.A., Grow Jogos e Brinquedos S.A., Candide Indústria e Comércio Ltda., Brinquedos Bandeirante S.A., Ri Happy Brinquedos, Mattel, Inc., Hasbro, Inc., The LEGO Group, and Other players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Brazil’s toys and games market growth is driven by a growing child population, improving household purchasing power, and changing consumer lifestyles. Parents increasingly prefer educational, STEM-based, and creativity-enhancing toys that support learning and development. Strong demand for licensed toys linked to movies, cartoons, and gaming franchises boosts sales. Rapid expansion of e-commerce, mobile shopping, and organized retail improves market reach. Additionally, innovation in interactive, digital, and eco-friendly toys, combined with strong gifting demand during festivals and holidays, further supports market expansion.

Restraining Factors

Brazil’s toys and games market faces restraints such as high import taxes and manufacturing costs, which increase product prices. Economic instability and inflation affect consumer spending on non-essential items. Competition from low-cost counterfeit toys and safety regulation compliance challenges further limit market growth, especially for international brands.

Market Segmentation

The Brazil toys and games market share is categorized by product, application, and distribution channel.

- The video games segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil toys and games market is segmented by product into puzzles, preschool toys, outdoor and sports, dolls, video games, and others. Among these, the video games segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by widespread smartphone usage, affordable mobile data, and strong internet connectivity. A large youth and young adult population actively engages in mobile, console, and online gaming. The rise of esports, social gaming, and digital downloads further boosts demand. Additionally, frequent game updates, in-app purchases, and strong influence from global gaming franchises and content creators sustain continuous consumer spending, making video games the most revenue-generating segment in the market.

- The 15 years and above segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil toys and games market is segmented by application into up to 8 years, 9 - 15 years, and 15 years and above. Among these, the 15 years and above segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the strong demand for video games, consoles, mobile gaming, and online multiplayer platforms among teenagers and adults. This age group has higher disposable income and spends more on premium games, subscriptions, and in-game purchases. Growing esports culture, streaming platforms, and social gaming trends further encourage continuous engagement. Additionally, nostalgia-driven purchases and collectible games also contribute to higher spending in this segment compared to younger age groups.

- The offline segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil toys and games market is segmented by distribution channel into offline, online. Among these, the offline segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the strong presence of specialty toy stores, supermarkets, hypermarkets, and shopping malls across urban areas. Consumers prefer offline channels to physically examine toys, check quality, safety, and authenticity, especially for children’s products. Immediate product availability and in-store promotions also encourage purchases. Additionally, traditional buying habits and strong seasonal sales during festivals and holidays further support offline channel dominance despite the rapid growth of e-commerce.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil toys and games market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

-

Manufatura de Brinquedos Estrela S.A.

-

Tectoy S.A.

-

Grow Jogos e Brinquedos S.A.

-

Candide Indústria e Comércio Ltda.

-

Brinquedos Bandeirante S.A.

-

Ri Happy Brinquedos

-

Mattel, Inc.

-

Hasbro, Inc.

-

The LEGO Group

-

Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent News

11 March 2024, Redibra, a licensing company based in Brazil, has secured exclusive rights to represent the brand licensing for Unicorn Academy, a new fantasy-adventure series created by Spin Master. This CGI-animated series, produced by Spin Master Entertainment for Netflix, has already engaged audiences in over 190 countries and is available in more than 30 languages. Following the release of a 72-minute movie special and eight 22-minute episodes, 2024 promises to bring even more exciting content, along with a range of consumer products, such as toys and digital games, also developed by Spin Master.

31 October 2023, Candide Indústria e Comércio LTDA, a leading toy distributor in Brazil has established a strategic partnership with premier American collectibles company Funko. The agreement is a major step forward for the international expansion plans of Funko. To commemorate the alliance, Candide is set to debut an exclusive Funko booth at the annual Comic Con CCXP event in Brazil.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil toys and games market based on the below-mentioned segments:

Brazil Toys and Games Market, By Product

- Puzzles

- Preschool Toys

- Outdoor and Sports

- Dolls

- Video Games

- Others

Brazil Toys and Games Market, By Application

- Up to 8 years

- 9 - 15 years

- 15 years and above

Brazil Toys and Games Market, By Distribution Channel

- Offline

- Online

Frequently Asked Questions (FAQ)

-

What is driving the growth of Brazil’s toys and games market? Growth is driven by a large young population, rising disposable income, demand for educational and digital toys, licensed merchandise popularity, and expanding e-commerce and organized retail.

-

Which product segment dominates the market? The video games segment dominates due to high smartphone penetration, strong gaming culture, esports growth, and increased spending on digital entertainment

-

Which age group contributes the most to market revenue? The 15 years and above segment contributes the most, supported by higher spending on video games, consoles, subscriptions, and in-game purchases.

-

Which distribution channel is dominant in Brazil? Offline retail dominates, supported by toy stores, supermarkets, and malls, where consumers prefer physical inspection and immediate purchase

-

What are the key challenges in the market? Major challenges include high import taxes, economic fluctuations, price sensitivity, and competition from low-cost counterfeit toys

Need help to buy this report?