Brazil Sugar Confectionery Market Size, Share, By Product Type (Hard-Boiled Sweets, Caramel & Toffees, Gums & Jellies, Medicated Confectionery, Mints, Others), By Packaging Type (Sachet, Box, Others), By Distribution Channel (Retail Stores, Online Stores, Others), Brazil Sugar Confectionery Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesBrazil Sugar Confectionery Market Insights Forecasts to 2035

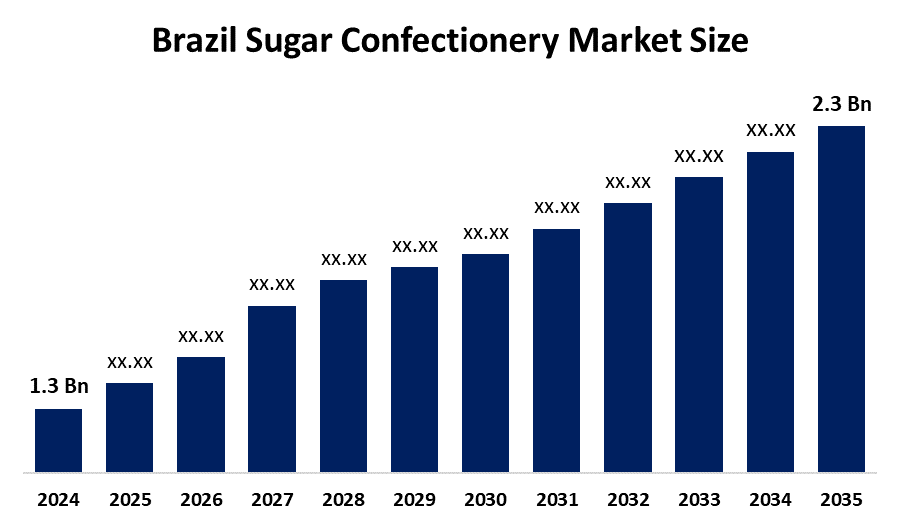

- Brazil Sugar Confectionery Market Size 2024: USD 1.3 Bn

- Brazil Sugar Confectionery Market Size 2035: USD 2.3 Bn

- Brazil Sugar Confectionery Market CAGR 2024: 6.1%

- Brazil Sugar Confectionery Market Segments: Phase Type, Packaging, and Distribution Channel

Get more details on this report -

Sugar confectionery is typically made up of foods made from sugar or sugar substitutes, starch, gelatine, glucose syrup, and flavours. There are many types of sugar confectionery, for example, gummies, candy, etc. Sugar confectionery products have a large market share in many cultures, due in large part to their wide acceptance as snack food, gift items, and holiday food, as well as being enjoyed by people of all ages. Brazil's candy confectionery industry continues to experience rapid growth due to the ready availability of cane sugar, increasing disposable incomes, the rise of urban lifestyles, and the increasing number of low-cost sugary treats. The innovative development of new flavour combinations and the emergence of retail stores and e-commerce platforms across Brazil support this increasing consumer demand for sugar confectionery.

Governments regulate the Brazilian sugar confectionery Market Size sector in numerous ways, including around product quality and safety, marketing and advertising, and labelling. Various government entities, such as ANVISA, implement a set of standards regarding health and safety for Brazil's confectionery industry that all manufacturers must achieve to be allowed to sell their products. For example, ANVISA requires that confectionery manufacturers use appropriate methods for sourcing and processing raw materials, maintain the best environmental conditions for the production, storage, and handling of products, ensure that packaging maintains product quality, and offer customers a quality product that meets their expectations. Product labelling regulations include providing detailed information about the ingredients and nutritional benefits of products, as well as information about allergenic ingredients, product storage instructions, and expiration dates. Advertising and promotional regulations exist to prevent consumers from being misled by advertisements and other promotional offers regarding the health benefits or other advantages of confectionery products, to children and families. Manufacturers and retailers must comply with the product labelling and advertising regulations to remain legally compliant, maintain consumer trust in their brand, and grow the market.

The market for high-end and handmade sugar confectionery is picking up speed in Brazil. Consumers are being more open to paying extra for quality ingredients, special flavors, and handmade goods. The boom in specialty stores and internet services is making premium products more available, which come with a glamorous label as opulent treats. This trend among consumers is predominantly found among the wealthy and millennial generations and is driven by the desire for bespoke and distinctive experiences. Producers are meeting the trend with limited-edition items, upscale flavors, and special partnerships with on-trend local artisans. For instance, in June 2025, Nestlé Professional launched Prestigio paste in Brazil, inspired by classic coconut candy. The chocolate-flavored paste with coconut pieces is versatile for decorations, fillings, baking, and freezing, expanding Nestlé’s food service product line. Additionally, this trend towards premiumization is a sign of increasing demand for differentiation and the willingness to move beyond the mass-market confectionery and try distinctive flavor profiles.

Brazil Sugar Confectionery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.3 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.1% |

| 2035 Value Projection: | USD 2.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Product Type, By Packaging Type |

| Companies covered:: | Arcor Brasil, Mondelez Brasil, Perfetti Van Melle Brasil, Nestlé Brasil, Dori Alimentos, Florestal Alimentos, Docile Alimentos, Riclan, Fini Brasil, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Brazil Sugar Confectionery Market:

The Brazil Sugar Confectionery Market Size is driven by the country’s strong sugar production base, ensuring steady raw material availability and cost efficiency. Rising disposable incomes, urbanization, and a young population support frequent consumption of affordable indulgent treats. Growing demand for impulse snacks, gifting, and seasonal confectionery further fuels sales. Innovation in flavors, textures, and packaging, along with the introduction of premium and reduced-sugar variants, attracts diverse consumers. Additionally, the expansion of supermarkets, convenience stores, and e-commerce platforms improves product accessibility and market reach across urban and semi-urban areas.

The Brazil Sugar Confectionery Market Size is restrained from growing health awareness and rising concerns over obesity and diabetes, which reduce sugar consumption. Increasing government regulations, sugar taxes, and labeling requirements further impact demand. Volatile sugar prices, competition from healthier snack alternatives, and rising production and logistics costs also challenge market growth and profitability for manufacturers.

The future of brazil sugar confectionery market is bright and promising, with versatile opportunities through the development of low-sugar, sugar-free, and functional products targeting health-conscious consumers. Premiumization, innovative flavors, and sustainable packaging can enhance brand appeal. Expanding e-commerce, impulse-buy formats, and gifting segments, along with penetration into emerging urban and rural markets, further support future growth.

Market Segmentation

The Brazil Sugar Confectionery Market share is classified into product type, packaging type, and distribution channel.

By Product Type:

The Brazil Sugar Confectionery Market Size is divided by product type into hard-boiled sweets, caramel & toffees, gums & jellies, medicated confectionery, mints, and others. Among these, the gums & jellies segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. strong consumer preference for chewy textures, fruity flavors, and colorful formats, especially among children and young adults. Gummies and jellies benefit from impulse buying, affordable pricing, wide availability across retail channels, and continuous product innovation, making them the most popular and high-volume category in the market.

By packaging type:

The Brazil Sugar Confectionery Market Size is divided by packaging type into sachet, box, and others. Among these, the sachet segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Sachet packaging dominates because it is affordable, lightweight, and convenient for on-the-go consumption. It suits single-serve and impulse buying behavior, which is common among Brazilian consumers, especially children and young adults. Sachets are widely used in convenience stores, kiosks, and supermarkets, ensuring high product visibility. Their lower packaging and transportation costs help manufacturers offer competitive pricing, making sachets attractive in a price-sensitive market.

By Distribution Channel

The Brazil Sugar Confectionery Market Size is divided by distribution channel into retail stores, online stores, and others. Among these, the retail stores segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Retail stores dominate because they offer wide accessibility, extensive product variety, and immediate purchase options, which appeal to consumers seeking convenience and impulse buys. Supermarkets, hypermarkets, and convenience stores provide prominent shelf visibility, promotional displays, and bundled offers that attract buyers. While online channels are growing, many consumers still prefer physically selecting candies, gums, and chocolates. Additionally, retail stores support bulk purchases, seasonal demand, and last-minute gifting, reinforcing their leading role in market sales.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil sugar confectionery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Sugar Confectionery Market:

- Arcor Brasil

- Mondelez Brasil

- Perfetti Van Melle Brasil

- Nestlé Brasil

- Dori Alimentos

- Florestal Alimentos

- Docile Alimentos

- Riclan

- Fini Brasil

- Others

Recent News in Brazil Sugar Confectionery Market:

In August 2023, the acquisition of chocolate company Garoto by Nestlé has been conditionally approved by Brazil's competition authority after more than two decades of legal battles. Through this strategic move, Nestlé aims to accelerate product development, expand ESG actions, and further develop its sustainable sourcing program in Brazil.

In July 2023, Ferrara Candy Company, the largest sugar confectionery company in the U.S., has announced its acquisition of Dori Alimentos, a leading candy and snacks manufacturer in Brazil. The transaction will be made through Ferrara's holding company and is expected to bring together complementary candy portfolios and create opportunities for both companies. The acquisition is set to strengthen Ferrara's presence in the fast-growing Brazilian market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil sugar confectionery market based on the below-mentioned segments:

Brazil Sugar Confectionery Market, By Product Type

- Hard-Boiled Sweets

- Caramel & Toffees

- Gums & Jellies

- Medicated Confectionery

- Mints

- Others

Brazil Sugar Confectionery Market, By Packaging Type

- Sachet

- Box

- Others

Brazil Sugar Confectionery Market, By Distribution Channel

- Retail Stores

- Online Stores

- Others

Frequently Asked Questions (FAQ)

-

How does Brazil’s sugar production affect the confectionery market?Brazil’s abundant sugar supply ensures cost-effective manufacturing, stable raw material availability, and competitive pricing for local confectionery products.

-

Are regional tastes influencing product innovation in Brazil?Yes, regional preferences for tropical fruit flavors, spicy-sweet combinations, and traditional Brazilian treats drive manufacturers to create localized products.

-

How is sustainability impacting the market?Eco-friendly packaging and ethically sourced ingredients are becoming important, with brands gaining consumer trust through responsible practices.

-

Which consumer group drives impulse confectionery purchases?Children, teenagers, and young adults are the primary drivers of impulse buys, especially for gums, jellies, and colorful candies.

-

How does seasonality affect sales?Festivals, holidays, and school events cause seasonal spikes in demand, encouraging limited-edition and gift-pack offerings.

-

Are there opportunities in online personalization?Yes, e-commerce allows custom flavor packs, gift sets, and subscription boxes, expanding engagement and repeat purchases.

-

How does urbanization influence the market?Urban lifestyles increase demand for convenient, on-the-go confectionery formats, fueling sachet and small-pack sales in cities.

Need help to buy this report?