Brazil Sports Drinks Market Size, Share, and COVID-19 Impact Analysis, By Packaging (PET Bottles, Cans), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail Channel, and Others), and Brazil Sports Drinks Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesBrazil Sports Drinks Market Insights Forecasts to 2035

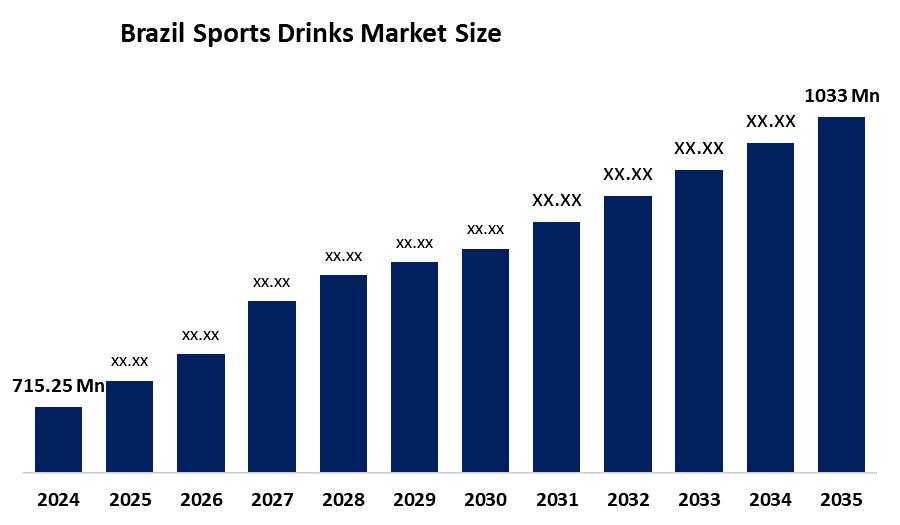

- The Brazil Sports Drinks Market Size Was Estimated at USD 715.25 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.4% from 2025 to 2035

- The Brazil Sports Drinks Market Size is Expected to Reach USD 1033 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Brazil sports drinks market size is anticipated to reach USD 1033 million by 2035, growing at a CAGR of 3.4% from 2025 to 2035. The Brazil sports drinks market is driven by rising health consciousness, increasing fitness and gym culture, growing participation in sports, urbanization, and demand for hydration and energy-boosting beverages, alongside product innovation with functional ingredients and natural formulations.

Market Overview

The Brazil sports drinks market consists of beverages specifically formulated to support hydration, electrolyte balance, and energy replenishment during and after physical activity. These drinks include isotonic, energy, and protein-fortified variants aimed at athletes, fitness enthusiasts, and health-conscious consumers. The market has experienced steady growth due to increasing awareness of fitness and wellness, rising participation in sports and gym activities, urbanization, and higher disposable incomes. Expanding retail channels, including supermarkets, convenience stores, and e-commerce platforms, have further boosted product availability. Analysts project the market to maintain a compound annual growth rate (CAGR) of 3–7% over the coming years, driven by continued consumer focus on performance, recovery, and functional nutrition.

Government support and policies play an indirect yet significant role in the market’s development. Programs such as Brazil’s “Mais Esporte” promote sports participation, youth engagement, and public physical activity initiatives, increasing the potential consumer base for sports drinks. Hosting major sporting events also raises awareness of performance beverages. Additionally, the Brazilian Health Regulatory Agency (ANVISA) ensures strict compliance for product safety, labeling, and health claims, fostering consumer confidence in sports drinks. While no direct subsidies exist, these regulatory frameworks and initiatives create a supportive environment for market growth.

Key trends shaping the Brazil sports drinks market include a growing focus on health and functional benefits, with low-sugar, vitamin-enriched, and clean-label products gaining popularity. Product innovation continues, with plant-based, electrolyte-rich, and specialty hydration formulas emerging. Expanded distribution through physical and online channels improves accessibility nationwide. Finally, the increasing fitness and sports culture, reflected in higher gym memberships and participation in athletic events, drives consistent demand for performance-focused beverages, sustaining market growth.

Report Coverage

This research report categorizes the market for the Brazil sports drinks market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil sports drinks market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil sports drinks market.

Brazil Sports Drinks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 715.25 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 3.4% |

| 2035 Value Projection: | USD 1033 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | PepsiCo, Inc., The Coca-Cola Company, Red Bull GmbH, Monster Beverage Corporation, BA Sports Nutrition, LLC, Kill Cliff, Suntory Beverage & Food Limited, Fraser and Neave Holdings Bhd, and Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Brazil sports drinks market is primarily driven by rising health consciousness and increasing awareness of fitness and wellness among consumers. Growing participation in gym activities, sports, and outdoor exercises fuels demand for hydration and performance-enhancing beverages. Urbanization and higher disposable incomes make functional drinks more accessible, while lifestyle shifts toward preventive health and active living support consistent consumption. Additionally, product innovation with low-sugar, vitamin-enriched, and electrolyte-rich formulations attracts health-focused consumers, further boosting market growth and expanding the consumer base across various age groups and activity levels.

Restraining Factors

The Brazil sports drinks market faces restraints due to high sugar content in many products, leading to growing health concerns among consumers. Additionally, intense competition from alternative beverages like flavored water and natural juices limits market growth. Price sensitivity, particularly among young consumers, and strict regulatory requirements for labeling and nutritional claims further challenge market expansion and profitability.

Market Segmentation

The Brazil sports drinks market share is classified into packaging and distribution channel.

- The PET bottles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil sports drinks market is segmented by packaging into PET bottles and cans. Among these, the PET bottles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. PET bottles dominate the market due to their convenience, portability, and practicality. They are lightweight, reducing transportation costs and making them easier for consumers to carry during workouts or outdoor activities. PET bottles also offer resealability, allowing users to consume the drink in multiple sittings, unlike cans. Additionally, they can hold larger volumes, catering to consumers seeking more hydration per purchase. Their cost-effectiveness and widespread availability in retail and gyms further strengthen their market dominance.

- The supermarkets and hypermarkets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil sports drinks market is segmented by distribution channel into supermarkets and hypermarkets, convenience stores, online retail channels, and others. Among these, the supermarkets and hypermarkets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Supermarkets and hypermarkets dominate the market because they provide high product availability, competitive pricing, and a one-stop shopping experience, attracting a broad consumer base. Their widespread presence in urban and semi-urban areas ensures easy accessibility for regular and occasional buyers. These stores also run frequent promotions and discounts, encouraging bulk purchases. Additionally, consumers trust these organized retail channels for product quality and authenticity, making them the preferred choice over convenience stores, online platforms, and other smaller outlets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil sports drinks market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PepsiCo, Inc.

- The Coca-Cola Company

- Red Bull GmbH

- Monster Beverage Corporation

- BA Sports Nutrition, LLC

- Kill Cliff

- Suntory Beverage & Food Limited

- Fraser and Neave Holdings Bhd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil sports drinks market based on the below-mentioned segments:

Brazil Sports Drinks Market, By Packaging

- PET Bottles

- Cans

Brazil Sports Drinks Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail Channel

- Others

Frequently Asked Questions (FAQ)

-

Q1. Why are sports drinks gaining popularity beyond athletes in Brazil?Increasing urban fitness culture, outdoor activities, and heat-driven hydration needs have expanded consumption to non-athletes.

-

Q2. What is the preferred packaging type in Brazil and why?PET bottles lead due to portability, resealability, and larger volumes, which suit active lifestyles and on-the-go consumption.

-

Q3. Which retail channels are most effective for sales?Supermarkets and hypermarkets dominate because of wide availability, promotional offers, and easy access for bulk buying.

-

Q4. Are smaller, local brands making an impact?health-focused and niche local brands are gaining traction with natural ingredients and innovative formulations.

-

Q5. How is taste influencing market trends?Consumers increasingly demand unique flavors, prompting brands to launch fruit-infused and natural taste options.

-

Q6. What health concerns affect market growth?High sugar content in some drinks has led to cautious consumption and demand for low-sugar or fortified alternatives.

Need help to buy this report?