Brazil Soft Gel Capsule Market Size, Share, By Type (Gelatin Capsules and Non-Gelatin Softgel Capsules), By Manufacturers (Pharmaceutical Companies, Nutraceutical Companies, and Others), By Application (Health Supplements, Pharmaceuticals, and Cosmetics & Personal Care), Brazil Soft Gel Capsule Market Size Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareBrazil Soft Gel Capsule Market Size Insights Forecasts to 2035

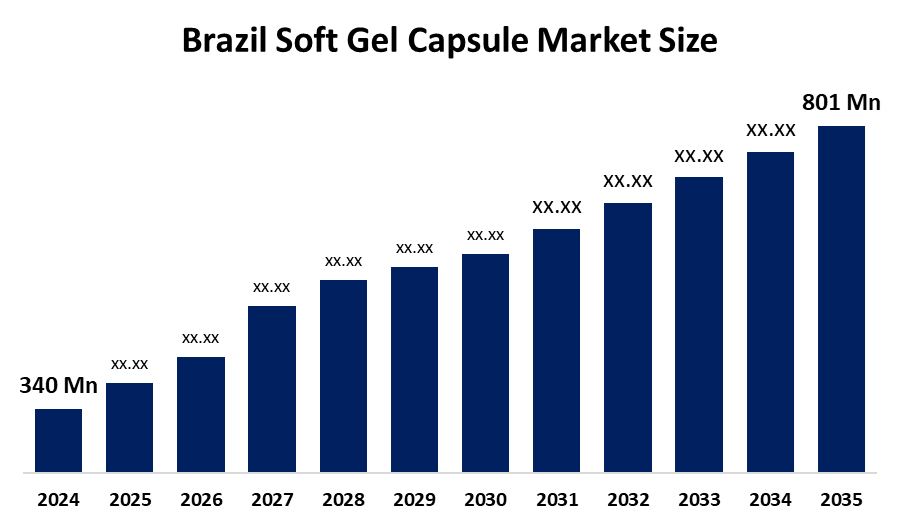

- Brazil Soft Gel Capsule Market Size 2024: USD 340 Mn

- Brazil Soft Gel Capsule Market Size 2035: USD 801 Mn

- Brazil Soft Gel Capsule Market Size CAGR 2024: 7.1%

- Brazil Soft Gel Capsule Market Size Segments: Type, Manufacturers, Application.

Get more details on this report -

Soft gel capsules are a solid oral dosage form consisting of a smooth, flexible gelatin shell filled with liquid or semi-solid formulations such as oils, suspensions, or solutions. They are designed to improve drug stability, enhance the bioavailability of poorly soluble ingredients, and offer easy swallowing with accurate dosing for patients. Furthermore, the rapid growth of Brazil’s soft gel capsules market is driven by rising consumer demand for health supplements and nutraceuticals, growing pharmaceutical adoption for enhanced bioavailability, expanding contract manufacturing, and improved manufacturing technologies that boost product quality and accessibility. Supportive regulations and increasing awareness of preventive healthcare also accelerate market expansion.

The Brazil Soft Gel Capsules Market Size is being shaped by several key trends, reflecting both global shifts and local demands. A significant trend is the pronounced shift toward plant-based and non-gelatin soft gel capsules, driven by the expanding vegan and vegetarian populations, as well as general consumer preference for cleaner label products. This trend mandates investment in alternative shell materials like tapioca or carrageenan. Another major trend involves advancements in encapsulation and fill-material technologies, notably the development of specialized soft gels for targeted delivery, such as enteric coatings that ensure the capsule bypasses the stomach and dissolves in the intestine, enhancing drug absorption and reducing gastric irritation.

Continuous advancements in rotary die technology, automated filling systems, and high-precision encapsulation improve product quality and manufacturing efficiency. Manufacturers in Brazil increasingly invest in technology that supports production scalability, uniformity, and stability. New encapsulation materials allow previously incompatible APIs and nutrients to be formulated into soft gels. Improved machinery reduces product defects, optimizing throughput and reducing waste. Technology investments enhance compliance with stringent regulatory standards. These improvements significantly elevate market competitiveness and industry capability.

Brazil Soft Gel Capsule Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 340 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.1% |

| 2035 Value Projection: | 801 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Manufacturers |

| Companies covered:: | Softcaps (Procaps Group), Procaps Group, Catalent, Inc., Aenova Group, Sirio Pharma, EuroCaps Ltd., Lonza Group, Thermo Fisher Scientific, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Brazil Soft Gel Capsule Market Size:

The Brazil soft gel capsules market is driven by increasing demand for dietary supplements, vitamins, and nutraceuticals due to rising health consciousness and preventive healthcare trends. Soft gel capsules are preferred for their superior bioavailability, easy swallowing, and accurate dosing, supporting adoption in pharmaceuticals and supplements. Growth in the aging population, higher incidence of lifestyle diseases, and expanding self-medication practices further fuel demand. Additionally, advancements in encapsulation technology, the availability of plant-based softgels, expanding contract manufacturing, and strong distribution through pharmacies and online channels significantly support market growth.

The Brazil soft gel capsules market faces restraints such as high manufacturing and raw material costs, particularly gelatin and specialized fill materials. Strict regulatory compliance increases approval time and costs. The sensitivity of soft gels to heat and humidity affects storage and shelf life. Additionally, limited skilled manufacturing capabilities and competition from tablets and hard capsules limit wider adoption.

The Brazil soft gel capsules market presents strong opportunities driven by rising demand for nutraceuticals, herbal supplements, and omega-3 products. Growing preference for preventive healthcare and self-medication supports market expansion. The development of plant-based and clean-label soft gel capsules creates new avenues among vegan and health-conscious consumers. Expansion of contract manufacturing, increasing pharmaceutical R&D, and the rapid growth of e-commerce and pharmacy chains further enhance market reach. Additionally, technological advancements improving stability and bioavailability offer opportunities for product differentiation and long-term growth.

Market Segmentation

The Brazil Soft Gel Capsule Market Size share is classified into type, manufacturer, and application.

By Type:

The Brazil Soft Gel Capsule Market Size is divided by type into gelatin capsules and non-gelatin softgel capsules. Among these, the gelatin capsules segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Gelatin soft gel capsules dominate because they are cost-effective, widely available, and supported by well-established manufacturing processes. They offer excellent flexibility, stability, and compatibility with oils and liquid formulations commonly used in pharmaceuticals and dietary supplements. Strong regulatory acceptance and long-standing consumer trust further support their widespread use. In addition, Brazil’s large nutraceutical and pharmaceutical industries prefer gelatin softgels due to their reliable performance, scalable production, and consistent quality across diverse applications.

By Manufacturer:

The Brazil Soft Gel Capsule Market Size is divided by manufacturer into pharmaceutical companies, nutraceutical companies, and others. Among these, the nutraceutical companies segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Nutraceutical companies dominate due to strong consumer demand for dietary supplements, vitamins, and omega-3 products. Soft gel capsules are preferred for their easy swallowing, better absorption, and appealing appearance, making them ideal for nutraceutical formulations. Rising health awareness, preventive healthcare trends, and self-medication practices further boost consumption. Additionally, widespread distribution through pharmacies, supermarkets, and e-commerce platforms allows nutraceutical brands to reach a broad consumer base, reinforcing their market dominance.

By Application:

The Brazil Soft Gel Capsule Market Size is divided by application into health supplements, pharmaceuticals, and cosmetics & personal care. Among these, the health supplements segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Health supplements dominate because consumers widely use vitamins, minerals, omega-3 fatty acids, and herbal products for daily wellness and preventive healthcare. Soft gel capsules are preferred for their easy swallowing, faster absorption, and accurate dosing. Rising health awareness, increasing self-medication, and a growing aging population further boost demand. In addition, strong availability through pharmacies, supermarkets, and online platforms enables a wide product reach, supporting the leading position of the health supplements segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil Soft Gel Capsule Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Soft Gel Capsule Market Size:

- Softcaps (Procaps Group)

- Procaps Group

- Catalent, Inc.

- Aenova Group

- Sirio Pharma

- EuroCaps Ltd.

- Lonza Group

- Thermo Fisher Scientific

- Others

Recent Developments in Brazil Soft Gel Capsule Market Size:

In June 2020, Capsugel (Lonza) announced the launch of DBcaps or double-blinded capsules, designed to opaquely and securely over-encapsulate drugs during clinical trials.

In May 2021, Hofseth BioCare ASA (HBC) partnered with Catalent to develop a delayed-release formulation of HBC’s OmeGo fish oil. Under this partnership, Catalent used its proprietary OptiGel DR technology to encapsulate OmeGo, HBC’s unique fish oil derived from sustainable, traceable, and fresh Norwegian Atlantic salmon.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil Soft Gel Capsule Market Size based on the below-mentioned segments:

Brazil Soft Gel Capsule Market Size, By Type

- Gelatin Capsules

- Non-Gelatin Softgel Capsules

Brazil Soft Gel Capsule Market Size, By Manufacturers

- Pharmaceutical Companies

- Nutraceutical Companies

- Others

Brazil Soft Gel Capsule Market Size, By Application

- Health Supplements

- Pharmaceuticals

- Cosmetics & Personal Care

Frequently Asked Questions (FAQ)

-

What are soft gel capsules?Soft gel capsules are oral dosage forms with a soft gelatin or non-gelatin shell containing liquid or semi-solid ingredients.

-

Which segment dominates the Brazil Soft Gel Capsule Market Size?Health supplements dominate the market due to high demand for vitamins, omega-3, and herbal products.

-

Which type of soft gel capsule is most widely used?Gelatin soft gel capsules dominate because of cost-effectiveness and established manufacturing processes.

-

Who are the major end users?Nutraceutical companies are the leading end users, followed by pharmaceutical companies.

-

What drives market growth in Brazil?Rising health awareness, preventive healthcare trends, and demand for easy-to-consume supplements drive growth.

Need help to buy this report?