Brazil Social Commerce Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Apparel, Personal and Beauty Care, Accessories, Home Products, Health Supplements, Food and Beverages, Other), By Sales Channel (Video Commerce, Social Network-Led Commerce, Social Reselling, and Other), and Brazil Social Commerce Market Insights, Industry Trend, Forecasts to 2035

Industry: Electronics, ICT & MediaBrazil Social Commerce Market Size Insights Forecasts to 2035

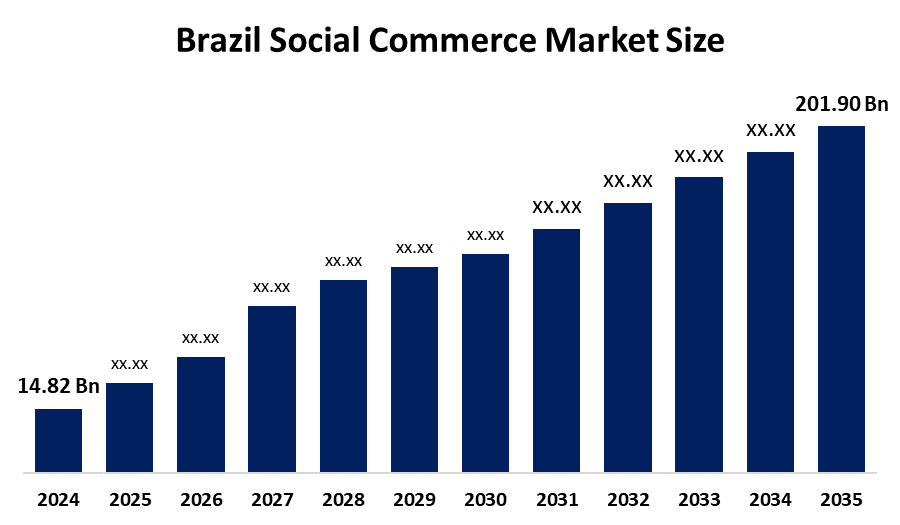

- The Brazil Social Commerce Market Size Was Estimated at USD 14.82 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 26.8% from 2025 to 2035

- The Brazil Social Commerce Market Size is Expected to Reach USD 201.90 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Brazil Social Commerce Market Size Is Anticipated To Reach USD 201 Billion By 2035, Growing At A CAGR Of 26.8% From 2025 To 2035. The Brazil social commerce market is driven by increasing smartphone penetration, widespread social media usage, rising e-commerce adoption, and consumer preference for convenient, personalized shopping experiences, along with the growth of influencer marketing and integrated payment solutions, boosting online transactions.

Market Overview

The Brazil Social Commerce Market Size refers to buying and selling products or services directly through social media platforms like Instagram, Facebook, TikTok, and WhatsApp, combining e-commerce with social interactions. The market is growing rapidly due to increasing smartphone and internet penetration, widespread social media usage, and rising e-commerce adoption. Influencer marketing, user-generated content, and live product demonstrations enhance consumer engagement and trust. Additionally, the COVID-19 pandemic accelerated digital shopping habits, encouraging both small businesses and large retailers to adopt social commerce strategies for direct consumer reach.

Key trends shaping the market include live-stream shopping for real-time engagement, integrated in-app payment solutions for seamless transactions, AI-driven personalization for targeted recommendations, and social selling by small businesses to expand reach. Technology and innovation are also vital, with AR/VR tools for virtual try-ons, chatbots for instant support, and analytics to optimize product offerings. Continuous advancements in mobile apps and social media features ensure a smooth, engaging, and scalable shopping experience, attracting both consumers and businesses.

Technology and innovation play a key role in Brazil’s social commerce market. Platforms are integrating AR and VR tools for virtual try-ons, chatbots for instant customer support, and AI-driven algorithms for personalized recommendations. Advanced analytics help businesses optimize product offerings, while automated logistics and inventory management improve delivery efficiency. Mobile apps and social media features continue to evolve, providing seamless and engaging shopping experiences. These innovations enhance customer satisfaction, boost sales, and allow both small and large businesses to scale effectively in the competitive social commerce landscape.

Report Coverage

This research report categorizes the market for the Brazil Social Commerce Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil social commerce market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil social commerce market.

Brazil Social Commerce Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14.82 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 26.8% |

| 2035 Value Projection: | USD 201.90 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Sales Channel |

| Companies covered:: | Meta Platforms, Inc., Mercado Libre, Inc., ByteDance Ltd. (TikTok Shop), Sea Ltd. (Shopee), Amazon.com, Inc., Facily, Magazine Luiza (Magalu), Social Digital Commerce / Social S.A., Showkase, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Brazil Social Commerce Market Size is driven by increasing smartphone penetration and widespread internet access, enabling more consumers to shop online through social media platforms. The growing popularity of social networks encourages engagement with brands, while e-commerce adoption rises due to convenience and personalized experiences. Influencer marketing and user-generated content build trust and influence purchasing decisions. Additionally, integrated in-app payment solutions, live-stream shopping, and the shift in consumer behaviour following the COVID-19 pandemic further accelerate the market’s growth and adoption across both small and large businesses.

Restraining Factors

The Brazil Social Commerce Market Size faces restraints such as limited digital literacy among certain consumer segments and concerns over online payment security. Poor internet connectivity in rural areas and high competition among platforms also hinder growth. Additionally, return management challenges, counterfeit products, and a lack of consumer trust in new sellers can slow the adoption of social commerce across the country.

Market Segmentation

The Brazil social commerce market share is classified into product type and sales channel.

- The apparel segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil social commerce market is segmented by product type into apparel, personal and beauty care, accessories, home products, health supplements, food and beverages, and other. Among these, the apparel segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The apparel segment dominates the market because clothing and fashion items are highly visual and easily promoted through social media platforms. Influencer marketing, live-stream shopping, and user-generated content effectively showcase styles, trends, and outfits, attracting consumer attention. The convenience of browsing and purchasing apparel online, along with a wide variety of options, encourages frequent purchases. Additionally, fashion products appeal to younger, tech-savvy consumers who are active on social media, driving higher engagement and sales in this segment compared to others.

- The social network-led commerce segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil social commerce market is segmented by sales channel into video commerce, social network-led commerce, social reselling, and other. Among these, the social network-led commerce segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The social network-led commerce segment dominates the market because it leverages the widespread use of platforms like Instagram, Facebook, and WhatsApp, where consumers spend significant time daily. These platforms enable targeted advertising, influencer promotions, and seamless in-app purchases, creating a convenient and engaging shopping experience. Businesses, from small entrepreneurs to large retailers, benefit from direct consumer access, personalized interactions, and real-time feedback. This combination of reach, convenience, and trust makes social network-led commerce the preferred and most effective sales channel.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil social commerce market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Meta Platforms, Inc.

- Mercado Libre, Inc.

- ByteDance Ltd. (TikTok Shop)

- Sea Ltd. (Shopee)

- Amazon.com, Inc.

- Facily

- Magazine Luiza (Magalu)

- Social Digital Commerce / Social S.A.

- Showkase

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In September 2025, Temu launched its Local Seller Program in Brazil, allowing local businesses to sell directly to consumers. The initiative improves delivery efficiency, enhances customer experience, boosts brand visibility, and supports Brazil’s growing social and mobile-driven shopping trends.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil social commerce market based on the below-mentioned segments:

Brazil Social Commerce Market, By Product Type

- Apparel

- Personal and Beauty Care

- Accessories

- Home Products

- Health Supplements

- Food and Beverages

- Other

Brazil Social Commerce Market, By Sales Channel

- Video Commerce

- Social Network-Led Commerce

- Social Reselling

- Other

Frequently Asked Questions (FAQ)

-

1. What is the Brazil social commerce market?The Brazil social commerce market refers to buying and selling products or services directly through social media platforms like Instagram, Facebook, TikTok, and WhatsApp, combining e-commerce with social interactions.

-

2. What is the market size of Brazil social commerce?The Brazil social commerce market has been rapidly growing due to increasing smartphone penetration, social media usage, and e-commerce adoption, with billions in annual transactions.

-

3. What are the key driving factors for Brazil social commerce market?The market is driven by smartphone and internet penetration, social media popularity, influencer marketing, live-stream shopping, and integrated in-app payment solutions.

-

4. Which product segment dominates the Brazil social commerce market?The apparel segment dominates due to its visual appeal, influencer marketing potential, and frequent consumer purchases.

-

5. Which sales channel is most dominant in Brazil social commerce?Social network-led commerce is the dominant channel, leveraging platforms like Instagram, Facebook, and WhatsApp for direct sales and engagement.

Need help to buy this report?