Brazil Shelf-Stable Food Packaging Market Size, Share, By Packaging Type (Rigid Packaging, Flexible Packaging, And Semi-Rigid Packaging), By Material (Plastic, Paper & Paperboard, Metal, Glass, And Biodegradable Materials), And Brazil Shelf-Stable Food Packaging Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesBrazil Shelf-Stable Food Packaging Market Insights Forecasts to 2035

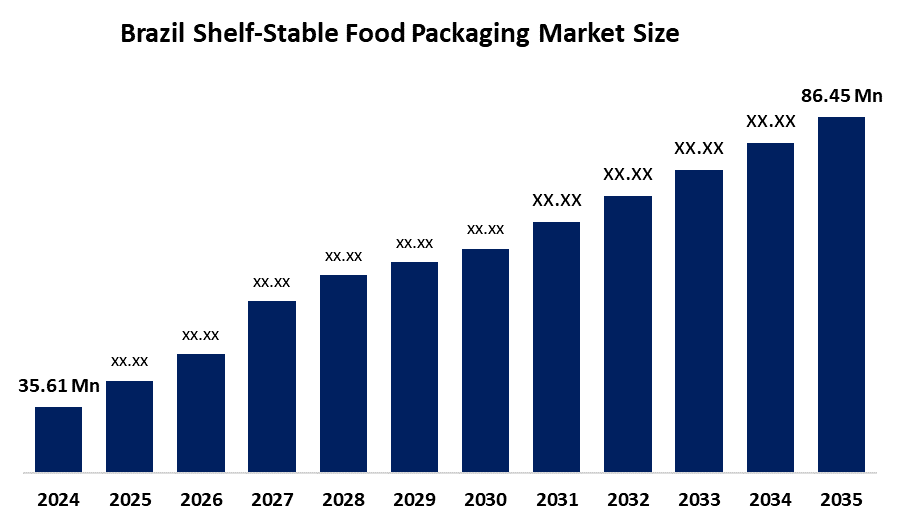

- Brazil Shelf-Stable Food Packaging Market Size 2024: USD 35.61 Bn

- Brazil Shelf-Stable Food Packaging Market Size 2035: USD 86.45 Bn

- Brazil Shelf-Stable Food Packaging Market CAGR 2024: 8.4%

- Brazil Shelf-Stable Food Packaging Market Segments: Packaging Type and Material

Get more details on this report -

Brazil shelf-stable food packaging market refers to sector specifically packaging food in Brazil that offers protection against contaminants and non-perishable products. Shelf-stable packaging is based on extending the life of food by preventing microbial growth and providing protection from oxidation, moisture entry, and physical damage. The Brazilian shelf-stable packaging market is growing in part due to an increase in consumer demand for convenient and long-term non-perishable products and the success of the shelf-stable packaging segment adds to the success of the broader food packaging sector and provides an opportunity to assist with domestic and export distribution and food resilience.

The shelf-stable food packaging in Brazil are backed by government support, including the Brazil’s National Solid Waste Policy, PNRS, established by Law No. 12.305/2010, which sets forth guidelines to reduce environmental impact. Brazil has committed to increasingly ambitious targets for collection and recycling of packaging materials, including plastic packaging, with goals such as recovering 32% of all packaging waste by 2026 en route to 50% by 2040, to adopt more sustainable and circular practices, which in turn influence investments and innovations in shelf-stable food packaging.

As technology advances, Brazil’s shelf-stable food packaging providers are now using freshness indicators, RFID traceability, and gas controls to manage internal packaging conditions, high-performance materials, and digital printing to enhance functional performance and communication between producers and users. These technologies help reduce food waste, enable greater logistical efficiency, and enhance product quality assurance for both domestic and export markets. R&D continues to promote sustainability in packaging through research into potential eco-friendly alternatives that combine optimal shelf-life extension capabilities with sustainability.

Market Dynamics of the Brazil Shelf-Stable Food Packaging Market:

The Brazil shelf-stable food packaging market is driven by the rising demand for non-perishable and convenient food products, urbanization, increased disposable income, growth in e-commerce and modern retail channels, strong transport resilience, and technological innovations in packaging preservation, increasing focus on food safety standards, and compliance with both domestic and international regulations creating sustained demand and investment within the market.

The Brazil shelf-stable food packaging market is restrained by the environmental and sustainability pressures, growing regulatory scrutiny, consumer demand for eco-friendly solutions, high initial costs, and complexity of integrating new technologies across existing production lines.

The future of Brazil shelf-stable food packaging market is bright and promising, with versatile opportunities emerging from the rise in urbanization and more expenses being available to people, the demand for convenient packaged foods has also been steadily on the rise. The growth of sustainability also creates new opportunities for companies that are creating eco–innovative materials and circular economy solutions. These trends will lead to increased demand for recyclable, biodegradable and compostable packaging products. Additionally, smart and active packaging technologies are developing opportunities for companies to create differentiated and valuable offerings.

Brazil Shelf-Stable Food Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 35.61 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 8.4% |

| 2035 Value Projection: | USD 86.45 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Amcor plc, Sealed Air Corporation, Sonoco Products Company, Berry Global Inc., Mondi plc, Klabin S.A., International Paper Company, Tetra Pak, WestRock Company, Huhtamaki Oyj, Braskem S.A., Zaraplast Industria de Embalagens Ltda., Videplast Plastic Industri Ltda., Bemis do Brasil Indústria e Comércio de Embalagens Ltda., Finepack Industria Tecnica de Embalagens Ltda., Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Brazil Shelf-Stable Food Packaging Market share is classified into packaging type and material.

By Packaging Type:

The Brazil shelf-stable food packaging market is divided by packaging type into rigid packaging, flexible packaging, and semi-rigid packaging. Among these, the flexible packaging segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Cost effectiveness, lightweight nature, excellent barrier protection, long term preservation, easy to handle, versatile to adopt different shapes, and crucial for extending shelf life all contribute to the flexible packaging segment's largest share and higher spending on shelf-stable food packaging when compared to other packaging type.

By Material:

The Brazil shelf-stable food packaging market is divided by material into plastic, paper & paperboard, metal, glass, and biodegradable material. Among these, the plastic segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The plastic segment dominates because of cost effectiveness, excellent barrier properties, lightweight nature, versatility in creating various formats, and rigid containers supporting product freshness, convenience, and brand appeal for a wide range of food & beverage products.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil shelf-stable food packaging market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Shelf-Stable Food Packaging Market:

- Amcor plc

- Sealed Air Corporation

- Sonoco Products Company

- Berry Global Inc.

- Mondi plc

- Klabin S.A.

- International Paper Company

- Tetra Pak

- WestRock Company

- Huhtamaki Oyj

- Braskem S.A.

- Zaraplast Industria de Embalagens Ltda.

- Videplast Plastic Industri Ltda.

- Bemis do Brasil Industria e Comercio de Embalagens Ltda.

- Finepack Industria Tecnica de Embalagens Ltda.

- Others

Recent Developments in Brazil Shelf-Stable Food Packaging Market:

In December 2025, Tetra Pak, launched its first-ever use of a paper-based barrier for juice packaging, in collaboration with Garcia Carrion. This innovation targets increased renewability and a reduced carbon footprint, which is highly relevant to Brazil’s focus on sustainable, shelf-stable solutions.

In March 2025, Huhtamaki received ANVISA (Brazil’s Health Regulatory Agency) clearance for a new molded-fiber production line in Rio Grande do Sul, which produces compostable fast-food bowls.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil shelf-stable food packaging market based on the below-mentioned segments:

Brazil Shelf-Stable Food Packaging Market, By Packaging Type

- Rigid Packaging

- Flexible Packaging

- Semi-Rigid Packaging

Brazil Shelf-Stable Food Packaging Market, By Material

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Biodegradable Materials

Frequently Asked Questions (FAQ)

-

Q: What is the Brazil shelf-stable food packaging market size?A: Brazil shelf-stable food packaging market is expected to grow from USD 35.61 billion in 2024 to USD 86.45 billion by 2035, growing at a CAGR of 8.4% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rising demand for non-perishable and convenient food products, urbanization, increased disposable income, growth in e-commerce and modern retail channels, strong transport resilience, and technological innovations in packaging preservation, increasing focus on food safety standards, and compliance with both domestic and international regulations creating sustained demand and investment within the market.

-

Q: What factors restrain the Brazil shelf-stable food packaging market?A: Constraints include the environmental and sustainability pressures, growing regulatory scrutiny, consumer demand for eco-friendly solutions, high initial costs, and complexity of integrating new technologies across existing production lines.

-

Q: How is the market segmented by packaging type?A: The market is segmented into rigid packaging, flexible packaging, and semi-rigid packaging.

-

Q: Who are the key players in the Brazil shelf-stable food packaging market?A: Key companies include Amcor plc, Sealed Air Corporation, Sonoco Products Company, Berry Global Inc., Mondi plc, Klabin S.A., International Paper Company, Tetra Pak, WestRock Company, Huhtamaki Oyj, Braskem S.A., Zaraplast Industria de Embalagens Ltda., Videplast Plastic Industria Ltda., Bemis do Brasil Industria e Comercio de Embalagens Ltda., Finepack Industria Tecnica de Embalagens Ltda., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?