Brazil Satellite Internet Market Size, Share, By Frequency Band (L-band, C-band, K-band, X-band), By industry (Transport & Cargo, Maritime, Corporates/Enterprises, Others, Energy & Utility, Government and Public Sector, Military, Media & Broadcasting), Brazil Satellite Internet Market Insights, Industry Trend, Forecasts to 2035.

Industry: Aerospace & DefenseBrazil Satellite Internet Market Insights Forecasts to 2035

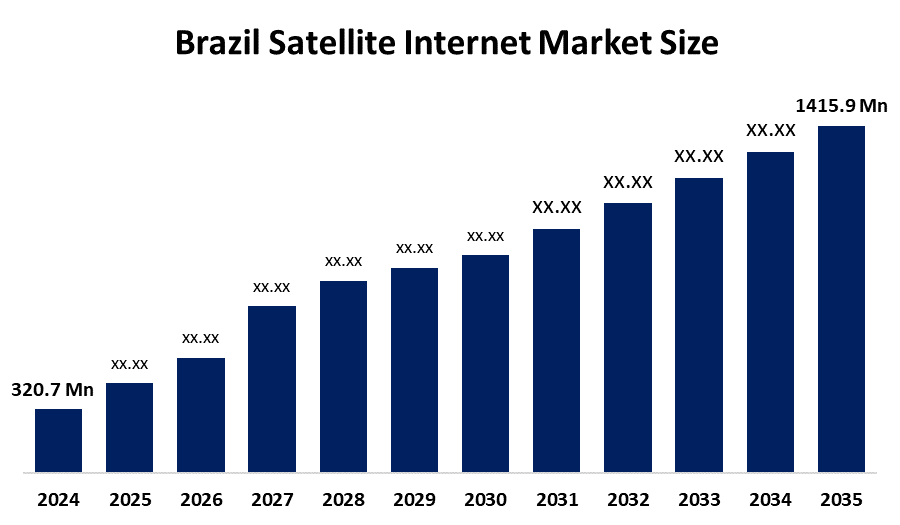

- Brazil Satellite Internet Market Size 2024: USD 320.7 Mn

- Brazil Satellite Internet Market Size 2035: USD 1415.9 Mn

- Brazil Satellite Internet Market CAGR 2024: 14.45%

- Brazil Satellite Internet Market Segments: Frequency Band and industry

Get more details on this report -

Brazil satellite internet is a communication technology that permits the distribution of broadband internet services all over Brazil by communicating through satellites. It also delivers reliable internet access in remote, rural, and underserved areas with no or poor terrestrial network services.

Viasat, a satellite company, revealed an innovative Direct-to-Handset (D2H) technology in Brazil that allows mobile phones to be connected directly via satellite (bypassing the traditional cellular networks). This is a significant step towards the provision of wider connectivity into hard-to-reach places and the possible IoT applications, for instance, in agriculture and transport.

As part of the GESAC project, co-financed by the government, Telebras collaborated with SES, the satellite operator, for connecting the Northern part of Brazil with the SES-17 Ka-band satellite by linking up more than 1500 locations (like public services, schools, health units, etc.). This venture provided remote areas with high-speed internet service.

The increasing demand for rural connectivity, smart agriculture, digital education, healthcare access, and IoT adoption will lead to a strong expansion of Brazil’s satellite internet market.

Market Dynamics of the Brazil Satellite Internet Market:

The Brazil satellite internet market is driven by the motivation to eliminate the digital divide between extensive rural and isolated areas, the shortage of terrestrial infrastructure, the increase in the demand for broadband connectivity, the government's digital inclusion programs, and IoT, telemedicine and online education services, along with the agriculture and mining activities growing as well.

The Brazil satellite internet market is restrained by the challenge of high costs of service and equipment, restrictions with latency in GEO satellites, and also competing with the growing fiber and mobile broadband networks in the urban areas.

The future of Brazil satellite internet market is bright and promising, with expanding LEO satellite deployments, strong government support for rural connectivity, rising digital services adoption, and increasing demand from agriculture, education, healthcare, and remote enterprises.

Brazil Satellite Internet Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 320.7 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 14.45% |

| 2035 Value Projection: | USD 1415.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Frequency Band, By industry |

| Companies covered:: | Hispamar, Visiontec, Telebras, Ruralweb Telecom, Algar Telecom, Embratel Star One (Star One), Arycom, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Brazil satellite internet market share is classified into frequency band and industry.

By Frequency band:

The Brazil satellite internet market is divided by frequency band into L-band, C-band, K-band, and X-band. Among these, the K-band segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The K-band is predominant because of its larger bandwidth, quicker data rates, cost-effective capacity, and widespread use for broadband, enterprise, and government satellite internet services in Brazil, which are the main factors contributing to the K-band's dominance.

By Industry:

The Brazil satellite internet market is divided by industry into transport & cargo, maritime, corporates/enterprises, others, energy & utility, government and public sector, military, media & broadcasting. Among these, the government and public sector segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Because of the country's digital inclusion strategy, the need for defense and security, emergency communications, and demand for reliable connectivity in remote schools, health centers, and public institutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil satellite internet market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Satellite Internet Market:

- Hispamar

- Visiontec

- Telebras

- Ruralweb Telecom

- Algar Telecom

- Embratel Star One (Star One)

- Arycom

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insight has segmented the Brazil satellite internet market based on the below-mentioned segments:

Brazil Satellite Internet Market, By Frequency band

- L-band

- C-band

- K-band

- X-band

Brazil Satellite Internet Market, By Industry

- Transport & Cargo

- Maritime

- Corporates/Enterprises

- Others

- Energy & Utility

- Government and Public Sector

- Military

- Media & Broadcasting

Frequently Asked Questions (FAQ)

-

Q: What is the Brazil satellite internet market size?A: Brazil satellite internet market is expected to grow from USD 320.7 million in 2024 to USD 1415.9 million by 2035, growing at a CAGR of 14.45% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the motivation to eliminate the digital divide between extensive rural and isolated areas, the shortage of terrestrial infrastructure, the increase in the demand for broadband connectivity, the government's digital inclusion programs, and IoT, telemedicine and online education services, along with the agriculture and mining activities growing as well.

-

Q: What factors restrain the Brazil satellite internet market?A: Constraints include the challenge of high costs of service and equipment, restrictions with latency in GEO satellites, and also competing with the growing fiber and mobile broadband networks in the urban areas.

-

Q: How is the market segmented by frequency band?A: The market is segmented into L-band, C-band, K-band, and X-band.

-

Q: Who are the key players in the Brazil satellite internet market?A: Key companies include Hispamar, Visiontec, Telebras, Ruralweb Telecom, Algar Telecom, Embratel Star One (Star One), Arycom, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?