Brazil ROV Market Size, Share, and COVID-19 Impact Analysis, By Type (Observation Class, Work Class, Intervention Class), By Application (Oil and Gas, Defense, Scientific Research), By User (Oil and Gas Companies, Government Agencies, Research Institutions), and Brazil ROV Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerBrazil ROV Market Insights Forecasts to 2035

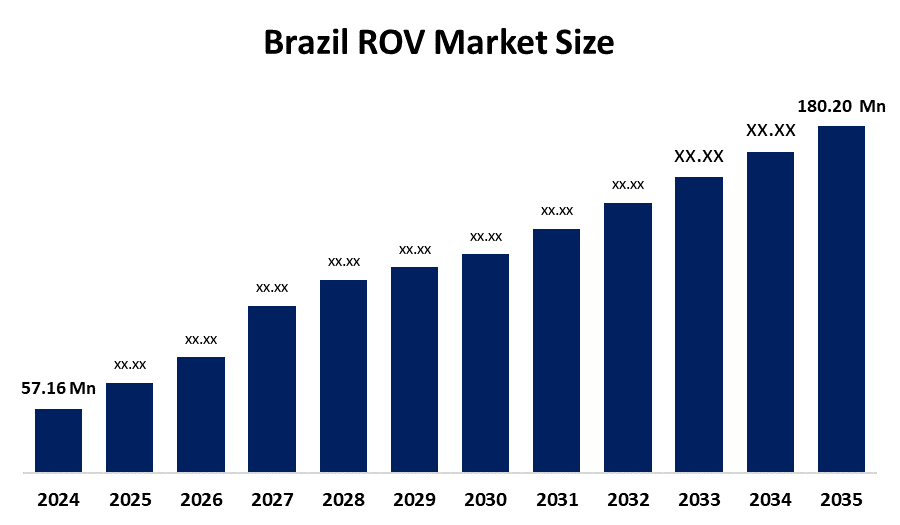

- The Brazil ROV Market Size Was Estimated at USD 57.16 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 11% from 2025 to 2035

- The Brazil ROV Market Size is Expected to Reach USD 180.20 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Brazil ROV market size is anticipated to reach USD 180.20 million by 2035, growing at a CAGR of 11% from 2025 to 2035. Brazil ROV market is driven by expanding offshore oil and gas exploration, deepwater pre-salt field development, rising subsea inspection and maintenance needs, growing investments by Petrobras, and increasing adoption of ROVs for cost-effective, safe underwater operations.

Market Overview

A remotely operated vehicle (ROV) is an unmanned underwater system controlled from a surface vessel through a tether. It is fitted with cameras, sensors, and manipulators to conduct inspection, repair, construction, and exploration activities in deep, hazardous, or inaccessible underwater environments, supporting offshore energy, marine research, and defense operations safely. Furthermore, growth factors include expansion of offshore wind and renewable marine projects, aging subsea infrastructure requiring frequent monitoring, stricter safety and environmental regulations, increased use of ROVs in naval defense, and demand for real-time underwater data to reduce operational risks and costs.

Market trends in Brazil’s ROV sector reflect strong momentum driven by deep-water offshore oil and gas activities, particularly in pre-salt fields, which continue to demand advanced subsea inspection and maintenance solutions. Increasing utilization of ROVs in marine research, oceanography, and underwater archaeology highlights a growing scientific focus on Brazil’s vast maritime resources. Expansion of submarine fiber-optic cable networks to support high-speed connectivity is further boosting ROV deployment. The defense sector is also adopting ROVs for surveillance and mine countermeasure operations.

Technological advancements, including higher depth capabilities, enhanced sensors, and improved maneuverability, are shaping market preferences. Additionally, supportive government initiatives for sustainable offshore operations and environmental monitoring are reinforcing long-term adoption of sophisticated ROV systems across multiple industries.

Report Coverage

This research report categorizes the market for the Brazil ROV market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil ROV market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil ROV market.

Brazil ROV Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 57.16 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 11% |

| 2035 Value Projection: | USD 180.20 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Type, By User |

| Companies covered:: | Oceaneering International, Fugro, Forum Energy Technologies, Saab Seaeye, Sonardyne, DeepOcean, DOF Subsea, TechnipFMC, Saipem, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Brazil ROV market is primarily driven by the country’s continued expansion of offshore energy activities, especially in complex deepwater environments that require reliable underwater intervention. Recent developments show rising use of advanced ROVs for subsea asset inspection, digital monitoring, and condition assessment. Growing marine research programs, new submarine communication cable installations, and increased naval security operations are widening application areas. At the same time, improvements in automation, sensor accuracy, and endurance are encouraging broader adoption of ROV systems across industries.

Restraining Factors

The Brazil ROV market faces restraints from high initial investment and operating costs, including vessel charter, maintenance, and skilled operator requirements. Limited local manufacturing capabilities and dependence on imports increased expenses. Additionally, complex regulatory approvals and challenging offshore weather conditions can delay ROV deployment and project timelines.

Market Segmentation

The Brazil ROV market share is classified into type, application, and end user.

- The work class segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil ROV market is segmented by type into observation class, work class, and intervention class. Among these, the work class segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Work-class ROVs dominate because offshore oil and gas projects in deepwater and pre-salt fields require robust systems capable of handling complex subsea tasks. These ROVs support inspection, maintenance, repair, and construction operations at significant depths. Their high payload capacity, advanced manipulators, and ability to operate in harsh offshore conditions make them essential for long-term field development, pipeline installation, and subsea infrastructure management across Brazil’s offshore energy sector.

- The oil and gas segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil ROV market is segmented by application into oil and gas, defense, and scientific research. Among these, the oil and gas segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The oil and gas segment dominates because the country has extensive deepwater and ultra-deepwater offshore reserves, especially in pre-salt basins. ROVs are critical for subsea inspection, maintenance, drilling support, and pipeline installation in these complex environments. Continuous investments by Petrobras and international operators, along with aging subsea infrastructure requiring regular monitoring, sustain high demand for ROV services compared to defense and scientific research applications.

- The oil and gas companies segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil ROV market is segmented by user into oil and gas companies, government agencies, and research institutions. Among these, the oil and gas companies segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Oil and gas companies dominate due to their intensive offshore operations in deepwater and ultra-deepwater pre-salt fields. ROVs are essential for inspection, maintenance, repair, drilling support, and installation of subsea infrastructure. Continuous investments by Petrobras and international operators, long project durations, and the need for frequent monitoring of pipelines and subsea equipment generate significantly higher ROV demand than government or research applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil ROV market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Oceaneering International

- Fugro

- Forum Energy Technologies

- Saab Seaeye

- Sonardyne

- DeepOcean

- DOF Subsea

- TechnipFMC

- Saipem

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil ROV market based on the below-mentioned segments:

Brazil ROV Market, By Type

- Observation Class

- Work Class

- Intervention Class

Brazil ROV Market, By Application

- Oil and Gas

- Defense

- Scientific Research

Brazil ROV Market, By User

- Oil and Gas Companies

- Government Agencies

- Research Institutions

Frequently Asked Questions (FAQ)

-

What are ROVs used for in Brazil?ROVs are used for offshore oil and gas inspection, subsea maintenance, pipeline installation, scientific research, defense operations, and submarine cable monitoring in Brazil’s deepwater environments

-

Which ROV type is most common in Brazil?Work-class ROVs dominate due to their high payload, advanced manipulators, and ability to perform complex deepwater inspection, maintenance, and repair operations in pre-salt offshore fields.

-

Who are the main ROV users in Brazil?Oil and gas companies are the largest users, followed by government agencies and research institutions, relying on ROVs for exploration, subsea infrastructure maintenance, and scientific studies.

-

What is driving ROV market growth in Brazil?Growth is driven by deepwater oil and gas projects, pre-salt exploration, marine research, fiber-optic cable installation, defense applications, and technological advancements in ROV capabilities.

-

What challenges does the ROV market face in Brazil?High costs, regulatory approvals, complex offshore conditions, reliance on imports, and limited local manufacturing are key challenges restraining the market’s expansion.

-

How are ROVs contributing to Brazil’s marine research?ROVs assist in oceanographic studies, underwater archaeology, and marine biology research by providing high-resolution imaging, real-time data, and access to deep or hazardous underwater areas safely.

-

What recent technological advancements are seen in Brazil ROVs?Advancements include AI-assisted navigation, enhanced sensors, improved manipulators, higher depth ratings, and automation features, increasing operational efficiency and reliability in complex offshore and subsea projects.

-

Are ROVs used in Brazil’s defense sector?Yes, the defense sector uses ROVs for mine detection, maritime surveillance, underwater inspections, and security operations, enhancing naval capabilities while reducing human risk in hazardous environments.

-

How does Brazil’s offshore oil industry influence ROV demand?Offshore oil and gas exploration, particularly in deepwater pre-salt fields, requires continuous subsea inspection, maintenance, and installation, making ROVs essential and driving strong market demand.

-

Can ROVs support telecommunications infrastructure in Brazil?Yes, ROVs assist in the installation, inspection, and maintenance of submarine fiber-optic cables, supporting high-speed internet connectivity and reliable global communication networks across Brazil.

Need help to buy this report?