Brazil Reverse Osmosis Membrane Market Size, Share, By End Use (Residential, Industrial, Municipal, And Others), By Distribution Channel (Direct Sales And Indirect Sales), And Brazil Reverse Osmosis Membrane Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsBrazil Reverse Osmosis Membrane Market Insights Forecasts to 2035

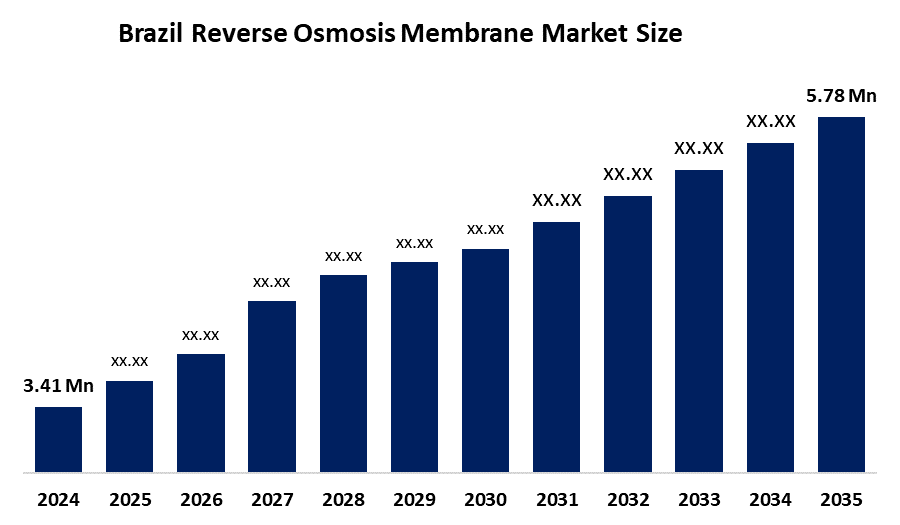

- Brazil Reverse Osmosis Membrane Market Size 2024: 3.41 Million Units

- Brazil Reverse Osmosis Membrane Market Size 2035: 5.78 Million Units

- Brazil Reverse Osmosis Membrane Market CAGR 2024: 4.91%

- Brazil Reverse Osmosis Membrane Market Segments: End Use and Distribution Channel

Get more details on this report -

The Brazil reverse osmosis membrane market refers to a sector of overall membrane separation technology industry and includes making, selling, and putting into use semi-permeable RO membranes for the purpose of purifying water, desalinating seawater, reusing wastewater, and treating industrial effluents in Brazil. RO membranes are key components of systems used to remove dissolved salts, microorganisms, and numerous other pollutants from water by using pressure on the water to push it through a polymeric or composite membrane to produce a high-quality product suitable for municipal drinking water, food and beverage manufacturing, pharmaceutical manufacturing and other industrial applications.

The reverse osmosis membrane in Brazil are backed by government support, including the New Sanitation Legal Framework, has set statutory targets for 99% of the population to have access to treated drinking water and 90% to have sewage collection and treatment by the end of 2033, while also facilitating increased private investment and regulatory oversight in water infrastructure projects. These figures reflect the ongoing need for investment in water purification solutions and infrastructure modernization, which support the adoption of advanced RO membrane systems across municipal and industrial sectors.

As technology advances, Brazil’s reverse osmosis membrane providers are now using thin film membranes composed of improved performance and extended use are now available for use in high performing membrane technology. Improved energy efficient design features are now becoming available with lower operational costs and an increase in the sustainability of membrane systems. Digital monitoring of membrane systems through the use of digital monitors and sensors, to assist in the monitoring of system performance and to predict membrane replacement cycles is also being adopted by larger treatment facilities and industrial users of membrane technology as a means to maximise the amount of uptime achieved from their membranes.

Market Dynamics of the Brazil Reverse Osmosis Membrane Market:

The Brazil reverse osmosis membrane market is driven by the increasing urbanization and industrialization, rising demand for reliable water purification and reuse, increased environmental and public health awareness, compliance with strict potability standards, expansion of municipal sanitation infrastructure under federal and state programs, and water scarcity and episodic droughts in key regions further drive investments in desalination and advanced treatment solutions like RO.

The Brazil reverse osmosis membrane market is restrained by the high operational costs, limited energy for pressurizing feed water, high management costs, economic disparities, budget constraints in certain municipalities can slow adoption, and technical challenges in maintaining water purity.

The future of Brazil reverse osmosis membrane market is bright and promising, with versatile opportunities emerging from the infrastructure upgrades with a greater emphasis on wastewater reuse and recycling. Sustainable water management practices are also becoming more important. Private companies are being encouraged to participate through incentive programs and supportive regulations established by government entities, which will create opportunities for both domestic and foreign technology suppliers. Membrane materials and energy-efficient design advancements can lower the entry barrier for small communities and decentralized water systems, as well as expand their potential market outside of traditional municipal or large industrial installations.

Brazil Reverse Osmosis Membrane Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 3.41 Million units |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.91% |

| 2035 Value Projection: | 5.78 Million units |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | DuPont Water Solutions, Toray Industries, LG Chem, Hydranautics, Veolia Water Technologies, Koch Separation Solutions, ArcelorMittal, Veolia, Alfa Laval AB, Toyobo Co. Ltd., Parker Hannifin Corporation, Lanxess AG, Applied Membranes Inc., Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Brazil Reverse Osmosis Membrane Market share is classified into end use and distribution channel.

By End Use:

The Brazil reverse osmosis membrane market is divided by end use into residential, industrial, municipal, and others. Among these, the municipal segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Increased water scarcity and drought, increasing regulatory pressure to improve water quality, high population density, and high industrial demand for high quality water all contribute to the municipal segment's largest share and higher spending on reverse osmosis membrane when compared to other end use.

By Distribution Channel:

The Brazil reverse osmosis membrane market is divided by distribution channel into direct sales and indirect sales. Among these, the direct sales segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The direct sales segment dominates because of increasing demand for RO membrane, high value transactions, direct interaction ensures technical support, maintenance, and reliable supply chains, and Brazil’s growing industrial and municipal infrastructure.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil reverse osmosis membrane market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Reverse Osmosis Membrane Market:

- DuPont Water Solutions

- Toray Industries

- LG Chem

- Hydranautics

- Veolia Water Technologies

- Koch Separation Solutions

- ArcelorMittal

- Veolia

- Alfa Laval AB

- Toyobo Co. Ltd.

- Parker Hannifin Corporation

- Lanxess AG

- Applied Membranes Inc.

- Others

Recent Developments in Brazil Reverse Osmosis Membrane Market:

In January 2026, ArcelorMittal initiated a project to build a sea water desalination plant in Tubarao to reduce reliance on fresh water from local rivers. The plant will use Toray’s ROMEMBRA RO membranes for salt removal and ‘D-Family’ Brackish Water RO elements for further polishing.

In July 2025, Veolia announced the construction of a large scale, advanced water reuse production station in Vitoria, Espirito Santo, in partnership with GS INIMA and CESAN. This facility was set to be the first in the world to convert a municipal wastewater plant into an industrial water producer using high performance membrane bioreactors and PROflex high-recovery reverse osmosis technology.

In November 2024, Toyobo MC, a global player, made its official debut in Brazil by introducing its high-performance Spiral Wound RO Membranes in partnership with BI Marketing and Services Pvt. Ltd. This aimed to address rising industrial water needs, including recycling and zero liquid discharge systems.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil reverse osmosis membrane market based on the below-mentioned segments:

Brazil Reverse Osmosis Membrane Market, By End Use

- Residential

- Industrial

- Municipal

- Others

Brazil Reverse Osmosis Membrane Market, By Distribution Channel

- Direct Sales

- Indirect Sales

Frequently Asked Questions (FAQ)

-

Q: What is the Brazil reverse osmosis membrane market size?A: Brazil reverse osmosis membrane market is expected to grow from 3.41 million units in 2024 to 5.78 million units by 2035, growing at a CAGR of 4.91% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing urbanization and industrialization, rising demand for reliable water purification and reuse, increased environmental and public health awareness, compliance with strict potability standards, expansion of municipal sanitation infrastructure under federal and state programs, and water scarcity and episodic droughts in key regions further drive investments in desalination and advanced treatment solutions like RO.

-

Q: What factors restrain the Brazil reverse osmosis membrane market?A: Constraints include the high operational costs, limited energy for pressurizing feed water, high management costs, economic disparities, budget constraints in certain municipalities can slow adoption, and technical challenges in maintaining water purity.

-

Q: How is the market segmented by end use?A: The market is segmented into end use into residential, industrial, municipal, and others.

-

Q: Who are the key players in the Brazil reverse osmosis membrane market?A: Key companies include DuPont Water Solutions, Toray Industries, LG Chem, Hydranautics, Veolia Water Technologies, Koch Separation Solutions, ArcelorMittal, Veolia, Alfa Laval AB, Toyobo Co. Ltd., Parker Hannifin Corporation, Lanxess AG, Applied Membranes Inc., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?