Brazil Retail Cooler Market Size, Share, By Distribution Channel (Online and Offline), By Capacity (Below 10 quarts, Between 11-25 quarts, Between 26-50 quarts, and Above 50 quarts), Brazil Retail Cooler Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsBrazil Retail Cooler Market Size Insights Forecasts to 2035

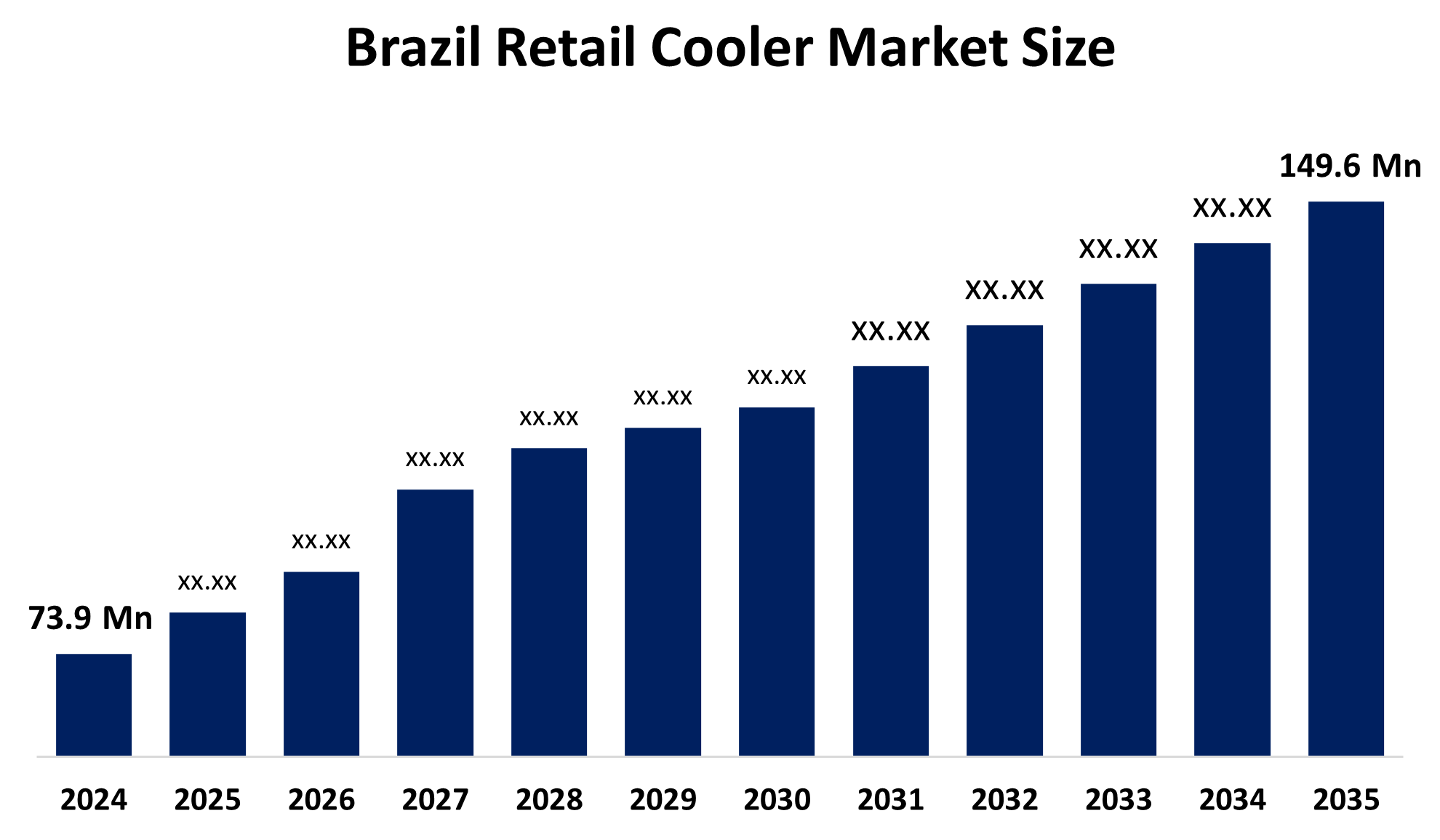

- Brazil Retail Cooler Market Size 2024: USD 73.9 Million

- Brazil Retail Cooler Market Size 2035: USD 149.6 Million

- Brazil Retail Cooler Market CAGR 2024: 6.62%

- Brazil Retail Cooler Market Segments: Distribution Channel and Capacity

Get more details on this report -

The Brazil Retail Cooler Market Size consists of portable and stationary cooling storage solutions used in retail outlets to preserve beverages, dairy products, frozen foods, and perishable items at controlled temperatures. These coolers are widely used across supermarkets, convenience stores, foodservice outlets, and specialty retail locations. The market is experiencing steady growth due to expanding organized retail infrastructure, increasing demand for chilled and frozen products, and rising consumer preference for fresh and ready-to-consume food and beverages.

The Brazil Retail Cooler Market Size is supported by government initiatives promoting food safety standards, cold chain development, and energy-efficient refrigeration systems. Private investments from retail chains and foodservice operators are accelerating the adoption of modern cooling equipment. Additionally, state-level incentives for energy-efficient appliances and sustainability-focused retail infrastructure are encouraging the replacement of traditional refrigeration units with advanced retail coolers.

Technological advancements are significantly shaping the Brazil Retail Cooler Market Size. Manufacturers are integrating smart temperature controls, inverter compressors, eco-friendly refrigerants, and energy-efficient insulation materials to enhance performance and reduce operational costs. The adoption of IoT-enabled monitoring systems and digital temperature tracking is improving product safety, operational efficiency, and compliance with food storage regulations across retail environments.

Market Dynamics of the Brazil Retail Cooler Market:

The Brazil Retail Cooler Market Size is driven by rapid growth in organized retail, increasing consumption of frozen and chilled food products, and expansion of convenience stores and supermarkets. Rising urbanization, changing consumer lifestyles, and higher demand for cold beverages are boosting cooler installations. Additionally, strict food safety regulations, growth of quick-service restaurants, and rising investments in cold chain infrastructure are significantly contributing to market expansion across Brazil.

The Brazil Retail Cooler Market Size is restrained by high initial investment costs, maintenance expenses, and energy consumption concerns. Fluctuating electricity prices, limited infrastructure in rural areas, and the high cost of advanced refrigeration technologies may hinder adoption among small retailers, thereby slowing market growth during the forecast period.

The future of the Brazil Retail Cooler Market Size presents promising opportunities due to increasing demand for energy-efficient and eco-friendly cooling solutions. Growth opportunities are supported by the expansion of modern retail formats, rising penetration of smart refrigeration technologies, increasing adoption of solar-powered coolers, and the growing food and beverage retail sector across urban and semi-urban regions.

Brazil Retail Cooler Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 73.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.62% |

| 2035 Value Projection: | USD 149.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Distribution Channel, By Capacity |

| Companies covered:: | Metalfrio Solutions S.A., Eletrofrio Refrigeracao Ltda., Fricon Industrial Ltda., Gelopar Refrigeracao Paranaense Ltda., Refrimate Engenharia do Frio Ltda., Polar Refrigeraçao, Imbera Brasil, Venancio Refrigeraçao, Climafrio Equipamentos, and Friomix Refrigeracao and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The Brazil Retail Cooler Market share is classified into distribution channel and capacity.

By Distribution Channel:

The Brazil Retail Cooler Market Size is segmented by distribution channel into online and offline. Among these, the offline segment dominated the market share in 2024 and is expected to grow at a notable CAGR during the forecast period. The dominance of offline channels is attributed to direct dealer networks, physical retail equipment stores, after-sales service availability, and strong relationships between manufacturers and retail operators.

By Capacity:

The Brazil Retail Cooler Market Size is segmented by capacity into below 10 quarts, between 11–25 quarts, between 26–50 quarts, and above 50 quarts. Among these, the between 26–50 quarts segment accounted for the largest share in 2024 and is predicted to grow at a significant CAGR over the projected period. This segment’s dominance is driven by its suitability for supermarkets, convenience stores, and foodservice outlets that require moderate storage capacity with efficient space utilization.

Competitive Analysis:

The report provides an appropriate analysis of the key organizations involved within the Brazil Retail Cooler Market Size, along with a comparative evaluation based on product offerings, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also includes an elaborative analysis of recent developments such as product launches, technological innovations, partnerships, mergers & acquisitions, and strategic expansions, enabling a comprehensive evaluation of market competition.

Top Key Companies in Brazil Retail Cooler Market:

- Metalfrio Solutions S.A.

- Eletrofrio Refrigeracao Ltda.

- Fricon Industrial Ltda.

- Gelopar Refrigeracao Paranaense Ltda.

- Refrimate Engenharia do Frio Ltda.

- Polar Refrigeraçao

- Imbera Brasil

- Venancio Refrigeraçao

- Climafrio Equipamentos

- Friomix Refrigeracao

Recent Developments in Brazil Retail Cooler Market:

- In February 2025, Metalfrio Solutions S.A. expanded its energy-efficient retail cooler lineup in Brazil by introducing next-generation refrigeration units using eco-friendly refrigerants.

- In May 2025, Fricon Industrial Ltda. invested in manufacturing capacity expansion to meet rising demand from supermarkets and convenience stores across Brazil.

- In October 2024, Gelopar Refrigeracao Paranaense Ltda. partnered with major Brazilian retail chains to deploy smart retail coolers with digital temperature monitoring systems.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firms

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil Retail Cooler Market Size based on the following segments:

Brazil Retail Cooler Market, By Distribution Channel

- Online

- Offline

Brazil Retail Cooler Market, By Capacity

- Below 10 quarts

- Between 11–25 quarts

- Between 26–50 quarts

- Above 50 quarts

Frequently Asked Questions (FAQ)

-

Q: What is the Brazil retail cooler market size?A: Brazil Retail Cooler Market is expected to grow from USD 73.9 million in 2024 to USD 149.6 million by 2035, growing at a CAGR of 6.62% during the forecast period 2025–2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by expansion of organized retail, increasing demand for chilled and frozen products, strict food safety regulations, and rising investments in cold chain and refrigeration infrastructure.

-

Q: What factors restrain the Brazil retail cooler market?A: Constraints include high installation and maintenance costs, energy consumption concerns, and limited adoption among small retailers.

-

Q: How is the market segmented?A: The market is segmented by distribution channel and by capacity.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?