Brazil Respiratory Devices Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Therapeutic Devices, Diagnostic & Monitoring Devices), By Therapeutic Devices (Drug Delivery Devices, Mechanical Ventilators, Continuous Positive Airway Pressure, Resuscitators, Humidfiliers, Airway Clearance Devices, Oxygen Concentrators, Consumables & Disposables), By Application (Chronic Obstructive Pulmonary Disease, Asthma, Obstructive Sleep Apnea, Respiratory Distress Syndrome, Pneumonia, Cystic Fibrosis), and Brazil Respiratory Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareBrazil Respiratory Devices Market Insights Forecasts to 2035

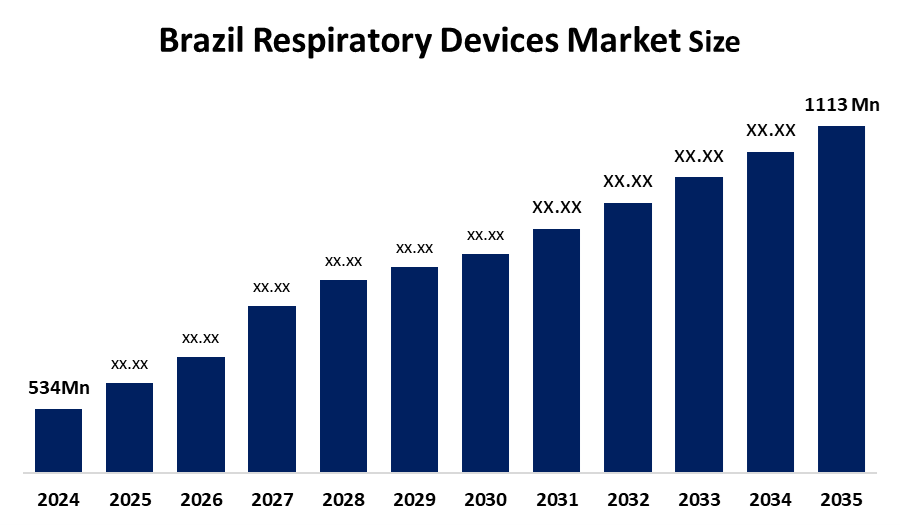

- The Brazil Respiratory Devices Market Size Was Estimated at USD 534 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.9% from 2025 to 2035

- The Brazil Respiratory Devices Market Size is Expected to Reach USD 1113 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Brazil Respiratory Devices Market size is anticipated to reach USD 1113 million by 2035, growing at a CAGR of 6.9% from 2025 to 2035. Brazil respiratory devices market is driven by rising prevalence of respiratory diseases, an aging population, increasing air pollution, growing demand for home healthcare, improved healthcare infrastructure, higher awareness of sleep apnea, and government initiatives supporting respiratory care access.

Market Overview

Respiratory devices are medical instruments used to diagnose, support, treat, and monitor breathing and lung function. These devices perform functions such as oxygen delivery, ventilation, airway clearance, and respiratory monitoring for patients with acute or chronic respiratory conditions. They are widely used across hospitals, clinics, emergency care facilities, and home healthcare settings.

The Brazil respiratory devices market is expanding due to several key factors, including the growing prevalence of respiratory disorders, rising air pollution levels, an increasing elderly population, the growing popularity of home healthcare, improvements in hospital infrastructure, and greater public awareness of sleep-related and pulmonary diseases. These factors are collectively driving increased demand for respiratory care devices. Additionally, the market is strongly influenced by the high and rising incidence of respiratory diseases such as chronic obstructive pulmonary disease (COPD) and asthma in Brazil. Increased awareness of the importance of early diagnosis and timely treatment is further contributing to the demand for advanced respiratory devices across the country.

The government is implementing healthcare programs focused on strengthening healthcare infrastructure and providing subsidies for the purchase of medical equipment. For instance, according to a report by Emergo, Brazil’s medical device regulator, ANVISA, approved its 2024–2025 Regulatory Agenda in December 2023, covering 172 topics across 66 themes. Key initiatives under Section 11 include the introduction of electronic labeling for layperson devices, revisions to medical device reprocessing regulations, updates to Software as a Medical Device (SaMD) guidelines (RDC nº 657/2022), reviews of safety and effectiveness requirements, and updates to INMETRO certification standards. Consequently, these regulatory efforts are expected to streamline market access, enhance product safety, and support the adoption of advanced medical and respiratory devices across Brazil.

These initiatives have been instrumental in making respiratory care solutions more accessible to the general public. Additionally, the growing elderly population, which is more susceptible to respiratory disorders, is driving higher demand for portable and user-friendly devices.

Report Coverage

This research report categorizes the market for the Brazil respiratory devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil respiratory devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil respiratory devices market.

Brazil Respiratory Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 534 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.9% |

| 2035 Value Projection: | USD 1113 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product |

| Companies covered:: | Koninklijke Philips N.V., ResMed Inc., Medtronic Plc, Fisher & Paykel Healthcare Limited, Drägerwerk AG & Co. KGaA, Masimo Corporation, General Electric Company (GE Healthcare), Chart Industries, Hamilton Medical, and other players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Brazil respiratory devices market is driven by the rising prevalence of respiratory diseases such as asthma, COPD, and sleep apnea, increasing air pollution, and a growing elderly population. Expanding home healthcare services, improving hospital infrastructure, and greater awareness of early diagnosis and treatment further boost demand. Additionally, technological advancements in portable and non-invasive respiratory devices, along with government initiatives to improve access to respiratory care, support steady market growth.

Restraining Factors

The Brazil respiratory devices market faces restraints from high device and maintenance costs, limited reimbursement coverage, and unequal access to advanced healthcare in rural areas. Shortage of trained respiratory professionals, regulatory approval delays, and dependence on imported devices also restrict adoption and slow overall market growth.

Market Segmentation

The Brazil respiratory devices market share is categorized by product type, therapeutic device, and application.

- The therapeutic devices segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil respiratory devices market is segmented by product type into therapeutic devices, diagnostic & monitoring devices. Among these, the therapeutic devices segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by products that are used continuously for treatment rather than occasional diagnosis. Rising cases of COPD, asthma, and sleep apnea require long-term oxygen therapy, ventilation, and airway support. Increased adoption of home healthcare, post-COVID respiratory care needs, and a growing elderly population further boost demand for ventilators, nebulizers, CPAP, and oxygen concentrators. Additionally, hospitals and clinics invest more in treatment devices due to their higher utilization rates and recurring replacement cycles.

- The oxygen concentrators segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil respiratory devices market is segmented by therapeutic devices into drug delivery devices, mechanical ventilators, continuous positive airway pressure, resuscitators, humidfiliers, airway clearance devices, oxygen concentrators, consumables & disposables. Among these, the oxygen concentrators segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the growing burden of COPD, asthma, and post-COVID respiratory complications requiring long-term oxygen therapy. These devices are widely used in both hospitals and homecare because they are cost-effective, easy to operate, and reduce dependence on oxygen cylinders. Rising preference for home-based treatment, an expanding elderly population, and increasing availability of portable oxygen concentrators further support strong adoption. Additionally, government and private healthcare providers favor concentrators for continuous, reliable oxygen supply.

- The chronic obstructive pulmonary disease segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil respiratory devices market is segmented by application into chronic obstructive pulmonary disease, asthma, obstructive sleep apnea, respiratory distress syndrome, pneumonia, and cystic fibrosis. Among these, the chronic obstructive pulmonary disease segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by a long-term, progressive disease requiring continuous respiratory support. High smoking rates, increasing air pollution, and an aging population in Brazil contribute to a large COPD patient base. Patients often need oxygen therapy, nebulizers, ventilators, and monitoring devices over extended periods, increasing device utilization. Unlike acute conditions, COPD requires ongoing treatment and management, driving consistent demand across hospitals and homecare settings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil respiratory devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

-

Koninklijke Philips N.V.

-

ResMed Inc.

-

Medtronic Plc

-

Fisher & Paykel Healthcare Limited

-

Drägerwerk AG & Co. KGaA

-

Masimo Corporation

-

General Electric Company (GE Healthcare)

-

Chart Industries

-

Hamilton Medical

-

Other players

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In April 2022, ANVISA, Brazil's medical device market regulator, issued a new resolution updating Brazilian Good Manufacturing Practices (BGMP) for medical devices. ANVISA's RDC 665/2022 replaced previous regulations, including RDC 16/2013 and IN 08/2013.

In October 2024, with rising demand for critical care equipment, Medtronic announced plans to increase the production of its ventilators in Brazil. To meet the demands of Brazilian hospitals and healthcare systems, the company is expanding its supply chain operations and manufacturing capacity.

In September 2024, ResMed unveiled a new range of sleep apnea treatments and CPAP devices that are intended to increase patient comfort and therapy compliance. The goal of these gadgets is to improve respiratory care in Brazil's homecare sector by incorporating mobile health monitoring and more user-friendly interfaces.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil respiratory devices market based on the below-mentioned segments:

Brazil Respiratory Devices Market, By Product Type

- Therapeutic Devices

- Diagnostic & Monitoring Devices

Brazil Respiratory Devices Market, By Therapeutic Devices

- Drug Delivery Devices

- Mechanical Ventilators

- Continuous Positive Airway Pressure

- Resuscitators

- Humidfiliers

- Airway Clearance Devices

- Oxygen Concentrators

- Consumables & Disposables

Brazil Respiratory Devices Market, By Application

- Chronic Obstructive Pulmonary Disease

- Asthma

- Obstructive Sleep Apnea

- Respiratory Distress Syndrome

- Pneumonia

- Cystic Fibrosis

Frequently Asked Questions (FAQ)

-

How is the Brazil respiratory devices market evolving? The market is shifting toward home-based care and portable respiratory devices, driven by chronic disease management and post-pandemic care needs

-

Why are oxygen concentrators so popular in Brazil? They are cost-effective, easy to use, portable, and provide continuous oxygen supply, making them ideal for both hospitals and home care

-

Which factor most affects device adoption in rural areas? Limited healthcare infrastructure and low awareness of respiratory therapies restrict adoption outside urban centers.

-

Are local Brazilian companies contributing significantly to the market? Yes, local manufacturers are emerging, especially for ventilators and oxygen solutions, supporting domestic supply and pandemic response

-

How does air quality influence the market? Rising pollution increases respiratory disease prevalence, boosting demand for both therapeutic and monitoring devices

-

What role do government initiatives play? Programs improving access to respiratory care and home-based oxygen therapy drive wider adoption of devices

-

Which segment is expected to grow fastest? Portable and smart respiratory devices for homecare are anticipated to grow rapidly due to convenience and patient preference

Need help to buy this report?